By Leon Yee and Jennifer Lo

In recent years, Singapore has attracted large inflows of wealth to be managed here, establishing its status as a leading wealth management hub in the region. This is largely thanks to the rule of law, economic and political stability, welcoming investment climate and business-friendly environment in Singapore, which have all played a pivotal role in attracting high net-worth individuals to invest in Singapore.

According to the Global Family Office Compensation Benchmark Report recently published by KPMG Private Enterprise and family office consultancy Agreus, it is estimated that 59% of the family offices in Asia are located in Singapore. The number of single family offices (“SFOs”) in Singapore has leapt from 700 in 2021 to 1,100 as of the end of 2022.

On 5 July 2023, the Monetary Authority of Singapore (“MAS”) announced adjustments to the qualifying criteria for the tax incentive schemes available to SFOs under Sections 13O and 13U of the Income Tax Act (“S13O/U Tax Incentive Schemes”). These schemes are in line with MAS’ goal to provide a conducive tax environment to support the growth of the asset and wealth management industry in Singapore.

Key changes in Qualifying Criteria under the S13O/U Tax Incentive Scheme

Significant changes to the qualifying criteria for the S13O/U Tax Incentive Schemes include:

-

- Removing the grace period for meeting the minimum asset under management (“AUM”) such that there must be a minimum AUM of S$20 million in designated investments at the point of application and throughout the incentive period;

- Introducing the requirement for a family office (“FO”) to hire at least one (1) investment professional who is not a family member;

- Introducing the concept of Capital Deployment Requirement (“CDR”) whereby funds are required to be invested in specified categories;

- Broadening the scope of eligible investments to include blended finance structures in which financial institutions in Singapore have been substantially involved and climate-related investments;

- Recognising twice the amount invested in Singapore-listed equities, eligible exchange-traded funds, unlisted funds that invest primarily in Singapore-listed equities and blended finance structures with substantial involvement of financial institutions in Singapore; and

- Recognising grants given by SFOs to support blended finance structures.

The latest changes are aimed at encouraging SFOs to invest in blended finance structures, and to deploy funds to climate-related projects, not just in Singapore, but anywhere in the world.

Effective Date of Updated Qualifying Criteria

The changes apply to all new applications for S13O/U Tax Incentive Schemes submitted to MAS after 10am on 5 July 2023. The new criteria do not apply to:

(a) Funds which have made the preliminary submission to MAS before 5 July 2023; and

(b) Funds which have already been granted approval under the S13O/U Tax Incentive Schemes.

Revised Qualifying Criteria

We set out below in detail the revised qualifying criteria for the S13O/U Tax Incentive Schemes following these changes:

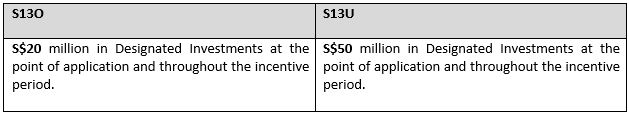

Previously, funds applying for the tax exemption under S13O were required to have a minimum fund size of S$10 million at the point of application, and were given a 2-year grace period to increase its AUM to S$20 million. Under the new rules, the 2 year grace period has been removed, and funds applying for the S13O and S13U Tax Incentive Schemes are required to have S$20 million and S$50 million in Designated Investments respectively, not only at the point of application, but also throughout the incentive period.

If the fund’s AUM in Designated Investments falls below the required S$20 million or S$50 million at any one point in time after it has been awarded the S13O or S13U tax exemption status, then it will not enjoy the tax exemption for that year of assessment (“YA”).

Designated Investments are as defined in the Income Tax (Exemption of Income of Prescribed Persons Arising from Funds Managed by Fund Manager in Singapore) Regulations 2010, and include most types of financial assets, non-Singapore real estate and certain commodities.

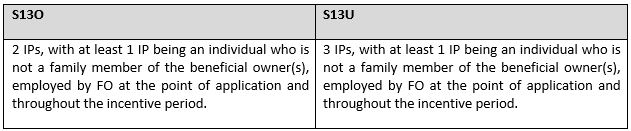

Minimum number of Investment Professionals (“IPs”)

Previously, there was no requirement that an IP must be a non-family member for S13O funds. In addition, previously, S13O funds were given a one-year grace period to employ the second IP if it was unable to employ two IPs at the point of application. S13U funds were also given a one-year grace period to employ a non-family member as an IP, if it was unable to do so by the point of application.

The grace periods have now been removed, and the requirement for at least one IP to be a non-family member has been introduced for S13O funds.

MAS expects all qualifying IPs to have the relevant formal work experience or academic qualifications, and must be employed as a portfolio manager, research analyst or trader who will earn a minimum monthly salary of S$3,500. Qualified IPs must also be Singapore tax residents; if an individual is not considered as a Singapore tax resident for any YA, he cannot be considered as a qualifying IP for that YA.

