Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partner Jerry Maatman, special counsel Brian Sullivan, and associate Jesse Stavis with their discussion and analysis of ERISA class action litigation trends and rulings from 2022 and what employers can expect in 2023. We hope you enjoy the episode.

Episode Transcript

Jerry Maatman: Hello, loyal blog readers! Welcome to our Weekly Class Action Wire. I’m joined by my friends and colleagues today Jesse Stavis and Brian Sullivan, and we’re going to talk about ERISA class actions today. Can you two give us a high level view of the class action landscape in 2022?

Brian Sullivan: Sure – great to be here, Jerry. The bulk of cases in this area over the last 2 to 3 years have primarily asserted that ERISA fiduciaries have breached their fiduciary duties – usually of prudence and loyalty. Plaintiffs will claims that ERISA plans been offering expensive or under-performing investment options and charging participants excessive record keeping and administrative fees. These claims are so popular that since 2020, more than 200 fee and expense cases have been filed.

Jesse Stavis: Thank you, Jerry. I would just add to Brian’s summary that in general it’s challenging to beat ERISA class certification claims because these claims typically assert that discrete types of the alleged plan mismanagement led to common injuries affecting large numbers of plan participants in similar ways. So plaintiffs don’t usually run into the issues of typicality and commonality that we see in some other class action contexts. What that means is that early dismissal is often a defendant’s best hope to avoid the burden and expensive of discovery.

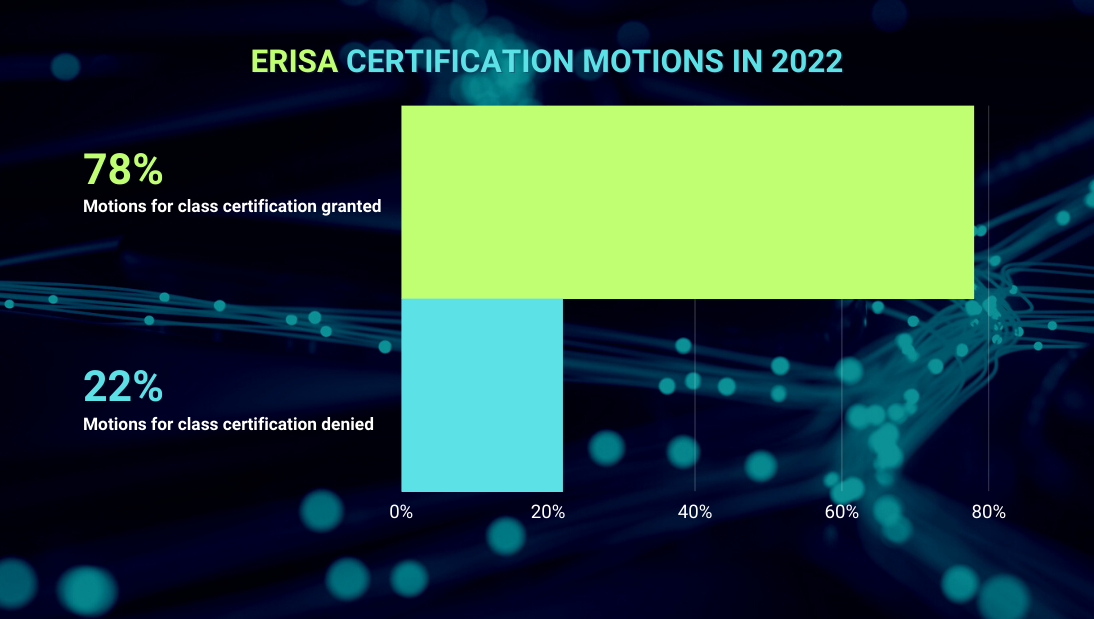

Jerry: Well, in my own personal experience, defense of class actions under the ERISA statute for employers tend to be big ticket and expensive and serious pieces of litigation. How did employers do in 2022 when it came to the scorecard for class certification, grants or denials?

Jesse: Not very well. In 2022, the plaintiffs’ bar succeeded in obtaining class certification in 78% of these cases.

Jerry: Well, that means that employers were successful 22% of the time at least. What were some of the salient defenses that employers relied upon to beat and defeat class certification motions in the ERISA space?

