Almost eight months into the new administration, the federal government has slashed staffing at the Environmental Protection Agency and begun unwinding both recent and long-standing environmental rules. Policyholders and carriers see the regulatory pullback from pollution and other standards as bringing immediate benefits and long-term uncertainty.

Pollution claims have largely emerged from historic commercial general liability policies written before the mid-1980s, when an absolute pollution exclusion became the industry standard, and subsequent pollution risk policies, said Max H. Stern of Duane Morris.

“Very likely, we’ll see a decrease in new claims being made with a major reduction in environmental enforcement, and that will be helpful to the pollution liability insurance market because they’re just going to have less risk,” he told Law360. Read the full article on the Law360 website.

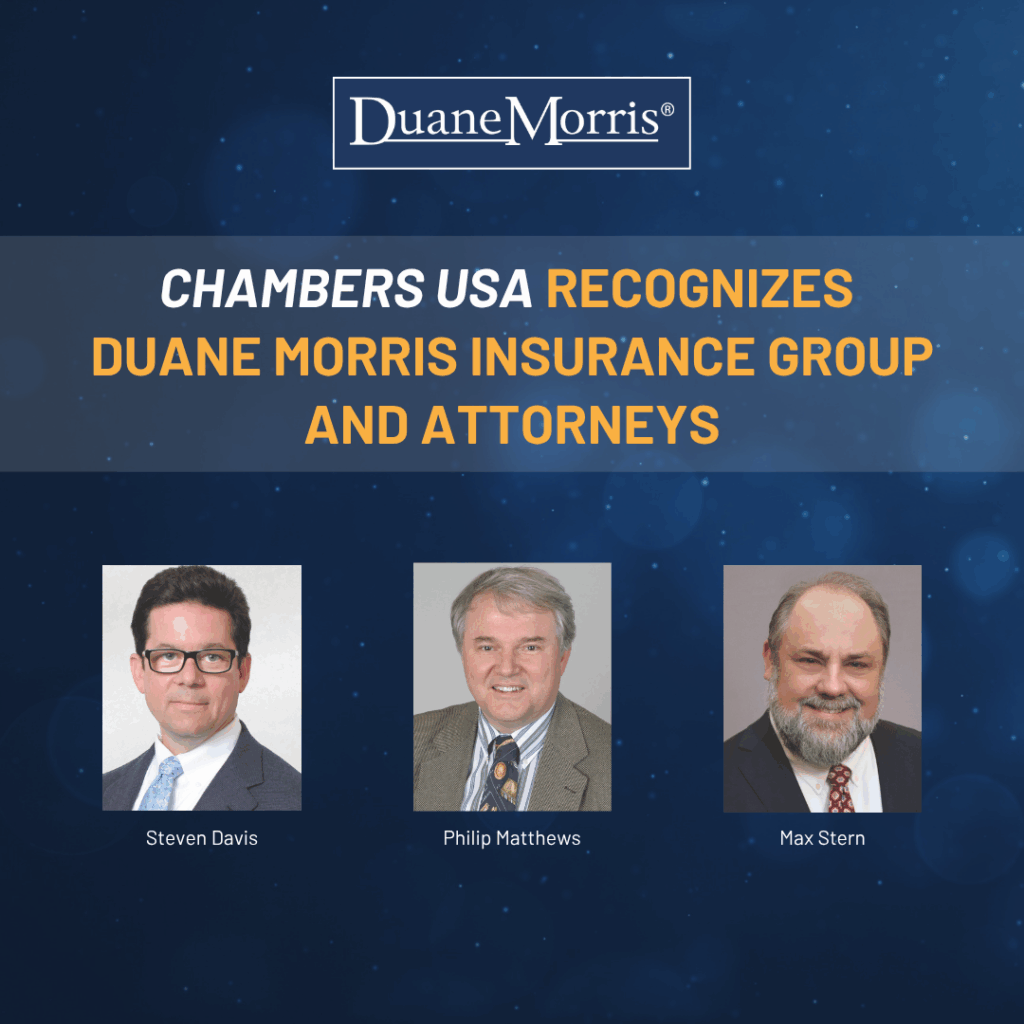

Chambers USA Recognizes Duane Morris Insurance Group and Attorneys

Duane Morris LLP is pleased to announced that Chambers USA has recognized Duane Morris Insurance group and attorneys.

