By Gerald L. Maatman, Jr. and Jennifer A. Riley

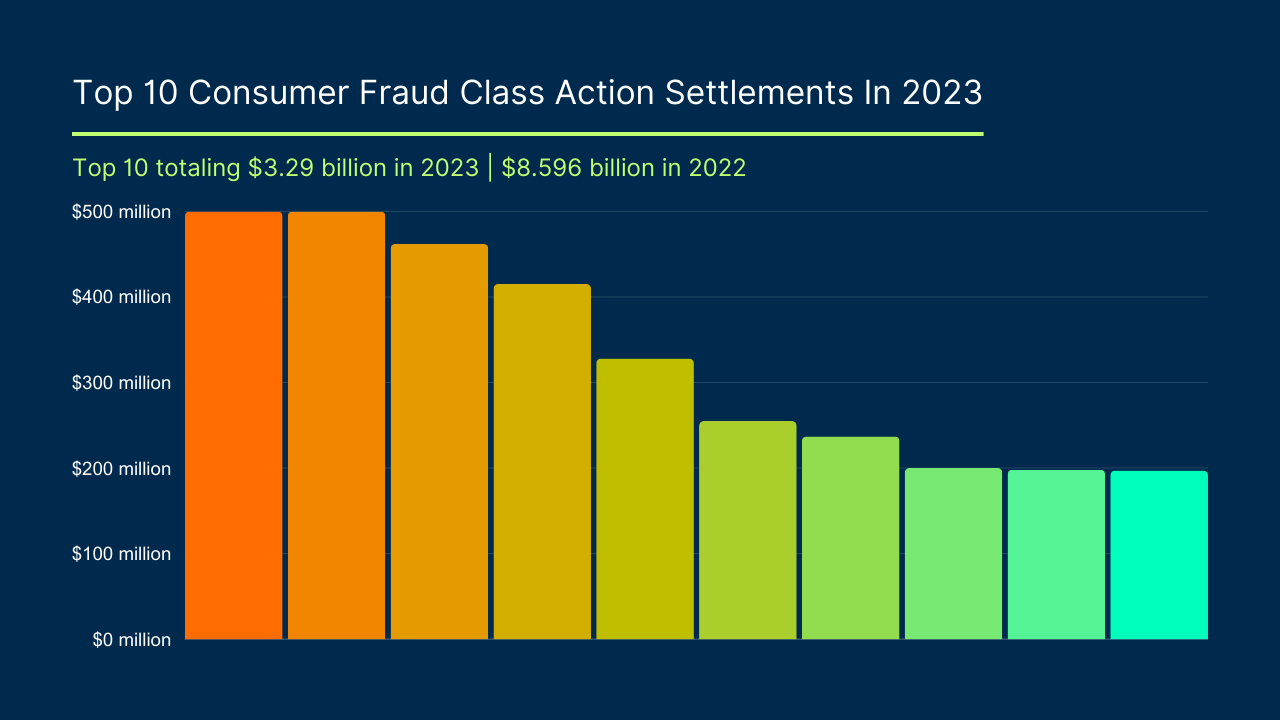

Duane Morris Takeaways: Corporate defendants saw unprecedented settlement numbers across all areas of class action litigation in 2022 and 2023, and halfway through 2024, settlement numbers remain robust. The cumulative value of the top ten settlements across all substantive areas of class action litigation hit near record highs in 2023, second only to the settlement numbers observed in 2022. When the numbers for 2022 and 2023 are combined, the totals signal that corporate defendants have entered a new era of heightened risks and higher stakes in the valuation of class actions. On an aggregate basis, across all areas of litigation, class actions and government enforcement lawsuits garnered more than $51.4 billion in settlements in 2023, almost as high as the record-setting $66 billion in 2022. When combined, the two-year settlement total eclipses any other two-year period in the history of American jurisprudence.

