In an opinion filed on the last day of 2019, the California Court of Appeal, Third District, reversed a trial court’s holding that an additional insured was not bound by an arbitration agreement in an insurance policy. In Philadelphia Indemnity Insurance Company v. SMG Holdings, Inc., Case No. C082841 (certified for publication on January 28, 2020), the court held that an arbitration agreement in a commercial general liability policy (“CGL”) issued by Philadelphia Indemnity Insurance Company (“Philadelphia”) bound SMG Holdings, Inc. (“SMG”), a “third party beneficiary” under the policy that was also “equitably estopped” from avoiding the arbitration clause. The court reversed the trial court, vacated its order denying Philadelphia’s petition to compel arbitration, and directed the trial court to order arbitration of the coverage dispute. Continue reading “California Court of Appeal: Third Party, Additional Insured Bound by Policy’s Arbitration Clause”

Paul Killion Elected to the California Academy of Appellate Lawyers

Duane Morris partner Paul J. Killion has been elected to the California Academy of Appellate Lawyers. The CAAL is an election-only organization devoted to excellence in appellate practice, comprised of about 100 of the top appellate lawyers in the state.

Duane Morris partner Paul J. Killion has been elected to the California Academy of Appellate Lawyers. The CAAL is an election-only organization devoted to excellence in appellate practice, comprised of about 100 of the top appellate lawyers in the state.

Florida Federal Court recognizes Federal Admiralty Rule of Strict Enforcement of Warranties in Marine Insurance Preempts State Law

We are pleased to present a decision in which we prevailed from the United States District Court for the Southern District of Florida.

The ruling is significant for its holding that the 11th Circuit Court of Appeals [encompassing the US Southeast including Florida] recognizes an established Federal Admiralty rule of law that warranties in marine insurance are to be strictly enforced. The ruling clarifies a number of inconsistent decisions in Florida holding that only navigational limits warranties were entitled to strict enforcement, and that the Florida Anti-Technical statute otherwise applied. The primary distinction is that the strict enforcement of a warranty excuses the policy from responding in the event of a violation independent of a causal relationship between the violation and the claimed loss, whereas many states’ laws, such as Florida’s Anti-Technical Statute, require the insurer to prove a causal relationship between the violation and the claimed loss to deny a claim.

Duane Morris’ Thomas Newman Recognized as the NYC Appellate “Lawyer of the Year” by Best Lawyers

Duane Morris’ Thomas Newman has been named by Best Lawyers as the 2019 “Lawyer of the Year” in New York City for Appellate Practice. The recognition is given to only one attorney for each practice area and city. Lawyers are selected based on high marks received during peer-review assessments conducted by Best Lawyers each year. Mr. Newman also received this distinction in 2018 and 2013.

Mr. Newman practices in the areas of insurance and reinsurance law, including coverage, claims handling, contract drafting and arbitration and litigation. In addition to his insurance/reinsurance practice, Mr. Newman has wide experience in appellate practice and has handled hundreds of appeals in both state and federal courts in New York and elsewhere and has argued 80 appeals in the New York Court of Appeals.

He is a member of the American Academy of Appellate Lawyers; a life member of the American Law Institute; a Fellow of the Chartered Institute of Arbitrators; a member of the London Court of International Arbitration; a member of the American College of Coverage and Extracontractual Counsel; a member of ARIAS-U.S.; a member of the Federation of Defense and Corporate Counsel; a Fellow of the New York State Bar Association Foundation; and a member of the New York State Office of Court Administration’s Advisory Committee on Civil Practice.

He is the original author of New York Appellate Practice, co-author of the Handbook on Insurance Coverage Disputes and the author of numerous articles on insurance/reinsurance and appellate practice.

Directors Roundtable Program, “Dealing with Corporate Crisis”

Duane Morris partners Christopher Casey and Damon Vocke will present a complimentary Directors Roundtable program, “Dealing with Corporate Crisis,” on Thursday, June 28, 2018, from 8:30 a.m. to 10:30 a.m. at the Deloitte Conference Center in New York City. For more information or to register, please visit the Directors Roundtable website.

Representations and Warranties Insurance Beyond the Current Cycle of Merger Activity: Will Those Chickens Come Home to Roost?

