Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jerry Maatman and associate Nelson Stewart with their analysis of key trends and notable rulings in the securities fraud class action landscape. We hope you enjoy the episode.

Episode Transcript

Jerry Maatman: Thank you loyal blog readers for joining us for our Friday weekly podcast, the Class Action Weekly Wire. I’m Jerry Maatman, partner at Duane Morris, and joining me today is Nelson Stewart, an associate in our New York office, to talk about securities fraud class action litigation. Thanks so much Nelson for being on the podcast today.

Nelson Stewart: Great to be here, Jerry – thank you.

Jerry: We wanted to discuss for our clients key trends and developments over the past year in securities fraud class action litigation. Obviously a very serious area of large amount of case law, and so we wanted in this podcast to get your thoughts and ideas about what corporate counsel should be thinking about in terms of key developments in 2022 and what you see in the future in 2023. Nelson, could you share with our listeners an overview of the way in which federal securities laws are structured?

Nelson: Sure – the pillars of federal securities law are the Securities Act of 1933 and the Securities Exchange Act of 1934. These statutes were enacted after the stock market crash of 1929 to regulate the securities markets and promote transparency in those markets for investors. The Securities Act regulates securities for public sale, while the Securities Exchange Act governs the trading of existing securities and securities markets. The Securities Act allows private litigants to pursue claims against corporate issuers for material misrepresentations or omissions made in connection with a securities offering. But a Plaintiff needs to show the shares of the security can be traced back to the actual offering in order to bring a claim under the Securities Act. Because of this limitation, investors alleging claims of securities purchased on an exchange after an offering has occurred tend to look to the implied private right of action under the Securities Exchange Act Section 10(b) and under SEC Rule 10b-5, which prohibit fraudulent schemes or fraudulent misrepresentations or admissions in a broad range of securities transactions.

Jerry: When it comes to class certification under Rule 23 – certainly that’s a rigorous standard to meet a la Walmart Stores v. Dukes – what particular barriers or challenges do plaintiffs face in this particular space when they seek to secure class certification in a securities fraud lawsuit?

Nelson: Proving reliance is one of the prerequisites to class certification under Rule 23(b)(3). The proposed class is often a varied and large group of plaintiffs. This could create individual fact issues that could overwhelm predominant ones and present a very difficult hurdle to class certification. This challenge was eased considerably in the ruling of Basic, et al. v. Levinson, where the U.S. Supreme Court adopted a “fraud on the market” theory of reliance. This theory avoids the need to show individual reliance by employing the presumption that, when a stock trades in an efficient market, investors “rely on the market as an intermediary for setting the stock’s price in light of all publicly available material information; accordingly, when [an investor] buys or sells the stock at the market price, one has, in effect, relied on all publicly available information, regardless of whether the buyer and/or seller was aware of that information personally.”

Jerry: I know the Basic presumption is very unique in this space – does it apply in all securities fraud cases, or are there certain requirements before it may be invoked?

Nelson: The Basic presumption for class certification is invoked by showing that the alleged misrepresentation was publicly known; that it was material; that the stock traded in an efficient market; and that the plaintiffs traded the stock between the time the misrepresentation was made, and the time when the misrepresentation was publicly corrected, or when the truth was revealed. Basic resulted in a significant expansion in securities class actions, and in an attempt to address this expansion and limit frivolous class actions, Congress enacted the Private Securities Litigation Reform Act (“PSLRA”) and the Securities Litigation Uniform Standards Act of 1998 (“SLUSA”).

Jerry: Nelson, I know that class certification rulings in this space tend to find their way into The Wall Street Journal, and I know you’ve analyzed this area in detail – in your opinion, what are some of the key class certification rulings over the past year that corporate counsel should know about?

Nelson: In 2022, a number of defendants successfully argued that plaintiffs failed to satisfy the heightened pleading standards required by the PSLRA, The higher bar of the PSLRA requires that a complaint alleging misstatements or omissions specify each statement alleged to have been misleading, and indicate the reasons why the statement is misleading.

In In Re Carnival Corp. Securities Litigation, plaintiffs alleged that Carnival had made false and misleading statements regarding its COVID-19 polices and the risks posed to its business by the pandemic. The court’s review of the complaint found that Carnival’s statements affirming compliance with regulatory requirements and safety protocols were not actionable and immaterial. The court found that the statements affirming Carnival’s commitment to passenger and crew safety too vague and general to satisfy the particularity requirements of Federal Rule 9(b) and the PSLRA.