As a prelude to the Duane Morris Class Action Review – 2025, this post reports on our analysis of class action settlements through the first half of 2024. The data shows that for the period of January 1 to June 30, 2024, the current year is on pace with the numbers of the previous two years. As of the end of the first half of 2024, the aggregate settlement total across all areas of class action litigation and government enforcement lawsuits is $22.9 billion (in accounting for the top 5 settlements in the various substantive areas of law). It is anticipated that these numbers will increase across the board by the end of the year and when measured by the top 10 settlements in each category.

More Billion Dollar Class Action Settlements

At the mid-way point of 2024, there are four settlements over the billion-dollar mark. In 2023, parties resolved 14 class actions for $1 billion or more in settlements, making 24 billion-dollar settlements in the last two years. Reminiscent of the Big Tobacco settlements nearly two decades ago, 2022 and 2023 marked the most extensive set of billion-dollar class action settlements and transfer of wealth in the history of the American court system.

The Scorecard On Leading Class Actions Settlements Halfway Through 2024

The plaintiffs’ class action bar has scored rich settlements thus far in 2024 in virtually every area of class action litigation.

$14.45 Billion – Products liability/mass tort class actions

$4.17 Billion – Antitrust class actions

$2.05 Billion – Securities fraud class actions

$628 Million – Consumer fraud class actions

$388.95 Million – Data breach class actions

$331.5 Million – Privacy class actions

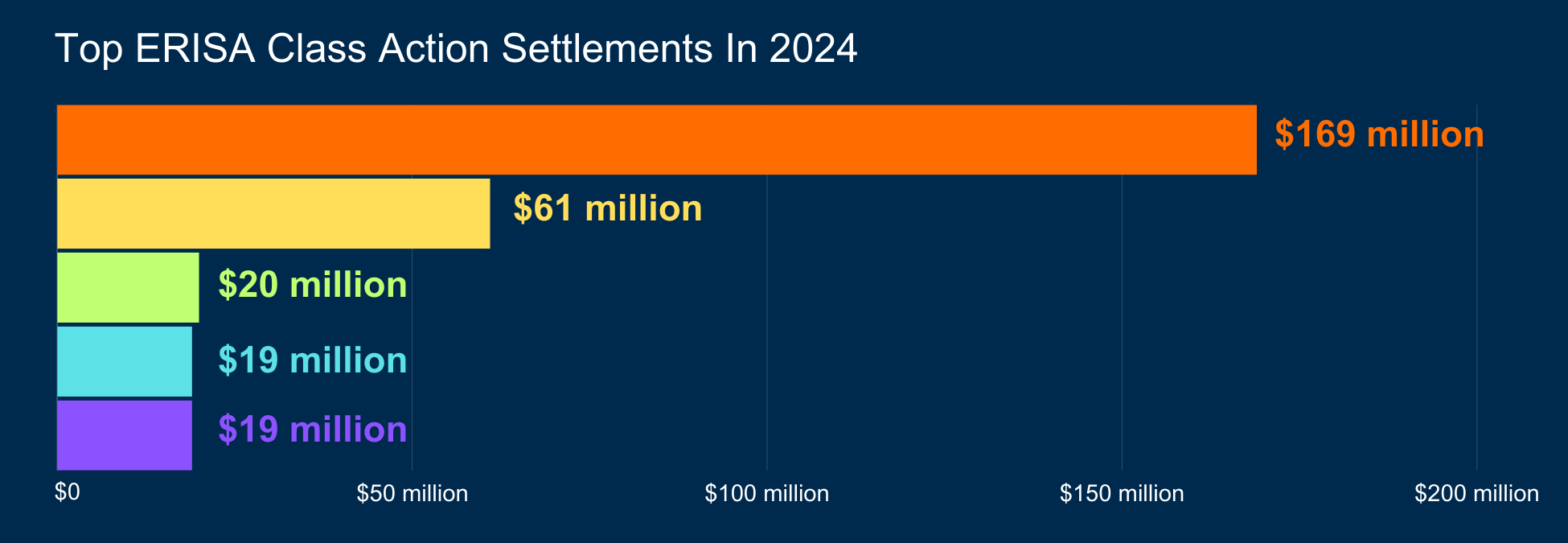

$288 Million – ERISA class actions

$157.15 Million – Wage & hour class and collective actions

$147 Million – Discrimination class actions

$101.3 Million – Labor class actions

$67.7 Million – Government enforcement actions

$58.8 Million – Civil rights class actions

$49.69 Million – TCPA class actions

$24.96 Million – Fair Credit Reporting Act class actions

The high dollar settlements of the past two years suggested that the plaintiffs’ bar would continue to be equally, if not more aggressive, with their case filings and settlement positions. From the 2024 data, it certainly looks to be the case as we end the first half of the year.

The data points in each category are set out in the following charts.

Top Class & Collective Action Litigation Settlements In 2024

Top Antitrust Class Action Settlements In 2024

-

- $2.77 billion – In Re College Athlete NIL Litigation, Case No. 20-CV-3919 (N.D. Cal. May 23, 2024) (settlement agreement reached to resolve claims with former college athletes who filed an antitrust class action seeking compensation allegedly denied to them for decades before the Supreme Court overturned the NCAA’s compensation ban)..

