The U.S. Department of Justice (DOJ) and the U.S. Department of Health and Human Services (HHS) announced on July 2, 2025, the creation of a DOJ-HHS False Claims Act Working Group. The working group is intended to strengthen HHS and DOJ’s “ongoing collaboration to advance priority enforcement areas” of the Trump administration. Read the full Alert on the Duane Morris website.

New DOJ Program Incentivizes Alleged Whistleblowers

The Department of Justice’s Antitrust Division has officially launched its first-ever Whistleblower Rewards Program through a memorandum of understanding with the United States Postal Service and the U.S. Postal Service Office of Inspector General. This new program offers monetary rewards of up to 30 percent of criminal fines recovered for individuals who provide information leading to successful antitrust prosecutions of at least $1 million in fines. Read the full Alert on the Duane Morris LLP website.

Duane Morris Partner William M. McSwain Named to Forbes’ Inaugural America’s Best-In-State Lawyers List for 2025

Duane Morris partner and co-chair of the firm’s White-Collar Criminal Defense, Corporate Investigations and Regulatory Compliance Group William M. McSwain, has been named to Forbes’ inaugural America’s Best-In-State Lawyers list for 2025 in the category of White Collar Defense – Pennsylvania.

Former U.S. Attorney Who Prosecuted USA v. Kousisis Examines the Supreme Court’s Decision

On May 22, 2025, in a significant and much-anticipated white-collar case, Kousisis, et al. v. United States, the U.S. Supreme Court, in a 9-0 opinion authored by Justice Amy Coney Barrett, held that a defendant who induces a victim to enter into a transaction under materially false pretenses may be convicted of federal fraud even if the defendant did not seek to cause the victim any net economic loss. In other words, if the defendant obtained money or property as a result of a fraudulently induced transaction, that’s enough for a federal fraud conviction—even if the victim received the full economic benefit of the bargain.

Read the full analysis by William M. McSwain, co-chair of Duane Morris’ White-Collar Criminal Defense, Corporate Investigations and Regulatory Compliance division. He served as the U.S. Attorney for the Eastern District of Pennsylvania from 2018 to 2021.

Chambers USA Recognizes Duane Morris White-Collar Division and Attorneys

Duane Morris LLP is pleased to announced that Chambers USA has recognized Duane Morris White-Collar Criminal Defense, Corporate Investigations and Regulatory Compliance division and attorneys.

New Jersey & Pennsylvania

Litigation: White-Collar Crime & Government Investigations

Northern New Jersey attorneys

Eric R. Breslin, Litigation: White-Collar Crime & Government Investigations

Melissa S. Geller, Litigation: White-Collar Crime & Government Investigations

Pennsylvania Attorneys

Christopher H. Casey, Litigation: White-Collar Crime & Government Investigations

Mary P. Hansen, Litigation: White-Collar Crime & Government Investigations

William M. McSwain, Litigation: White-Collar Crime & Government Investigations

Michael M. Mustokoff, Litigation: White-Collar Crime & Government Investigations

Michael J. Rinaldi, Litigation: White-Collar Crime & Government Investigations

Leigh M. Skipper, Litigation: White-Collar Crime & Government Investigations

CMS Issues Final Rule on Returning Medicare and Medicaid Overpayments

By Daniel R. Walworth, Christopher H. Casey, Frederick R. Ball, Erin M. Duffy and Arti Fotedar

The Centers for Medicare & Medicaid Services (CMS) issued a Final Rule as part of the 2025 Physician Fee Schedule, which revises requirements for reporting and returning overpayments of Medicare and Medicaid funds. The Final Rule, which took effect January 1, 2025, amends CMS’s regulation interpreting the federal overpayment statute in two key ways: It revises the definition of when an overpayment is “identified” to trigger the 60-day return period and establishes a 180-day timeframe for investigating additional related overpayments.