Nationwide

Insurance: Dispute Resolution: Insurer

Philip R. Matthews, Insurance: Dispute Resolution: Insurer

Max H. Stern, Insurance: Dispute Resolution: Insurer

California

Philip R. Matthews, Insurance: Insurer

Max H. Stern, Insurance: Insurer

Pennsylvania

Steven Burgess Davis, Insurance

SDNY Enforces NY Choice of Law Clause in Policy Despite Alleged Conflict with Law in State of Issuance

Insurance policies frequently contain choice-of-law provisions providing that their interpretation is subject to the law of a particular jurisdiction. Thus, if a policy’s choice-of-law provision requires that the policy be interpreted in accordance with New York law, then the policy should be interpreted in accordance with New York law. That seemingly self-evident proposition was recently upheld by the United States District Court for the Southern District of New York in Cajun Conti, LLC v. Starr Surplus Lines Ins. Co., 23 Civ. 8844 (KPF), 2025 WL 764131 (S.D.N.Y. Mar. 11, 2025).

But, according to the insured, Cajun Conti, the proposition is not self-evident at all. This is because the insurance policy containing the New York choice-of-law provision was issued to Cajun Conti in Louisiana, and, under the Louisiana Insurance Code, foreign choice-of-law provisions are void, at least for policies issued in Louisiana and subject to approval by the Louisiana Department of Insurance. See La. Rev. Stat. § 22:868.

The Southern District, however, rejected Cajun Conti’s invocation of the Louisiana statute, and enforced the parties’ contractual commitment to be bound by New York law. Cajun Conti, 2025 WL 764131, at *4-*7. The Court did so for several reasons.

First, Section 5-1401 of New York’s General Obligations Law provides that any contract governing transactions in excess of $250,000 containing a New York choice-of-law provision is enforceable in New York. Indeed, New York’s highest court has held that a provision subject to Section 5-1401 obviates the need for any further conflicts-of-law analysis. The provision is presumptively enforceable. Cajun Conti, 2025 WL 764131, at *4.

Second, the Cajun Conti court noted that, even in the absence of Section 5-1401, New York courts should enforce choice-of-law provisions as a matter of contract interpretation. To that end, the court cited a recent decision from New York’s Court of Appeals holding that “when the parties have chosen New York law, a court may not contravene that choice through common-law conflicts analysis.” Cajun Conti, 2025 WL 764131, at *5 (citing Petróleos de Venezuela S.A. v. MUFG Union Bank, N.A., 41 N.Y.3d 462, 476 (2024)).

Third, the Cajun Conti court rejected a “public policy” exception to the foregoing rules, finding no basis for such an exception in controlling New York law. Cajun Conti, 2025 WL 764131, at *6.

Based on the foregoing principles of New York law, the Cajun Conti court concluded that the Louisiana statute purporting to void the contract provision is ultimately irrelevant.

The takeaway is that courts in New York should apply New York law to insurance policies requiring the application of New York law, irrespective of alleged public policy concerns arising from contrary law of the insureds’ home state. This rule provides certainty to the parties concerning their rights and obligations and ensures that their contractual intent will be upheld.

Cases We’re Watching: Certified Question to Nevada Supreme Court—Excess Carrier’s Equitable Subrogation Claim

Earlier this Fall, the Ninth Circuit certified the following question to the Nevada Supreme Court:

Under Nevada law, can an excess insurer state a claim for equitable subrogation against a primary insurer where the underlying lawsuit settled within the combined policy limits of the insurers?

The Nevada Supreme Court has since accepted the certified question and ordered briefing, which is currently underway.

The case at issue involves an equitable subrogation claim brought by an excess insurer against a primary insurer. The excess insurer filed suit against the primary insurer after the excess insurer paid $4 million of a $5 million settlement to resolve underlying litigation arising out of a murder at a Las Vegas apartment complex. The underlying litigation—alleging negligence and wrongful death against the insured owner of the apartment complex—was filed in 2019.