- $418 million – Burnett, et al. v. the National Association of Realtors, Case No. 19-CV-332, Gibson, et al. v. National Association of Realtors, Case No. 23-CV-788, and Umpa, et al. v. The National Association of Realtors, Case No. 23-CV-945 (W.D. Mo. Mar. 15, 2024) and Moehrl, et al. v. The National Association of Realtors, Case No. 19-CV-1610 (N.D. Ill. Apr. 23, 2024) (preliminary settlement approval granted in a class action to resolve claims that broker commission rules caused home sellers across the country to pay inflated fees).

- $385 million – In Re Suboxone (Buprenorphine Hydrochloride and Naloxone) Antitrust Litigation, Case No. 13-MD-2445 (E.D. Penn. Feb. 27, 2024) (final settlement approval granted in a class action to resolve claims brought by states, insurers and buyers of a new dissolvable strip version of Suboxone to the market, encouraging the move from tablets to strips by misrepresenting to the U.S. Food and Drug Administration that the tablets posed a risk to children of accidental consumption).

- $335 million – Le, et al. v. Zuffa LLC, Case No. 15-CV-1045 (D. Nev. Mar. Mar. 20, 2024) (preliminary settlement approval sought in a class action to resolve claims that fighters’ wages were suppressed by up to $1.6 billion).

- $265 million – In Re Generic Pharmaceuticals Pricing Antitrust Litigation, Case No. 16-MD-2724 (E.D. Penn. June 26, 2024) (preliminary settlement approval granted for a class action to resolve claims by direct purchasers, end-payors and states alleging that multiple makers of generic drugs conspired to keep the prices on their products high, in violation of state laws and the federal Sherman Act).

Top Civil Rights Class Action Settlements In 2024

-

- $17.5 million – Clark, et al. v. City Of New York, Case No. 18 Civ. 2334 (S.D.N.Y. Apr. 5, 2024) (settlement approval sought in a class action to resolve claims alleging that the city policy department’s policy requiring all arrested individuals to have their photograph taken without a head covering violated the Religious Land Use and Institutionalized Persons Act).

- $13.7 million – Sow, et al. v. New York, Case No. 21 Civ. 533, (S.D.N.Y. Mar. 5, 2024) (final settlement approval granted for a class action resolving claims by individuals who were arrested or arrested and subjected to force by the New York City Police Department during protests in 2020 following the murder of George Floyd).

- $12.8 million – In Re Chiquita Brands International Inc., Alien Tort Statute And Shareholders Derivative Litigation, Case No. 08-MD-1916 (S.D. Fla. June 24, 2024) (preliminary settlement approval granted in a class action to resolve claims alleging that the company funded Colombian paramilitary groups leading to the deaths of over 2,500 victims.

