Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jerry Maatman and associate Alessandra Mungioli with their discussion of 2023 developments and trends in consumer fraud class action litigation as detailed in the recently published Duane Morris Consumer Fraud Class Action Review – 2024.

Check out today’s episode and subscribe to our show from your preferred podcast platform: Spotify, Amazon Music, Apple Podcasts, Google Podcasts, the Samsung Podcasts app, Podcast Index, Tune In, Listen Notes, iHeartRadio, Deezer, YouTube or our RSS feed.

Episode Transcript

Jerry Maatman: Welcome loyal blog listeners. Thank you for being on our weekly podcast, the Class Action Weekly Wire. My name is Jerry Maatman, I’m a partner at Duane Morris, and joining me today is my colleague, Alessandra. Thank you for being on our podcast to talk about thought leadership with respect to class actions.

Alessandra Mungioli: Thank you, Jerry. I’m glad to be here.

Jerry: Today we’re going to discuss our recent publication, our e-book on the Duane Morris Consumer Fraud Class Action Review. Listeners can find this book on our blog. Could you tell us a little bit about what readers can expect from this e-book?

Alessandra: Absolutely Jerry. Class action litigation in the consumer fraud space remains a key focus of the plaintiff’s bar. A wide variety of conduct gives rise to consumer fraud claims which typically involve a class of consumers who believe they were participating in a legitimate business transaction, but due to a merchant or a company’s alleged deceptive or fraudulent practices, the consumers were actually being defrauded.

Every state has consumer protection laws, and consumer fraud class actions require courts to analyze these statutes, both with respect to plaintiffs’ claims and also with respect to choice of law analyses when a complaint seeks to impose liability that is predicated on multiple states’ consumer protection laws.

To assist corporate counsel and business leaders with navigating consumer fraud class action litigation, the class action team here at Duane Morris has put together the Consumer Fraud Class Action Review, which analyzes significant rulings, major settlements, and identifies key trends that are apt to impact companies in 2024.

Jerry: This is a great, essential desk reference for practitioners and corporate counsel alike dealing with class actions in this space. Difficult to do in a short podcast, but what are some of the key takeaways in that desk reference?

Alessandra: Just as the type of actionable conduct varies, so, too, do the industries within which consumer fraud claims abound. In the last several years, for example, the beauty and cosmetics industry saw a boom in consumer fraud class actions as consumers demanded increased transparency regarding the ingredients in their cosmetic products and the products’ effects. In 2023, consumer fraud class actions ran the gamut of false advertising and false labeling claims as well.

Artificial intelligence also made its way into the class action arena in the consumer fraud space for the first time in 2023. In MillerKing, LLC, et al. v. DoNotPay Inc., the plaintiff, a Chicago law firm, filed a class action alleging the defendant, an online subscription service that uses “robot lawyers” programmed with AI, was not licensed to practice law and therefore brought claims for consumer fraud, deceptive practices, and breach of trademark. The defendant moved to dismiss the action on the basis that the plaintiff failed to establish an injury-in-fact sufficient to confer standing, which the court granted. The plaintiff asserted that the conduct caused “irreparable harm to many citizens, as well as to the judicial system itself,” and constituted “an infringement upon the rights of those who are properly licensed,” such as “attorneys and law firms.” The court found that the plaintiff failed to demonstrate any real injury per its claims, and granted the defendant’s motion to dismiss.

Jerry: Well, robot lawyers and lawyer bots – that’s quite a development in 2023. How did the plaintiffs’ bar do in – what I consider the Holy Grail in this space – securing class certification, and then conversion of a certified class into a monetary class-wide settlement?

