Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jennifer Riley and special counsel Brandon Spurlock with their analysis of key trends and notable rulings in the Racketeer Influenced And Corrupt Organizations (“RICO”) Act class action space. We hope you enjoy the episode.

Episode Transcript

Jennifer Riley: Thank you for being here again for the next episode of our Friday weekly podcast, the Class Action Weekly Wire. I’m Jen Riley, partner at Duane Morris, and joining me today is special counsel Brandon Spurlock – thank you for being on the podcast, Brandon!

Brandon Spurlock: Great to be here, Jen.

Jen: So today we wanted to discuss trends and important developments in the Racketeer Influenced and Corrupt Organizations Act – or better known as RICO – class action litigation. So RICO is a federal law that provides for extended criminal penalties and a civil cause of action for acts performed as part of an ongoing criminal enterprise. Congress enacted the RICO in 1970 in an attempt to combat organized crime in the United States. The law has since been used to prosecute a variety of offenses – including securities fraud, money laundering, and even environmental crimes. Brandon, can you explain the burden on the plaintiff in a RICO action?

Brandon: Thank you, Jen. RICO allows the government to prosecute individuals associated with criminal activities such as the leaders of crime organizations. Although there are criminal charges, today we’re going to focus on the burden for a civil RICO claim. In a civil case, a plaintiff must prove certain elements. First, pattern of criminal activity – the plaintiff must show that the defendant committed a pattern of at least two crimes patterns can include everything from the same victim to the same methods used to commit the crimes, or that the crimes happened within the same year. Also, plaintiff must prove the existence of an enterprise, and that can take a couple of different forms. One, that defendants invested the proceeds of the pattern of racketeering activity into an enterprise, or that the defendant is acquired or maintained an interest or control in the enterprise. Also, you can show the defendants conducted or participated affairs of the enterprise through a pattern of racketeering activity. Lastly, you could show that defendants conspired to do one of the above. Civil RICO class actions are significant pieces of litigation due to the exposure of treble damages such class actions can present extraordinary risks, but we should note the statute of limitations in civil RICO cases is four years, and that starts to run the moment the victim discovers the damages.

Jen: Wow, that is very different from many of the types of claims that we typically have discussed on this podcast. How often are RICO class actions granted class certification?

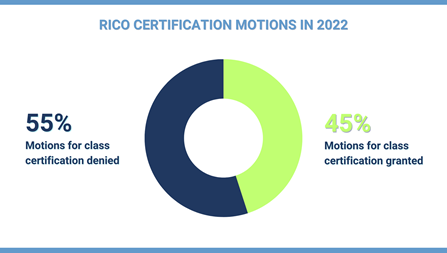

Brandon: Great question, Jen. In 2022, the plaintiffs’ bar secured class certifications at a rate of 45% and companies secure denials in 55% of the rulings in 2022. So five of the 11 motions for class certification were granted; six of 11 motions were denied.

Jen: Which of these would you say are really the key rulings for 2022-2023?

Brandon: Yeah, interesting – let me tell you about one approach. Companies often utilize an aggressive posture by attacking class claims with preemptive motions to dismiss. The theory behind such a motion is that no amount of discovery can shore up a defective class claim on its face and that it can never be certified. So in 2022 three different courts – two district courts as well as the Eleventh Circuit – address this tactic in the context of RICO class actions. In Zantac (Ranitidine) Products Liability Litigation Plumbers & Pipefitters Local Union 630 Welfare Fund, et al. v. Glaxosmithkline LLC, defendants moved to dismiss the complaint as an impermissible shotgun pleading under Eleventh Circuit case law. The district court agreed and dismissed the complaint without prejudice and with leave to amend. The district court ruled that the complaint listed 67 related and unrelated defendants across two groups, thereby creating confusion and failing to provide a factual basis to distinguish the conduct of the individual defendants. The district court also found that the complaint asserted irrelevant matters and allegations, making it virtually impossible to know which factual allegations were intended to support which claims for relief. On appeal, the Eleventh Circuit confirmed. The Eleventh Circuit determined that the plaintiffs failed to sufficiently allege how its injuries were traceable to the conduct of each defendant. The Eleventh Circuit concluded that the plaintiffs had Article III standing to bring its claims against the defendants who allegedly sold the product that issued to the members for which it provided reimbursement. So for class representation purposes, the appellate court ruled that the claims the plaintiffs made on behalf of class members need not be stricken or disregarded as those claims may be considered when determining the appropriateness of class certification under Rule 23. For these reasons, the Eleventh Circuit affirmed in part and reversed in part the district court’s ruling granting the defendant’s motion to dismiss.

