By Gerald L. Maatman, Jr. and Jennifer A. Riley

Duane Morris Takeaways: As we kick off 2024, we are pleased to announce the publication of the second annual edition of the Duane Morris Class Action Review. It is a one-of-its-kind publication analyzing class action trends, decisions, and settlements in all areas impacting corporations, including the substantive areas of antitrust, appeals, the Class Action Fairness Act, civil rights, consumer fraud, data breaches, discrimination, EEOC-Initiated and government enforcement litigation, the Employee Retirement Income Security Act of 1974, the Fair Credit Reporting Act, wage & hour class and collective actions, labor, privacy, procedural issues, product liability and mass torts, the Racketeer Influenced and Corrupt Organizations Act, securities fraud, state court class actions, the Telephone Consumer Protection Act, and the Worker Adjustment and Retraining Notification Act. The Review also highlights key rulings on attorneys’ fee awards in class actions, motions granting and denying sanctions in class actions, the top class action settlements across all areas of law, and primers on both the Illinois Biometric Information Privacy Act and the California Private Attorney General Act. Finally, the Review provides insight as to what companies and corporate counsel can expect to see in 2024.

This past year Employment Practices Liability Consultant Magazine (EPLiC) called the DMCAR “the Bible” on class action litigation and an essential desk reference for business executives, corporate counsel, and human resources professionals.” It said that “The Review must-have resource for in-depth analysis of class actions in general and workplace litigation in particular.” EPLiC continued that “The Duane Morris Class Action Review analyzes class action trends, decisions, and settlements in all areas impacting Corporate America,” and “provides insight as to what companies and corporate counsel can expect . . . in terms of filings by the plaintiffs’ class action bar.”

Click here to access our customized website featuring all the Review highlights, including the ten major trends across all types of class actions over the past year.

Order your free copy of the eBook here, and download the Review overview on the key Rule 23 decisions and top class action settlements here.

The 2024 Review analyzes rulings from all state and federal courts in 23 areas of law. It is designed as a reader-friendly research tool that is easily accessible in hard copy and e-Book formats. Class action rulings from throughout the year are analyzed and organized into 23 chapters and 6 appendices for ease of analysis and reference.

Executive Summary Of Key Class Action Trends Over The Past Year

Class action litigation presents one of the most significant risks to corporate defendants today. Procedural mechanisms like the one set forth in Rule 23 of the Federal Rules of Civil Procedure have the potential to expand a claim asserted on behalf of a single person into a claim asserted on behalf of a behemoth that includes every employee, customer, or user of a particular company, product, or service, over an extended period.

A class action allows one or more individuals to pursue claims on behalf of a defined and sometimes sprawling group of similarly situated individuals. When the plaintiffs’ bar aggregates the claims of many individuals in a single lawsuit, a class action can present substantial implications for a corporate defendant. As a result, class action litigation poses some of the most significant legal risks that companies face. By joining the claims of many individuals in a single lawsuit, class actions have the potential to increase potential damages exponentially. A negative ruling in a class action has the potential to reshape a defendant’s business model, to impact future cases, as well as to set guidelines for the entire industry. This can make the outcome of a class action lawsuit significant and potentially devastating for a company. Due to their potential implications, class actions are often costly to defend. Defending against a class action can be a time-consuming and resource-intensive process that diverts management attention from core business activities. Plaintiffs can attempt to leverage this reality to make class actions as expensive and disruptive as possible, in an effort to bring about litigation fatigue and to extract a sizable settlement.

Class actions are often complex legal proceedings with uncertain outcomes. The complexity can arise from managing multiple claims, myriad legal issues, and assorted class members, making it challenging for corporate defendants to predict and control the result. Due to these factors, corporate defendants should approach class actions from a broad vantage point with a thoughtful and multi-faceted defense strategy.

We developed this one-of-a-kind resource to provide a practical desk reference for corporate counsel faced with defending class action litigation. We have organized this year’s book into 23 chapters, with five appendices, each of which provides a rundown of the trends in a particular area of class action litigation, along with the key decisions from courts across the country that companies can use to shape their defense strategies.