Continue reading “Cases We’re Watching: Certified Question to Nevada Supreme Court—Excess Carrier’s Equitable Subrogation Claim”Cases We’re Watching: Fifth Circuit Appeal of Summary Judgment on Stowers Demand

Finding that the Stowers doctrine was not “activated,” the United States District Court for the Southern District of Texas entered summary judgment in favor of an insurer on its declaratory relief claim. After an underlying judgment was entered against its insured, the insurer sought declaratory relief establishing that it owed only its remaining policy limits for an excess verdict. The trial court agreed with the insurer, entered summary judgment, and the matter is now on appeal to the United States Court of Appeals for the Fifth Circuit.

The coverage dispute arose out of an underlying personal injury suit filed in Texas state court. In the underlying suit, the claimants sued the insured for injuries sustained while at the insured’s business. The claimants’ counsel sent a written settlement offer to the insured, requesting “payment of all policy limits of any and all insurance contract,” which was subsequently rejected. The claimants eventually prevailed at trial against the insured, obtaining a verdict totaling $3.2 million. The insurer tendered its remaining limits, but the claimants asserted that the insurer was obligated to pay the entire judgment because the claimants’ pre-trial settlement demand was a proper Stowers demand.

The trial court provided background on the so-called Stowers doctrine and demands:

“Under G.A. Stowers Furniture Co. v. American Indem. Co., 02 S.W.2d 544 (Tex. Comm’n. App. 1929, holding approved), Texas law imposes a ‘basic tort duty,’ known as the Stowers doctrine, under which insurers, ‘when faced with a settlement offer within policy limits, must accept the offer … when an ordinarily prudent insurer would do so in light of the reasonably apparent likelihood and degree of that insured’s potential exposure to a valid judgment in the suit in excess of policy limits.’” Law Office of Rogelio Solis PLLC v. Curtis, 83 F.4th 409, 411 n.1 (5th Cir. 2023) (quoting Travelers Indem. Co. v. Citgo Petroleum Corp., 166 F.3d 761, 761 (5th. Cir. 1999)). “When . . . the insurer’s negligent failure to settle results in an excess judgment against the insured, the insurer is liable under the Stowers doctrine for the entire amount of the judgment, including the part exceeding the insured’s policy limits.” G.A. Stowers Furniture Co., 15 S.W.2d at 548.

Continue reading “Cases We’re Watching: Fifth Circuit Appeal of Summary Judgment on Stowers Demand”Fungi and Pollution Exclusions Foreclose Duty to Defend Wrongful Death Suit

Facing claims that it “allowed a dangerous substance—mold” to grow in a resident’s apartment, an insured sought coverage under its “businessowners insurance” coverage. In denying a duty to defend the underlying wrongful death suit, the insurer relied on two exclusions: (1) the “Fungi or Bacteria Exclusion” and (2) the Pollution Exclusion. After analyzing the plain meaning of both exclusions, the U.S. District Court for the Northern District of Georgia agreed with the insurer, held that it owed no duty to defend the insured, and granted the insurer’s motion for judgment on the pleadings.

The court began by applying basic principles under Georgia law. It noted, “[i]f the terms of the insurance contract are plain and unambiguous, the Court must ‘simply [] apply [them] as written, regardless of whether doing so benefits the carrier or the insured.’” Reed v. Auto Owners Ins. Co., 284 Ga. 286, 287 (2008). “This rule holds even for policy exclusions, which ‘must be given effect’ when unambiguous, ‘even if ‘beneficial to the insurer and detrimental to the insured.’” Cont’l Cas. Co. v. Winder Lab’ys, LLC, 73 F.4th 934, 941 (11th Cir. 2023) (quoting Fid. Nat’l Title Ins. Co. of N.Y. v. OHIC Ins. Co., 275 Ga. App. 55, 57 (2005)).

The policy provided coverage for sums “that the insured becomes legally obligated to pay as damages because of ‘bodily injury’” to which the insurance applies. “Bodily injury” includes “bodily injury, sickness or disease sustained by a person, including death resulting from any of these at any time.” In “any suit” seeking damages covered by the policy, the insurer has a “duty to defend the insured.” The court then turned to the relevant exclusions.