Brian: Well, perhaps unexpectedly, the most common defenses don’t really involve class certification issues at all – and they come much earlier, because companies will focus on arguing that the plaintiffs have failed to state the claim under Rule 12(b)(6). There’s been a lot of confusion about exactly what plaintiffs need to say in the complaint to get over the 12(b)(6) hurdle, and there was hope that last year the much awaited Hughes v. Northwestern University decision would clarify that standard, but instead in an 8-to-nothing unanimous decision they didn’t do much of that at all, and sort of kicked the can down the road. So the threshold for what will state a plausible claim is still pretty unclear.

Jerry: Were there any particular rulings that struck you as important ones in 2022, if you’re an employer in terms of guideposts in the ERISA world?

Jesse: Yes, there certainly were. Davis v. Salesforce.com and Kong v. Trader Joe’s were two significant cases in the Ninth Circuit. Both of these cases involve duty of prudence claims, where plaintiffs challenged defendants alleged failure to select lower cost mutual fund share classes or other investment vehicles. And in both the district court dismissed the claims that the Ninth Circuit reversed. So in Davis the district court had taken judicially noticed documents refuting the plaintiffs’ allegations. But the Ninth Circuit disagreed with this approach and held that “the judicially noticed document on which the defendants rely… are not sufficient at the pleading stage to render plaintiffs’ facially plausible allegations inadequate.” Kong came out just a week later, and in that case, the Ninth Circuit explained that the “defendants’ explanation for the more expensive choice is unavailing at the pleadings stage.”

Brian: But despite some early and significant losses last year, some other more recent appellate decisions provided defendants a measure of hope. One example is in Smith v. CommonSpirit Health, which is a Sixth Circuit case. The court there affirmed a dismissal of the plaintiff’s complaint, which largely focused on her plan’s retention of allegedly underperforming actively-managed funds. The Sixth Circuit was less deferential to the plaintiff’s allegations than other courts have been, explaining that she did not “plausibly plead that this ERISA plan acted imprudently merely by offering actively managed funds in its mix of investment options.” Instead the Sixth Circuit explained that while “ pointing to an alternative course of action… will often be necessary to show a fund to acted imprudently… that factual allegation is not by itself sufficient.” Rather, a plaintiff must present evidence “that an investment was imprudent from the moment the administrator selected it, that the investment became imprudent over time, or that the investment was otherwise clearly unsuitable for the goals of the fund based on ongoing performance.” The Sixth Circuit reached a similar conclusion with regard to the plaintiff’s claims concerning excessive recordkeeping fees.

Jerry: That’s an interesting analysis. I wanted to switch gears just slightly and talk about the impact of arbitration agreements with class action waivers. How is that particular defense working out in the ERISA class action space?

Brian: Not as well as it has in others. Despite the successful reliance on arbitration provisions with class action waivers in other areas of the law, federal courts have been less consistent in the ERISA space. Some federal courts of appeal have enforced these provisions, but others have not, and they’ve held that instead, provisions like those cannot prelude plan participants from bringing representative claims under ERISA.

Jerry: Jesse, if one would look to significant rulings on the arbitration front – in your opinion, what was the most significant ERISA ruling involving arbitration last year?

Jesse: Sure. Well, Holmes v. Baptist Health South Florida was a very interesting case. There plaintiffs alleged defendants breached their fiduciary duties by failing to review and contain costs, and by choosing expensive investment options over cheaper or better performing ones. The defendant there sought to enforce an arbitration agreement that included a class action waiver that precluded an individual from receiving remedial or equitable relief. Plaintiffs challenged enforcement of the agreement by arguing that it violated what’s called the “effective vindication” doctrine. And the ‘effective vindication’ doctrine, theoretically, allows plaintiffs to invalidate an arbitration agreement if it precludes them from effectively vindicating their federal statutory rights. The court rejected this argument and granted the motion to compel arbitration. The court held that there is no authority where the Eleventh Circuit has applied the ‘effective vindication’ doctrine in this context, and it also held that while the individual plan participants never agreed to arbitrate their claims, the plan itself had.

