By Gerald L. Maatman, Jr. and Jennifer A. Riley

Duane Morris Takeaways: As we kick off 2025, we are pleased to announce the publication of the third annual edition of the Duane Morris Class Action Review. It is a one-of-its-kind publication analyzing class action trends, decisions, and settlements in all areas impacting corporations, including class certification rulings in the substantive areas of antitrust, appeals, the Class Action Fairness Act, civil rights, consumer fraud, data breaches, discrimination, EEOC-initiated and government enforcement litigation, the Employee Retirement Income Security Act of 1974, the Fair Credit Reporting Act, labor, privacy, procedural issues, product liability and mass torts, the Racketeer Influenced and Corrupt Organizations Act, securities fraud, state court class actions, the Telephone Consumer Protection Act, wage & hour class and collective actions, and the Worker Adjustment and Retraining Notification Act. The Review also highlights key rulings on attorneys’ fee awards in class actions, motions granting and denying sanctions in class actions, the largest class action settlements across all areas of law, and primers on both the Illinois Biometric Information Privacy Act and the California Private Attorney General Act. Finally, the Review provides insight as to what companies and corporate counsel can expect to see in 2025.

We are humbled and honored by the recent review of the Duane Morris Class Action Review by Employment Practices Liability Consultant Magazine (“EPLiC”) – the review is here. EPLiC said, “The Duane Morris Class Action Review is ‘the Bible’ on class action litigation and an essential desk reference for business executives, corporate counsel, and human resources professionals.” EPLiC continued, “The review is a must-have resource for in-depth analysis of class actions in general and workplace litigation in particular. The Duane Morris Class Action Review analyzes class action trends, decisions, and settlements in all areas impacting corporate America and provides insight as to what companies and corporate counsel can expect in terms of filings by the plaintiffs’ class action bar and government enforcement agencies like the Equal Employment Opportunity Commission (EEOC) and the Department of Labor (DOL).”

We are equally proud that the Review made its way into American jurisprudence over the past year, with a federal district court citing our analysis on class action trends in its decision on a motion for class certification.

Click here to access our customized website featuring all the Review highlights, including the ten major trends across all types of class actions over the past year. Order your free copy of the e-book here, and download the Review overview here.

Check out an exclusive article featuring the Review posted this morning in Forbes here. The Firm’s press release on the Review can be found here.

The 2025 Review analyzes rulings from all state and federal courts in 23 areas of law. It is designed as a reader-friendly research tool that is easily accessible in hard copy and e-book formats. Class action rulings from throughout the year are analyzed and organized into 23 chapters and 7 appendices for ease of analysis and reference.

Executive Summary Of Key Class Action Trends Over The Past Year

Class action litigation presents one of the most significant risks to corporate defendants today. Procedural mechanisms like the one set forth in Rule 23 of the Federal Rules of Civil Procedure have the potential to expand a claim asserted on behalf of a single person into a claim asserted on behalf of a behemoth that includes every employee, customer, or user of a particular company, product, or service, over an extended period. Class actions allow plaintiffs to pursue claims on behalf of a defined and sometimes sprawling group of unnamed individuals. By aggregating the claims of many persons in a single lawsuit, plaintiffs can seek to increase the size of their cases exponentially in terms of the number of claims they assert and the damages they seek. As a result, class actions can present substantial implications for corporate defendants.

As plaintiffs increase the size of their cases, the resulting legal risks can grow, bringing increased leverage for plaintiffs. A negative ruling in a class action has the potential to reshape a defendant’s business model, to impose significant financial consequences, and to shape standards for the entire industry. The outcome of a class action lawsuit, therefore, can be significant and potentially devastating for a company. Due to their potential implications, class actions are often costly to defend. Defending a class action can be a time-consuming and resource-intensive process that diverts management attention from core business activities. Plaintiffs can attempt to leverage this reality to make class actions as expensive and disruptive as possible, in an effort to bring about litigation fatigue and to extract sizable settlements from corporations.

Class actions are sometimes even more perilous to settle. Given the potential size and cost, class action settlements can attract media attention and lead to public scrutiny. Lucrative settlements can prompt copy-cat lawsuits and lead to more claims. Negative publicity can have widespread implications, including potential harm to a company’s reputation, potential damage to its brand, and potential drop in consumer trust. Class actions are complex legal proceedings with uncertain outcomes. The complexity can arise from managing multiple claims, myriad legal issues, and assorted class members, making it challenging for corporate defendants to predict and control the result. Due to these factors, corporate defendants should approach class actions from a broad vantage point with a thoughtful and multi-faceted defense strategy.

We developed a one-of-a-kind resource to provide a practical desk reference for corporate counsel faced with defending class action litigation. We have organized this year’s book into 23 chapters, with seven appendices, each of which provides an analysis of the trends in a particular area of class action litigation, along with the key decisions from courts across the country that companies can use to shape their defense strategies.