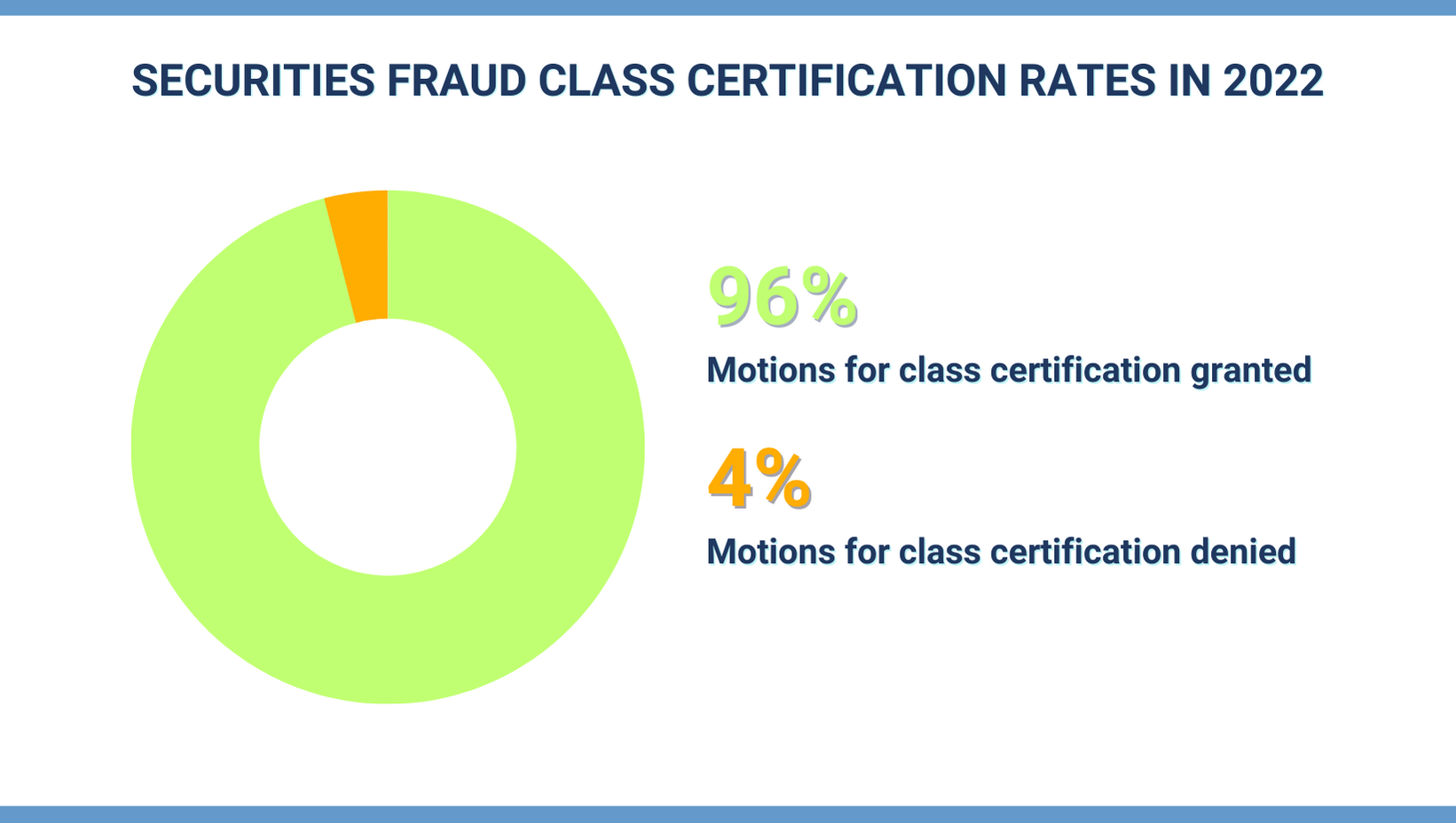

Jerry: I know that the Holy Grail in class actions for plaintiffs’ counsel is securing class certification. In terms of a scorecard over the past year, relatively how did plaintiffs and defendants do in dealing with either preemptive motions to dismiss that attacked securities fraud class actions, or an actual litigation of certification motions?

Nelson: In 2022, plaintiffs’ bar was successful in obtaining class certification of at least part of a class in almost all of the cases that went to that stage of litigation. However, companies were successful almost 50% of the time in obtaining favorable rulings on motions to dismiss, motions to strike, and motions for summary judgment – as was the case in In Re Carnival, for example.

Jerry: In terms of All-Star rulings in 2022 for class certification, do you have any favorites in terms of cases you’ve studied and analyzed?

Nelson: Yes – one case in particular involved the Basic presumption we discussed. In St. Clair County Employees’ Retirement System, et al. v. Acadia Healthcare Co., plaintiffs alleged several misrepresentations and omissions concerning the quality of care and staffing at the defendant’s health care facilities. News items and reports by securities analysts later disclosed allegations of understaffing, cost cutting, and patient neglect at those facilities had in fact occurred. In an attempt to overcome the Basic presumption, the defendant argued that the misrepresentations alleged in the complaint were merely generic and not material to the relationship between a misrepresentation relied upon and its impact on the company’s share price. The defendant offered an expert report in support of this argument, but the court determined that the defendant failed to rebut the Basic presumption because the report offered no analysis showing a disconnect between the allegedly generic misstatements and the company’s share price. The court found that in the absence of such analysis, mere contentions that the statements were generic were insufficient to overcome the Basic presumption. As a result, the court granted the plaintiffs’ motion for class certification.