Jerry: Given the high predominance of certification in ERISA class actions, when you sit down to architect a defense – to help an employer fight off one of these lawsuits – what other areas gain traction in 2022 in terms of defenses to preempt these sorts of class actions?

Brian: Well, you always want to evaluate whether a class action complaint contains class action and allegations that passed muster And so one of the strategies in that regard is to evaluate whether the plan is alleged what’s called a “fail-safe” class, and that’s one that defines the class membership based on the determination or resolution of a merits issue. For example it would, it would include a class defined to include all individuals whose rights were violated. So in White v. Hilton Hotel Retirement Plan, the court held that the plaintiffs’ proposed class was an impermissible fail-safe class and denied class certification. Plaintiffs challenged certain vesting determinations made by the plan and they allegedf defendants failed to keep proper documentation related to their claims. The plaintiffs sought to certify a class of plan participants who submitted claims for “vested retirement benefits” and “have been denied vested rights to retirement benefits that have been denied” by the defendants in various ways. The court determined that, insofar as the plaintiffs’ class definition depended on whether an individual had “vested retirement benefits,” it was an impermissible fail-safe class because “the question of whose rights have vested is central to the merits of this action.”

Jesse: Defendants also succeeded in decertifying a class in Haley v. TIAAA. In that case the Second Circuit decertified a class with more than 200,000 members. The Plaintiffs in Haley alleged that a loan program the defendant had offered to her 403(b) defined contribution retirement plan was a prohibited transaction under ERISA. She sought to certify a class of approximately 8,000 employee benefit plans whose fiduciaries contracted with the defendant to provide similar loan programs. The program plaintiff challenge offered loans secured by plan participants’ retirement savings. Plaintiff sought to hold the defendant liable as a non-fiduciary under ERISA. Basically, her argument was that TIAAA knowingly participated in the alleged violation by her plan fiduciary. The district court allowed these claims to proceed and ultimately certified the class under Rule 23(b)(3). On appeal, however, the Second Circuit reversed. The court felt that plaintiff had failed to establish predominance because analyzing one of the ERISA exemptions that potentially applied to the challenged transactions would require a focus on the conduct of fiduciaries in determining loan program pricing, and determining how each of the 8,000 plans that they’re pricing would require an individualized treatment. And so a massive class action was an inappropriate vehicle for resolving the alleged claims.

