Duane Morris partners Christopher Casey and Damon Vocke will present a complimentary Directors Roundtable program, “Dealing with Corporate Crisis,” on Thursday, June 28, 2018, from 8:30 a.m. to 10:30 a.m. at the Deloitte Conference Center in New York City. For more information or to register, please visit the Directors Roundtable website.

Representations and Warranties Insurance Beyond the Current Cycle of Merger Activity: Will Those Chickens Come Home to Roost?

Representations and warranties insurance transfers the risk of certain known unknowns and unknown unknowns from transaction participants to the underwriting insurer.[1] Such risk transfer can create moral hazard especially where one of the parties to the transaction, i.e. the seller (and also the underwriting broker), receive the majority, if not all, remuneration on the deal and exit the stage before the unknowns become knowns. It also can create a situation where insurers who seek an expanded share of what has been called a “prolonged sellers’ market” may face deteriorating claims and be left with an undesirable position when the economic waters recede.[2]

What is Representations and Warranties Insurance

Representations and warranties insurance provides coverage for financial losses resulting from a breach of a representation or warranty made by a seller in a purchase and sale agreement. It is a subset of transactional risk insurance and sometimes called M&A insurance or warranty and indemnity insurance. Counterparties used to address these type of risks through negotiated escrows which kept the risk allocated among the parties to the transaction. Transactional parties often now lay that risk off to an insurer’s balance sheet.

The Domestic Market Has Grown at an Astronomical Pace

The market for representations and warranties insurance exploded in the past decade. According to one of the major brokers, total industry limits (combined primary and excess) approached $14.7 billion and generated approximately $526.5 million in premium on more than two-thousand issued policies in 2016.[3] That is remarkable growth for a product that reportedly generated $10 billion in bound coverage worldwide in 2013 and was on virtually no one’s radar screen before the recent M&A uptick which followed the Great Recession.

As of 2018, a representations and warranties policy is generally priced between 2.25% to 4% of the limit of liability with market capacity and appetite for large transactions increasing. Typically, 1-3% of enterprise value is retained, but it has been reported that recent retentions have gone below 1% as the market tightens among insurers competing for market share.

Reported Claims Experience

AIG was one of the first insurers to write representations and warranties insurance (referred to as warranty & indemnity insurance outside the domestic market) and has published three annual reports on its claims experience. According to those reports, approximately one-in-five (19.4%) policies written result in a claim.[4] The largest deals from a dollar perspective (deal size over $1 billion) generate the highest claims frequency (24%) and the largest average claim ($19 million). An increased year-on-year claims frequency was reported across all classes of deal size. According to AIG, nearly half of all material claims (46%) resulted in what was termed a mid-sized payout (payment on the claim between $1 million to $10 million) with an average settlement of $4 million over the five year period of policies written between 2011-2016. That reported average settlement was up, from $3.5 million, in the prior report.

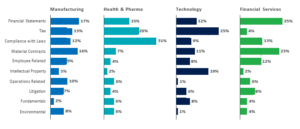

In 2018, AIG for the first time provided data broken down on breach type by industry sector as set forth below.[5]

AIG’s reported claims figures suggest that insureds have become more sophisticated in their use of the product with an impact on the frequency and severity of claims.

Judicial Determinations of First Impression

In 2017, the United States Court of Appeals for the Seventh Circuit became the first court of review to address a claim for indemnity under a representations and warranty policy in a published opinion.[6] A $23.4 million stock purchase deal for a specialty dairy products company which resulted in a $10 million settlement between the corporate buyer and the family members who had sold their 100% interest in the company was at issue before the court. The sellers purchased a seller’s warranty and indemnity insurance policy with an aggregate cover of $10 million over a $1.5 million retention which provided coverage for various representations made in the deal documents on a claims made basis with a policy period extending for six years after the closing.

The Seventh Circuit affirmed summary judgment in favor of the insurer. The court held that the settled claims were for breach of general representations for which the deal documents capped damages at $1.5 million. As a result, the damages attributable to covered claims (fraud claims were excluded under the policy) were limited to the amount of the insured’s $1.5 million retention such that the insurer had no liability. The court recognized that had the settlement been structured in a different way or the claims been litigated, such that allegations were made against the sellers in a complaint filed with a court of record subject to Federal Rule of Civil Procedure 11 or a state court equivalent, then the insurer might have been liable. The saving grace for the insurer here appears to have been that the insureds rushed to settle and did not structure their settlement in a way to invoke coverage. The court also recognized that the insured failed to give the insurer sufficient time to review and approve/reject the settlement before consummation.

