This post was co-authored by Brad Thompson and Justus Getty.

- It is anticipated that by no later than the end of January 2018 the Trump administration will decide what, if any, import relief will be granted to the domestic solar panel manufacturing industry.

- Suniva petitioned the U.S. International Trade Commission (ITC) for import relief in May 2017, claiming domestic solar panel manufacturers have been seriously injured by increased solar panel imports.

- The four ITC Commissioners unanimously agreed on September 22, 2017, that imported solar panels have caused “serious injury” to domestic manufacturers, and have now made varying remedy proposals to President Trump for his approval.

- The potential impact on the domestic solar industry could be significant or relatively minor; however, the mere uncertainty around what the Trump administration might do has caused a “spike” in demand for solar panels as companies have stockpiled panels ahead of a potential imposition of tariffs or quotas on solar panel imports.

A widely followed trade case is set to reach its conclusion by the end of January, 2018, with an announcement from the Trump administration of what, if any, actions will be taken to protect the U.S. domestic solar panel industry. The administration has received recommendations from the U.S. International Trade Commission (ITC), triggering a two-month window for the President to take action. (The administration also could act earlier or grant itself additional time to hand down a final decision). The case was originally brought before the ITC this past May by domestic solar panel manufacturers Suniva, Inc., who was then joined by SolarWorld Americas Inc. in the case.

Although the ITC is no stranger to trade-related disputes, the renewable energy industry is not a typical litigant before Commission. The ITC is an independent, quasi-judicial federal agency that wields broad investigative responsibilities on trade matters. The ITC is perhaps best known in the legal profession as the venue for patent actions to block infringing products from being imported into the United States. These cases are often referred to as Section 337 investigations, after the portion of the Trade Act of 1974 that prohibits importation of infringing goods. In a Section 337 investigation, ITC staff, aided by the patent owner and importer, determines whether the imported products infringe the asserted patents. A finding of infringement results in an order banning importation of the infringing products. Given the degree of overseas manufacturing in many industries today, Section 337 investigations are known as a powerful tool for patent owners to use against their competitors.

A lesser-known and fairly infrequently-used type of case at the ITC is brought under Section 201 of the Trade Act. A Section 201 investigation is initiated by a party that believes a domestic industry is being seriously injured or threatened with serious injury by increased imports. The party can be a US trade association, company, union, or group of workers. The party files a petition with the ITC requesting “import relief,” and the ITC generally has 120 days to conduct its investigation.

An ITC investigation typically uses questionnaires sent to companies in the relevant industry to collect data on key economic indicators (i.e., sales volume, import volume, domestic production, etc.). ITC staff then compile the data and produce a report which the ITC Commissioners can vote to adopt. Since the report relies on private and confidential business data, publicly available versions are often heavily redacted.

Importantly, a petition under Section 201 does not need to show that importers engaged in unfair trade practices; rather, fair and successful import competition may be sufficient to trigger import relief. If the ITC finds serious injury to domestic industry caused by increased imports, the ITC then provides recommendations to the President, who has final authority over import relief. Import relief can take many forms, but generally includes tariffs on imports, import quotas, or a combination of the two.

Section 201 investigations are sometimes referred to as “escape clause” actions because they derive their authority from a portion of international trade law that allows countries to escape from or modify previously-granted trade concessions. As the U.S. negotiates trade agreements throughout the world, it typically agrees to reduce, cap, or eliminate tariffs on certain classes of goods. However, if those trade concessions result in imports “in such increased quantities … as to cause or threaten serious injury to domestic producers,” then the U.S. may suspend its obligations under the trade agreement and protect its domestic industry. [1]. Understandably, suspension of trade obligations are rarely implemented because they may undermine the trade agreement itself.

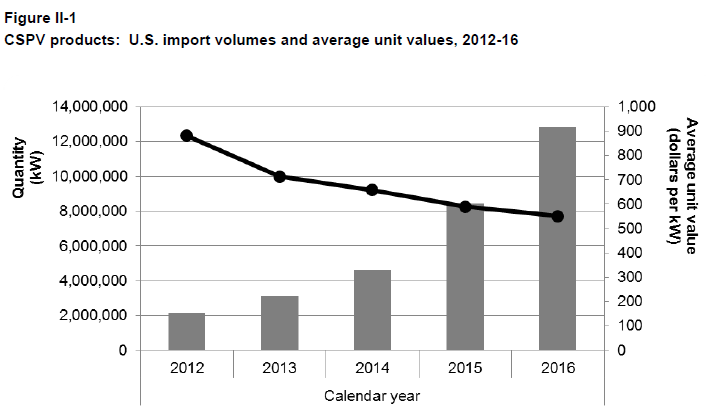

A petitioner under Section 201 must first demonstrate that imports of the product have increased. In Suniva’s case, the ITC investigation found what everyone in the renewables sector already knew: that there was a significant increase in solar panel imports between 2012 and 2016 of 492%. [2]. Figure II-1 from the ITC report shows the dramatic increases in solar panel importation during this time period. The ITC also found an increase in imports as a ratio to domestic production, topping out at 2,276% in 2016.

Figure II-1 of the ITC report.

A petitioner under section 201 then must show a “serious injury” to a domestic industry. To evaluate whether a serious injury has occurred, the ITC will typically look for: (A) the significant idling of domestic production facilities, (B) the inability of domestic companies to carry out domestic production at a reasonable profit, and (C) the significant unemployment or underemployment in the domestic industry. [3].