We identified 10 key trends that characterize the past year. These trends involve: (i) the continued prevalence of massive class action settlements; (ii) expansive growth in privacy class action litigation; (iii) plaintiff-friendly class certification conversion rates; (iv) an expansive growth of data breach litigation; (v) decisions by the U.S. Supreme Court fueling class action litigation; (vi) transformative rulings on the PAGA front, bolstering its popularity among the plaintiffs’ class action bar; (vii) a resurgence of broader and more aggressive government enforcement activity; (viii) the emergence of generative artificial intelligence (AI) and its potential to reshape class action litigation; (ix) a new focus on ESG-related class action risks; and (x) the continued impact of the arbitration defense in the class action space.

Trend #1 – Class Action Settlement Numbers Continue To Spike At Unprecedented Levels

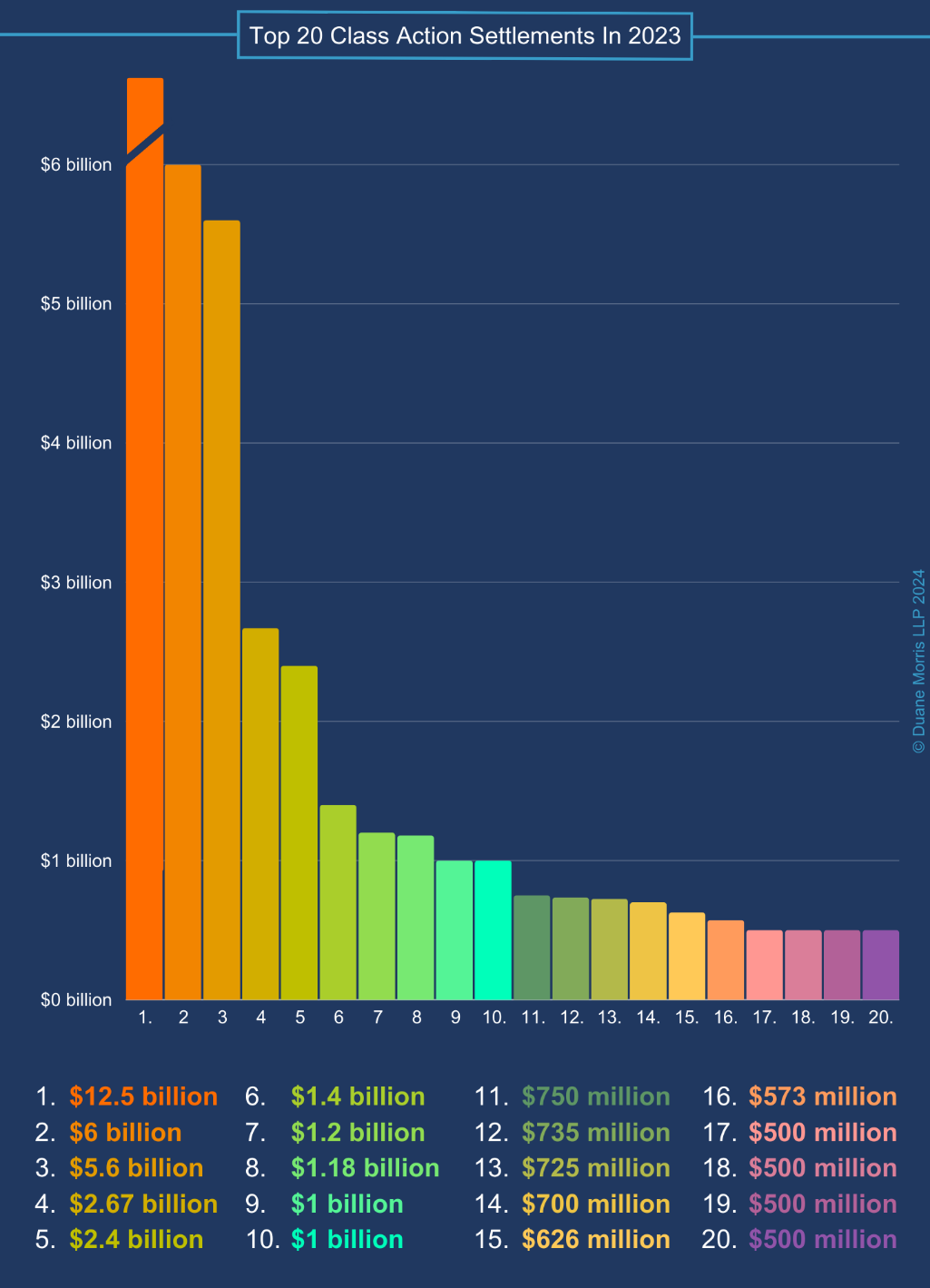

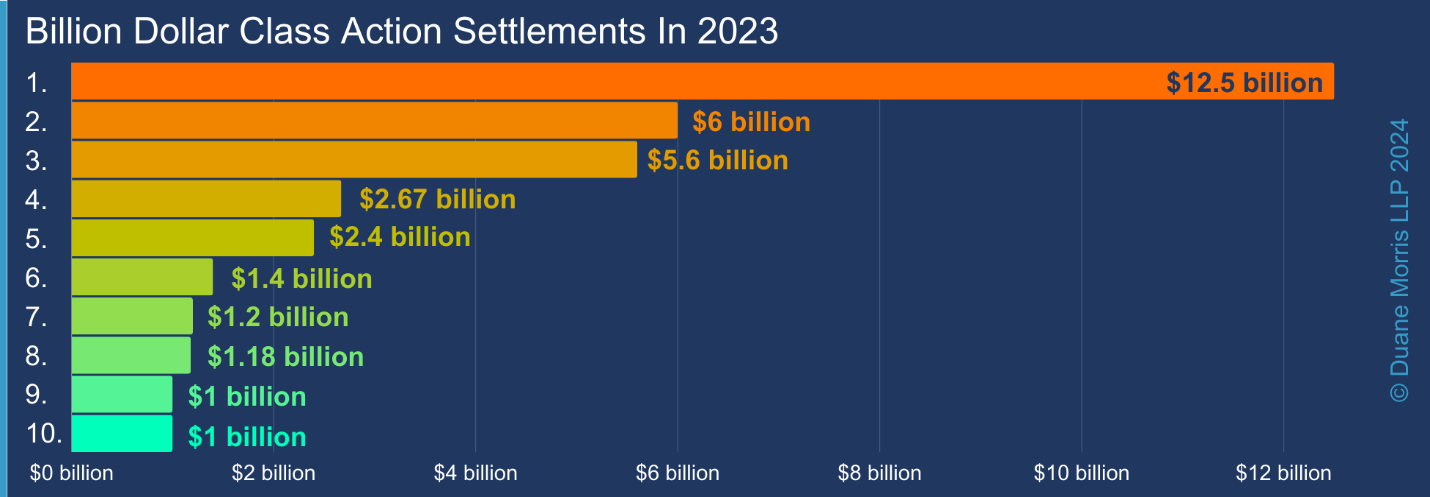

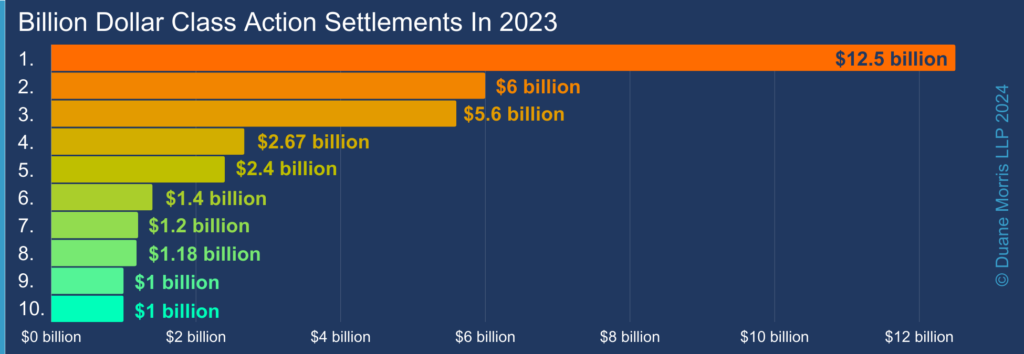

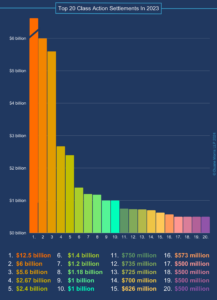

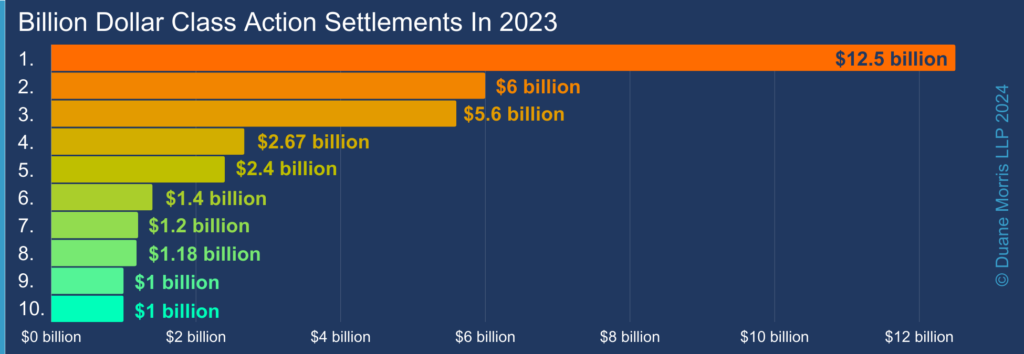

In 2023, settlement numbers exceeded expectations for the second year in a row. The cumulative value of the top ten settlements across all substantive areas of class action litigation hit near record highs, second only to the settlement numbers we observed in 2022. When the numbers for 2022 and 2023 are combined, the totals signal that we have entered a new era of heightened risks and higher stakes in the valuation of class actions.

In 2023, settlement numbers exceeded expectations for the second year in a row. The cumulative value of the top ten settlements across all substantive areas of class action litigation hit near record highs, second only to the settlement numbers we observed in 2022. When the numbers for 2022 and 2023 are combined, the totals signal that we have entered a new era of heightened risks and higher stakes in the valuation of class actions.

On an aggregate basis, across all areas of litigation, class actions and government enforcement lawsuits garnered more than $51.3 billion in settlements in 2023. The largest 20 settlements during 2023 included those on the above chart.

Such numbers are second only to the value of class actions and government enforcement settlements in 2022, which topped $67 billion. Combined, the two-year settlement total eclipses any other two-year period in the history of American jurisprudence.

Trend #2 – Privacy Class Actions Gained Momentum, Increasing In Number And Sophistication