First Circuit Embraces More Restrictive View of False Claims Act Kickback Enforcement Provision

By Daniel R. Walworth, Christopher H. Casey, Frederick R. Ball, Erin M. Duffy and Joseph R. Welsh

The United States Court of Appeals for the First Circuit’s opinion in United States v. Regeneron Pharmaceuticals, Inc. has sharpened the circuit split for demonstrating the effect of a kickback on healthcare decisions under the False Claims Act (FCA). The Regeneron court held that an FCA claim based on an alleged violation of the Anti-Kickback Statute requires demonstrating that an alleged unlawful kickback was the “but-for” cause of a submitted claim.

Duane Morris Adds Assistant U.S. Attorneys on East and West Coast

Adding depth to its white-collar practice on both the East Coast and West Coast, Duane Morris announced the hire of two former assistant U.S. attorneys on Monday.

Eric Boden, who served as an assistant U.S. attorney in both New Jersey and Pennsylvania over the past decade and most recently was appointed attorney-in-charge of the Trenton, New Jersey, branch office of the U.S. Attorney’s Office, will be joining the firm’s trial group in New York. Garth Hire, who worked as a federal prosecutor since 2021 in the northern and central districts of California and served as chief of the Oakland U.S. Attorney’s Office, will be joining the firm’s San Francisco office. […]

“Over the last year, I was looking to join a firm like Duane Morris, and it quickly became clear that Duane Morris was the right match for me,” Boden said in an interview. “I’m hoping to bring all of my expertise and background into what I can do to help the white-collar practice at the firm.”

Hire added, “This was really an unparalleled opportunity to operate across all of the firm’s California offices in the white-collar space.”

Government Agencies Send Mixed Messages on Ephemeral Messaging, Placing Regulated Entities in Apparent Double Bind

Officials with the FBI and Cybersecurity and Infrastructure Security Agency (“CISA”) recently recommended Americans use encrypted messaging apps in response to the Salt Typhoon cyberattack that infiltrated at least eight U.S. telecommunications companies. In a news call to address the Salt Typhoon attack, Jeff Greene, the executive assistant director for cybersecurity at CISA, stated, “Encryption is your friend,” and an official with the FBI added that “responsibly managed encryption” benefits users who wish to protect their mobile device communications. These statements acknowledge that ephemeral messaging, which generally refers to messaging applications that employ “end-to-end encryption” or auto-delete technology, minimizes the risk of falling victim to a cyberattack.

But these recommendations and statements in favor of the legitimate benefits of encrypted messaging apps in enhancing a cybersecurity posture, may appear inconsistent with other statements disfavoring the use of such apps to conduct business.

Continue reading “Government Agencies Send Mixed Messages on Ephemeral Messaging, Placing Regulated Entities in Apparent Double Bind”SEC Division of Enforcement: 2024 By the Numbers

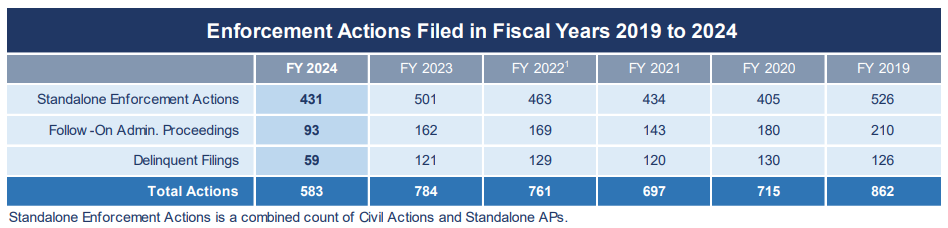

The U.S. Securities and Exchange Commission recently announced its enforcement results for fiscal year 2024. The SEC’s Division of Enforcement filed 583 enforcement actions, a 26% decline from fiscal year 2023, including:

- 432 standalone actions (representing a 14% decline from 2023);

- 93 follow-on administrative proceedings (43% decline); and

- 59 delinquent filer actions (51% decline).