Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jerry Maatman and associates Jesse Stavis and Anshul Agrawal with their discussion of the key trends analyzed in the 2025 edition of the ERISA Class Action Review, including analysis of two major rulings and their significant impact on ERISA litigation in 2025.

Stay tuned for the publication of the ERISA Class Action Review on Tuesday, March 25.

Check out today’s episode and subscribe to our show from your preferred podcast platform: Spotify, Amazon Music, Apple Podcasts, Samsung Podcasts, Podcast Index, Tune In, Listen Notes, iHeartRadio, Deezer, and YouTube.

Episode Transcript

Jerry Maatman: Welcome to our listeners. Thank you for being here on our weekly podcast series, the Class Action Weekly Wire. I’m Jerry Maatman, a partner with Duane Morris, and joining me today are my colleagues, Jesse and Anshul, and we’re here to talk about Episode 93 on class action issues involving ERISA. Welcome, gentlemen.

Jesse Stavis: Thanks, Jerry, always happy to be part of the podcast.

Anshul Agrawal: Yeah, thank you so much, Jerry.

Jerry: Today on our podcast we’re going to highlight our publication of the second edition of the Duane Morris ERISA Class Action Review. Jesse, can you share with our listeners a little bit about this publication?

Jesse: Absolutely. The surge of class action litigation filed under the Employee Retirement Income Security Act, or ERISA, over the last several years definitely persisted in 2024. Class action litigators in the plaintiffs’ bar continued to primarily focus on challenges to ERISA fiduciaries’ management of 401(k) and other retirement plans. The class action team at Duane Morris is pleased to present the ERISA Class Action Review – 2025, which analyzes the key ERISA-related rulings and developments in 2024, as well as the significant legal decisions and trends impacting this type of class action litigation for 2025. We hope the companies will benefit from this resource in their compliance with these evolving laws and standards.

Jerry: Well, certainly the subject matter of the book in terms of the key rulings in 2024 showed, I think, a mixed bag of results for both the defense bar and plaintiffs. Anshul, let’s talk a little bit about what you have identified as the biggest issues over the past 12 months, and that would be the increasing amount of class action litigation over 401(k) forfeiture issues. It’s certainly an area of concern for our clients, and we’re seeing some major developments. Could you share with our listeners your view of kind of the heart of these sorts of claims?

Anshul: Yeah, absolutely. So, the central issue here revolves around how employers handled forfeited 401(k) contributions. So specifically, the employers matching contributions when an employee leaves before they’re fully vested. Normally, if an employee leaves early, they forfeit these unvested funds, and many companies have been using this money to offset their own contributions in future years. However, there’s been a shift, because in 2024 we saw several class actions challenging this practice with plaintiffs, arguing that this forfeited money should instead be used to cover the administrative costs of the plan rather than reducing the employer’s future contributions. These claims have made it past motions to dismiss in several cases, including Perez-Cruet v. Qualcomm and Rodriguez v. Intuit. So, courts are increasingly finding that these claims may be valid under ERISA’s fiduciary duty standards.

Jerry: My take is that these cases are having real world consequences for people at companies that are in charge of managing 401(k) programs going forward. Jesse, do you think that these sorts of lawsuits are going to have lasting effects on the way in which employers treat these sorts of funds?

Jesse: Oh, definitely. The outcome of these cases could set new precedents. Courts have been indicating that companies might be violating their fiduciary duties if they’re not using forfeited funds for the benefit of plan participants. For example, in Perez-Cruet, the court found that Qualcomm’s use of forfeited funds for current employees’ accounts rather than administrative costs may have been a breach of fiduciary duty. Now this case, along with others like it, shows that companies could face real risks if they continue using forfeited funds solely to offset their own contributions. What’s particularly important here is the courts are saying that even if companies follow the plan’s documentation, they still have a duty to act in the best interest of the participants. This could definitely lead to a shift in how companies structure their 401(k) plans.

Jerry: I think it’s fascinating that we’re dealing with a statute that’s more than six decades old, but we’re bumping up against issues that have never been decided. Another thing that comes to my mind is the impact of socially and environmentally conscious investing, or what’s called ESG investing. And the big huge decision this year in the Spence v. American Airlines case. Anshul, can you comment on your take in terms of what was going on in that particular ruling?

Anshul: Yeah, sure. So, in the Spence case, a plaintiff challenged American Airlines’ investment decisions in the company’s 401(k) plan. The plaintiff argued that the plan’s fiduciaries breached their duties by selecting underperforming ESG funds and by choosing managers who prioritized these types of environmental and social goals over profitability. What’s notable here is that the plaintiff wasn’t just challenging the individual investments, but also the fund managers themselves for their ESG focus. The court found these claims plausible, allowing the case to move forward. So, this decision definitely has the potential to change how fiduciaries view ESG factors in their investment strategies, particularly when considering ERISA’s duty of prudence. If courts continue to allow these types of claims to proceed, it could lead to greater scrutiny of ESG investments in retirement plans.

