- As a result of bankruptcy, SunEdison will sell a portfolio of more than 100 patents and 200 patent applications to China’s GLC-Poly Energy Holdings.

- The bulk of the portfolio is directed to SunEdison’s proprietary materials and processes for manufacturing a solar panel.

- Transfer of ownership to GLC-Poly may complicate business for former SunEdison supplier SMP Ltd.

Last month the judge overseeing SunEdison Inc.’s bankruptcy denied an effort by South Korea-based SMP Ltd. to prevent the sale of SunEdison’s patent portfolio. SMP, which was formed as a joint venture between Samsung and SunEdison to supply key elements of SunEdison’s solar panels, had argued that Korean law prevented SunEdison from terminating a supply and license agreement. If SMP prevailed on this argument, then SunEdison would have been unable to terminate the supply and license agreement, and as a result would have been prevented from selling its patent portfolio.U.S. Bankruptcy Judge Stuart Bernstein dismissed SMP’s claims, finding that New York law governed the agreement and that SunEdison had properly terminated it. Judge Bernstein’s decision thus removed a potential obstacle to the sale of SunEdison’s patent portfolio.

As part of its bankruptcy proceeding, SunEdison put its patent portfolio up for auction in August 2016. The portfolio was included in a sale of assets relating to SunEdison’s solar materials business that included assumed contracts, property, equipment, and intellectual property.

The Chinese firm GLC-Poly Energy Holdings Ltd. made a “stalking horse bid” of $150 million for the assets. A stalking horse bid is used in bankruptcy proceedings to protect the bankrupt party from undervaluing its assets; it is essentially the opening bid made by an interested party at the start of an asset sale. When the auction closed in October 2016, GLC-Poly remained the highest bidder. With the recent removal of SMP’s objection, GLC-Poly is poised to complete the sale.

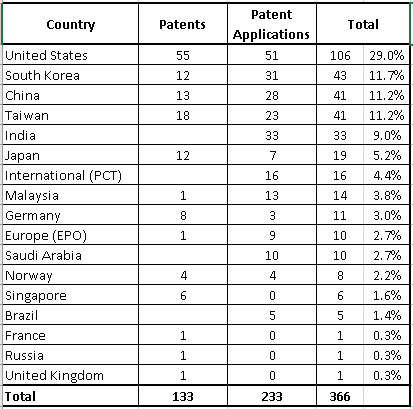

When SunEdison proposed selling the assets in August 2016, the patent portfolio contained 133 granted patents and 233 pending patent applications. The SunEdison portfolio has a presence in 17 patent jurisdictions, as shown below in Table 1. Since that time, a number of the patent applications have likely been granted as new patents.

Table 1. SunEdison Patents and Patent Applications by Jurisdiction

As a U.S.-based company with manufacturing and sourcing operations in South Korea, a patent protection strategy focused on those countries is reasonable. China, Taiwan, and India are also logical countries for seeking patents due to their importance as solar component producers, solar energy consumers, and a likely location for competing solar firms. Beyond these countries, SunEdison’s portfolio has limited coverage in parts of Asia, Europe, the Middle East, and Brazil. Using conservative cost estimates, this portfolio probably represents an investment of at least $4 million to $6 million in legal and government fees.

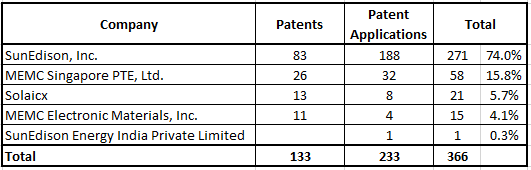

As shown in Table 2, the portfolio is divided among five corporate entities, with the bulk of the patents and patent applications owned by SunEdison itself. Of note, 13 patents and 8 patent applications are owned by Solaicx, a silicon materials manufacturer acquired by SunEdison in 2010. The Solaicx patents and patent applications cover aspects of the Continuous Czochralski Process (CCZ), which is discussed further below as a key technical area of SunEdison’s expertise.

Table 2. SunEdison Patents and Patent Applications by Company

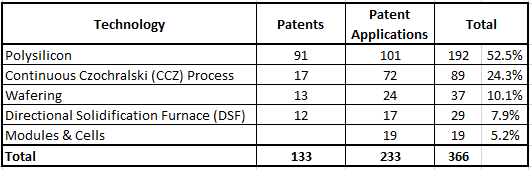

The SunEdison portfolio can also be divided into technology areas that are covered by a given patent or patent application. Table 3 provides a breakdown of technologies.

Table 3. SunEdison Patents and Patent Applications by Technology

A majority of the portfolio is directed to inventions that improve the polysilicon materials used in solar panel manufacturing. We know that SunEdison’s South Korean supplier, SMP, was constructing a polysilicon plant that utilizes SunEdison’s proprietary Fluidized Bed Reactor technology to produce electronic-grade silicon. SunEdison’s plan to replace lower-quality solar-grade silicon with electronic-grade silicon was a key component of its plan to dramatically increase the efficiency of SunEdison solar panels. This portion of the SunEdison portfolio is likely the most concerning for SMP, as GLC-Poly now will likely own at least some parts of the technological process in South Korea. This could potentially make it difficult for SMP to continue producing electronic-grade silicon, or may require SMP to license the technology from GLC-Poly.

Another substantial portion of the portfolio protects inventions related to the CCZ process. SunEdison’s acquisition of Solaicx was driven in part by Solaicx’s patent holdings in CCZ technology. The CCZ process is a manufacturing technique that has yielded it higher quality silicon ingots (used in manufacturing solar cells) with lower processing costs.

The remainder of SunEdison’s portfolio is divided among wafering (dividing solar cell materials and forming them into solar panels), directional solidification furnaces, and miscellaneous others relating to the manufacturing and structuring of solar cells.

The SunEdison case demonstrates that sometimes patents and patent applications may be among the most valuable assets a company owns – even in bankruptcy. (For a similar example, see the Nortel Networks bankruptcy of 2011, where the Nortel patent portfolio sold for $4.5 billion). Going forward, this also may be a case study worth watching for the disruptive power of strong patent protection, as we wait to see whether GLC-Poly threatens any competitors – including SunEdison’s former supplier, SMP – with patent lawsuits.