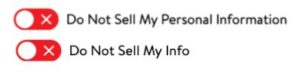

While the Colorado Privacy Act (CPA) has already been in effect, as of July 1, 2024, companies that meet the threshold compliance criteria for CPA and that engage in the processing of personal data for purposes of targeted advertising or the sale of personal data (“covered entities”) must implement a universal opt-out mechanism, which allows users to more easily exercise their opt-out rights with these covered entities. Specifically, a universal opt-out mechanism allows a user to configure their internet browser settings, and as a result, the websites the user visits from that browser automatically receive the user’s opt-out signal. As of July 1, 2024, covered entities must recognize and honor a user’s opt-out preferences where communicated through a universal opt-out mechanism.

Read the full Alert on the Duane Morris LLP website.