Representations and warranties insurance transfers the risk of certain known unknowns and unknown unknowns from transaction participants to the underwriting insurer.[1] Such risk transfer can create moral hazard especially where one of the parties to the transaction, i.e. the seller (and also the underwriting broker), receive the majority, if not all, remuneration on the deal and exit the stage before the unknowns become knowns. It also can create a situation where insurers who seek an expanded share of what has been called a “prolonged sellers’ market” may face deteriorating claims and be left with an undesirable position when the economic waters recede.[2]

What is Representations and Warranties Insurance

Representations and warranties insurance provides coverage for financial losses resulting from a breach of a representation or warranty made by a seller in a purchase and sale agreement. It is a subset of transactional risk insurance and sometimes called M&A insurance or warranty and indemnity insurance. Counterparties used to address these type of risks through negotiated escrows which kept the risk allocated among the parties to the transaction. Transactional parties often now lay that risk off to an insurer’s balance sheet.

The Domestic Market Has Grown at an Astronomical Pace

The market for representations and warranties insurance exploded in the past decade. According to one of the major brokers, total industry limits (combined primary and excess) approached $14.7 billion and generated approximately $526.5 million in premium on more than two-thousand issued policies in 2016.[3] That is remarkable growth for a product that reportedly generated $10 billion in bound coverage worldwide in 2013 and was on virtually no one’s radar screen before the recent M&A uptick which followed the Great Recession.

As of 2018, a representations and warranties policy is generally priced between 2.25% to 4% of the limit of liability with market capacity and appetite for large transactions increasing. Typically, 1-3% of enterprise value is retained, but it has been reported that recent retentions have gone below 1% as the market tightens among insurers competing for market share.

Reported Claims Experience

AIG was one of the first insurers to write representations and warranties insurance (referred to as warranty & indemnity insurance outside the domestic market) and has published three annual reports on its claims experience. According to those reports, approximately one-in-five (19.4%) policies written result in a claim.[4] The largest deals from a dollar perspective (deal size over $1 billion) generate the highest claims frequency (24%) and the largest average claim ($19 million). An increased year-on-year claims frequency was reported across all classes of deal size. According to AIG, nearly half of all material claims (46%) resulted in what was termed a mid-sized payout (payment on the claim between $1 million to $10 million) with an average settlement of $4 million over the five year period of policies written between 2011-2016. That reported average settlement was up, from $3.5 million, in the prior report.

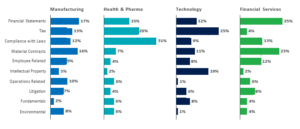

In 2018, AIG for the first time provided data broken down on breach type by industry sector as set forth below.[5]

AIG’s reported claims figures suggest that insureds have become more sophisticated in their use of the product with an impact on the frequency and severity of claims.

Judicial Determinations of First Impression

In 2017, the United States Court of Appeals for the Seventh Circuit became the first court of review to address a claim for indemnity under a representations and warranty policy in a published opinion.[6] A $23.4 million stock purchase deal for a specialty dairy products company which resulted in a $10 million settlement between the corporate buyer and the family members who had sold their 100% interest in the company was at issue before the court. The sellers purchased a seller’s warranty and indemnity insurance policy with an aggregate cover of $10 million over a $1.5 million retention which provided coverage for various representations made in the deal documents on a claims made basis with a policy period extending for six years after the closing.

The Seventh Circuit affirmed summary judgment in favor of the insurer. The court held that the settled claims were for breach of general representations for which the deal documents capped damages at $1.5 million. As a result, the damages attributable to covered claims (fraud claims were excluded under the policy) were limited to the amount of the insured’s $1.5 million retention such that the insurer had no liability. The court recognized that had the settlement been structured in a different way or the claims been litigated, such that allegations were made against the sellers in a complaint filed with a court of record subject to Federal Rule of Civil Procedure 11 or a state court equivalent, then the insurer might have been liable. The saving grace for the insurer here appears to have been that the insureds rushed to settle and did not structure their settlement in a way to invoke coverage. The court also recognized that the insured failed to give the insurer sufficient time to review and approve/reject the settlement before consummation.

While Ratajczak resulted in a decision for the insurer, the opinion left much room for creative buyers or sellers to structure claims in a way to obtain coverage where the policy drafter might have intended otherwise.