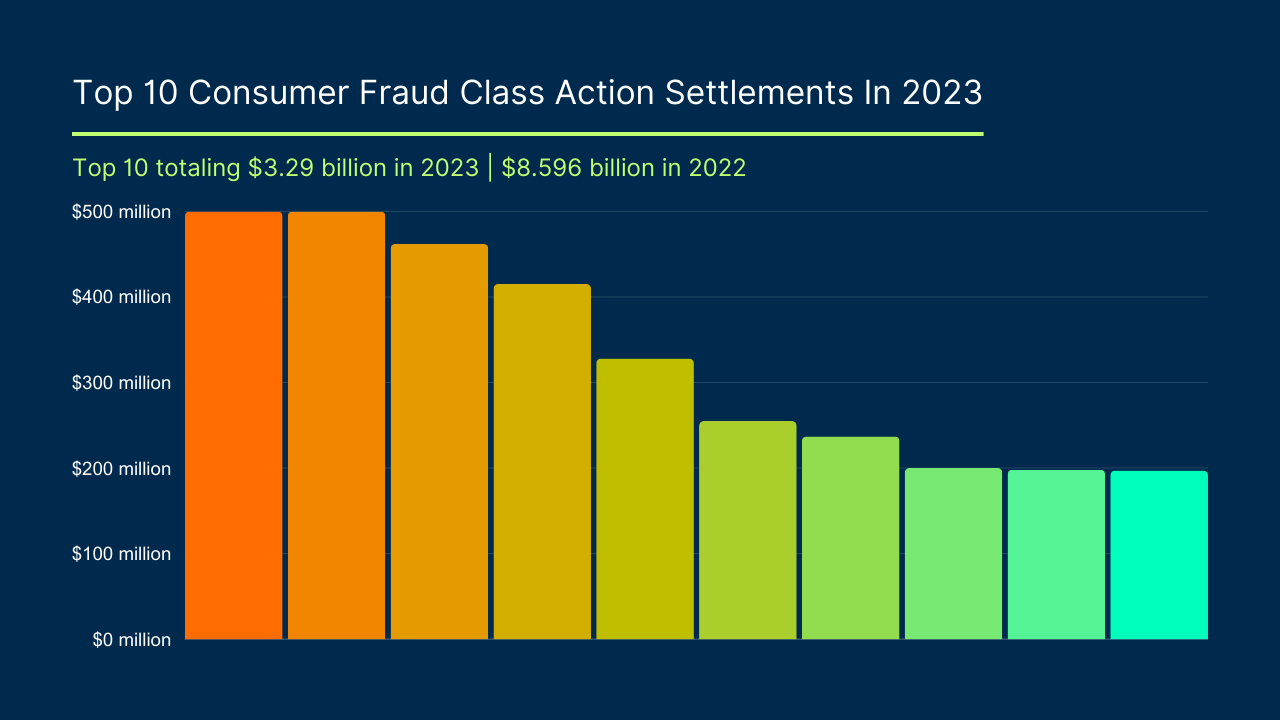

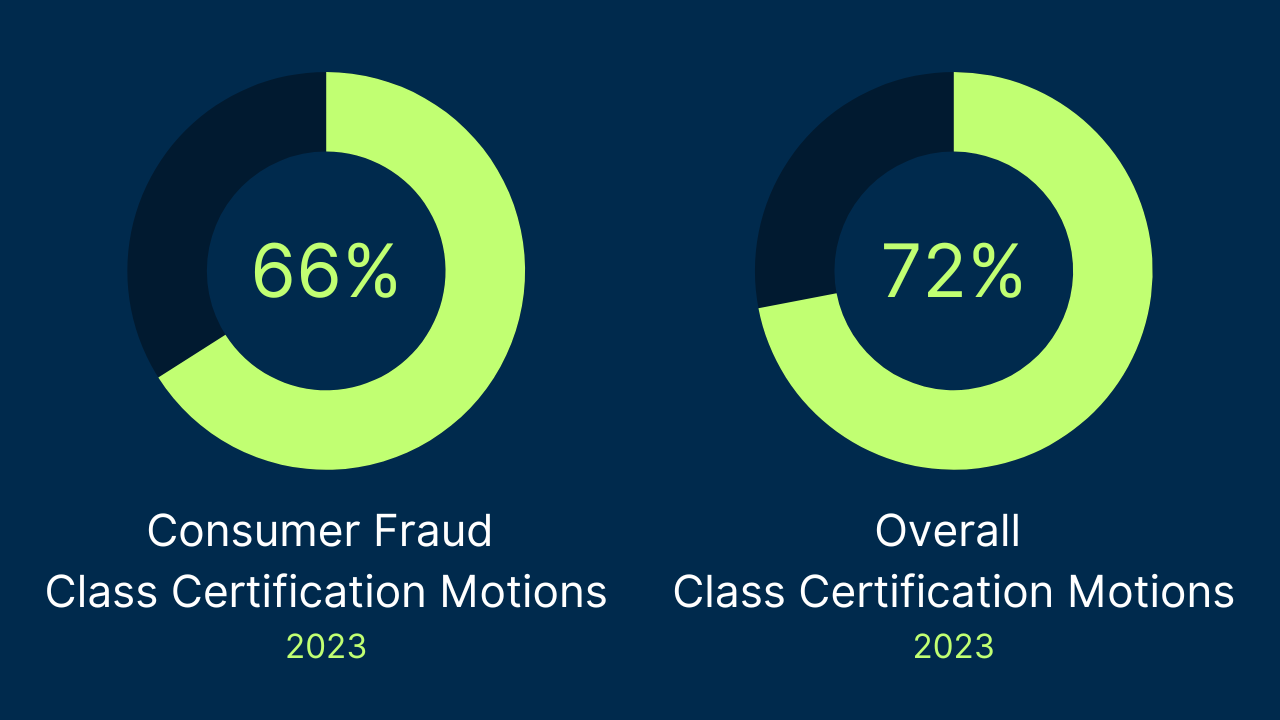

Alessandra: So settlements were very lucrative in 2023. The top 10 consumer fraud class action settlements in 2023 totaled $3.29 billion. And by comparison, the top 10 settlements in 2022 had totaled $8.5 billion, so we have seen a downward trend. Notably, five of these 10 settlements last year took place in California courts. The top settlements in 2023 resolved litigation stemming from a variety of different theories, from smartphone performance issues to the marketing of vape products. Last year, courts granted plaintiffs’ motions for class certification in consumer fraud lawsuits approximately 66% of the time. And the overall certification rate for class actions in 2023 was 72%.

Jerry: Well, that’s quite a litigation scorecard. And this is an area of interest that the class action team at Duane Morris will be following closely and blogging about in 2024. Well, thank you for being with us today and thank you loyal blog readers and listeners for joining our weekly podcast again. You can download the Duane Morris Consumer Fraud Class Action Review off our website. Have a great day!

Alessandra: Thank you!