- $10 million – Adberg, et al. v City Of Seattle, Case No. 20-2-14351-1 (Wash. Super. Ct. Jan. 30, 2024) (settlement reached to end a lawsuit brought by more than 50 protesters who say they were brutalized by its police force during Black Lives Matter demonstrations in the summer of 2020).

- $4.8 million – Students For Fair Admissions, Inc., et al. v. University Of North Carolina, Case No. 14-CV-954 (M.D.N.C. Jan. 29, 2024) (the University of North Carolina agreed to cover the fees and expenses of a group founded by affirmative action advocates that won a U.S. Supreme Court challenge to the school’s consideration of race in student admissions).

Top Consumer Fraud Class Action Settlements In 2024

-

- $150 million – In Re Chevrolet Bolt EV Battery Litigation, Case No. 20-CV-13256 (E.D. Mich. May 16, 2024) (preliminary settlement approval sought in a class action to resolve claims against General Motors LLC and LG units over alleged battery which allegedly make cars prone to overheating and fires).

- $145 million – In Re Kia Hyundai Vehicle Theft Marketing, Sales Practices, And Products Liability Litigation, Case No. 22-ML-3052 (N.D. Cal. July 15, 2024) (final settlement approval sought in a class action resolving claims that that consumers were left vulnerable to theft and damage due to vehicles being improperly manufactured with design flaws).

- $125 million – National Veterans Legal Services Program, et al. v. United States, Case No. 16-CV-745 (D.D.C. Mar. 20, 204) (preliminary settlement approval granted in a class action resolving claims challenging the legality of “excessive” PACER fees).

- $108 million – Elder, et al. v. Reliance Worldwide Corp., Case No. 20-CV-1596 (N.D. Ga. Apr. 23, 2024) (preliminary settlement approval granted in a class action to resolve claims alleging that the defendants made and sold water heater connector hoses with defective rubber linings).

- $100 million – Esposito, et al. v. Cellco Partnership d/b/a Verizon Wireless, Case No. MID-L-6360-23 (N.J. Super. Apr. 26, 2024) (final settlement approval granted in a class action to resolve claims that the company misled its customers by not disclosing certain fees in its postpaid wireless service plans).

Top Data Breach Class Action Settlements In 2024

-

- $350 million – In Re Alphabet Inc. Securities Litigation, Case No. 18-CV-6245 (N.D. Cal Apr. 9, 2024) (preliminary settlement approval granted in a class action alleging that a software glitch led to a data breach in which Google+ users’ personal data was exposed for three years).

- $15 million – Salinas, et al. v. Block Inc., Case No. 22-CV-4823 (N.D. Cal. June 3, 2024) (preliminary settlement approval granted in a class action to resolve claims that a December 2021 data breach at the companies exposed personally identifiable information, account numbers and trading activity of 8.2 million people).

- $8.7 million – Sherwood, et al. v. Horizon Actuarial Services LLC, Case No. 22-CV-1495 (N.D. Ga. Apr. 2, 2024) (final settlement approval granted for a class action to resolve claims that employer benefit plan members’ sensitive data was exposed in a massive breach at a consulting company).

- $8 million – In Re Orrick, Herrington & Sutcliffe LLP Data Breach Litigation, Case No. 23-CV-4089 (N.D. Cal. May 31, 2024) (preliminary settlement approval granted in a class action to resolve claims brought by clients of a law firm alleging their personal information was compromised in a March 2023 data breach of some of the firm’s client data).

- $7.25 million – In Re Lincare Holdings Inc. Data Breach Litigation, Case No. 22-CV-1472 (M.D. Fla. June 24, 2024) (final settlement approval granted for a class action to resolve claims that the company failed to protect consumers from a 2021 data breach).

Top Discrimination Class Action Settlements In 2024

-

- $54 million – California Civil Rights Department v. Activision Blizzard Inc., Case No. 21STCV26571 (Cal. Super. Jan. 17, 2024) (consent decree entered for an action to resolve claims that the company engaged in gender discrimination, pay inequities, and fostered a culture of sexual harassment in the workplace).