Continue reading “Fungi and Pollution Exclusions Foreclose Duty to Defend Wrongful Death Suit”Texas Contractor’s Coverage Claims Foreclosed by Defective Workmanship Exclusion

In a recent case decided in the Southern District of Texas, the court entered summary judgment, holding that the insurer’s “construction [and] workmanship” exclusion excluded coverage as a matter of law. The claim, brought by a contractor against a subcontractor’s insurer, arose out of allegedly defective work related to pipe fabrication.

The contractor agreed to fabricate, construct, and install pipes for a construction project in Corpus Christi, Texas. The contractor then hired a subcontractor to fabricate piping for the project. “As a pipe fabricator, [the subcontractor] was responsible for creating or customizing pipes for the Project so that they fit its exact requirements.” “In connection with its work,” the subcontractor obtained a property insurance policy, which covered the workshop where it welded the components to fit the project’s needs.

The contractor eventually discovered that some of the subcontractor’s work was defective, and asserted that the subcontractor missed “delivery times and production standards for the [p]roject.” The contractor eventually pursued a claim under the subcontractor’s policy.

The insurer denied the claim, asserting: (1) the pipes were not “covered property”; (2) the damages to the pipes did not occur at a “covered location”; and (3) the damages to the pipes did not constitute “physical loss.” The insurer also relied on “Exclusion ‘f,’” which barred coverage “for loss resulting from the design, specification, construction, workmanship, installation, or maintenance of property[.]” In response, the contractor filed suit, alleging breach of contract (as subrogee to the subcontractor’s rights), and extracontractual claims for violations of Sections 541 and 542 of the Texas Insurance Code.

Continue reading “Texas Contractor’s Coverage Claims Foreclosed by Defective Workmanship Exclusion”Hawai‘i High Court Holds Insurer has no Duty to Defend Fossil Fuel Company Against Climate Change Suit, Upholding Pollution Exclusion

By: Gina Foran and Bill Baron

The Hawai‘i Supreme Court ruled on October 7 that AIG has no duty to defend Aloha Petroleum against climate change lawsuits, because the pollution exclusions in AIG’s policies barred coverage for the suits.

Certain cities and counties in Hawaiʻi sued major oil companies, including Aloha, for their role in emitting greenhouse gases (“GHGs”) that contribute to global warming. Plaintiffs alleged that Aloha was on notice that its products caused catastrophic climate change because the industry had been advised in the 1960s through various channels, including the American Petroleum Institute (“API”), an oil industry group, of the effect that burning fossil fuels would have on the climate. API commissioned studies that predicted the earth’s temperatures would significantly increase around 2000 and cause catastrophic effects by the mid-21st century. Aloha was aware, or should have been aware, of these studies. Plaintiffs alleged that Aloha “had actual knowledge that their products were defective and dangerous,” and “acted with conscious disregard for the probable dangerous consequences of their conduct’s and products’ foreseeable impact upon the rights of others.” The District Court in the coverage action thus concluded that the counties alleged reckless conduct.

The District Court certified two questions to the Hawaiʻi Supreme Court: (1) whether an “accident” includes an insured’s reckless conduct; and (2) whether GHGs are “pollutants” within the meaning of pollution exclusions. The Court held that an “accident” did include reckless conduct, but ultimately concluded that AIG had no duty to defend the insured because the pollution exclusions in the policies unambiguously barred coverage for “pollutants” which include GHGs.

Continue reading “Hawai‘i High Court Holds Insurer has no Duty to Defend Fossil Fuel Company Against Climate Change Suit, Upholding Pollution Exclusion”California Supreme Court Questions Existence of “So-Called” Illusory Coverage Doctrine Under California Law As It Rejects Insured’s Coverage Arguments For COVID-19-Related Losses

By Max Stern, Terrance Evans, Todd Norris and Jessica La Londe

On August 8, 2024, in a case entitled John’s Grill v. The Harford Financial Services Group, No. S278481, the Supreme Court of California questioned the existence of the “so-called” illusory coverage doctrine under California law, as it concluded that a policyholder had, in any event, failed to satisfy its foundational elements.