Jen: Also instances in which courts granted summary judgment to defendants in RICO cases – one of those rulings occurred in a case called Ward, et al. v. Crow Vote LLC. In that case the plaintiffs were a group of chef competitors on the defendant’s Favorite Chef Competition. They filed a class action alleging that the voting system used in the competition constituted an illegal gambling business and violation of RICO. The winner of the competition was determined by the number of votes from members of the public – the parties disputed whether the contest was designed to make it unlikely or impossible that a chef competitor could win without paid voting. The defendant in that case filed a motion for summary judgment, claiming that the competition was not illegal gambling. The court agreed and concluded that the contest was in fact not illegal gambling. The Court ruled that the defendants met their initial burden by demonstrating that there was an absence of evidence of injury to the plaintiff’s business or property. The court stated that the plaintiff’s motive behind the purchase of the votes did not change the undisputed facts showing that the plaintiffs received what they bargained for, i.e. votes for money, resulting in there being no tribal issue as to injury to the plaintiff’s business or property in violation of RICO.

Brandon: Jen, I love that case – very interesting. Here’s another one where the court denied class certification outright in a RICO class action. In Wacker Drive Executive Suites, LLC, et al. v. Jones Lang LaSalle Americas (Ill.) LP, the plaintiffs filed a RICO class action arising from the alleged conspiracy between a building manager and two labor unions to force tenants to hire union-only movers and contractors. The plaintiffs filed a motion for class certification pursuant to Rule 23, and the court denied the motion. The court determined that the plaintiffs failed – failed to provide significant proof of the central common issues, namely those relating to the existence of the required agreements conspiracies between the building manager and the labor unions, and the existence of an enterprise under the RICO statute, as to all the buildings that issue in the class action. The court additionally ruled that since no common issue was present, the plaintiffs’ claims were not typical of the claims of the class and common issues did not predominate. The court also found the class certification was inappropriate – from the ground that even if liability could be proven on a class-wide basis, the plaintiffs did not meet their burden to demonstrate damages for the tenants who incurred contractor expenses on a class-wide basis.

Jen: Thanks, Brandon. The last ruling I wanted to highlight was a ruling regarding decertification. This recently occurred in a case called Freitas, et al. v. Cricket Wireless, LLC. In that case the plaintiffs were a group of cellular telephone users. They filed a class action alleging that the defendant advertised 4G service and sold 4G capable phones in markets where the defendant did not actually provide 4G coverage – in violation of RICO, of course. Following discovery the defendant moved to decertify the class and the court granted the motion. The defendant contended that decertification was warranted because the plaintiffs’ damages model did not comport with either of their theories of class-wide liability, and that the named plaintiff was inadequate to represent the class because she felt outside of the class definition. The defendant contended that the plaintiffs’ expert’s damages model did not isolate the damages attributable only to overcharges due to alleged misrepresentations about 4G coverage. The court agreed – the court found that the expert failed to control for price differentials based on criteria other than 4G coverage, including processing speed, memory, battery life, etc., and granted the motion to decertify the class.

Brandon: Very interesting ruling, Jen. I really like it because it’s a good example of how lack of commonality in a class-wide damages case can render a class unsuitable for certification.

Jen: Thanks, Brandon – great insights and analysis. I know that these are only some of the cases that presented very interesting rulings in 2022 in RICO class actions. As we move into 2023, the year is sure to give us some more insights and valuable information in terms of the ways that class actions are going to be evolving in the RICO space. Well that brings me to the end of our podcast for today, thank you everyone in our audience for joining – was great to have you with us, and we will see you next week! Thank you.