- $30 million – Employees’ Retirement System Of Rhode Island v. Paul Marciano, et al., Case No. 2022-0839 (Del. Chan. Jan. 4, 2024) (final settlement approval granted for a class action to resolve claims of decades of alleged sexual misconduct by one of the company’s co-founders).

- $25 million – Jewett, et al. v. Oracle America Inc., Case No. 17-CIV-02669 (Cal. Super. Ct. Feb. 11, 2024) (preliminary settlement agreement sought in a class action to resolve claims that female employees were paid less than male employees).

- $20 million – Council, et al. v. Merrill Lynch Pierce Fenner, Case No. 24-CV-534 (M.D. Fla. May 24, 2024) (preliminary settlement approval sought in a class action to resolve claims alleging discrimination and retaliation against a proposed class of nearly 1,400 Black financial advisers who alleged they received less pay and promotions compared to their white counterparts).

- $18 million – Forsyth, et al. v. HP Inc., Case No. 16-CV-4775 (N.D. Cal. Mar. 29, 2024) (final settlement approval granted in a class action to resolve claims alleging that the company unlawfully pushed out hundreds of older workers as part of a workforce reduction plan in violation of the ADEA).

Top EEOC / Government Enforcement Class Action Settlements In 2024

-

- $16.5 million – In The Matter Of Avast Ltd., Case No. 202-3033 (FTC Jan. 19, 2024) (consent decree entered following a Federal Trade Commission lawsuit alleging that the company sold personal information to more than 100 third parties despite promising to protect consumers from online tracking).

- $16 million – U.S. Department Of Labor v. Disaster Management Group LLC (DOL Jan. 24, 2024) (consent order entered following investigations into 62 government subcontractors hired to construct temporary housing and provide services to Afghan refugees at Joint Base McGuire-Dix-Lakehurst in New Jersey).

- $15 million – California Civil Rights Department v. Snap Inc. (Cal. Super. Ct. June 18, 2024) (consent order entered following an investigation into the company’s hiring and pay practices were discriminatory, finding the company failed to ensure women were treated equally, resulting in a glass ceiling for pay and promotions, sexual harassment and retaliation when female workers spoke up).

- $11.5 million – Washington Department Of Labor & Industries v. Boeing (May 24, 2024) (the parties entered into a compliance agreement following an investigation by the agency after it received four complaints in November 2022 from workers who were performing aircraft maintenance overseas, and found that Boeing had not paid or accounted for all overtime and for paid sick leave for the additional time going to worksites while out of town).

- $8.7 million – EEOC v. DHL Express (USA) Inc., Case No. 10-CV-6139 (N.D. Ill. Apr. 24, 2024) (consent decree entered resolving a lawsuit filed alleging that the company gave Black workers more difficult and dangerous work assignments than white employees).

Top ERISA Class Action Settlements In 2024

-

- $169 million – Electrical Welfare Trust Fund, et al. v. United States, Case No. 19-CV-353, (Fed. Claims Ct. May 16, 2024) (final settlement approval granted in a class action alleging that the government illegally exacted certain contributions from SISAs under it for benefit year 2014).

- $61 million – In Re GE ERISA Litigation, Case No. 17-CV-12123 (D. Mass. Mar. 7, 2024) (final settlement approval granted in consolidated class actions alleging that the company violated the ERISA by directing employee retirement savings into underperforming GE Asset Management funds to generate fees for the subsidiary before it was sold).

- $20 million – Durnack, et al. v. Retirement Plan Committee Of Talen Energy Corp., Case No. 20-CV-5975 (E.D. Penn. June 4, 2024) (final settlement approval granted for a class action resolving claims from employees alleging that that they were owed early retirement pension benefits and pension supplements due to a change in control).

- $19 million – Krohnengold, et al. v. New York Life Insurance Co., Case NO. 21-CV-1778 (S.D.N.Y. Mar. 5, 2024) (preliminary settlement approval granted in a class action to resolve claims alleging that the company unlawfully kept underperforming proprietary investment options in two employee retirement plans).