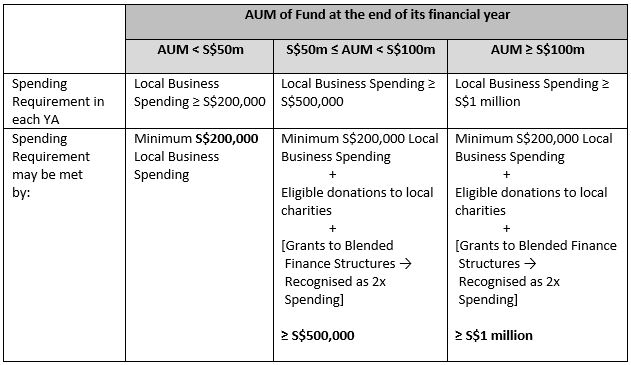

Minimum spending requirement

Funds applying for the S13O/U Tax Incentive Scheme (whether under S13O or S13U) must incur a minimum S$200,000 in Local Business Spending in accordance with the following framework:

All awardees will still be required to meet minimally S$200,000 in Local Business Spending in each basis period relating to any YA.

Local Business Spending includes expenses paid to local entities, such as remuneration, management fees, tax advisory fees, and operating costs, but does not include taxes, penalties or expenses relating to financing activities. Outlays that are donations and grants (i.e., contribution with no return of principal and income) are excluded from the computation of Local Business Spending.

Previously, S13O funds had to incur a minimum of S$200,000 in total business spending, while S13U funds had to incur a minimum of S$500,000 in local business spending. Also, non-local business spending had counted towards the total business spending for S13O funds.

Following the changes, the spending requirements for both S13O and S13U funds are now streamlined. In addition, donations to local charities and grants to blended finance structures are now counted towards Local Business Spending, with greater recognition given to grants to blended finance structures with such grants being scaled up by a 2x multiplier.

Minimum CDR

Funds applying for the S13O/U Tax Incentive Scheme (whether under S13O or S13U) are now required to invest at least 10% of its AUM or S$10m, whichever is lower, in:

(i) Equities, REITs, Business Trusts or ETFs listed on MAS-approved exchanges;

(ii) Qualifying Debt Securities;

(iii) Non-listed funds distributed by licensed financial institutions in Singapore;

(iv) Investments into non-listed Singapore-incorporated operating companies with operating business(es) and with substantive presence in Singapore;

(v) Climate-related investments;

(vi) Blended finance structures with substantial involvement of financial institutions in Singapore.

The fund must meet the CDR by the end of the first full-year Annual Declaration and in each subsequent financial year.

Investments into any of the following will be scaled up by a 2x multiplier:

(a) Equities listed on MAS-approved exchanges

(b) ETFs with primary mandates to invest in Singapore-listed equities on MAS-approved exchanges;

(c) Non-listed funds distributed in Singapore with primary mandates to invest in Singapore-listed equities on MAS-approved exchanges; and

(d) Deeply concessional capital in blended finance structures with substantial involvement of financial institutions in Singapore.

Investments into concessional capital in blended finance structures with substantial involvement of financial institutions in Singapore will be scaled up by a 1.5x multiplier.

Private Banking Account

Funds applying for the S13O/U Tax Incentive Scheme (whether under S13O or S13U) are required to maintain a private banking account with a MAS-licensed financial institution at the point of application and throughout the incentive period.

Concluding Remarks

The expansion in scope of recognised investments to include donations to local charities, climate-related investments and blended finance structures are welcome developments, and a step in the right direction in addressing climate change issues.

It has also become increasingly important for funds to actively and carefully monitor their AUM and investments to ensure that they do not, at any time, fall below the prescribed requirements, to avoid losing their tax exemption status in that particular year.

It is hoped that with these latest changes announced by the MAS, capital from SFOs will be deployed in a more meaningful manner, channelling greater benefits to Singapore-based businesses.

For More Information

If you have any questions about this article, please contact Duane Morris & Selvam Chairman Leon Yee or Associate Director Jennifer Lo if you would like to discuss this update.

About Duane Morris & Selvam LLP

Duane Morris & Selvam LLP is a joint law venture between international firm Duane Morris LLP and Singapore-based firm Selvam LLC. Duane Morris & Selvam runs a unique Latin American-Asian practice out of Singapore, with a team of international lawyers qualified in multiple jurisdictions including Singapore, the U.S., the U.K., Canada, Mexico and Colombia, with substantial experience in international transactions and disputes. Duane Morris & Selvam also has cooperative relationships with some of the best Latin American and Asian law firms.

Disclaimer: This Alert has been prepared and published for informational purposes only and is not offered, nor should be construed, as legal advice. For more information, please see the firm’s full disclaimer.