By Alex W. Karasik, Gerald L. Maatman, Jr. and Jennifer A. Riley

By Alex W. Karasik, Gerald L. Maatman, Jr. and Jennifer A. Riley

Duane Morris Takeaways: The EEOC’s fiscal year 2023 (“FY 2023”) spans from October 1, 2022 to September 30, 2023. Through the midway point of FY 2023, EEOC enforcement litigation filings have been fairly status quo with a total of 29 new lawsuits filed in the first six months. Traditionally, the second half of the EEOC’s FY, and particularly in the final month of September, are when the majority of filings occur. Even so, an analysis of the types of lawsuits filed, and the locations where they are filed, is informative for employers in terms of what to expect during the fiscal year-end lawsuit filing rush in September.

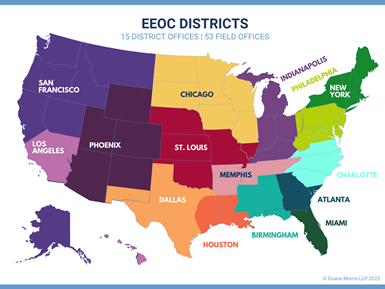

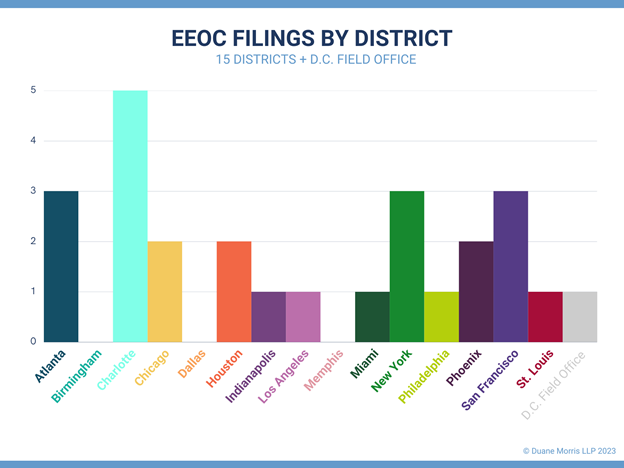

Cases Filed By EEOC District Offices

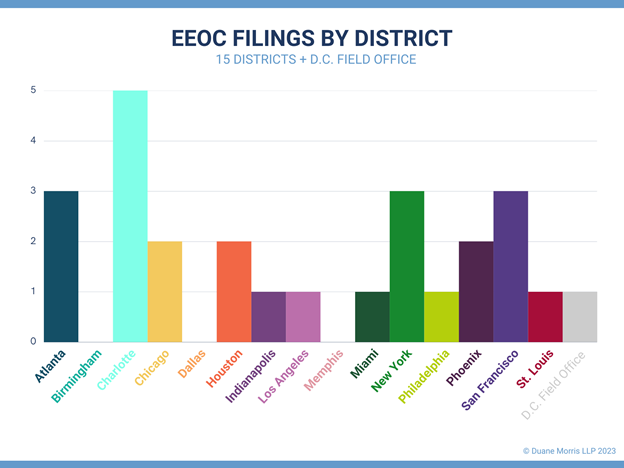

In addition to tracking the total number of filings, we closely monitor which of the EEOC’s 15 district offices are most active in terms of filing new cases over the course of the FY. Some districts tend to be more aggressive than others, and some focus on different case filing priorities. The following chart shows the number of lawsuit filings by EEOC district office.

The most noticeable trend of the first six months of FY 2023 shows that the Charlotte District Office already filed five lawsuits. The Los Angeles and San Francisco District Offices each filed 13 lawsuits in FY 2022. In the first half of FY 2023, however, there was only one filed in Los Angeles, and three in San Francisco. The Birmingham and Dallas District Offices have yet to file a single lawsuit in FY 2023.