- $19 million – Colon, et al. v. Johnson, Case No. 22-CV-888 (M.D. Fla. June 10, 2024) (preliminary settlement approval granted in a class action to resolve claims alleging that the company and executives enacted a scheme that diverted workers’ retirement benefits to shell companies and private equity firm Palm Beach Capital).

Top FCRA, FDPCA, And FACTA Class Action Settlements In 2024

-

- $9.75 million – Sullen, et al. v. Vivint, Inc.,Case No. 01-CV-2023-903893 (Ala. Cir. Ct. Apr. 23, 2024) (final settlement approval granted in a class action alleging that the company accessed credit information in violation of the Fair Credit Reporting Act and created Vivint accounts without authorization).

- $6.76 million – Martinez, et al. v. Avantus LLC, Case No. 20-CV-1772 (D. Conn. Feb. 27, 2024) (final settlement approval granted in a class action alleging that the company violated federal law by including inaccurate information on mortgage borrowers’ credit reports).

- $5.7 million – Steinberg, et al. v. Corelogic,Case No. 22-CV-498 (S.D. Cal. Apr. 9, 2024) (final settlement approval granted in a class action lawsuit to resolve claims that the company violated the federal Fair Credit Reporting Act by listing consumers as deceased on credit reports when they were actually alive).

- $1.87 million – Parker, et al. v. The Salvation Army, Case No. 20-CV-4787 (Cal. Super. Ct. Mar. 20, 2024) (preliminary settlement approval granted in a class action to resolve claims to resolve claims the company failed to comply with the Fair Credit Reporting Act (FCRA) when procuring job applicant background checks for employment applicants.

- $877,000 – McKey, et al. v. TenantReports.com LLC, Case No. 22-CV-1908-GJP (E.D. Penn. Feb. 27, 2024) (final settlement approval granted in a class action lawsuit to resolve claims that the company prepared consumer background reports that included outdated criminal non-conviction information).

Top FLSA / Wage & Hour Class And Collective Settlements In 2024

-

- $72.5 million – Utne, et al. v. Home Depot USA Inc., Case No. 16-CV-1854 (N.D. Cal. Mar. 8, 2024) (final settlement approval granted for a class action to resolve claims that the company failed to pay hourly wages, pay final wages on time, and provide accurate written wages).

- $38 million – In The Matter Of The Investigation Of Letitia James, Attorney General Of The State Of New York Of Lyft Inc., AOD No. 23-041 (AG Labor Bureau Nov. 30, 2024) (the New York Attorney General took legal action against Lyft, claiming the ride-booking company withheld wages from drivers by deducting taxes and fees from their pay instead of having passengers pay those expenses and prevented drivers from receiving the benefits they were entitled to under New York law).

- $16.65 million – Goldthorpe, et al. v. Cathay Pacific Airways Ltd., Case No. 17-CV-3233 (N.D. Cal. June 20, 2024) (preliminary settlement approval sought in a class action to resolve claims alleging that the airline violated state labor laws governing meal and rest periods, overtime and reserve duty pay).

- $16 million – Oman, et al. v. Delta Air Lines Inc., Case No. 15-CV-131 (N.D. Cal. May 15, 2024) (preliminary settlement approval sought in a class action to resolve claims alleging that the company failed to provide accurate wage statements in violation of California Labor Law).

- $14 million – Bolding, et al. v. Banner Bank, Case No. 17-CV-601 (W.D. Wash. Jan. 8, 2024)(final settlement approval sought in a class and collective action to resolve claims that the company misclassified mortgage loan officers as exempt employees and thereby failed to pay overtime compensation in violation of federal and state wage & hour laws).

Top Labor Class Action Settlements In 2024

-

- $55 million – Saunders, et al. v. State of Michigan Unemployment Insurance Agency, Case No. 22-000007-MM (Mich. Cl. Ct. Apr. 16, 2024) (preliminary settlement approval granted in a class action to resolve claims that unemployment benefits were improperly clawed back without notice during the COVID-19 pandemic)

- $20 million – In Re International Longshore and Warehouse Union, Case No. 23-BK-30662 (N.D. Cal. Bankr. Feb. 22, 2024) (preliminary settlement approval granted in a class action to resolve claims alleging that the union of engaging in an unlawful boycott of the company during a labor dispute).