While Ratajczak resulted in a decision for the insurer, the opinion left much room for creative buyers or sellers to structure claims in a way to obtain coverage where the policy drafter might have intended otherwise.

The Current M&A Cycle

M&A activity remains robust and many leading experts predict the trend to continue through 2018.[7] Representations and warranties products appear here to stay and have a place in a well-managed portfolio. However, these policies have long tail risk typically providing coverage for general representations up to three years and fundamental representations up to six years with some market participants reportedly offering longer coverage periods in an attempt to capture market share. What will happen if the current M&A market turns and current policyholders look to hedge loses by making increased claims or potentially assigning their interest in policies including assignments made in bankruptcy. Insurers would be well served to keep an eye on market conditions and work through strategies to address any increase in claims percentage or severity in advance of any economic downturn as such claims experience may directly impact loss ratios.

[1] The phrase unknown unknowns was popularized by former Secretary of Defense Donald Rumsfeld who on February 12, 2002, stated at a Department of Defense news briefing: “Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns – the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.” Transcript available at http://archive.defense.gov/Transcripts/Transcript.aspx?TranscriptID=2636, last visited May 24, 2018.

[2] AIG, Claims Intelligence Series, M&A Insurance – The New Normal?, May 2018, available at https://www.aig.com/content/dam/aig/america-canada/us/documents/insights/aig-manda-claimsintelligence-2018-r-and-w.pdf, last visited May 24, 2018.

[3] Gallagher Market Conditions, January 2018, available at https://www.ajg.com/media/1701903/rw-market-conditions-2018.pdf, last visited May 24, 2018.

[4] AIG, Claims Intelligence Series, M&A Insurance – The New Normal?, May 2018, available at https://www.aig.com/content/dam/aig/america-canada/us/documents/insights/aig-manda-claimsintelligence-2018-r-and-w.pdf, last visited May 24, 2018.

[5] Id., Source of Reprinted Graphic.

[6] Ratajczak v. Beazley Solutions, Ltd., 870 F.3d 650 (7th Cir. 2017).

[7] See, JP Morgan’s 2018 Global M&A Outlook, available at https://www.jpmorgan.com/jpmpdf/1320744801603.pdf, last visited May 24, 2018, and Deloitte’s The State of the Deal, M&A Trends 2018, available at https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-mergers-acquisitions-2018-trends-report.pdf, last visited May 24, 2018, among other forecasters.

Insurance Adjusters Can Be Sued Individually for Bad Faith in Washington

In a decision for Division One of the Washington Court of Appeals, Moun Keodalah, et al. v. Allstate Ins. Co., et al., No. 75731‑8-I, 2018 WL 1465526 (Wash. Ct. App. Mar. 26, 2018), the court held that a policyholder may directly sue an insurance claims adjuster for insurance bad faith and violations of the Washington Consumer Protection Act (“CPA”), even if the adjuster is acting within the course and scope of his or her employment. Prior to this decision, Washington courts permitted an insurance adjuster to be named individually in cases alleging bad faith or CPA violations only if they were employed by a third party independent adjusting firm.

The underlying case which resulted in the Keodalah decision involved a motorcycle accident where the insured, Keodalah, was hit by an uninsured motorcyclist while both were driving. The motorcyclist died and Keodalah suffered injuries. Keodalah had UIM insurance through Allstate.

A police investigation determined that the motorcyclist was speeding and that Keodalah was not on the phone during the time of collision. Allstate’s own investigation also revealed that motorcyclist was speeding and splitting lanes at the time of the accident and that the motorcyclist’s excessive speed caused the collision.

Keodalah requested that Allstate pay its $25,000 UIM limits. Allstate denied, offering $1,600 to settle the claim based on its assessment that Keodalah was 70% at fault. After Keodalah asked Allstate to explain its basis for its position, Allstate increased its offer to $5,000.

Keodalah then sued Allstate, asserting a UIM claim. Allstate designated Tracey Smith, an Allstate insurance adjuster on the claim, as its 30(b)(6) representative. Smith claimed that Keodalah ran the stop sign and was on his cell phone, despite the fact that Allstate had the investigative reports showing the opposite. Smith later admitted that her statements were untrue.