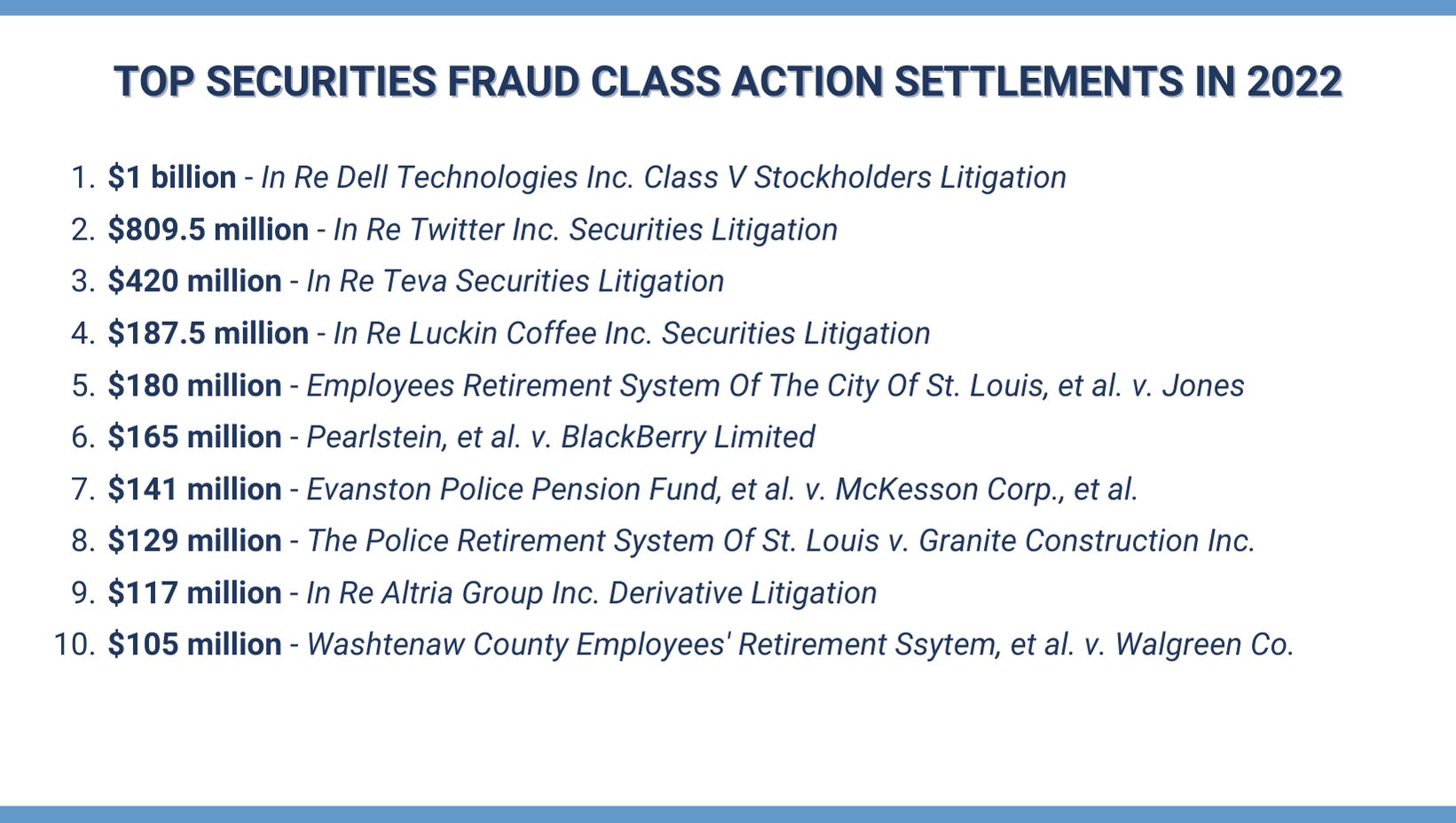

Jerry: I know that in many particular subset of areas class certifications lead to settlements, and in 2022 class action settlements were the highest they had ever been in decades. What did the space look like in terms of securities fraud class action settlements?

Nelson: The plaintiffs’ class action bar successfully converted class certification rulings into class-wide settlement at a brisk pace in 2022. The top ten securities fraud class-wide settlements totaled $3.25 billion in the past year. The top settlement was a class action against Dell Technologies for $1 billion, resolving claims that the defendants breached their fiduciary duties to former shareholders of a particular kind of Dell stock. There was also a large settlement of over $800 million from Twitter in a class action, where stockholders alleged that Twitter artificially inflated its stock price by misleading investors about user engagement.

Jerry: Those are hefty numbers and a lot of coin – I’m sure in 2023 the plaintiffs’ bar will be loaded for bear again. Well thank you for your analysis Nelson, and for your overview of the developments over the past year in securities throughout class action litigation, and thank you to our listeners for joining our Friday weekly podcast. Have a great day!