- $20 million – Bauserman, et al. v. State Of Michigan Unemployment Insurance Agency, Case No. 15-000202 (Mich. Ct. Claims Jan. 29, 2024) (final settlement agreement granted in a class action to resolve claims over the Michigan Unemployment Insurance Agency’s use of a computer program to detect fraudulent claims, which resulted in thousands of false fraud determinations).

- $3.8 million – Moliga, et al. v. Qdoba Restaurant Corp., Case No. 23-2-11540-6 (Wash. Super. Ct. Apr. 10, 2024) (preliminary settlement approval granted in a class action to resolve claims that the company violated Washington state’s pay transparency law when it failed to disclose pay information in job postings).

- $2.5 million – Arrison, et al. v. Walmart Inc., Case No. 21-CV-481 (D. Ariz. Feb. 16, 2024) (preliminary settlement approval granted in a class action to resolve claims that the company should have paid nearly 80,000 workers for the time they spent undergoing COVID-19 screenings before clocking in for their shifts).

Top Privacy Class Action Settlements In 2024

-

- $90 million – In Re Facebook Internet Tracking Litigation, Case Nos. 22-16903 and 22-16904 (9th Cir. Feb. 21, 2024) (final settlement approval affirmed in a class action to resolve claims alleging that Facebook used cookies to track the internet activity of logged-out social network users who visited third-party websites containing Facebook “Like” button plugins).

- $75 million – Rogers, et al. v. BNSF Railway Co., Case No. 19-CV-3083 (N.D. Ill. June 18, 2024) (final settlement approval granted in a class action to resolve claims alleging that the company unlawfully scanned drivers’ fingerprints for identity verification purposes without written, informed permission or notice when they visited BNSF rail yards).

- $62 million – In Re Google Location History Litigation, Case No. 18-CV-5062 (N.D. Cal. May 3, 2024) (final settlement approval granted in a class action to resolve claims that Google illegally collected and stored smartphone users’ private location information).

- $52.5 million – Schreiber, et al. v. Mayo Foundation For Medical Education And Research, Case No. 22-CV-188 (W.D. Mich. May 25, 2024) (final settlement approval granted in a class action to resolve claims that the company shared subscriber information with third parties without getting consumer consent).

- $52 million – In Re Clearview AI Inc. Consumer Privacy Litigation, Case No. 21-CV-135 (N.D. Ill. June 21, 2024) (preliminary settlement approval granted in a novel settlement in a multidistrict litigation targeting Clearview AI’s allegedly unlawful practice of “scraping” internet photos to collect biometric facial data wherein the class will receive a 23% stake in the company).

Top Products Liability And Mass Tort Class Action Settlements In 2024

-

- $10.3 billion – In Re Aqueous Film-Forming Foams Product Liability Litigation, MDL 2873 (D.S.C. Mar. 29, 2024) (final settlement approval granted in a class action to resolve claims with 3M by utilities that maintain it’s liable for the damage they have and will incur due to its signature PFAS that were used for decades in specialized fire suppressants, called aqueous film-forming foams (AFFF), that were sprayed directly into the environment and reached drinking water).

- $1.18 billion – Camden, et al. v. E.I. DuPont de Nemours & Co., Case No. 23-3230 (D.S.C. Feb. 8, 2024) (final settlement approval granted in a class action to resolve claims in a multidistrict litigation for the firefighting agent aqueous film forming foam (AFFF), which contains per- and polyfluoroalkyl substances (PFAS).

- $1.1 billion – Philips Recalled CPAP, Bi-Level PAP, And Mechanical Ventilator Products Liability Litigation, Case No. 21-MC-1230 (W.D. Penn. Apr. 29, 2024) (settlement reached in a multi-district litigation claiming that degraded foam in breathing machines caused plaintiffs personal injuries or will require long-term medical monitoring).