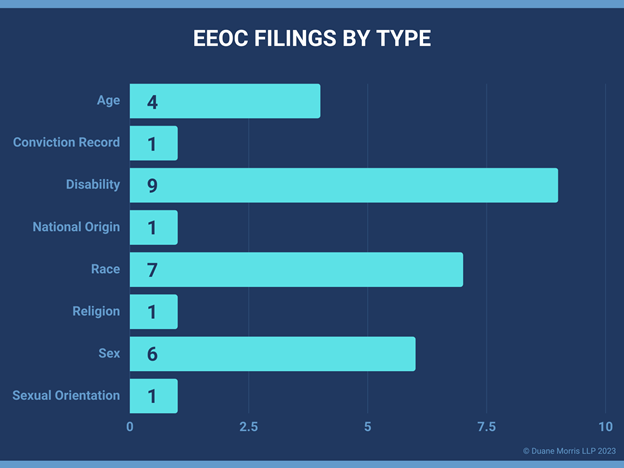

Analysis Of The Types Of Lawsuits Filed In First Half Of FY 2023

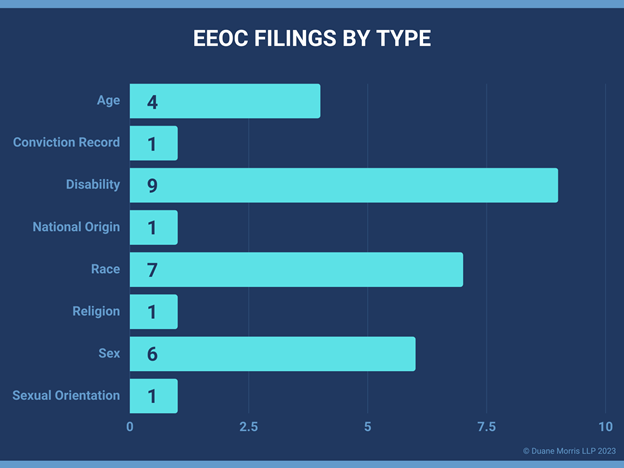

We also analyzed the types of lawsuits the EEOC filed throughout the first six months, in terms of the statutes and theories of discrimination alleged, in order to determine how the EEOC is shifting its strategic priorities. The chart below shows the EEOC filings by allegation type.

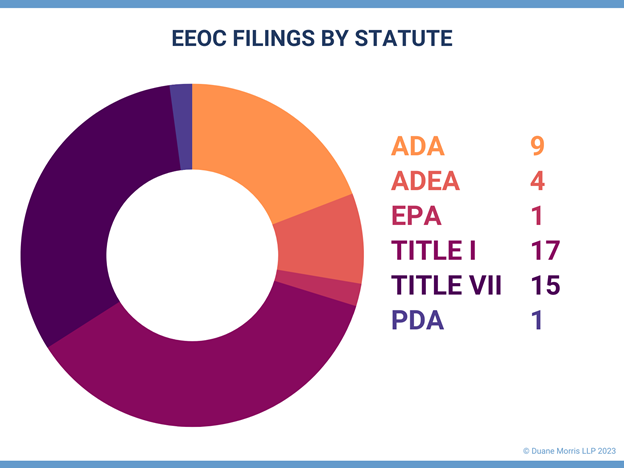

The percentage of each type of filing has remained fairly consistent over the past several years. Title VII cases again made up the majority of cases filed the first half of FY 2023, with 59% of all filings, (lower than the 69% in FY 2022, but similar to the 62% in FY 2021 and 60% in FY 2020). ADA cases also made up a significant percentage of the EEOC’s FY 2023 filings thus far, at 31%, an increase from the 18% in FY 2022, although down from the 36% in FY 2021. There were also four ADEA cases filed in the first half of the FY.