Before trial, Keodalah rejected Allstate’s offer of $15,000 to settle the claim. The case proceeded to trial where the jury determined the motorcyclist was 100% at fault and awarded Keodalah $108,000.

Keodalah then filed suit against Allstate and Smith. Keodalah alleged IFCA violations, insurance bad faith, and CPA violations. After the trial court dismissed Keodalah’s claims against Smith, the Washington Court of Appeals granted discretionary review on two issues.

First, the court looked at whether an individual insurance adjuster may be liable for bad faith, concluding that this is permissible. It reasoned that the pertinent statute, RCW 48.01.030, required that “all persons” involved in insurance act in good faith. The term “person” was defined to include an individual. Therefore, the court determined that under the plain language of the statute, insurance representatives, as individuals, had a duty to act in good faith and could be sued if they breach that duty. The court also cited to two Washington decisions for support – one in federal district court and one in Division Three of the Washington Court of Appeals – which similarly held that the same statute unambiguously applies to corporate insurance adjusters based on the statute’s plain language. The difference in Keodalah was that the insurance adjuster was an individual adjuster employed by the insurer, while the prior cases involved third-party corporate adjusters.

The second issue was whether an individual insurance adjuster could be liable for violation of the CPA, which prohibits “[u]nfair methods of competition and unfair or deceptive acts or practices in the conduct of any trade or commerce.” RCW 19.86.020. The court answered this question in the affirmative, rejecting Smith’s argument that a contractual relationship is required in order for there to be liability under the CPA.

The court did hold that the plaintiff was foreclosed from suing the insurance adjuster under the Washington Insurance Fair Conduct Act (“IFCA”) due to the recent decision in Perez-Cristantos v. State Farm Fire & Casualty Insurance Co, 187 Wn.2d 669, 672 (2017), which held that the IFCA does not create an independent cause of action against insurers for regulatory violations.

At this time, no petition has been filed yet seeking review of this decision by the Washington Supreme Court.

A Reservation of Rights Alone Is Not Enough to Trigger Independent Counsel in California

Last month, California’s Third Appellate District added to a growing list of California appellate decisions holding that the mere possibility or potential for a conflict is not legally sufficient to require a defending insurer to provide independent counsel under California’s Cumis statute, Civil Code section 2860. Simply because the insurer sent a reservation of rights letter is not enough.

In Centex Homes v. St. Paul Fire and Marine Ins. Co. (1/22/2018, No. C081266) __Cal.App.5th __, the Third District addressed a dispute between insurer St. Paul and a developer, Centex Homes, regarding whether the insurer was required to provide independent counsel to defend Centex against actions brought by several homeowners alleging construction defects. St. Paul insured one of Centex’s subcontractors—Ad Land Venture—and Centex tendered the lawsuits to St. Paul for defense. St. Paul agreed to defend, subject to certain reservations of rights, including St. Paul’s right to deny indemnity to Centex for any claims by the homeowners not covered by the policy, including claims for damage to Ad Land’s work and damage caused by the work of other subcontractors not insured by St. Paul.

St. Paul appointed a defense attorney to defend Centex in the underlying actions, but Centex claimed St. Paul’s reservation of rights created a conflict requiring St. Paul to pay for independent counsel under California Civil Code section 2860.

Centex essentially argued that a right to independent counsel exists whenever an insurer reserves rights. The Third District disagreed. Quoting Gafcon, Inc. v. Ponsor & Associates (2002) 98 Cal.App.4th 1388, 1421, the court explained, “a conflict of interest does not arise every time the insurer proposes to provide a defense under a reservation of rights. There must also be evidence that ‘the outcome of [the] coverage issue can be controlled by counsel first retained by the insurer for the defense of the [underlying] claim.’” The court rejected the contention that defense counsel in a construction defect case could control the outcome of the coverage case. (Centex, supra, at p.13-14.)

A conflict of interest exists “only when the basis for the reservation of rights is such as to cause assertion of factual or legal theories which undermine or are contrary to the positions to be asserted in the liability case[.]” (Gafcon, supra, 98 Cal.App.4th at 1421-22.) A “mere possibility of an unspecified conflict does not require independent counsel[;]” rather, the conflict must be “significant, not merely theoretical, actual, not merely potential.” (Dynamic Concepts, supra, 61 Cal.App.4th at 1007.)

