By Gerald L. Maatman, Jr., Alex W. Karasik, George J. Schaller, and Jennifer A. Riley

By Gerald L. Maatman, Jr., Alex W. Karasik, George J. Schaller, and Jennifer A. Riley

Duane Morris Takeaways: In FY 2023, the EEOC’s litigation enforcement activity showed that any previous slowdown due to the COVID-19 pandemic is well in the rearview mirror, as the total number of lawsuits filed by the EEOC increased from 97 in 2020 to a whopping total of 144 in FY 2023. Per tradition, September 2023 was a busy month for EEOC-Initiated litigation, as this month marks the end of the EEOC’s fiscal year. This year, 67 lawsuits were filed September, up from the 39 filed in September of FY 2022.

Overall, the FY 2023 lawsuit filing data confirms that EEOC litigation is back in full throttle, with no signs of slowing down. Employers should take heed. Amplifying that activism, the Commission issued a press release at the end of the fiscal year touting its increased enforcement litigation activity, a somewhat unprecedented media statement that the EEOC has never issued in previous years.

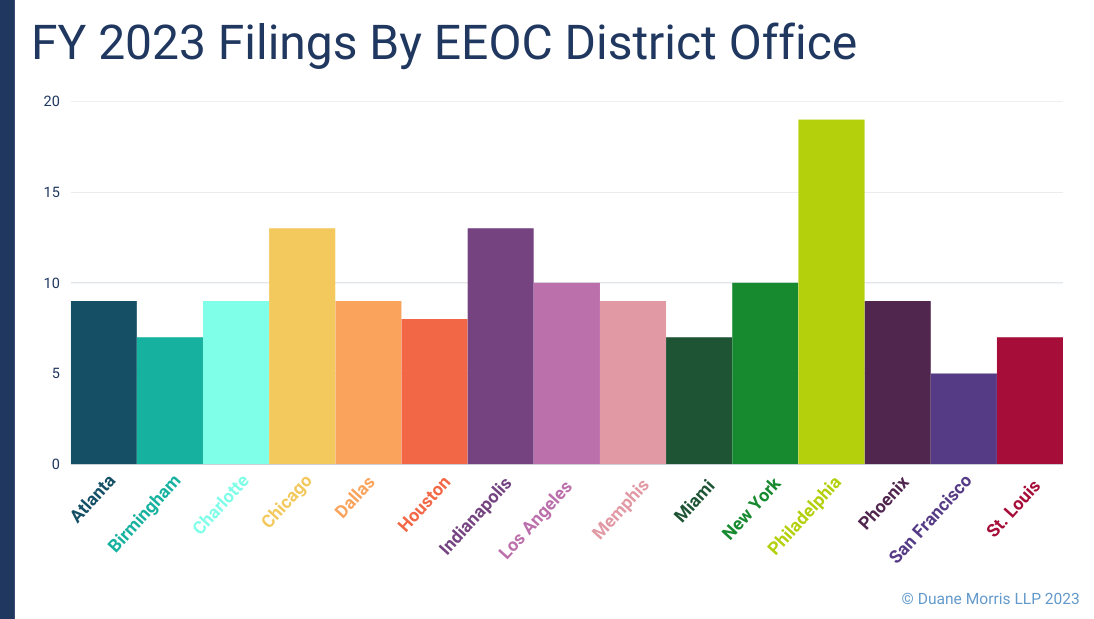

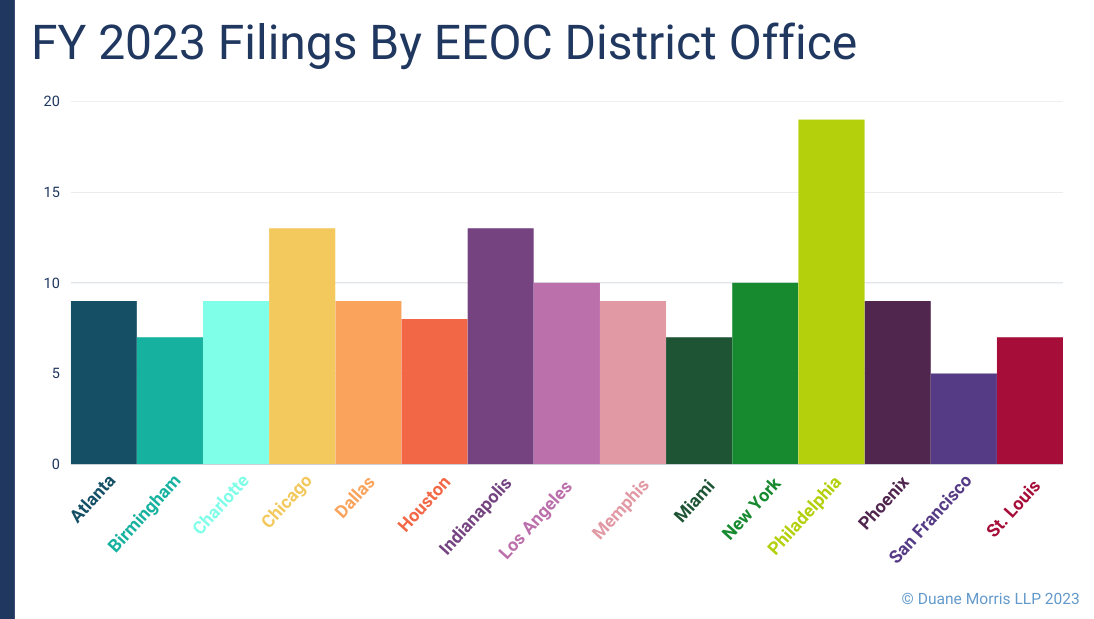

Lawsuit Filings Based On EEOC District Offices

