Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jennifer Riley, special counsel Brandon Spurlock, and associate Jeff Zohn with their discussion of 2023 developments and trends in privacy class action litigation as detailed in the recently published Duane Morris Privacy Class Action Review – 2024.

Check out today’s episode and subscribe to our show from your preferred podcast platform: Spotify, Amazon Music, Apple Podcasts, Google Podcasts, the Samsung Podcasts app, Podcast Index, Tune In, Listen Notes, iHeartRadio, Deezer, YouTube or our RSS feed.

Episode Transcript

Jennifer Riley: Welcome to our listeners, thank you for being here for our weekly podcast, the Class Action Weekly Wire. I’m Jennifer Riley, partner at Duane Morris, and joining me today is special counsel Brandon Spurlock and associate Jeffrey Zohn. Thank you for being on the podcast, guys.

Brandon Spurlock: Thank you, Jen, happy to be part of the podcast.

Jeff Zohn: Thanks, Jen, I am glad to be here.

Jennifer: Today on the podcast we are discussing the recent publication of this year’s edition of the Duane Morris Privacy Class Action Review. Listeners can find the eBook publication on our blog, the Duane Morris Class Action Defense Blog. Brandon, can you tell our listeners a little bit about our new publication?

Brandon: Yeah, sure, Jen, the last year saw a virtual explosion of privacy class action litigation. As a result, compliance with privacy laws in the myriad ways that companies interact with employees, customers, and third parties is a corporate imperative. To that end, the class action team at Duane Morris is pleased to present the Privacy Class Action Review – 2024. This publication analyzes the key privacy-related rulings and developments in 2023, and the significant legal decisions and trends impacting privacy class action litigation for 2024. We hope the companies and employers will benefit from this resource. Their compliance with these evolving laws and standards