We identified ten key trends that characterized 2024. These trends include: (i) the continued prevalence of massive class action settlements; (ii) the normalization of plaintiff-friendly class certification conversion rates across substantive areas of class action litigation; (iii) the expansion of privacy class action litigation; (iv) continued efforts to chip away at and counter the impact of the arbitration defense as a barrier to class action litigation; (v) a surge of challenges to diversity, equity, and inclusion (DEI) programs that are likely to fuel class claims; (vi) decisions by the U.S. Supreme Court laying the groundwork for rebooted litigation theories and defenses; (vii) continued growth of data breach class actions; (viii) attention-getting headlines regarding PFAS litigation, which generated the largest class settlement and attorneys’ fee award of 2024; (ix) filing activity in California on the PAGA front demonstrating its continued popularity among the plaintiffs’ class action bar; and (x) a decreased role for government enforcement activity.

Trend # 1 – Settlement Numbers Break $40 Billion For The Third Year In A Row

In 2024, settlement numbers broke the $40 billion mark for the third year in a row. The cumulative value of the highest ten settlements across all substantive areas of class action litigation totaled $42 billion. That number is the third highest value we have tallied in the last two decades, trailing only the settlement numbers from 2023 and 2022. In 2023 settlements totaled $51.4 billion, and in 2022, settlements totaled $66 billion. Combined, the past three years of $159.4 billion reflect use of the class action mechanism to redistribute wealth at an unprecedented level.

Trend #2 – Class Certification Numbers Normalize Across Substantive Areas

Although courts issued fewer decisions on motions for class certification in 2024 as compared to 2023, the plaintiffs’ class action bar obtained certification at a more consistent rate across all substantive areas, suggesting that plaintiffs are being more selective in their investments and the cases they pursue through class certification. In 2024, courts issued rulings on 432 motions for class certification, a decrease from 2023, when courts issued rulings on 451 motions for class certification. Of those, courts granted motions for class certification at a lower rate. Courts granted 272 of those motions, for a certification rate of approximately 63%. In 2023, by contrast, courts granted 324 motions for class certification, for a certification rate of approximately 72%.

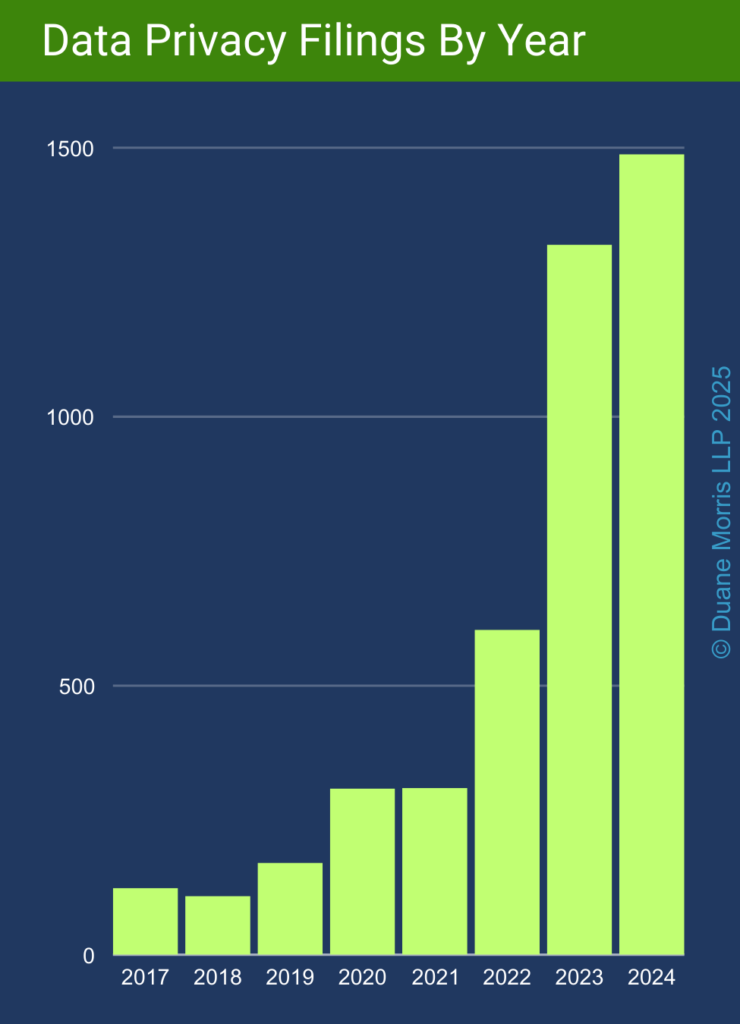

Trend #3 – Privacy Class Actions Continue To Proliferate As Plaintiffs Search For Winning Theories

The plaintiffs’ class action bar has continued to invest in the privacy class action space and, over the past year, has generated a multitude of filings, making privacy one of the hottest areas of growth in terms of activity by the plaintiffs’ class action bar. As technology continues to infiltrate our everyday lives, it provides ongoing inspiration for novel claims. Two of the most active areas of privacy litigation over the past year include: (1) litigation regarding “biometric” technologies under the Illinois Biometric Privacy Act (BIPA); and (2) claims regarding website advertising technologies (adtech) asserted under a variety of federal and state statutory and common laws.