The Centex decision follows a long line of California decisions that are “both considered and settled.” (Centex, supra, at p.8.) California courts have repeatedly held that in the absence of an actual conflict of interest giving rise to the insured’s right to independent counsel, the defending insurer controls the defense of the underlying suit, including settlement and trial. “[U]ntil such a conflict arises, the insurer has the right to control defense and settlement of the third party action against its insured, and is generally a direct participant in the litigation.” (Gafcon, supra, 98 Cal.App.4th at 1407, citing James 3 Corp. v. Truck Ins. Exchange (2001) 91 Cal.App.4th 1093, fn. 3; see also Federal Ins. Co. v. MBL, Inc. (2013) 219 Cal.App.4th 29, 41 [“[T]he mere fact the insurer disputes coverage does not entitle the insured to Cumis Counsel;…”]; Blanchard v. State Farm Fire and Cas. Co. (1991) 2 Cal.App.4th 345, 350; Dynamic Concepts, Inc. v. Truck Ins. Exch. (1998) 61 Cal.App.4th 999, 1007; Long v. Century Indem. Co. (2008) 163 Cal.App.4th 1460, 1468; Centex Homes v. St. Paul Fire & Marine Ins. Co. (2015) 237 Cal.App.4th 23, 31-32.)

In Its October-2018 Term, the Supreme Court of the United States Will Address Whether the Court or a Panel of Arbitrators Decides Applicability of the Federal Arbitration Act Where the Parties Have Delegated Questions of Arbitrability to the Arbitrators

On February 26, 2018, the Supreme Court of the United States granted certiorari in Oliveira v. New Prime, Inc., 857 F.3d 7 (1st Cir. 2017), cert. granted, 2018 WL 1037577 (U.S. Feb. 26, 2018) (No. 17-340), and added the case to its October-2018 Term. The Court will resolve a circuit split which has developed among the First, Eighth, and Ninth Circuits, in addition to division among lower federal and state courts, regarding gateway questions of arbitrability under the Section 1 definitions and exemptions of the FAA. More specifically, the Court will again address efforts by lower courts to avoid the broad mandate under the FAA in favor of the enforcement of arbitration agreements in the context of an arbitration agreement containing an express class waiver provision.

The FAA applies to “[a] written provision in any maritime transaction or a contract evidencing a transaction involving commerce to settle by arbitration . . . .” 9 U.S.C. §2 (emphasis added). At issue in New Prime (and the circuit split before SCOTUS), is the intersection of the FAA’s definition of commerce which provides for various exceptions including one for “any other class of workers engaged in foreign or interstate commerce”, 9 U.S.C. §1, and the Supreme Court’s directive that “[a]n agreement to arbitrate a gateway issue is simply an additional, antecedent agreement the party seeking arbitration asks the federal court to enforce”. Rent-A-Center, West, Inc. v. Jackson, 561 U.S. 63, 70 (2010). Couched broadly, the question before the Supreme Court is whether a party who wishes to avoid an agreement to arbitrate questions of arbitrability can do so by presenting the dispute as one of statutory interpretation under the FAA. In other words, how broad is the mandate of Rent-A-Center. Such a question may hold similarities to the age old quandary which came first, the chicken or the egg.

Legal questions concerning the enforcement of arbitration agreements and initial questions of arbitrability under the FAA remain points of heated contention. One of the benefits of arbitration is a streamlined process where discovery (and its attendant costs) can be moderated and controlled before a panel of subject matter experts who bring reinsurance, insurance, or other expertise to the dispute at hand. Those efficiencies are much more difficult to realize if courts engage in lengthy proceedings, including discovery and the weighing of evidence, to determine gateway factual questions about arbitrability where the parties contracted to submit questions of arbitrability, i.e. the arbitrator’s jurisdiction among other issues, to the arbitrators.

Prominent Insurance Lawyer Damon Vocke Joining Duane Morris

CHICAGO and NEW YORK, January 2, 2018 – Former General Re Corporation President and General Counsel Damon Vocke is joining the Duane Morris insurance practice, the firm announced today. Vocke had most recently headed his own firm, the Vocke Law Group, with locations in New York, Chicago and Stamford, Connecticut. Along with partner Ronald Lepinskas and special counsel Mark Holton from the Vocke firm, he joins a Duane Morris insurance industry practice group that comprises over 100 lawyers in offices across the firm. Vocke will be working with the group nationally and particularly in New York.

To continue reading, please visit the Duane Morris website.