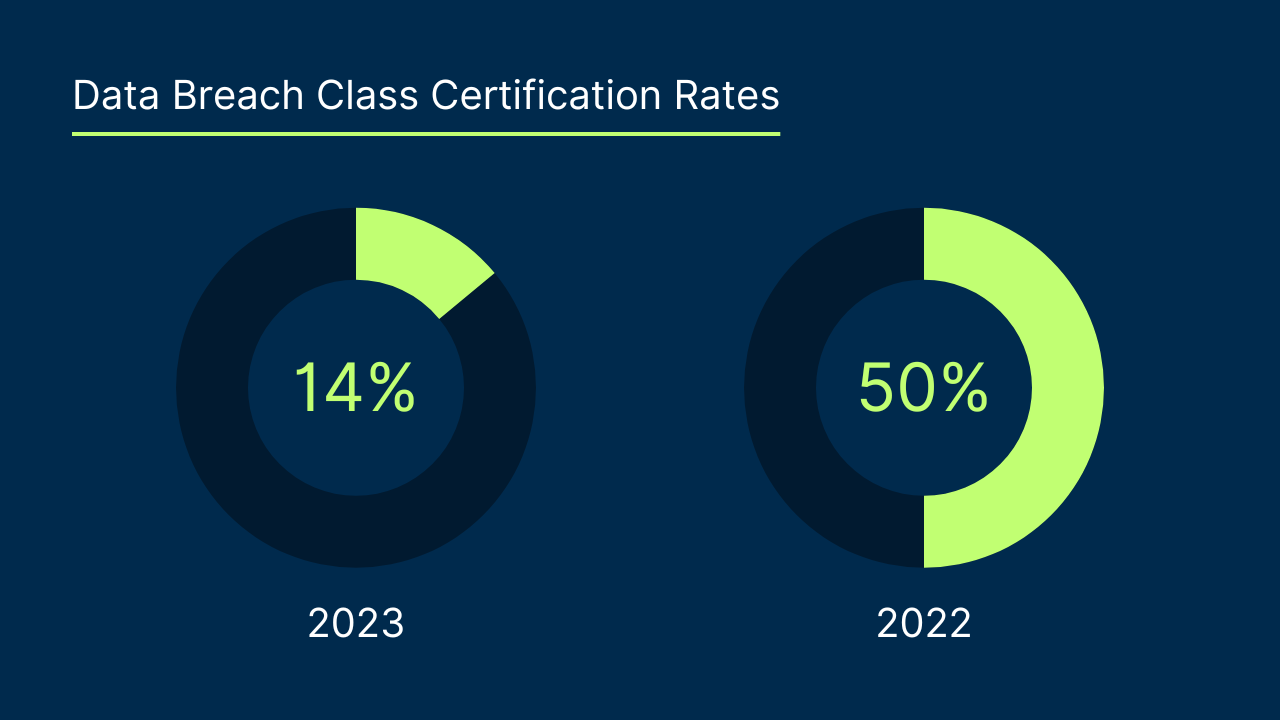

Jennifer: In the rapidly evolving privacy litigation landscape, it is crucial for businesses to understand how courts are interpreting these often ambiguous privacy statutes. In 2023, courts across the country issued a mixed bag of results leading to major victories for both plaintiffs and defendants. Jeff, what were some of the takeaways from the publication with regard to litigation in this area in 2023?

Jeff: Yeah, you’re absolutely right that there was a mixed bag of results – both defendants and plaintiffs can point to major BIPA victories in 2023. This past year will definitely be remembered for some of the landmark pro-plaintiff rulings that will provide the plaintiffs’ bar with more than enough ammunition to keep BIPA litigation in the headlines for the foreseeable future. Specifically in 2023, the Illinois Supreme Court issued two seminal decisions that increase the opportunity for recovery of damages under BIPA, including Tims, et al. v. Black Horse Carriers, which held a five-year statute of limitations applies to claims under BIPA, and Cothron, et al. v. White Castle System, Inc., which held that a claim accrues under the BIPA each time a company collects or discloses biometric information.

Jennifer: Two major rulings indeed. Brandon, what do you anticipate these rulings will mean for privacy class actions in 2024?