Trend #4 – Plaintiffs Continue To Chip Away At The Arbitration Defense

Despite another tumultuous year of rulings, the arbitration defense remained one of the most powerful weapons in the class action defense toolkit. A defendant’s ability to enforce an arbitration agreement containing a class or collective action waiver continues to reign as one of the most impactful defenses in terms of shifting the pendulum of class action litigation. The U.S. Supreme Court cleared the last hurdle to widespread adoption of such agreements with its decision in Epic Systems Corp. v. Lewis, et al., 138 S. Ct. 1612 (2018). In response, more companies of all types and sizes updated their onboarding systems, terms of use, and other types of agreements to require that employees and consumers resolve any disputes in arbitration on an individual basis. In 2024, the defense won 91 of 167 motions to compel arbitration, for a success rate of 54%. By way of comparison, in 2023 the defense won 126 of 190 motions to compel arbitration, for a success rate of 66%.

Trend #5 – Plaintiffs Target DEI and ESG Initiatives Prompting Roll Back

The U.S. Supreme Court’s 2023 decision in Students for Fair Admissions, Inc. (SFFA), et al. v. President & Fellows of Harvard College, 600 U.S. 181 (2023), stimulated a flood of claims targeting diversity equity and inclusion (DEI) programs over the past year. Headlines were replete with cases of employees and applicants accusing employers of prioritizing diversity over merit and improperly using protected characteristics to guide decision-making, setting the stage for more class action activity in this area.

Trend #6 – The Supreme Court Lays The Groundwork For Rebooted Litigation Theories

As the ultimate referee of law, the U.S. Supreme Court traditionally has defined the playing field for class action litigation and, through its rulings, has impacted the class action landscape. The past year was no exception. Although the U.S. Supreme Court did not directly address the procedural mechanisms that govern class actions during its most recent term, it issued multiple decisions that are sure to influence the class action space.

Trend #7 – Data Breaches Gives Rise To An Unprecedented Number Of Class Action Filings

Data breach litigation remained expansive in 2024 as plaintiffs filed more data breach class actions than in any other year and double the number filed in 2022. As the number of data breaches has accelerated, such events have provided the fuel for a surge of class actions. Despite the significant increase in filings, courts issued few (only five) class certification decisions in 2024, suggesting that many motions are in the pipeline or that, observing the difficulty that plaintiffs have faced in certifying such cases over the past two years, plaintiffs are electing to monetize their data breach claims prior to reaching that crucial juncture. So long as defendants continue to play ball on the settlement front, we are likely to see settlement payouts continue to lure plaintiffs to this space and fuel those filing numbers.

Trend #8 – PFAS Inspires Forever Litigation

PFAS class actions inspired some of the most attention-grabbing headlines this past year across the legal landscape. PFAS, or per- and polyfluoroalkyl substances, are a group of manmade chemicals that are resistant to oil, water, and heat. They are used in many consumer and industrial products and are commonly called “forever chemicals” because of their persistence, meaning they do not break down easily in the environment. PFAS generated the largest class action settlement in 2024, which came in at more than twice the next highest settlement, which also involved PFAS, and generated an attorneys’ fee award of nearly one billion dollars. These numbers are going to inspire a continued wave of PFAS class actions, as the plaintiffs’ class action bar targets more companies with claims that their products or packaging contained PFAS, and those companies, in turn, search for claims against their material suppliers.

Trend #9 – California Remains Ground Zero For PAGA Representative Actions

The California Private Attorneys General Act (PAGA) inspired more representative lawsuits than any other statute in America over the past year. According to the California Department of Industrial Relations, plaintiffs filed more than 9,464 PAGA notices in 2024, a nearly 22% increase over 2023, and a whopping 85,936% increase over the 11 PAGA notices filed in 2006. The so-called PAGA reform legislation passed in 2024 by California lawmakers seemingly did little to nothing to curb interest in these cases, which continue to present one of the most viable workarounds to workplace arbitration agreements.

Trend #10 – The Change At The White House Signals A Decreased Role For Government Enforcement Litigation

Government enforcement litigation is similar in many respects to class action litigation. In lawsuits brought by the U.S. Equal Employment Opportunity Commission (EEOC), as well as the U.S. Department of Labor (DOL), government enforcement claims typically involve significant monetary exposure, numerous claimants, and complex procedures. These types of lawsuits most often pose reputational risks to companies. As the White House shifts from blue back to red, the incoming Trump Administration has promised less government oversight of business and less regulation, thereby signaling less government enforcement litigation. Change, therefore, is inevitable.

Conclusion

Class action litigation is a staple of the American judicial system. The volume of class action filings has increased each year for the past decade, and 2025 is likely to follow that trend. In this environment, programs designed to ensure compliance with existing laws and strategies to mitigate class action litigation risks are corporate imperatives.

The plaintiffs’ bar is nothing if not innovative and resourceful. Given the massive class action settlement figures from 2022 through 2024 (a combined total of $159.4 billion), coupled with the ever-developing law, corporations can expect more lawsuits, expansive class theories, and an equally if not more aggressive plaintiffs’ bar in 2025. These conditions necessitate planning, preparation, and decision-making to position corporations to withstand and defend class action exposures.