Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jerry Maatman and associate Jesse Stavis with their discussion of 2023 developments and trends in ERISA class action litigation as detailed in the recently published Duane Morris ERISA Class Action Review – 2024.

Check out today’s episode and subscribe to our show from your preferred podcast platform: Spotify, Amazon Music, Apple Podcasts, Google Podcasts, the Samsung Podcasts app, Podcast Index, Tune In, Listen Notes, iHeartRadio, Deezer, YouTube or our RSS feed.

Episode Transcript

Jerry Maatman: Welcome to our listeners, thank you for being here on our weekly podcast, the Class Action Weekly Wire. My name is Jerry Maatman, I’m a partner at Duane Morris, and joining me today is my colleague, Jesse Stavis. Thank you for being on the podcast – this is episode 50 of the Class Action Weekly Wire, so we’re excited to have you with us today, Jesse.

Jesse Stavis: Thanks, Jerry, always happy to be part of the podcast.

Jerry: Today we’re discussing a recent publication of Duane Morris, the inaugural issue of the Duane Morris ERISA Class Action Review, and listeners, you can find that e-book publication on our blog, the Duane Morris Class Action Blog. Jesse, could you give our listeners an idea of what they can expect from this publication?

Jesse: Absolutely, Jerry. So in the last few years we’ve seen a surge in class action litigation filed under the Employee Retirement Income Security Act, or ERISA, and 2023 was more the same. The plaintiffs’ bar continues to focus on challenges to ERISA fiduciary’s management of 401(k) and other retirement plans. To that end, the class action team at Duane Morris is pleased to present the ERISA Class Action Review for 2024. This publication analyzes the key ERISA-related rulings and developments in 2023, and the significant legal decisions and trends impacting this type of class action litigation for 2024. We hope the companies will benefit from this resource as they figure out how to comply with this evolving law and standards.

Jerry: Well, Jesse, in 2023 courts throughout the country issued what I consider to be a mixed bag of rulings – major victories for the plaintiff side, and likewise major victories for the defense side. In terms of your analysis of the case law and what occurred last year, what do you think are the key takeaways in the publication for corporate counsel?

Jesse: Well, Jerry, I’d say that motions to dismiss still play an outsized role in ERISA class action litigation. And in this respect litigators on both sides of the V are still dealing with the fallout of the Supreme Court’s decision in a 2022 case called Hughes v. Northwestern University. There was a lot of anticipation that this case would clear up some thorny issues surrounding the pleading standards in ERISA cases. Ultimately, though, the court issued a relatively narrow ruling that left us with more questions than answers. As a result, pleading standards are still very much up in the air. Now, courts have varied in how they have addressed motions to dismiss, but, generally speaking, there’s been a lot of focus on the sufficiency of the comparators that plaintiffs provide. Without more guidance from the Supreme Court, these battles are likely to continue. I will say that there were quite a few significant rulings in ERISA class actions in 2023. On the whole, the plaintiffs’ bar continued to have success, particularly when it came to fending off defense challenges to standing under Rule 12(b)(1).

Jerry: Well, I know, Jesse. In our practice we download and monitor the filings in all 50 States and in all Federal courts in these subsystem areas of law. And certainly ERISA class based litigation is a growing area, and one of the trends that I thought was important, and one of the takeaways that are very interesting for corporate counsel is the enforceability of workplace arbitration programs that have class action waivers in them, and while that might defuse the so-called atomic bomb of a class action in other substantive areas in ERISA. It’s not only so could you explain kind of the rationale on the lines of the case law that you followed in 2023 on that issue.