In addition to tracking the total number of filings, we closely monitor which of the EEOC’s 15 district offices are most actively filing new cases over the year and throughout September. Some districts tend to be more aggressive than others, and some focus on different case filing priorities. The following chart shows the number of lawsuit filings by EEOC district offices.

In FY 2023, Philadelphia District Office had by far the most lawsuit filings with 19, followed by Indianapolis and Chicago with 13 filings, and New York and Los Angeles each with 10 filings. Charlotte, Atlanta, Dallas, Phoenix, and Memphis had 9 each, Houston had 8, Miami, Birmingham, and St. Louis had 7 each, and San Francisco had 5 filings.

The most noticeable trend of FY 2023 is the filing deluge in Philadelphia (19 lawsuits), compared to FY 2022 where Philadelphia District Office filed 7 lawsuits. Similarly, Indianapolis ramped up its filings compared to the 7 filings from FY 2022. Like FY 2022, Chicago remained steady near the top of the list again with 13 filings. Los Angeles, had a slight increase, based on the 8 filings it had in FY 2022. Going another direction, Miami filings slightly fell compared to its 8 filings in FY 2022. Finally, both New York and Charlotte increased their filings from FY 2022, with New York substantially increasing from 7, and Charlotte moderately increasing from 7 filings.

The balance across various District Offices throughout the country confirms that the EEOC’s aggressiveness is in peak form, both at the national and regional level.