- $916 million – State Of Hawaii, et al. v. Bristol-Myers Squibb Co., Case No. 1CC141000708 (Hawaii Cir. Ct. May 21, 2024) (court found in favor of the plaintiffs and ordered payment by the companies to resolve claim alleging they marketed and sold Plavix in an unfair and deceptive manner, and that the companies failed to disclose that the drug could be harmful to those of East Asian and Pacific Islander ancestry).

- $750 million – In Re Aqueous Film-Forming Foams Products Liability Litigation, Case No. 18-MN-2873 (D.S.C. June 11, 2024) (preliminary settlement approval granted to resolve claims that Johnson Controls International PLC subsidiary Tyco Fire Products LP’s public water systems’ federal claims that some “forever chemicals” they detected in their supplies came from firefighting foam it made).

Top Securities Fraud Class Action Settlements In 2024

-

- $580 million – Iowa Public Employees’ Retirement System, et al. v. Bank of America Corp. Litigation, Case No. 17-CV-6221 (S.D.N.Y. Sept. 4, 2024) (final settlement approval granted in a class action to resolve claims alleging that the defendants conspired to block and boycott new offerings that would have increased competition and improved the efficiency and transparency of the market, in violation of Section 1 of the Sherman Act).

- $490 million – In Re Apple Inc. Securities Litigation, Case No. 19-CV-2033 (N.D. Cal. June 3, 2024) (preliminary settlement approval granted in a class action to resolve claims that Apple’s CEO Tim Cook defrauded shareholders by concealing falling demand for iPhones in China).

- $434 million – In Re Under Armour Securities Litigation, Case No. RDB-17-388 (D. Md. June 21, 2024) (settlement reached in a class action brought by investors alleging that the company inflated stock prices by hiding declining demand for its products).

- $350 million – In Re Alphabet Inc. Securities Litigation, Case No. 18-CV-6245 (N.D. Cal. Apr. 9, 2024) (preliminary settlement approval granted in a class action to resolve claims that the company deceived them about a March 2018 software glitch that allegedly gave third-party app developers the ability to access the private profile data of 500,000 users of the Google Plus social media site).

- $192.5 million – Chabot, et al. v. Walgreens Boots Alliance Inc., Case No. 18-CV-2118 (M.D. Penn. Feb. 7, 2024) (final settlement approval granted in a class action to resolve claims that the company’s executives lied about the likelihood of an ultimately unsuccessful merger between the two drugstore chains).

Top TCPA Class Action Settlements In 2024

-

- $21.88 million – Smith, et al. v. Assurance IQ LLC, Case No. 2023-CH-09225 (Ill. Cir. Ct. Sept. 3, 2024) (final settlement approval granted in a class action to resolve claims alleging that the company violated the Telephone Consumer Protection Act with unsolicited robocalls).

- $9.7 million – Berman, et al. v. Freedom Financial Network LLC, Case No. 18-CV-1060 (N.D. Cal. Feb. 16, 2024) (final settlement approval granted in a class action to resolve claims alleging that the debt consolidation company and its subsidiaries made telemarketing calls which violated the Telephone Consumer Protection Act).

- $9 million – Moore, et al. v. Robinhood Financial LLC, Case No. 21-CV-1571 (W.D. Wash. July 16, 2024) (final settlement approval granted in a class action to resolve claims that the company’s referral text messages violated Washington telemarketing laws).

- $7 million – Williams, et al. v. Choice Health Insurance LLC, Case No. 23-CV-292 (M.D. Ala. July 9, 2024) (final settlement approval granted in a class action to resolve claims that the company violated the TCPA with unsolicited marketing calls).

- $2 million – Burnett, et al v. CallCore Media Inc., Case No. 21-CV-3176 (S.D. Tex. June 25, 2024) (final settlement approval granted in a class action to resolve claims the company placed prerecorded phone calls to consumers in violation of state laws and the federal TCPA).