On June 5, 2025, the Appellate Division, First Department of the New York Supreme Court issued an opinion in Gamma USA, Inc. v. Pavarini McGovern, LLC, addressing the enforceability of a no-damages-for-delay clause in a construction contract between the subcontractor and contractor. The subcontractor had brought breach of contract claims based on alleged project delays, but the court dismissed those claims, citing the clause in the subcontract that barred recovery for delay-related damages..

The court found that the subcontract’s unambiguous Section 6.3 barred the subcontractor from recovering delay damages, regardless of other terms in the agreement. Section 6.3 provided:

“Notwithstanding any other provisions of this Subcontract, the Subcontractor agrees to make no claim for additional costs on account of, and assumes the risk of, any and all loss and expense for delay.”

This language was central to the ruling. It clearly allocated the risk of delay to the subcontractor and took precedence over any conflicting provision. The court rejected claims of ambiguity or conflicting terms and dismissed the case based on established precedent.

The subcontractor argued that exceptions to the no-damages-for-delay rule applied, including bad faith, reckless indifference, and breaches of fundamental obligations. The court rejected those arguments, concluding that the alleged conduct—such as poor planning, lack of scheduling detail, and removal of a crane—did not amount to intentional wrongdoing or fundamental breach. These were characterized as “inept administration,” which was insufficient to overcome the no-damage-for-delay clause.

The court also rejected the argument that the delays were unexpected. The subcontract clearly covered delays in starting, carrying out, and finishing the work. The subcontractor’s claim of a year-long delay did not alter the outcome, as the subcontract anticipated such delays.

The subcontractor’s claim that the contractor breached a fundamental obligation by failing to provide a crane was also dismissed. The subcontract stated that hoist size and capacity were limited, placed responsibility for oversized materials on the subcontractor, and gave the contractor discretion over site logistics. The court found no basis to support the argument that crane availability constituted a fundamental obligation under the subcontract.

This decision confirms that New York courts enforce no-damages-for-delay clauses that are clear and specific. Exceptions like bad faith or uncontemplated delays will not apply unless they involve conduct that goes beyond mere poor planning or administrative missteps. Subcontractors seeking to avoid the impact of such clauses must show that delays stemmed from deliberate misconduct or circumstances undisputably outside the scope of the agreement.

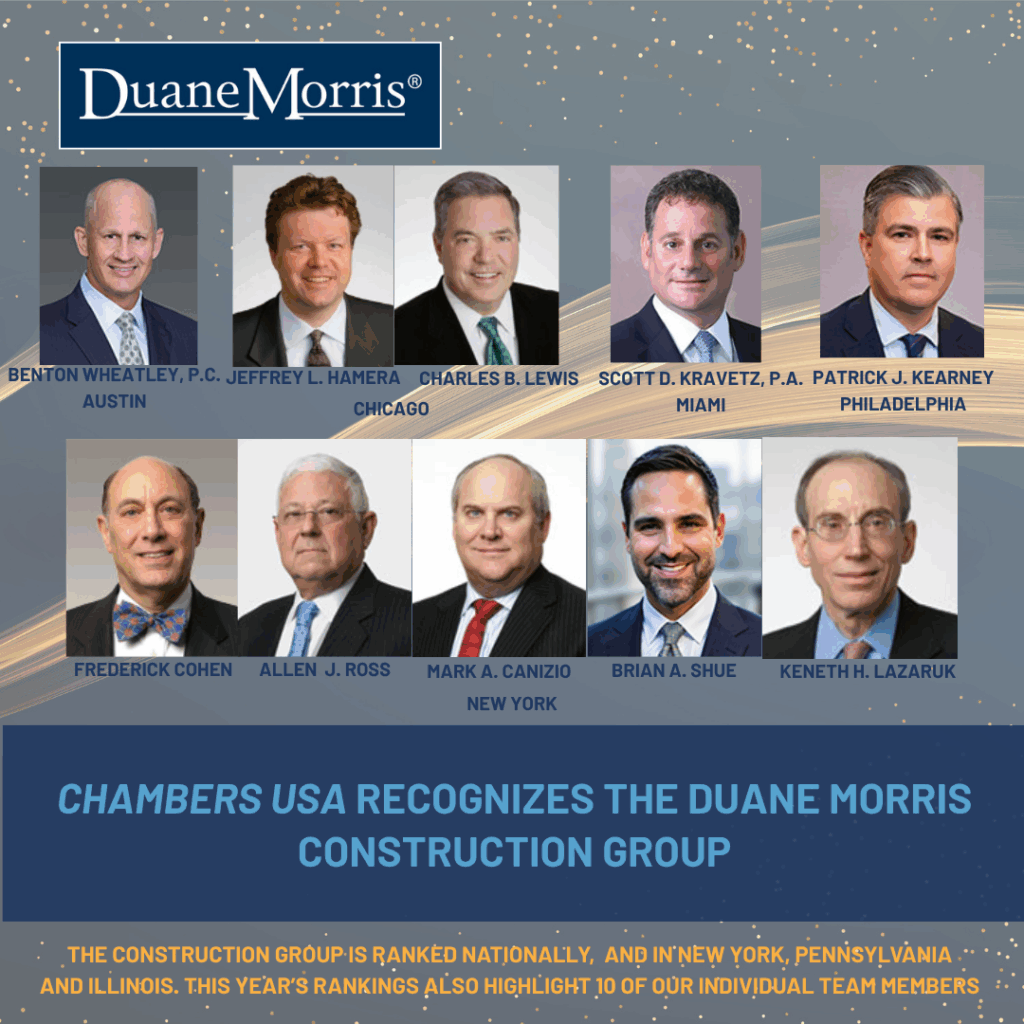

Jose A. Aquino (@JoseAquinoEsq on X) is a special counsel at Duane Morris LLP’s New York office, where he is a member of Construction Group, specializing in construction law, lien law, and government procurement law. He is also a member of the Cuba Business Group.

This blog is prepared and published for informational purposes only and should not be construed as legal advice. The views expressed herein are those of the author and do not necessarily reflect the views of Duane Morris LLP or its individual attorneys.