The Current M&A Cycle

M&A activity remains robust and many leading experts predict the trend to continue through 2018.[7] Representations and warranties products appear here to stay and have a place in a well-managed portfolio. However, these policies have long tail risk typically providing coverage for general representations up to three years and fundamental representations up to six years with some market participants reportedly offering longer coverage periods in an attempt to capture market share. What will happen if the current M&A market turns and current policyholders look to hedge loses by making increased claims or potentially assigning their interest in policies including assignments made in bankruptcy. Insurers would be well served to keep an eye on market conditions and work through strategies to address any increase in claims percentage or severity in advance of any economic downturn as such claims experience may directly impact loss ratios.

[1] The phrase unknown unknowns was popularized by former Secretary of Defense Donald Rumsfeld who on February 12, 2002, stated at a Department of Defense news briefing: “Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns – the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.” Transcript available at http://archive.defense.gov/Transcripts/Transcript.aspx?TranscriptID=2636, last visited May 24, 2018.

[2] AIG, Claims Intelligence Series, M&A Insurance – The New Normal?, May 2018, available at https://www.aig.com/content/dam/aig/america-canada/us/documents/insights/aig-manda-claimsintelligence-2018-r-and-w.pdf, last visited May 24, 2018.

[3] Gallagher Market Conditions, January 2018, available at https://www.ajg.com/media/1701903/rw-market-conditions-2018.pdf, last visited May 24, 2018.

[4] AIG, Claims Intelligence Series, M&A Insurance – The New Normal?, May 2018, available at https://www.aig.com/content/dam/aig/america-canada/us/documents/insights/aig-manda-claimsintelligence-2018-r-and-w.pdf, last visited May 24, 2018.

[5] Id., Source of Reprinted Graphic.

[6] Ratajczak v. Beazley Solutions, Ltd., 870 F.3d 650 (7th Cir. 2017).

[7] See, JP Morgan’s 2018 Global M&A Outlook, available at https://www.jpmorgan.com/jpmpdf/1320744801603.pdf, last visited May 24, 2018, and Deloitte’s The State of the Deal, M&A Trends 2018, available at https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-mergers-acquisitions-2018-trends-report.pdf, last visited May 24, 2018, among other forecasters.

Insurance Adjusters Can Be Sued Individually for Bad Faith in Washington

In a decision for Division One of the Washington Court of Appeals, Moun Keodalah, et al. v. Allstate Ins. Co., et al., No. 75731‑8-I, 2018 WL 1465526 (Wash. Ct. App. Mar. 26, 2018), the court held that a policyholder may directly sue an insurance claims adjuster for insurance bad faith and violations of the Washington Consumer Protection Act (“CPA”), even if the adjuster is acting within the course and scope of his or her employment. Prior to this decision, Washington courts permitted an insurance adjuster to be named individually in cases alleging bad faith or CPA violations only if they were employed by a third party independent adjusting firm.

The underlying case which resulted in the Keodalah decision involved a motorcycle accident where the insured, Keodalah, was hit by an uninsured motorcyclist while both were driving. The motorcyclist died and Keodalah suffered injuries. Keodalah had UIM insurance through Allstate.

A police investigation determined that the motorcyclist was speeding and that Keodalah was not on the phone during the time of collision. Allstate’s own investigation also revealed that motorcyclist was speeding and splitting lanes at the time of the accident and that the motorcyclist’s excessive speed caused the collision.

Keodalah requested that Allstate pay its $25,000 UIM limits. Allstate denied, offering $1,600 to settle the claim based on its assessment that Keodalah was 70% at fault. After Keodalah asked Allstate to explain its basis for its position, Allstate increased its offer to $5,000.

Keodalah then sued Allstate, asserting a UIM claim. Allstate designated Tracey Smith, an Allstate insurance adjuster on the claim, as its 30(b)(6) representative. Smith claimed that Keodalah ran the stop sign and was on his cell phone, despite the fact that Allstate had the investigative reports showing the opposite. Smith later admitted that her statements were untrue.

Before trial, Keodalah rejected Allstate’s offer of $15,000 to settle the claim. The case proceeded to trial where the jury determined the motorcyclist was 100% at fault and awarded Keodalah $108,000.