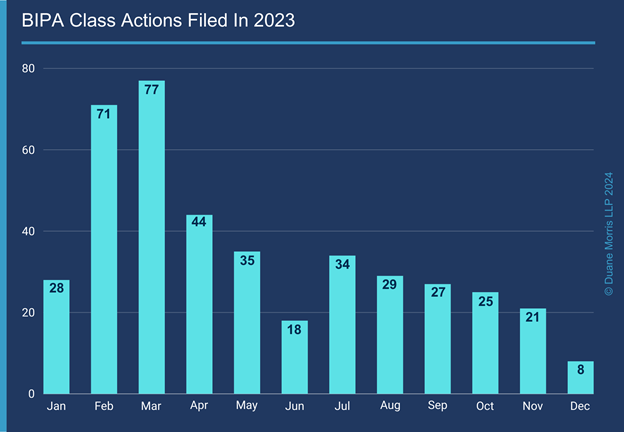

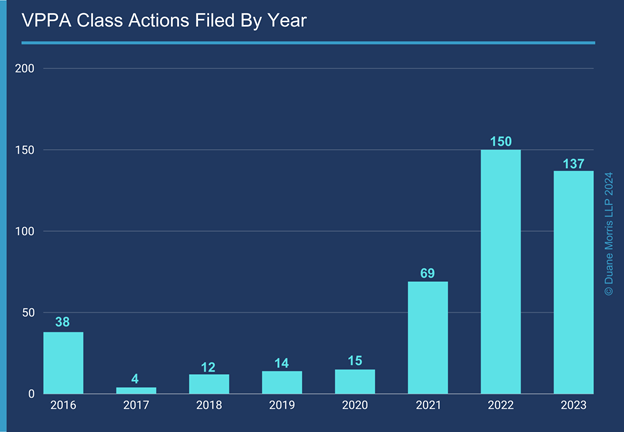

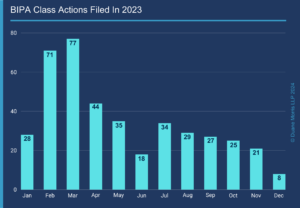

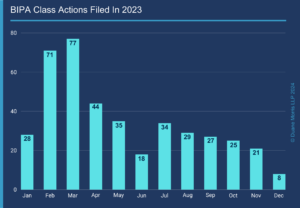

In 2023, the Illinois Biometric Privacy Act (BIPA) continued to fuel a swell of class action litigation. Its technical requirements, coupled with stiff statutory penalties and fee-shifting, provided a recipe for increased filings and hefty settlement demands from the plaintiffs’ class action bar. In terms of lawsuit filings, for nearly a decade following enactment of the BIPA, activity under the statute was largely dormant. Plaintiffs filed an average of approximately two total lawsuits filed per year from 2008 through 2016. Those numbers grew exponentially in 2017 and 2018 and then spiked as the plaintiffs’ class action bar filed a surge of class action lawsuits.

In 2022, companies saw more than five times as many class action lawsuit filings for alleged violations of the BIPA than they saw in 2018, and more than the number of class action lawsuit filings that they saw from 2008 through 2018 combined. Filings continued to accelerate in 2023, prompted by two rulings from the Illinois Supreme Court that increased the opportunity for recovery of damages under the BIPA. In the wake of these rulings, class action filings more than doubled. From January 1, 2023, to the ruling in Cothron, plaintiffs filed approximately 61 lawsuits in Illinois state and federal courts alleging violations of the BIPA. By contrast, in the same period of time following the ruling, plaintiffs filed 150 lawsuits in Illinois state and federal courts, representing an increase of 71%.

Trend #3 – The Likelihood Of Class Certification In 2023 Remained Strong

In 2023, the plaintiffs’ class action bar succeeded in certifying class actions at a high rate. Across all major types of class actions, courts issued rulings on 451 motions to grant or to deny class certification in 2023. Of these, plaintiffs succeeded in obtaining or maintaining certification in 324 rulings, an overall success rate of 72%. The numbers show that, when compared to 2022, plaintiffs filed more motions for class certification in 2023, resulting in more certified class actions in 2023. Across all major types of class actions, courts issued rulings on 451 motions to grant or deny class certification, and plaintiffs succeeded in obtaining or maintaining certification in 324 rulings, with an overall success rate of 72%. In 2022, by comparison, courts issued rulings on 335 motions to grant or to deny class certification, and plaintiffs succeeded in obtaining or maintaining certification in 247 rulings, an overall success rate of nearly 74%.

In 2023, the plaintiffs’ class action bar succeeded in certifying class actions at a high rate. Across all major types of class actions, courts issued rulings on 451 motions to grant or to deny class certification in 2023. Of these, plaintiffs succeeded in obtaining or maintaining certification in 324 rulings, an overall success rate of 72%. The numbers show that, when compared to 2022, plaintiffs filed more motions for class certification in 2023, resulting in more certified class actions in 2023. Across all major types of class actions, courts issued rulings on 451 motions to grant or deny class certification, and plaintiffs succeeded in obtaining or maintaining certification in 324 rulings, with an overall success rate of 72%. In 2022, by comparison, courts issued rulings on 335 motions to grant or to deny class certification, and plaintiffs succeeded in obtaining or maintaining certification in 247 rulings, an overall success rate of nearly 74%.