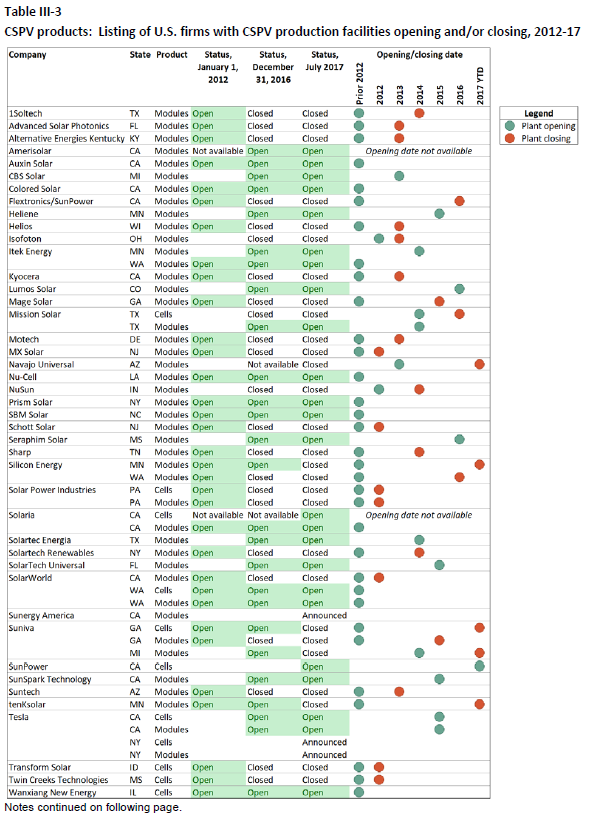

During its investigation of the solar panel industry, the ITC found a steep decline in domestic manufacturing facilities – from 33 to 16 – between 2012 and 2016. Those manufacturers remaining “continue[] to operate at below full capacity,” as “imports captured most of the growth in demand” seen in recent years. In Table III-3 of the report, reproduced below, the red dots indicate plant closures:

Table III-3 of the ITC Report. [4].

The ITC also found significant unemployment and underemployment in the solar panel industry, although the exact figures are redacted such that the magnitude of employment problems is not publically known. In another heavily-redacted passaged, the ITC concluded that domestic companies suffered hundreds of millions of dollars in losses between 2012 and 2016, and the industry faces “dismal and declining overall financial performance.” In view of this evidence, the ITC concluded that the domestic solar panel industry has been seriously injured.

If a petitioner can demonstrate serious injury, it finally must show that imports are a “substantial cause” of that injury. For a cause to be considered “substantial,” it must be equal to or greater than any other cause of the injury. Here, the ITC considers whether increased imports have led to a reduction in the domestic market share of the domestic producers, and explores other potential causes of the domestic injury.

The ITC notes in the Suniva/Solar World case report that the price of solar panels have dropped substantially in recent years as the market has been flooded with imports. Despite “explosive growth” in the solar panel market, domestic capacity was largely stagnant. The ITC concluded that imports are the substantial cause of the domestic industry’s injury, noting:

As imports increased rapidly and the domestic industry faced underutilization of its production assets, underinvestment, and closures, the domestic industry similarly was unable to take advantage of a market in which apparent U.S. consumption increased significantly.

The ITC also dismissed alternative causes such as “missteps” by the domestic industry, declining material costs, and reduced government incentives, as less significant than imports in causing the serious injury.

Once the ITC determines that a serious injury to the domestic industry has been substantially caused by increased imports, it is directed to recommend actions to the President to correct the injury and “facilitate[e] the efforts of the domestic industry to make a positive adjustment to import competition.” [5]. Those recommended actions may include: (A) imposition of or increase in tariffs on the imported product, (B) tariff-rate quotas, (C) any quantitative restriction on importation of the product, (D) adjustment measures including the provision of trade adjustment assistance, and (E) any combination of (A) through (D). [6].

In perhaps the most controversial portion of the Suniva/Solar World case report, the four ITC Commissioners offered three wildly-differing plans for providing import relief to the domestic solar panel industry. The plans included quota volumes ranging between 0.5 and 8.9 gigawatts of solar panel capacity, and in-quota tariffs between 0 and 10%, and above-quota tariffs starting at 30% and declining at varying rates between the plans. Those recommendations were sent to the President, who now has free reign to craft his own version of import relief or decline to provide any relief at all.

The solar industry – including solar panel manufacturers, installers, and consumers – is now anxiously awaiting a decision from the Trump administration that could significantly impact the industry for years to come. Regardless of the outcome, this dispute demonstrates the ability of the ITC to potentially have significant influence over the renewable energy industry, and may represent the beginning of additional domestic-based challenges to other segments of the growing “green energy” industry.

Notes

[1] 19 U.S.C. § 2251(a).

[2] Although this post uses the general term “solar panels” for readability, the specific product evaluated by the ITC is “Crystalline Silicon Photovoltaic Cells” or “CSPVs.”

[3] 19 U.S.C. § 2252(c)(1)(A).

[4] This table is available at p. 226 of the ITC’s report located at https://www.usitc.gov/investigations/title_7/2017/crystalline_silicon_photovoltaic_cells_whether_or/safeguard.htm.

[5] 19 U.S.C. § 2251(e)(1).

[6] 19 U.S.C. § 2251(e)(2).