Keodalah then filed suit against Allstate and Smith. Keodalah alleged IFCA violations, insurance bad faith, and CPA violations. After the trial court dismissed Keodalah’s claims against Smith, the Washington Court of Appeals granted discretionary review on two issues.

First, the court looked at whether an individual insurance adjuster may be liable for bad faith, concluding that this is permissible. It reasoned that the pertinent statute, RCW 48.01.030, required that “all persons” involved in insurance act in good faith. The term “person” was defined to include an individual. Therefore, the court determined that under the plain language of the statute, insurance representatives, as individuals, had a duty to act in good faith and could be sued if they breach that duty. The court also cited to two Washington decisions for support – one in federal district court and one in Division Three of the Washington Court of Appeals – which similarly held that the same statute unambiguously applies to corporate insurance adjusters based on the statute’s plain language. The difference in Keodalah was that the insurance adjuster was an individual adjuster employed by the insurer, while the prior cases involved third-party corporate adjusters.

The second issue was whether an individual insurance adjuster could be liable for violation of the CPA, which prohibits “[u]nfair methods of competition and unfair or deceptive acts or practices in the conduct of any trade or commerce.” RCW 19.86.020. The court answered this question in the affirmative, rejecting Smith’s argument that a contractual relationship is required in order for there to be liability under the CPA.

The court did hold that the plaintiff was foreclosed from suing the insurance adjuster under the Washington Insurance Fair Conduct Act (“IFCA”) due to the recent decision in Perez-Cristantos v. State Farm Fire & Casualty Insurance Co, 187 Wn.2d 669, 672 (2017), which held that the IFCA does not create an independent cause of action against insurers for regulatory violations.

At this time, no petition has been filed yet seeking review of this decision by the Washington Supreme Court.

A Reservation of Rights Alone Is Not Enough to Trigger Independent Counsel in California

Last month, California’s Third Appellate District added to a growing list of California appellate decisions holding that the mere possibility or potential for a conflict is not legally sufficient to require a defending insurer to provide independent counsel under California’s Cumis statute, Civil Code section 2860. Simply because the insurer sent a reservation of rights letter is not enough.

In Centex Homes v. St. Paul Fire and Marine Ins. Co. (1/22/2018, No. C081266) __Cal.App.5th __, the Third District addressed a dispute between insurer St. Paul and a developer, Centex Homes, regarding whether the insurer was required to provide independent counsel to defend Centex against actions brought by several homeowners alleging construction defects. St. Paul insured one of Centex’s subcontractors—Ad Land Venture—and Centex tendered the lawsuits to St. Paul for defense. St. Paul agreed to defend, subject to certain reservations of rights, including St. Paul’s right to deny indemnity to Centex for any claims by the homeowners not covered by the policy, including claims for damage to Ad Land’s work and damage caused by the work of other subcontractors not insured by St. Paul.

St. Paul appointed a defense attorney to defend Centex in the underlying actions, but Centex claimed St. Paul’s reservation of rights created a conflict requiring St. Paul to pay for independent counsel under California Civil Code section 2860.

Centex essentially argued that a right to independent counsel exists whenever an insurer reserves rights. The Third District disagreed. Quoting Gafcon, Inc. v. Ponsor & Associates (2002) 98 Cal.App.4th 1388, 1421, the court explained, “a conflict of interest does not arise every time the insurer proposes to provide a defense under a reservation of rights. There must also be evidence that ‘the outcome of [the] coverage issue can be controlled by counsel first retained by the insurer for the defense of the [underlying] claim.’” The court rejected the contention that defense counsel in a construction defect case could control the outcome of the coverage case. (Centex, supra, at p.13-14.)

A conflict of interest exists “only when the basis for the reservation of rights is such as to cause assertion of factual or legal theories which undermine or are contrary to the positions to be asserted in the liability case[.]” (Gafcon, supra, 98 Cal.App.4th at 1421-22.) A “mere possibility of an unspecified conflict does not require independent counsel[;]” rather, the conflict must be “significant, not merely theoretical, actual, not merely potential.” (Dynamic Concepts, supra, 61 Cal.App.4th at 1007.)