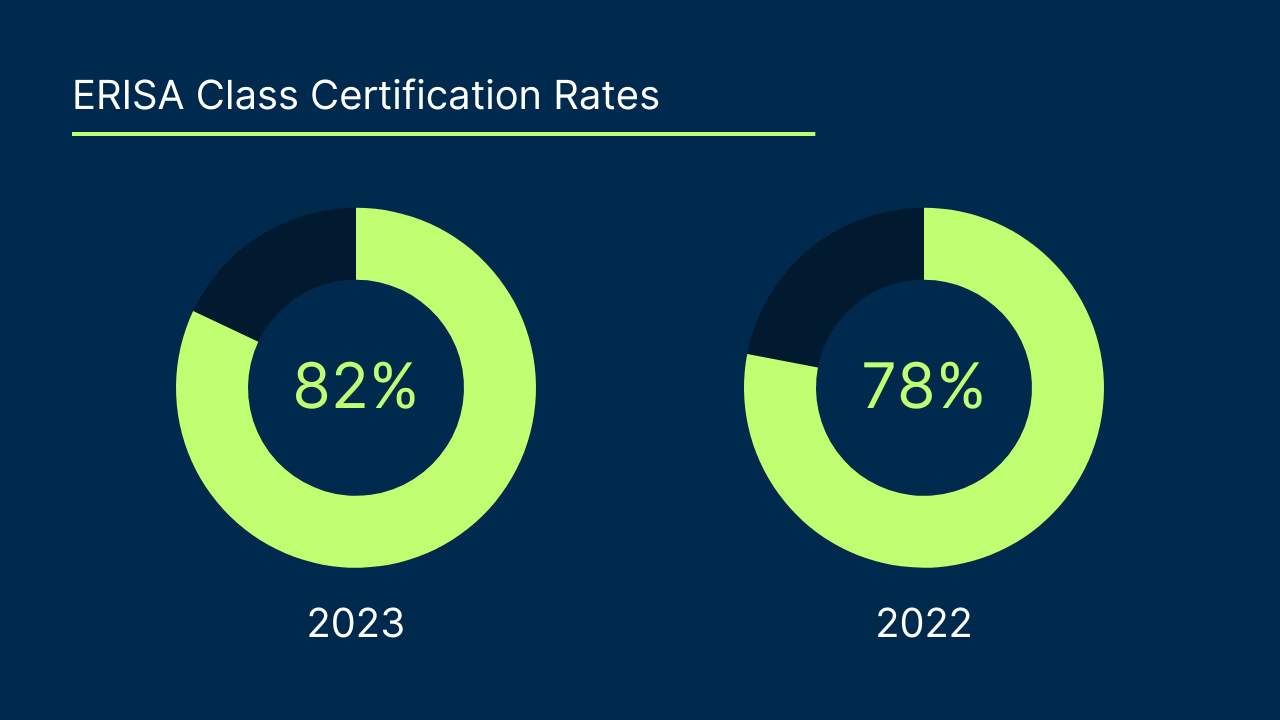

Jesse: Yeah, I would definitely agree that we are seeing less of an appetite to enforce these class action waivers, and that the difficulty of enforcing this waivers means that we’re really likely to see increased activity this year. There’s a very high rate of class certification – these cases in 2023 was granted 82% of the time, and of course, certification is the Holy Grail for plaintiffs’ lawyers, and that makes these cases very lucrative for the plaintiffs’ bar. I anticipate that class certification is going to remain challenging to defeat outright, and that all has to do with the nature of these claims. So ERISA plaintiffs assert that discrete types of plan mismanagement led to common injuries affecting large numbers of planned participants, and that it did it in similar ways. And, as you know, Jerry, that’s a very good recipe for class certification and it’s a good incentive for plaintiffs’ lawyers to file more of these cases.

Jerry: You used an interesting phrase that I think is spot on – the Holy Grail of these cases is class certification as I view them. The plaintiffs’ bar files them, tries to certify them, and then monetize them, because they know if a case gets certified, it becomes very, very dangerous to try and settle it, inevitably following the wake of certification numbers. What did the space look like on the ERISA front in terms of class-wide settlements in 2023?

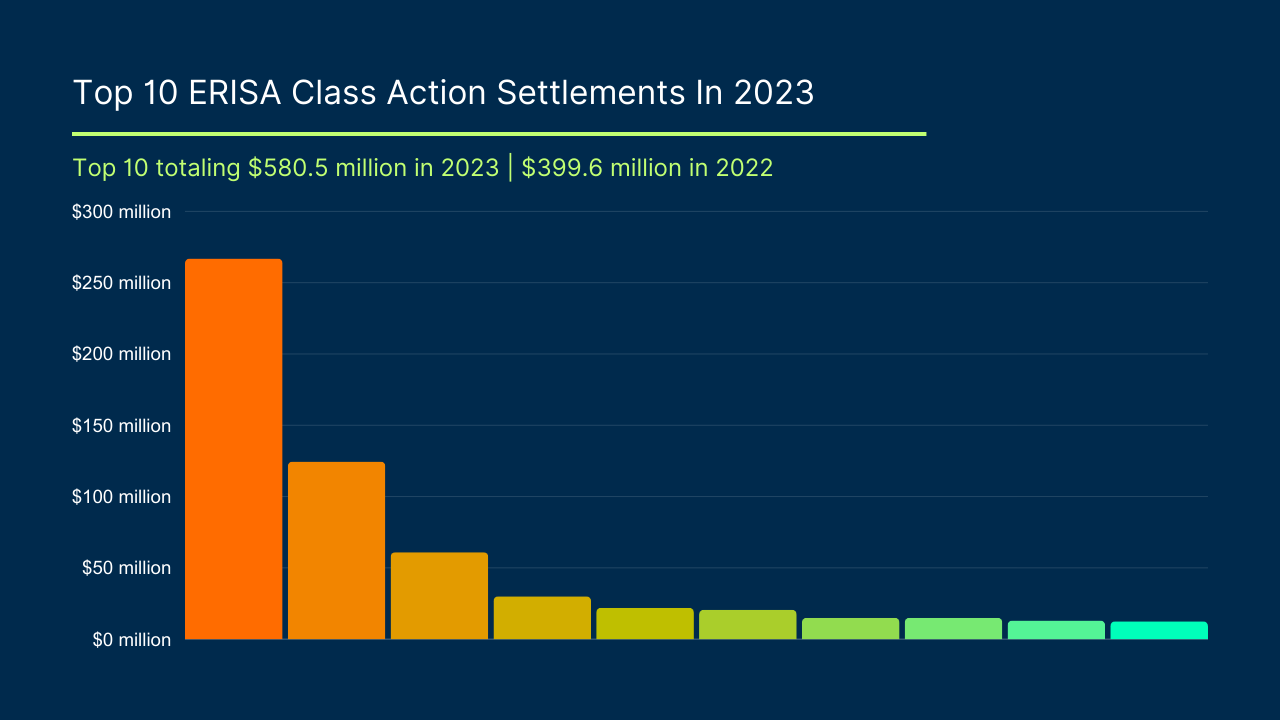

Jesse: Well, plaintiffs did very well in securing high value settlements. In 2023, the top 10 ERISA class action settlements totaled $580.5 million – so we crossed the half billion dollar mark. And that’s a significant jump from 2022, when the top 10 ERISA class action settlements totaled $399.6 million.

Jerry: Well, those are record breaking numbers, and we’re following them in 2024. And my prognostication as they’re going to be even higher this year as compared to last year. Thank you, Jesse, and thank you to our loyal blog listeners for reading our publication and for tuning into this week’s podcast. Jesse, I sincerely appreciate you joining the show this week and for your thought leadership in this space.

Jesse: Absolutely. Thanks for having me, Jerry, and of course, thanks to all the listeners.