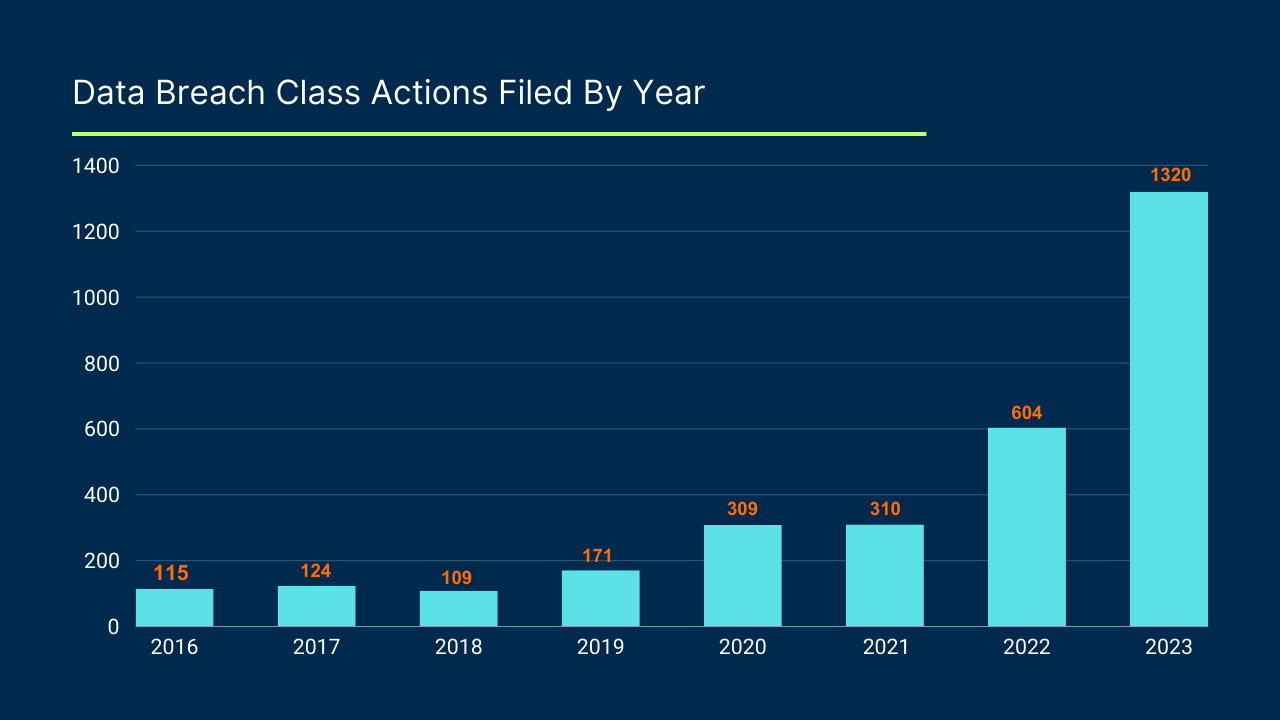

Brandon: Sure, Jen. These rulings have far-reaching implications together. They have the potential to increase monetary damages in BIPA class actions in an exponential manner, especially in employment context, where employees may scan in and out of work multiple times per day across more than 200 workdays per year. In 2023, in the wake of these rulings, class action filings more than doubled. We anticipate that the high volume of case filings will continue at 2024.

Jeff: I think it’s important to add that even though BIPA is an Illinois state statue, various other states are continuing to consider proposed copycat statutes that follow the lead of Illinois. The federal government likewise continues to consider proposals for a national statute. These factors have transformed biometric privacy compliance into a top priority for businesses nationwide and have promoted privacy class actions to the top of the list of litigation risks facing business today. If other states succeed in enacting similar statutes, businesses can expect similar surges in those States as the filing numbers of Illinois continue their upward trend.

Jennifer: Thanks so much for that information – all very important for companies navigating the privacy class action regulations and statutes. The Review also talks about the top privacy settlements in 2023. How did plaintiffs do in securing settlement funds last year?