Jerry: That to me is quite a headline and something that’s incredibly important to corporations and our clients to the extent that many are focused on ESG considerations, and this and the court’s ruling. That that might be a breach of fiduciary duties, seems to me to be a reordering of the playing field and the risks and compliance strategies when you’re looking in this area. Jesse, what would be your take on how this is going to play out in 2025

Jesse: Well, Jerry, I think that what makes Spence so interesting is that it highlights this tension between traditional profit-driven investing on the one hand, and socially conscious investments on the other. Now, in Spence, the court seemed to accept the argument that if ESG funds systematically underperform, fiduciaries could be seen as breaching their duty of prudence by investing in it. This opens up a new avenue for plaintiffs to challenge fiduciaries, and it’s something employers and investment managers will need to keep an eye on in the future. Now, we also saw some shifting regulatory perspectives here, especially with the Department of Labor’s rule allowing fiduciaries to consider ESG factors which is now under challenge. The Supreme Court’s Loper Bright decision which overturned Chevron deference could have significant implications for how courts evaluate these kinds of rules, and it might lead to more restrictive interpretations of fiduciary duties in the ESG context.

Jerry: Anshul, do you think that the Spence case is kind of a demarcation point where you’re going to see an increased focus by the plaintiffs’ bar and bringing class actions over this issue of putting notions other than profit first, and that that can translate into a breach of fiduciary duty?

Anshul: Yeah, I mean, that’s definitely possible. I think if other courts follow the lead of the Northern District of Texas, then we could see a rise in sort of these ESG-related lawsuits, particularly against employers or plan managers who prioritize these types of factors over pure financial performance. If more plaintiffs succeed in these claims, it could lead to more cautious approaches by fiduciaries when considering these ESG factors.

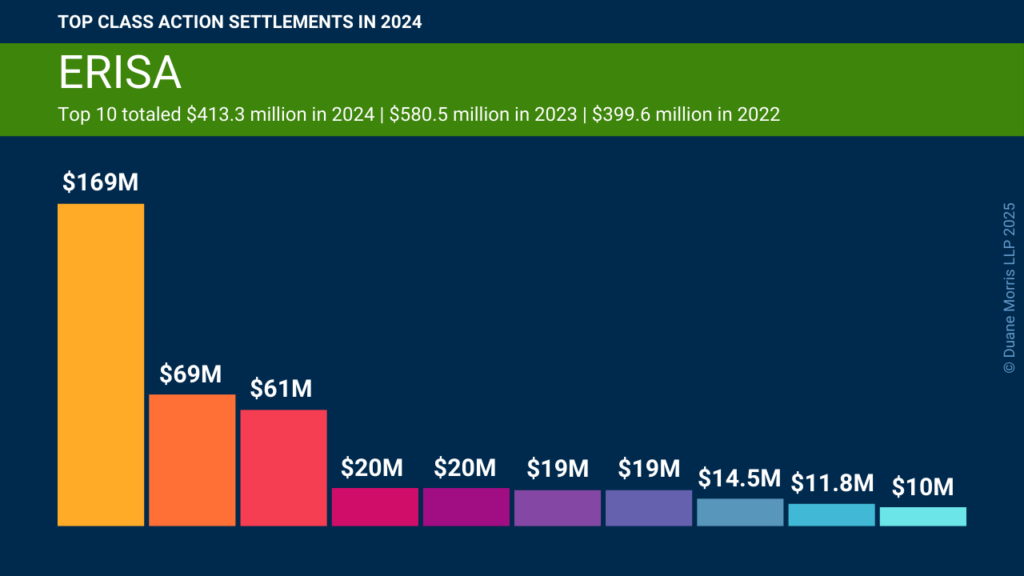

Jerry: I’ve always thought the business model of the plaintiffs’ class action bar is file a case, certify the case, then monetize the case by securing settlements. And 2024 certainly was a dramatic year when you talk about class action settlements. What about in the ERISA space in terms of how the plaintiffs’ bar did in taking down large-scale settlements?

Jesse: Well, Jerry, plaintiffs did very well in securing high dollar settlements in 2024, although not quite as well as in 2023. In 2024, the top 10 ERISA class action settlements totaled $413.3 million. This was a drop from 2023, when the top 10 settlements totaled $580.5 million.

Jerry: That’s still a lot of money, and that’s only the top 10, so, it dramatically illustrates the risk and compliance stakes for corporations in the ERISA class action space.

Well, thank you, gentlemen, for joining us on this week’s Class Action Weekly Wire and for providing us and lending us assistance in navigating the area of ERISA class actions, which is certainly at the top of the agenda for most corporations in terms of compliance activity.

Jesse: Thanks for having me, Jerry, and thanks, as always, to all the listeners.

Anshul: Thank you so much, Jerry, and thank you to everyone for tuning into the Weekly Wire