The Centex decision follows a long line of California decisions that are “both considered and settled.” (Centex, supra, at p.8.) California courts have repeatedly held that in the absence of an actual conflict of interest giving rise to the insured’s right to independent counsel, the defending insurer controls the defense of the underlying suit, including settlement and trial. “[U]ntil such a conflict arises, the insurer has the right to control defense and settlement of the third party action against its insured, and is generally a direct participant in the litigation.” (Gafcon, supra, 98 Cal.App.4th at 1407, citing James 3 Corp. v. Truck Ins. Exchange (2001) 91 Cal.App.4th 1093, fn. 3; see also Federal Ins. Co. v. MBL, Inc. (2013) 219 Cal.App.4th 29, 41 [“[T]he mere fact the insurer disputes coverage does not entitle the insured to Cumis Counsel;…”]; Blanchard v. State Farm Fire and Cas. Co. (1991) 2 Cal.App.4th 345, 350; Dynamic Concepts, Inc. v. Truck Ins. Exch. (1998) 61 Cal.App.4th 999, 1007; Long v. Century Indem. Co. (2008) 163 Cal.App.4th 1460, 1468; Centex Homes v. St. Paul Fire & Marine Ins. Co. (2015) 237 Cal.App.4th 23, 31-32.)

In Its October-2018 Term, the Supreme Court of the United States Will Address Whether the Court or a Panel of Arbitrators Decides Applicability of the Federal Arbitration Act Where the Parties Have Delegated Questions of Arbitrability to the Arbitrators

On February 26, 2018, the Supreme Court of the United States granted certiorari in Oliveira v. New Prime, Inc., 857 F.3d 7 (1st Cir. 2017), cert. granted, 2018 WL 1037577 (U.S. Feb. 26, 2018) (No. 17-340), and added the case to its October-2018 Term. The Court will resolve a circuit split which has developed among the First, Eighth, and Ninth Circuits, in addition to division among lower federal and state courts, regarding gateway questions of arbitrability under the Section 1 definitions and exemptions of the FAA. More specifically, the Court will again address efforts by lower courts to avoid the broad mandate under the FAA in favor of the enforcement of arbitration agreements in the context of an arbitration agreement containing an express class waiver provision.

The FAA applies to “[a] written provision in any maritime transaction or a contract evidencing a transaction involving commerce to settle by arbitration . . . .” 9 U.S.C. §2 (emphasis added). At issue in New Prime (and the circuit split before SCOTUS), is the intersection of the FAA’s definition of commerce which provides for various exceptions including one for “any other class of workers engaged in foreign or interstate commerce”, 9 U.S.C. §1, and the Supreme Court’s directive that “[a]n agreement to arbitrate a gateway issue is simply an additional, antecedent agreement the party seeking arbitration asks the federal court to enforce”. Rent-A-Center, West, Inc. v. Jackson, 561 U.S. 63, 70 (2010). Couched broadly, the question before the Supreme Court is whether a party who wishes to avoid an agreement to arbitrate questions of arbitrability can do so by presenting the dispute as one of statutory interpretation under the FAA. In other words, how broad is the mandate of Rent-A-Center. Such a question may hold similarities to the age old quandary which came first, the chicken or the egg.

Legal questions concerning the enforcement of arbitration agreements and initial questions of arbitrability under the FAA remain points of heated contention. One of the benefits of arbitration is a streamlined process where discovery (and its attendant costs) can be moderated and controlled before a panel of subject matter experts who bring reinsurance, insurance, or other expertise to the dispute at hand. Those efficiencies are much more difficult to realize if courts engage in lengthy proceedings, including discovery and the weighing of evidence, to determine gateway factual questions about arbitrability where the parties contracted to submit questions of arbitrability, i.e. the arbitrator’s jurisdiction among other issues, to the arbitrators.

Prominent Insurance Lawyer Damon Vocke Joining Duane Morris

CHICAGO and NEW YORK, January 2, 2018 – Former General Re Corporation President and General Counsel Damon Vocke is joining the Duane Morris insurance practice, the firm announced today. Vocke had most recently headed his own firm, the Vocke Law Group, with locations in New York, Chicago and Stamford, Connecticut. Along with partner Ronald Lepinskas and special counsel Mark Holton from the Vocke firm, he joins a Duane Morris insurance industry practice group that comprises over 100 lawyers in offices across the firm. Vocke will be working with the group nationally and particularly in New York.

To continue reading, please visit the Duane Morris website.