Trend #4 – Data Breach Class Actions Continued Their Growth And Inconsistent Outcomes

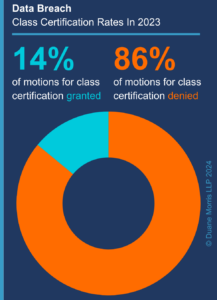

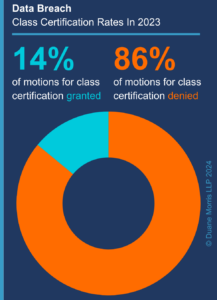

The volume of data breach class actions exploded in 2023 and their unique challenges, including issues of standing and uninjured class members, continued to vex the courts, leading to inconsistent outcomes.  Companies unfortunate enough to fall victim to data breaches in 2023 faced class actions at an increasing rate, including copy-cat and follow-on class actions across multiple jurisdictions, saddling companies with the significant costs of responding to the data breach as well as the costs of dealing with high-stakes class action lawsuits on multiple fronts. Plaintiffs bringing data breach class actions, however, continued to face hurdles associated with their ability to demonstrate an injury from the alleged data breach and, if they survived dismissal, with convincing courts to grant class certification. Indeed, only 14% of the class certification decisions issued in data breach cases in 2023 came out in favor of plaintiffs.

Companies unfortunate enough to fall victim to data breaches in 2023 faced class actions at an increasing rate, including copy-cat and follow-on class actions across multiple jurisdictions, saddling companies with the significant costs of responding to the data breach as well as the costs of dealing with high-stakes class action lawsuits on multiple fronts. Plaintiffs bringing data breach class actions, however, continued to face hurdles associated with their ability to demonstrate an injury from the alleged data breach and, if they survived dismissal, with convincing courts to grant class certification. Indeed, only 14% of the class certification decisions issued in data breach cases in 2023 came out in favor of plaintiffs.

Trend #5 – U.S. Supreme Court Rulings Continue To Impact The Class Action Landscape

As the ultimate referee of law, the U.S. Supreme Court traditionally has defined  the playing field for class action litigation and, through its rulings, has impacted the class action landscape. The past year did not buck that trend. On June 29, 2023, the U.S. Supreme Court ruled in Students for Fair Admissions, Inc., et al. v. President & Fellows of Harvard College, 600 U.S. 181 (2023), that two colleges and universities that considered race as a factor in the admissions process violated the Equal Protection Clause of the U.S. Constitution and Title VI of the Civil Rights Act of 1964. The ruling is fueling controversy along with a wave of claims that is likely to expand.

the playing field for class action litigation and, through its rulings, has impacted the class action landscape. The past year did not buck that trend. On June 29, 2023, the U.S. Supreme Court ruled in Students for Fair Admissions, Inc., et al. v. President & Fellows of Harvard College, 600 U.S. 181 (2023), that two colleges and universities that considered race as a factor in the admissions process violated the Equal Protection Clause of the U.S. Constitution and Title VI of the Civil Rights Act of 1964. The ruling is fueling controversy along with a wave of claims that is likely to expand.

The Supreme Court’s decision has also caused private sector employers to question whether the ruling impacts their diversity, equity, and inclusion (DEI) initiatives. While politicians moved quickly to stake out positions on the issue, the plaintiffs’ class action bar and advocacy groups moved to take advantage of the uncertainty to line up a deluge of claims.