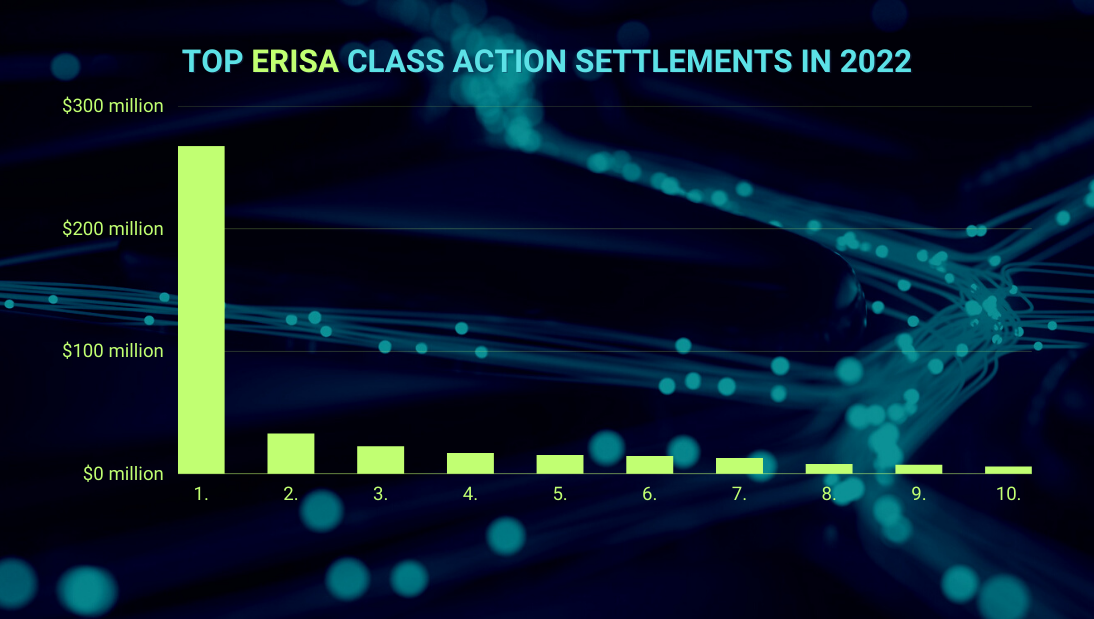

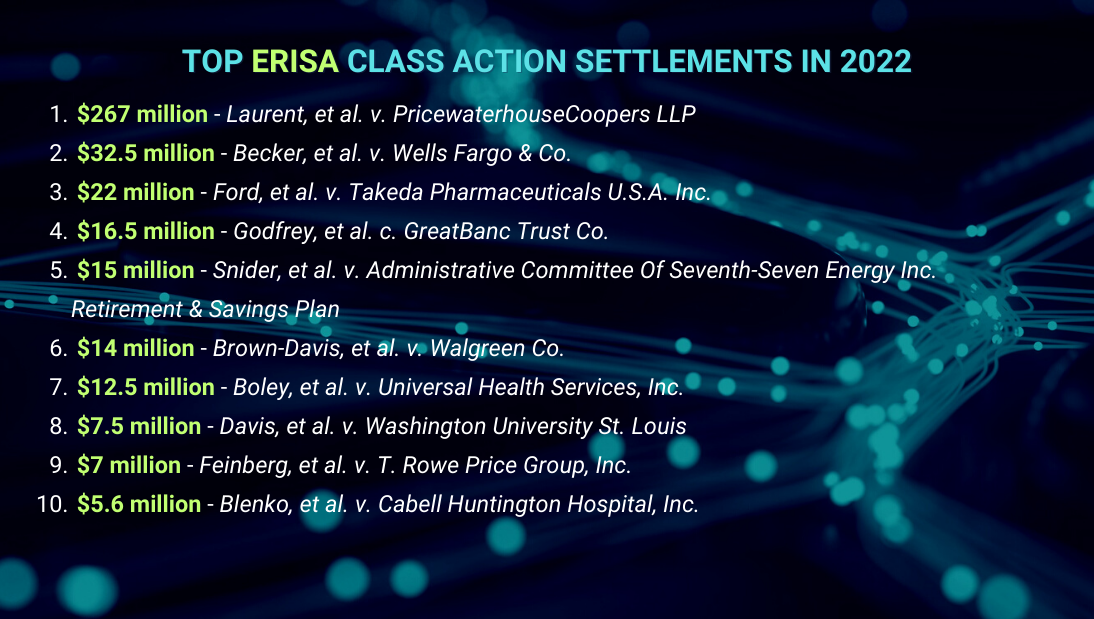

Jerry: Well, thank you both for that analysis – very interesting. Obviously the Holy Grail on the plaintiff side of the V is converting class certification orders into cash, and to strike settlements. In 2022, what did the ERISA class action settlement space look like in terms of the top 10 settlements compared to other years?

Brian: Oh, well, in 2022 – it’s been a consistent trends over the last few years. So the top 10 class actions settlements in 2022. The total was $399.6 million dollars which was almost the same as last year, which came in at $411.05 million, and the top 10 values over the preceding 4 years have been essentially flat.

Jerry: Jesse, what would you say to corporate counsel in terms of the signal of what that sort of settlement activity means for 2023?

Jesse: Well, without additional guidance from the Supreme Court, plaintiffs are going to continue to have success fending off defense challenges to standing and satisfaction of Rule 23(a)’s commonality, typicality, and adequacy requirements based on factual differences between the representative and class claims, and enforceability of mandatory arbitration and class action waver provisions. Without further clarifying guides from the Supreme Court, ERISA class action litigation will remain an active area with significant financial upside to the plaintiffs’ bar and high defense and settlement costs for defense in 2023.

Jerry: Well, thank you, Jesse and Brian, for your thought leadership and joining us on the weekly podcast. Loyal blog readers, we’d like to hear from you, and thank you so much for tuning in and joining us for our discussion on ERISA class action litigation. Have a great day!