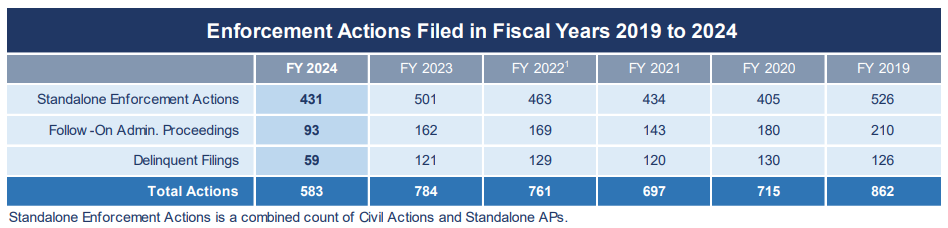

The U.S. Securities and Exchange Commission recently announced its enforcement results for fiscal year 2024. The SEC’s Division of Enforcement filed 583 enforcement actions, a 26% decline from fiscal year 2023, including:

- 432 standalone actions (representing a 14% decline from 2023);

- 93 follow-on administrative proceedings (43% decline); and

- 59 delinquent filer actions (51% decline).

(All charts are taken from the Addendum to the SEC’s 2024 Enforcement Results.)

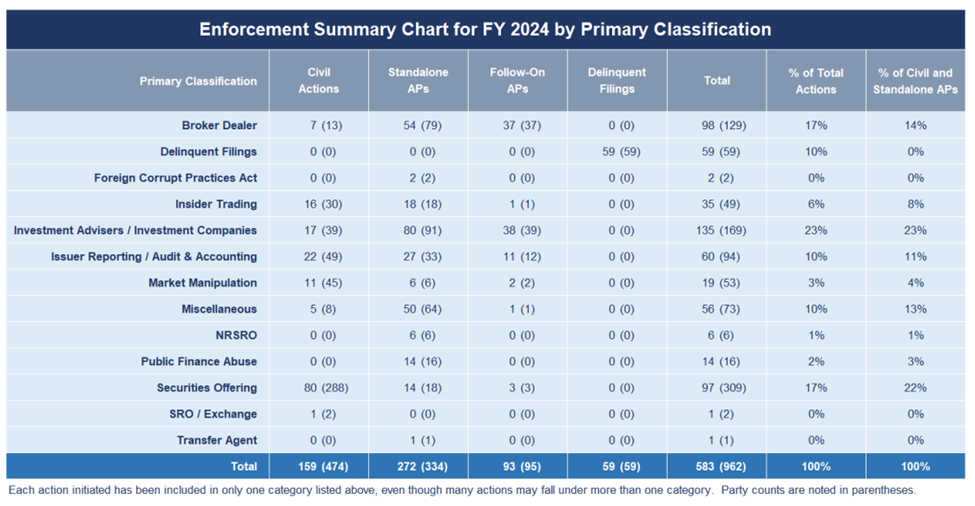

Broken down by primary classification, the SEC brought 135 investment adviser or investment company actions, 98 broker-dealer actions, and 97 securities offering actions—the top three categories of proceedings by total number. However, the 97 securities offering actions was a decline from the 167 such actions initiated in 2023. There were also sharp declines in delinquent filing actions (from 121 in 2023 to 59 in 2024) and issuer reporting, audit, and accounting actions (107 to 60).

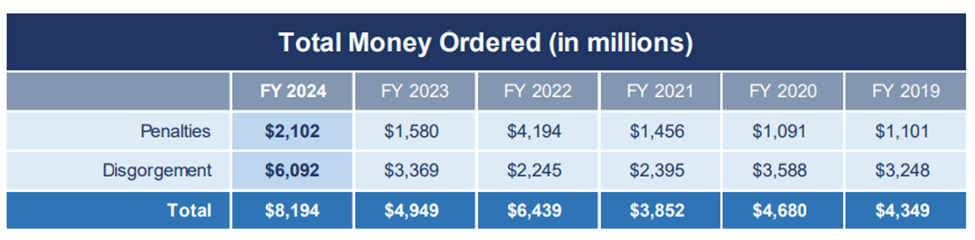

The Division of Enforcement obtained nearly $8.2 billion in financial remedies, which includes $6.1 billion in disgorgement and prejudgment interest, and $2.1 billion in civil penalties. Of the nearly $8.2 billion—the highest amount in SEC history—approximately 56% is attributable to a monetary judgment obtained following the SEC’s jury trial against Terraform Labs and Do Kwon, which involved a multiyear fraud involving crypto asset securities. See SEC v. Terraform Labs PTE Ltd., No. 23-cv-1346 (S.D.N.Y.). Another 28%, or $600 million in civil penalties, was attributable to the SEC’s “off-channel” communications initiative.

The SEC also distributed $345 million to harmed investors, down from the $930 million distributed in fiscal year 2023.

The SEC also reported receiving 45,130 tips, complaints, and referrals, the most ever for the SEC. Out of the total, there were more than 24,000 whistleblower tips, although 14,000 of which were submitted by two individuals—meaning the two individuals made roughly 28 reports per day. The SEC’s Office of the Whistleblower separately reported its results for fiscal year 2024. According to the Office of the Whistleblower, “[t]he same two individuals accounted for nearly 7,000 of the 18,354 whistleblower tips submitted in FY 2023.” Id. at 11 n.32.

The SEC credited market participants who self-reported or otherwise cooperated meaningfully with investigations, touting cases in which the SEC approved resolutions that imposed reduced or no civil penalties in response. The SEC also highlighted:

- recordkeeping cases, primarily focused on off-channel communications, that resulted in more than $600 million in civil penalties against more than 70 firms;

- Marketing Rule cases that resulted in settled charges against more than a dozen investment advisers;

- whistleblower protection cases, including an $18 million civil penalty against J.P. Morgan, the largest penalty for a standalone violation of the whistleblower protection rule; and

- cases involving emerging technologies and emerging risks, such as artificial intelligence, cybersecurity, and crypto. These are likely to remain areas of focus.

Overall, the 26% percent decline in total enforcement actions, with downward trends in each category of enforcement actions, represents a reversal of the post-pandemic trend of increases. However, Sanjay Wadhwa, Acting Director of the Division of Enforcement, suggested that the downward trend may be the result of improved industry compliance, and further noted that the numbers fail to account for “countless investigations that may not have resulted in an enforcement action for evidentiary or other reasons,” but that nevertheless “shined a spotlight on potentially problematic conduct and caused responsible market participants to cease engaging in it.”

With the upcoming change in administration, we are certain to see a shift in the Division of Enforcement’s priorities. We expect to see less of an emphasis on non-scienter based charges, such as books and records violations, and more of a focus on frauds involving significant losses to investors. It is also likely that the SEC will take a different approach to “crypto” enforcement. Rather than an “enforcement-by-regulation” approach, we expect to see the SEC issue guidance to the industry. Almost certainly, we will see the size of corporate penalties decrease. Some things will stay the same. The SEC will continue to bring insider trading cases and continue to work cooperatively with the Department of Justice and other governmental agencies.