Former Insurance GC Joins Duane Morris

When Damon Vocke launched an insurance litigation boutique in October 2016, the firm led by the former general counsel of Berkshire Hathaway Inc. reinsurance subsidiary General Re Corp. was marketed as a “nimble and low-cost” alternative to “mega firms.”

A little more than a year later, the Vocke Law Group (VLG) has shut its doors as Vocke and two other lawyers bring their practices to Duane Morris, a firm of more than 650 lawyers. Vocke said in an interview Tuesday that his clients would benefit from the broader geographic reach and legal knowledge offered by Duane Morris.

“We’re really excited to turbocharge what we’re doing and what we think we can continue to do with the broader, highly respected Duane Morris platform, particularly in the Midwest, East Coast and international business,” said Vocke, who held a number of business roles at Gen Re in addition to his title as in-house legal chief.

To continue reading, please visit the Duane Morris website.

2016 Insurance-Related Class Actions Filed In or Removed to Federal Court

This report analyzes 210 insurance-related class actions filed in or removed to federal court in 2016. In many respects, the results are predictable. The greatest percentage of the insurance-related class actions involve coverage or claims handling decisions, although there were a few interesting pockets of recurring class claims, such as inflated drug prices and cost of insurance (‘‘COI’’) increases for life insurance policies. The predominant forum choices were on the American coasts, California and Florida being the preferred locations. One notable result was the frequency of voluntary dismissals by the plaintif fand individual settlements reached with the named plaintif fonly. It can only be surmised that either these cases never were intended to be consummated as class actions or that impediments arose after filing that prevented a cost-effective resolution on a class-wide basis.

To read the rest of this article by Duane Morris partner Charlotte E. Thomas, please visit the Duane Morris website.

Applying Contractual Principles In Pa. Unfair-Trade Claims

Claims against insurers under Pennsylvania’s Unfair Trade Practices and Consumer Protection Law (UTPCPL) occupy a unique place in its jurisprudence. Insurance is highly regulated, and many other recovery avenues exist in Pennsylvania for aggrieved insureds, such as breach of contract and bad faith. Usually, insurance claims are tethered to contract law, since the insured-insurer relationship and duties are governed by the insurance policy. Courts should be reluctant to ignore contractual principles when a UTPCPL claim arises out of a policy.

Generally, deceptive insurance solicitations are actionable under the UTPCPL, while post-inception policy-related claims are not. Toy v. Metropolitan Life Insurance Co.[1] exemplifies this point. Toy involved an insurance salesman’s pre-issuance misrepresentations about the investment qualities of a life insurance policy. The insured asserted both bad faith and UTPCPL claims. The Pennsylvania Supreme Court affirmed dismissal of the statutory bad faith claim, concluding that bad faith did not cover an “insurer engaged in unfair or deceptive practices in soliciting the purchase of a policy.”[2] By contrast, the court allowed the UTPCPL deceptive sales practices claim to proceed. Under Toy, claims that arise out of solicitation-related deception can give rise to a UTPCPL claim, such as misrepresentations during the sale of the policy, while bad faith and breach of contract theories apply following policy inception.

Read the full text of this article by Duane Morris partner Charlotte Thomas.

Talc Litigation and Insurance Implications

Is talc the elusive “next big thing” long sought by the plaintiffs’ bar? Recent verdicts against cosmetic talc defendants, including Johnson & Johnson (“J & J”), suggest that talc litigation, at a minimum, is a material threat to talc defendants and the insurance industry. In 2016, J & J and other defendants suffered three large verdicts for exposure to its baby powder in St. Louis, Mo.: $72M, $70M and $55M. All three verdicts, in a jurisdiction considered favorable to asbestos plaintiffs, included substantial punitive damages. The plaintiffs in each of these cases alleged that exposure to talc contained in J&J’s baby powder caused them to contract ovarian cancer. Also in 2016, a Los Angeles jury awarded $18M to a plaintiff who sued a cosmetic talc defendant alleging exposure to cosmetic talc cause the plaintiff to contract mesothelioma.

Assuming talc litigation is not going away any time soon, several questions are raised. Are all talc claims the same? What is the relationship between talc and asbestos, if any? What defendants are at risk in the talc litigation? What are the insurance implications of talc claims, and are they alike or different from asbestos and other long-tail coverage claims? Continue reading “Talc Litigation and Insurance Implications”