The Rotterdam District Court has issued two judgments relating to the conviction and sentencing of an individual for exporting computer goods and software destined for Russian companies via intermediaries in Kazakhstan, Kyrgyzstan and Uzbekistan.

According to the judgment convicting the individual, the man had been selling computer equipment to two Russian companies prior to 2022. After the goods in questions became sanctioned, a fact he was made aware of by his customs agent, the man directed the exports to affiliates of his Russian customers in Kazakhstan, Kyrgyzstan and Uzbekistan. All the communications, however, remained with the Russian companies.

In an attempt to cover his tracks the man forged a contract between his company and the central Asian entities and provided this in response to questions from his bank.

The court convicted him of the charges, including forgery, holding that the EU Regulations did not require proof that the goods were actually delivered to Russia.

The exports in question were of thousands of items which were either dual-use or luxury goods and were predominantly computer equipment and software.

At sentencing the court made a number of comments:

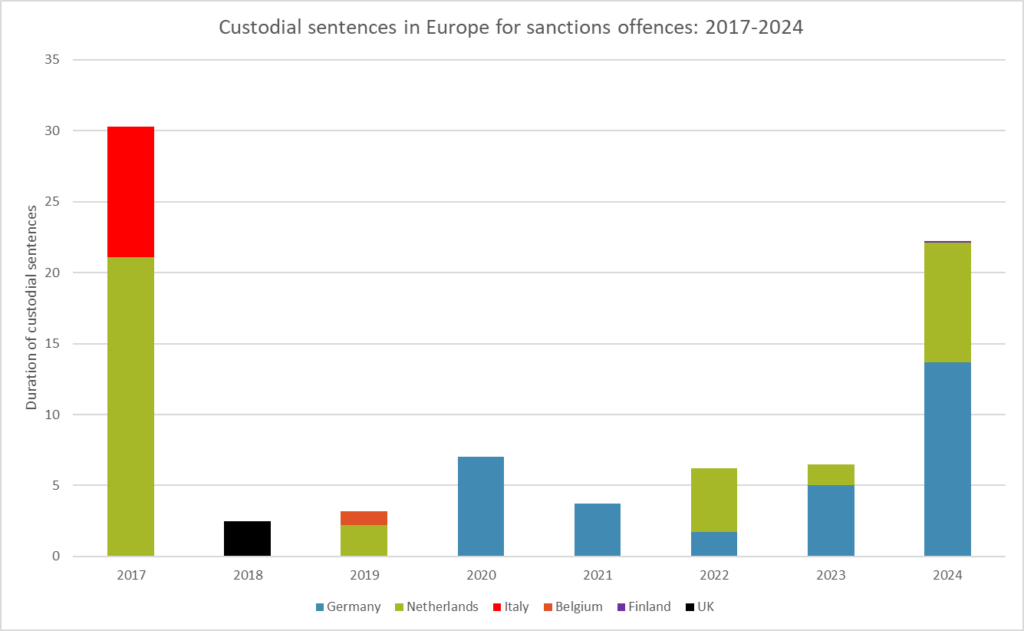

- firstly that “the court looked at penalties imposed in comparable cases, although there is not much comparative material”; and

- the court’s aim in sentencing was to “give the suspect a good rap on the knuckles”, but not to hinder the man’s ability to continue operating his business.

The man was given a custodial sentence equivalent to the length of his time served in pre-trial detention (450 days), a suspended sentence of just over 11 months, suspended for two years, and a community service order of 240 hours.

Goods which had been seized during the investigation were returned to him.

The second judgment related to confiscation of the proceeds of crime from the man.

The court calculated that the gross proceeds of the crimes were €1,924,579, from which the court deducted €1,626,269 in what it described as “deductible costs”, leaving a final figure for confiscation of €298,310 which the court considered to be the company’s “profit”. This was the amount the man was ordered to pay by way of confiscation order.

The judgment does not record the Court (or the prosecution) giving consideration to the recent CJEU judgment which upheld a confiscation of the gross proceeds of crime.