Trend #6 – PAGA Filings Reached An All-Time High

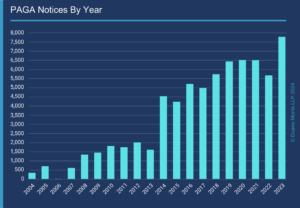

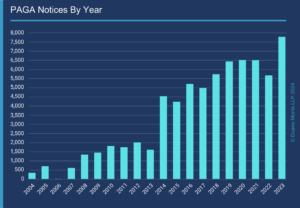

In 2023, employers saw claims filed under the California Private Attorneys General Act (PAGA) reach an all-time high. According to data maintained by the California Department of Industrial Relations, the number of PAGA notices filed with the LWDA has increased exponentially over the past two decades, from 11 in 2006 to 7,780 in 2023. The PAGA created a scheme to “deputize” private citizens to sue their employers for penalties associated with violations of the California Labor Code on behalf of other “aggrieved employees,” as well as the State. A plaintiff may pursue claims on a representative basis under the PAGA, i.e., on behalf of other allegedly aggrieved employees, but need not satisfy the class action requirements of Rule 23. In other words, the PAGA provides the plaintiffs’ class action bar a mechanism to harness the risk and leverage of a representative proceeding without the threat of removal to federal court under the CAFA and without the burden of meeting the requirements for class certification.

the California Department of Industrial Relations, the number of PAGA notices filed with the LWDA has increased exponentially over the past two decades, from 11 in 2006 to 7,780 in 2023. The PAGA created a scheme to “deputize” private citizens to sue their employers for penalties associated with violations of the California Labor Code on behalf of other “aggrieved employees,” as well as the State. A plaintiff may pursue claims on a representative basis under the PAGA, i.e., on behalf of other allegedly aggrieved employees, but need not satisfy the class action requirements of Rule 23. In other words, the PAGA provides the plaintiffs’ class action bar a mechanism to harness the risk and leverage of a representative proceeding without the threat of removal to federal court under the CAFA and without the burden of meeting the requirements for class certification.

Trend #7 – Government Enforcement Lawsuit Filings Reflected A Resurgence

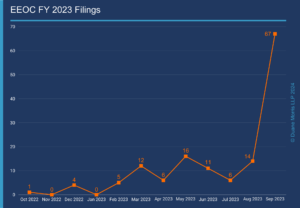

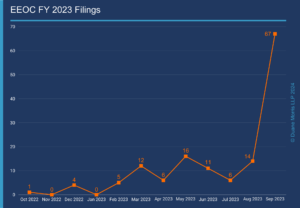

In 2023, the EEOC’s litigation enforcement activity showed that its previous slowdown in filing activity is well in the rearview mirror, as the total number of lawsuits filed by the EEOC increased from 97 in 2022 to 144 in FY 2023. In accordance with tradition, the EEOC filed more lawsuits in September 2023, the last month of its fiscal year, than in any other month from October 2022 forward. This past year, the EEOC filed 67 lawsuits in September, up from 39 filed in September 2022.

In 2023, the EEOC’s litigation enforcement activity showed that its previous slowdown in filing activity is well in the rearview mirror, as the total number of lawsuits filed by the EEOC increased from 97 in 2022 to 144 in FY 2023. In accordance with tradition, the EEOC filed more lawsuits in September 2023, the last month of its fiscal year, than in any other month from October 2022 forward. This past year, the EEOC filed 67 lawsuits in September, up from 39 filed in September 2022.

Trend #8 – Generative AI Began Transforming Class Action Litigation

Generative AI hit mainstream in 2023 and quickly become one of the most talked-about and debated subjects among corporate legal counsel across the country, as numerous companies jumped to incorporate AI while attempting to manage its risks. In 2023, we saw the tip of the iceberg relative to the ways that generative AI is poised to transform class action litigation. As the COVID 19 pandemic brought video-conferencing tools into the mainstream, such tools enabled more litigants to conduct and to attend more hearings, more depositions, and more mediations in less time. While the debate continues as to their effectiveness, generative AI is poised to enable lawyers to far surpass those gains in efficiency, potentially enabling the plaintiffs’ class action bar to do “more with less” like never before, leading to more lawsuits that can be handled by fewer lawyers in less time and a potential surge of class actions on the horizon.

Less than a year into the generative AI movement, we have seen the technology influence various aspects of the legal process, including by assisting legal professionals in analyzing vast amounts of data; automating the review of documents, contracts, and communications; increasing the speed and potentially enhancing the accuracy of e-discovery; and automating and enhancing the dissemination of information in the class action settlement administration process.

technology influence various aspects of the legal process, including by assisting legal professionals in analyzing vast amounts of data; automating the review of documents, contracts, and communications; increasing the speed and potentially enhancing the accuracy of e-discovery; and automating and enhancing the dissemination of information in the class action settlement administration process.