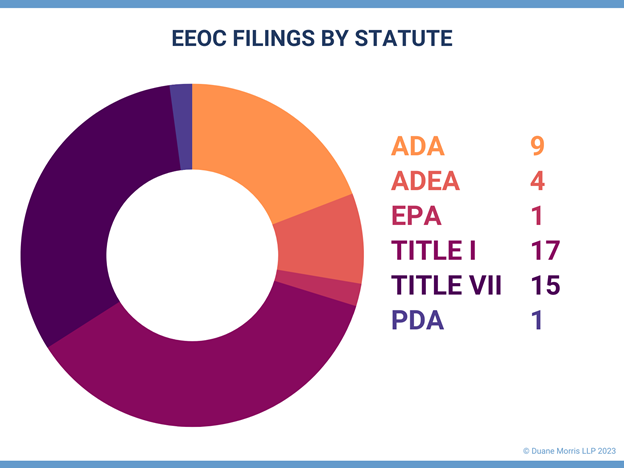

The graph below shows the number of lawsuits filed according to the statute under which they were filed (Title VII, Americans With Disabilities Act, Pregnancy Discrimination Act, Equal Pay Act, and Age Discrimination in Employment Act) and, for Title VII cases, the theory of discrimination alleged.

Notable 2023 Lawsuit Filings

Gender Identity Discrimination

After the 2020 U.S. Supreme Court’s decision in Bostock v. Clayton County, 140 S. Ct. 1731 (2020), which held that federal law prohibits employment discrimination against LGBTQ workers on the basis of sexual orientation or transgender status, we expected to see more aggressive EEOC-initiated litigation in this area. Two lawsuits involve claims of discrimination on the basis of sexual orientation and transgender status. In the first, EEOC v. TC Wheeler, Case No. 23-CV-286 (W.D.N.Y. Mar. 30, 2023), the EEOC alleged that management and employees harassed a transgender male employee because of his gender identity, including telling the employee that he “wasn’t a real man,” and asking invasive questions about his transition. The EEOC further alleged that other employees also made anti-transgender comments and continually referred to the employee by using female pronouns.

In EEOC v. Sandia Transportation, Case No. 23-CV-274 (D.N.Mex. Mar. 31, 2023), the EEOC alleged that the defendant discriminated against lesbian female employees on the basis of their sexual orientation. The EEOC contended that the owner of the company stated that women did not belong in the workplace, that he “hated dealing with women,” and referred to them in a number of derogatory terms.

Both of these lawsuits suggest that the EEOC will be filing more lawsuits seeking to protect against harassment of employees based on their sexual orientation or because of their gender.

Vaccine-Related Litigation

Given the prevalence of vaccine-related debates that emerged during the COVID-19 pandemic, we anticipated there would be a surge of exemption cases coming through the EEOC’s charge intake system. In EEOC v. Children’s Hospital of Atlanta, Case No. 22-CV-4953 (N.D. Ga. Dec. 15, 2022), the EEOC alleged that the pediatric healthcare system violated federal law when it fired a maintenance assistant for requesting a religious exemption to its influenza vaccination policy. The EEOC contended that the defendant terminated the employee for failing to receive the vaccination, despite his request for a religious exemption to the defendant’s flu vaccination requirements based on sincerely held religious beliefs. The EEOC noted that the defendant previously granted the employee religious exemptions in 2017 and 2018, but denied the request in 2019 and subsequently terminated his employment. We anticipate a significant uptick in vaccine-related litigation as the smoke clears from the global pandemic.

Race Discrimination

Several events involving race discrimination over the last few years have made this issue a continued priority for the EEOC. So far, the Commission filed a few notable lawsuits involving race discrimination. In EEOC v. First Advantage Background Services Corp., Case No. 23-CV-958 (N.D. Ill. Feb. 16, 2023), the defendant allegedly used background check information to make discriminatory hiring decisions on the basis of race. In EEOC v. Bilal & Aaya Subway, Inc., Case No. 23-CV-129 (E.D.N.C. March 16, 2023) the EEOC filed a lawsuit alleging that three Subway franchises subjected employees to racial discrimination when their owner regularly made racist statements about Black people and terminated workers because they were Black. The EEOC asserted that the harassment was severe and pervasive, that the owner criticized traditionally Black hairstyles, and fired an employee with dreadlocks.