John’s Grill suffered substantial losses during the COVID-19 pandemic. Its insurer denied coverage on various grounds including that the loss or damage claimed by John’s Grill did not fall within the insurance policy’s “Limited Fungi, Bacteria or Virus Coverage” endorsement. That endorsement generally excludes coverage for any virus-related loss or damage that the policy would otherwise provide, but it extends coverage for virus-related loss or damage if the virus was the result of certain specified causes of loss, including windstorms, water damage, vandalism, and explosion.

John’s Grill acknowledged that it could not meet the latter specified cause of loss limitation. Instead, it contended the limitation was unenforceable because it rendered the policy’s promise of virus-related coverage illusory. The Court of Appeal below agreed, and allowed John’s Grill’s claims for virus-related losses or damage to proceed.

Relying on “long-settled principles of contract interpretation,” the Supreme Court of California reversed, concluding that the “plain meaning of the policy govern[ed].” The Court stated that it “has never recognized an illusory coverage doctrine as such,” and rejected “the so-called illusory coverage doctrine [as articulated by John’s Grill],” stating that it “does not appear in our precedents.”

The Court went on to explain that even assuming some version of the doctrine did exist under California law, there were two hurdles John’s Grill would still need to clear before it could establish coverage, and it had not cleared either one in this case. First, in such a case, an insured would have to “make a foundational showing that it had a reasonable expectation that the policy would cover the insured’s claimed loss or damage.” The Court declared that “[s]uch a reasonable expectation of coverage is necessary under any assumed version of the doctrine.” Here, the Court concluded that based on the policy language limiting coverage to certain causes, John’s Grill could not have an objectively reasonable expectation the policy would provide coverage for all virus-related loss or damage, regardless of the cause. Second, the Court explained that even accepting John’s Grill’s articulation of the doctrine, it still could not demonstrate that coverage was illusory. The Court noted that restaurants handle both raw and cooked food, which could be contaminated by a virus and that “John’s Grill has not shown that the prospect of such contamination by water damage or other specified cause of loss is so unrealistic as to render the promised coverage illusory.” According to the Court, it is for the insured to consider the likelihood of benefiting from the policy’s limited virus coverage when obtaining coverage.

Insurers Prevail in California Supreme Court on COVID-19 Business Interruption Coverage

By Todd Norris, Max Stern, Brian Kelly, Terrance Evans and Jessica La Londe.

Earlier today, the Supreme Court of California issued a long-awaited opinion answering an insurance coverage question that had been certified to it by the Ninth Circuit Court of Appeals in Another Planet Entertainment, LLC v. Vigilant Ins. Co. (Cal. May 23, 2024, No. S277893) 2024 WL 2339132: “Can the actual or potential presence of the COVID-19 virus on an insured’s premises constitute ‘direct physical loss or damage to property’ for purposes of coverage under a commercial property insurance policy?” (Another Planet Entertainment, LLC v. Vigilant Insurance Co. (2022) 56 F.4th 730, 734.)

“[T]he question [arose] in the context of a civil lawsuit filed by Another Planet Entertainment, LLC (Another Planet) against its property insurer, Vigilant Insurance Company (Vigilant). Another Planet operates venues for live entertainment. It suffered pandemic-related business losses when its venues closed, and Vigilant denied Another Planet’s subsequent claim for insurance coverage. Another Planet filed suit in federal district court, alleging that the actual or potential presence of the COVID-19 virus at its venues or nearby properties caused direct physical loss or damage to property and triggered coverage under its insurance policy. The district court granted Vigilant’s motion to dismiss for failure to state a claim, and Another Planet appealed. According to the Ninth Circuit, the issue on appeal “[was] whether [Another Planet’s] allegations, if taken as true, were sufficient to show ‘direct physical loss or damage to property’ as defined by California law.’ (Another Planet, supra, 56 F.4th at p. 731.) Because the Ninth Circuit concluded that resolution of this question of California law could determine the outcome of the case pending before it, the Ninth Circuit certified the question to [the Supreme Court of California.]” (Another Planet, 2024 WL 2339132, at *1.) Continue reading “Insurers Prevail in California Supreme Court on COVID-19 Business Interruption Coverage”