Trend #9 – ESG Class Action Litigation Hit Its Stride

During the past year, the label “ESG” became “mainstream,” and discussion of its impact became a recurring topic of conversation in boardrooms across the country. ESG refers to broadly to “environmental, social, and governance,” which many companies have embraced as part of their business plans and corporate missions. ESG was not immune to lawsuits, and we saw a steady influx of class action litigation in two particular ESI spheres – (i) product advertising and (ii) employment and DEI-related lawsuits.

During the past year, the label “ESG” became “mainstream,” and discussion of its impact became a recurring topic of conversation in boardrooms across the country. ESG refers to broadly to “environmental, social, and governance,” which many companies have embraced as part of their business plans and corporate missions. ESG was not immune to lawsuits, and we saw a steady influx of class action litigation in two particular ESI spheres – (i) product advertising and (ii) employment and DEI-related lawsuits.

Most often, plaintiffs’ class action attorneys file greenwashing lawsuits as class actions. These lawsuits largely focus on claims that defendants marketed products as “environmentally responsible,” “sustainably sourced,” or “humanely raised,” arguing that such misleading claims induce purchasers to pay a premium for “greener” products.

Trend #10 – Arbitration Agreements Remained An Effective Tool To Cut Off Class Actions

Of all defenses, a defendant’s ability to enforce an arbitration agreement containing a class or collective action waiver may have had the single greatest impact in terms of shifting the pendulum of class action litigation. With its decision in Epic Systems Corp. v. Lewis, 138 S. Ct. 1612 (2018), the U.S. Supreme Court cleared the last hurdle to widespread adoption of such agreements. In response, more companies of all types and sizes updated their onboarding materials, terms of use, and other types of agreements to require that employees and consumers resolve any disputes in arbitration on an individual basis. To date, companies have enjoyed a high rate of success enforcing those agreements and using them to thwart class actions out of the gate.

decision in Epic Systems Corp. v. Lewis, 138 S. Ct. 1612 (2018), the U.S. Supreme Court cleared the last hurdle to widespread adoption of such agreements. In response, more companies of all types and sizes updated their onboarding materials, terms of use, and other types of agreements to require that employees and consumers resolve any disputes in arbitration on an individual basis. To date, companies have enjoyed a high rate of success enforcing those agreements and using them to thwart class actions out of the gate.

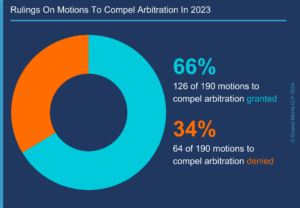

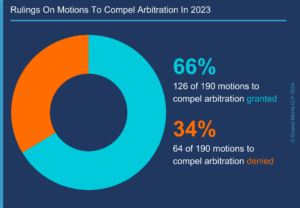

Statistically, corporate defendants fared well in asserting the defense. Across various areas of class action litigation, the defense won approximately 66% of motions to compel arbitration (approximately 126 motions across 190 cases) over the past year. Such numbers are similar to the numbers we saw in 2022, where defendants succeeded on 67% of motions to compel arbitration (roughly 64 motions granted in 96 cases).

Class action litigation is a staple of the American judicial system. The volume of class action filings has increased each year for the past decade, and 2024 is likely to follow that trend. In this environment, corporate programs designed to ensure compliance with existing laws and strategies to mitigate class action litigation risks are corporate imperatives.

The plaintiffs’ bar is nothing if not innovative and resourceful. Given the massive class action settlement figures in 2022 and 2023 (a combined total of $113 billion), coupled with the ever-developing law, corporations can expect more lawsuits, expansive class theories, and an equally if not more aggressive plaintiffs’ bar in 2024. These conditions necessitate planning, preparation, and decision-making to position corporations to withstand and defend class action exposures.

We hope the Duane Morris Class Action Review provides practical insights into complex potential strategies relevant to all aspects of class action litigation and other claims that can cost billions of dollars and require changed business practices in order to resolve.