These filings indicated that the EEOC will continue to litigation race discrimination claims on a priority basis throughout the remainder of the fiscal year.

March 2023 Release Of Enforcement Statistics

On March 13, 2023, the EEOC published its fiscal year 2022 Annual Performance Report (FY 2022 APR), highlighting the Commission’s recovery of $513.7 million in monetary relief for more than 38,000 victims of employment discrimination, including nearly $40 million as a direct result of litigation resolutions.

This annual publication from the EEOC is noteworthy for employers in terms of recognizing the EEOC’s reach, understanding financial exposure for workplace discrimination claims, and identifying areas where the EEOC may focus its litigation efforts in the coming year.

It is a must read for corporate counsel, HR professional, and business leaders.

Strategic Priorities

Addressing systemic discrimination has long been a top priority for the EEOC. In FY 2022, the EEOC resolved over 300 systemic investigations on the merits, obtaining more than $29.7 million in monetary benefits. The EEOC also resolved 10 systemic lawsuits, obtaining over $28 million in relief for nearly 1,300 individuals and significant equitable relief. To ensure the systemic lawsuit cupboard was not left bare, the EEOC filed 13 new systemic lawsuits.

Advancing racial justice was another strategic priority for the EEOC in FY 2022. The FY 2022 APR notes that the EEOC resolved 18 lawsuits alleging race or national origin discrimination, for approximately $4.6 million in relief benefiting 298 individuals. In addition, nine of the new 13 systemic lawsuits include claims of race or national origin discrimination. The EEOC also conducted 468 race and color outreach events, which reached 52,675 attendees. This includes 143 racial justice events reaching 9,064 attendees.

Finally, in recent years the EEOC has indicated that the use of artificial intelligence (“AI”) and algorithmic fairness in employment decisions is a strategic priority. In addition to providing AI training to systemic enforcement teams in the EEOC’s field offices, the EEOC hosted 24 AI and algorithmic fairness outreach events for 1,192 attendees. The EEOC’s efforts culminated with one lawsuit filing in this area. Of note, the EEOC prepared two ADA-related guidance publications relative to the use of artificial intelligence.

We anticipate that the EEOC will continue to focus on these strategic priorities in the remaining months of FY 2023.

Other Notable Developments

Beyond touting its monetary successes, the FY 2022 APR also highlights the EEOC’s efforts in the community. The EEOC conducted 3,302 outreach and training events, providing more than 225,906 individuals nationwide with information about employment discrimination and their rights and responsibilities in the workplace. Among these outreach programs were 399 events for small businesses, which were attend by approximately 18,878 individuals. Finally, 369 outreach events concerned the intersection of COVID-19 and employment discrimination laws. These COVID-19 programs had 26,041 attendees.

The EEOC also expanded its digital footprint, as the EEOC’s website had 10.8 million users. This marks a 3% increase over fiscal year 2021. There were 16 million user sessions, a 4.4% increase over fiscal year 2021. The EEOC had over 29 million page views, a 4.4% increase over fiscal year 2021, and there was a 3% increase in mobile traffic on the website. This data suggests that potential charging parties and other various constituents are more actively engaging with the Commission through its online platforms.

Takeaways For Employers

The first six months of the EEOC’s FY 2023 started with changes in leadership and a focus on new strategic initiatives. With a vastly increased proposed budget, it is more crucial than ever for employers to take heed in regards to the EEOC’s strategic priorities and enforcement agendas.

Stay tuned to our blog for future updates regarding the EEOC’s litigation activities.

By Gerald L. Maatman, Jr., Jennifer A. Riley, and Tyler Zmick

By Gerald L. Maatman, Jr., Jennifer A. Riley, and Tyler Zmick