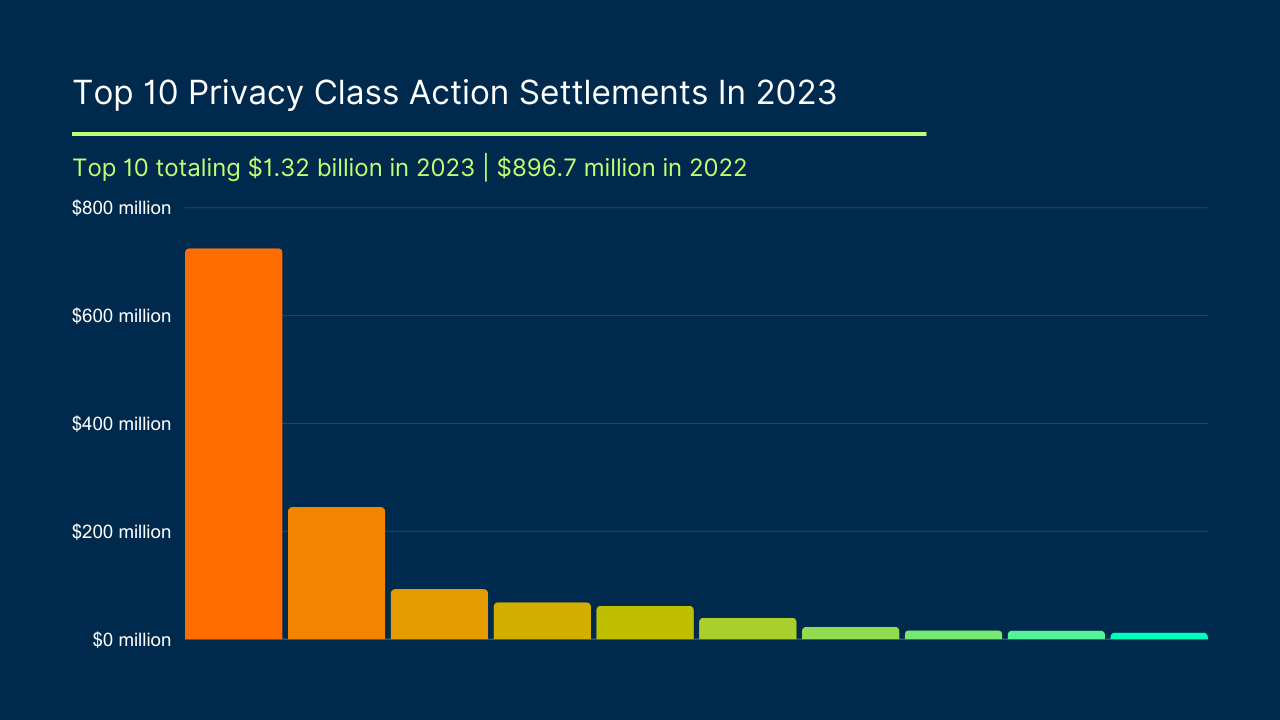

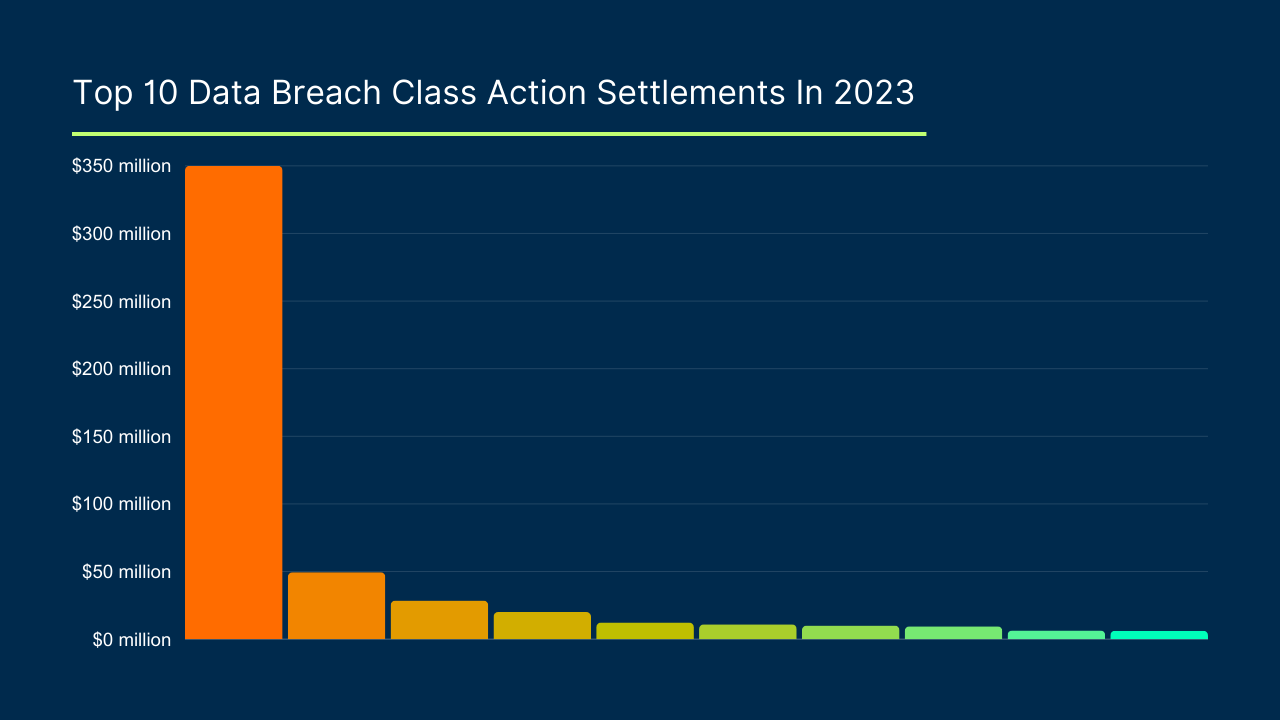

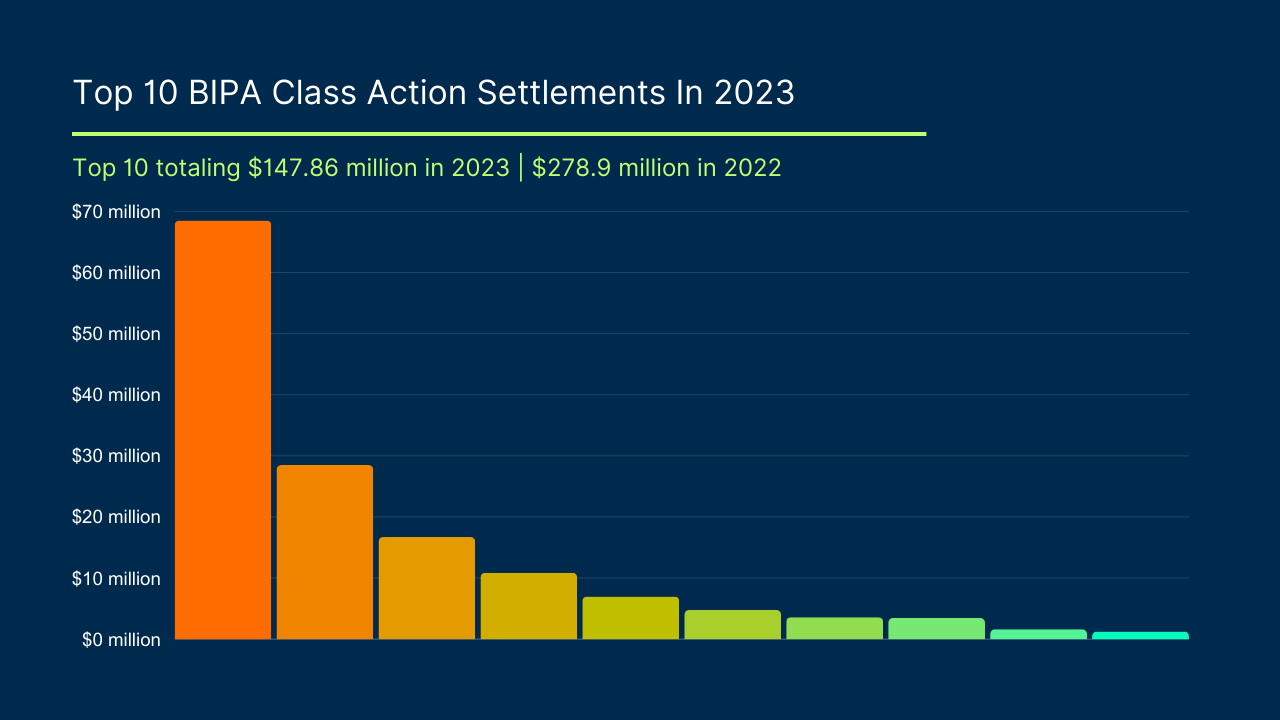

Brandon: Plaintiffs did very well in securing high dollar settlements. In 2023, the top 10 privacy settlements totaled $1.32 billion. This was a significant increase over 2022, when the top 10 privacy class action settlements totaled still a high number, but just almost $900 million. Specific to BIPA litigation settlements, the top 10 BIPA class action settlements totaled almost $150 million dollars in 2023.

Jennifer: Thank you. We will continue to track those settlement numbers in 2024 as record breaking settlement amounts have been a huge trend that we have tracked over the past two years. Thank you to Brandon and Jeff for being here today, and thank you to the loyal listeners for tuning in. Listeners, please stop by the blog for a free copy of the Privacy Class Action Review eBook.

Jeff: Thank you for having me, Jen, and thank you to all of our listeners.

Brandon: Thanks so much, everyone.