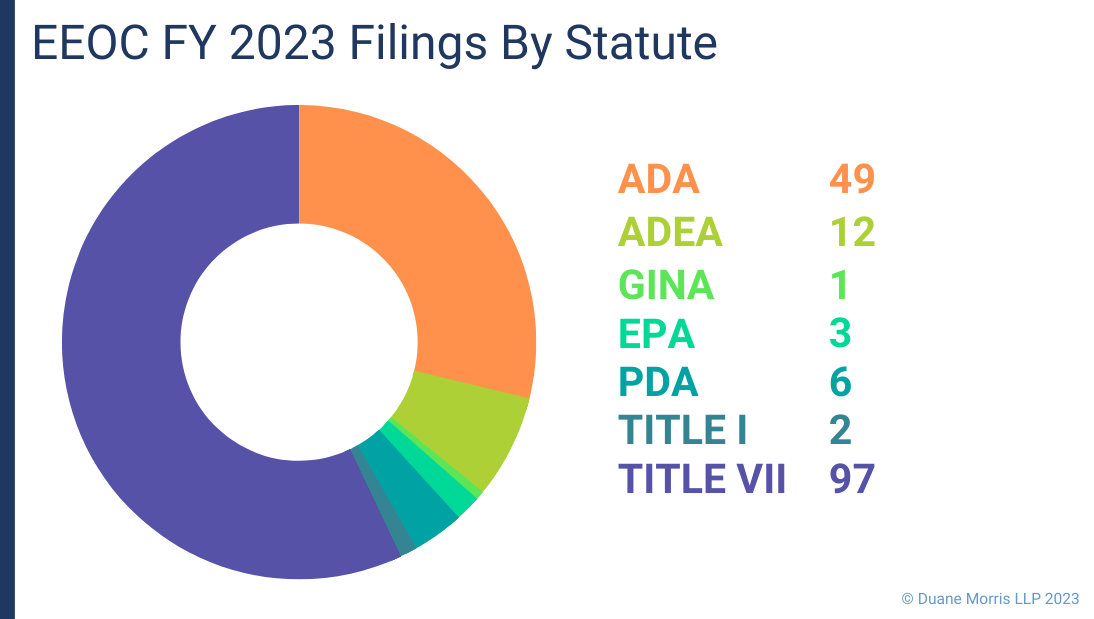

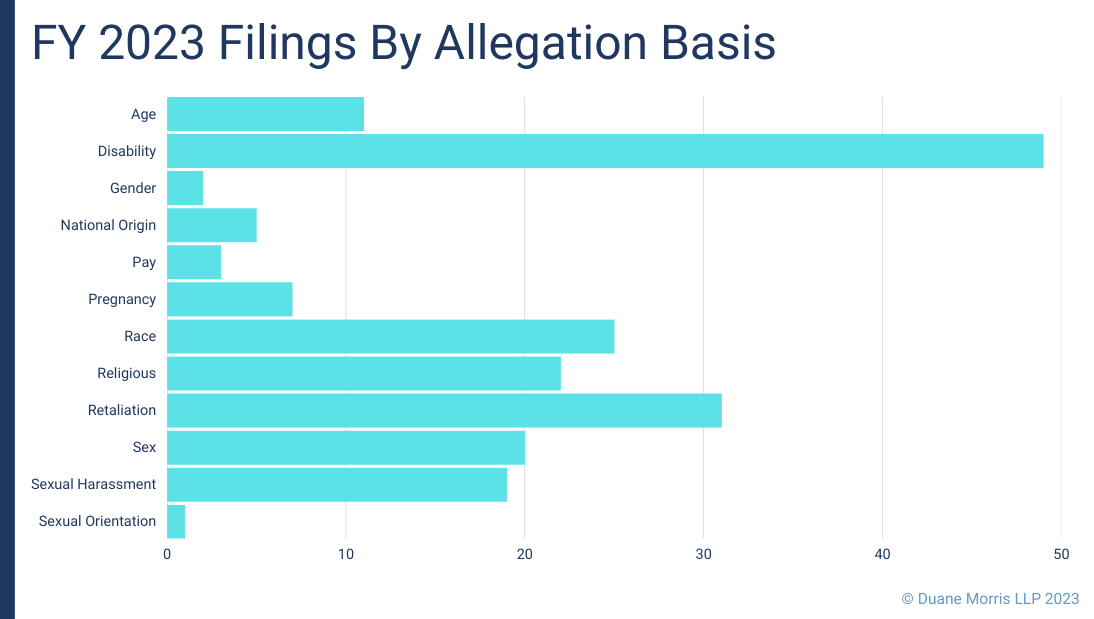

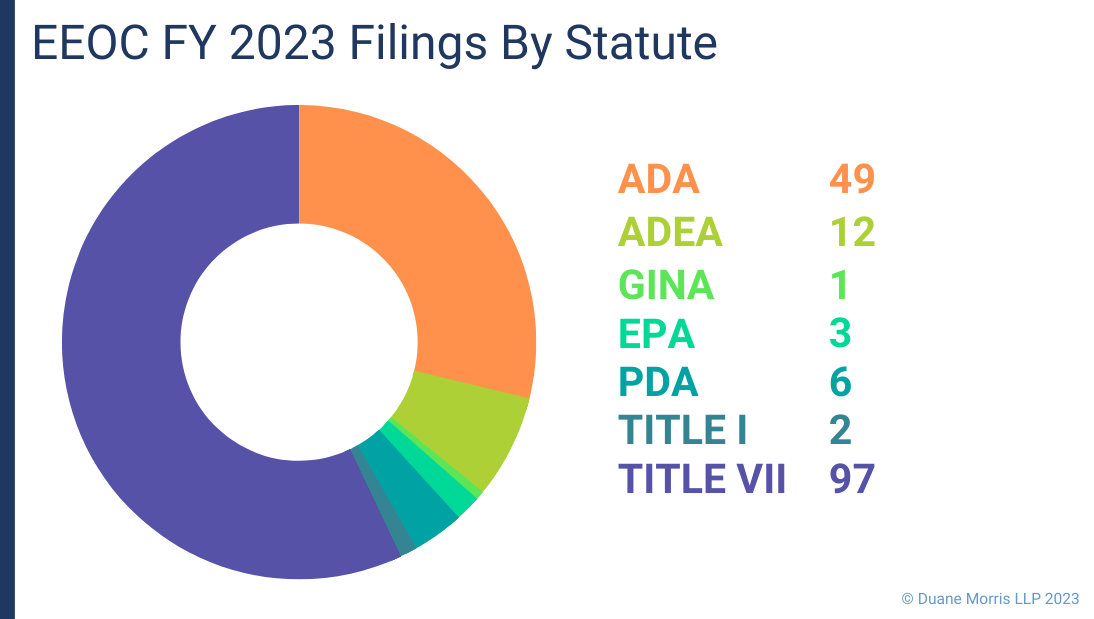

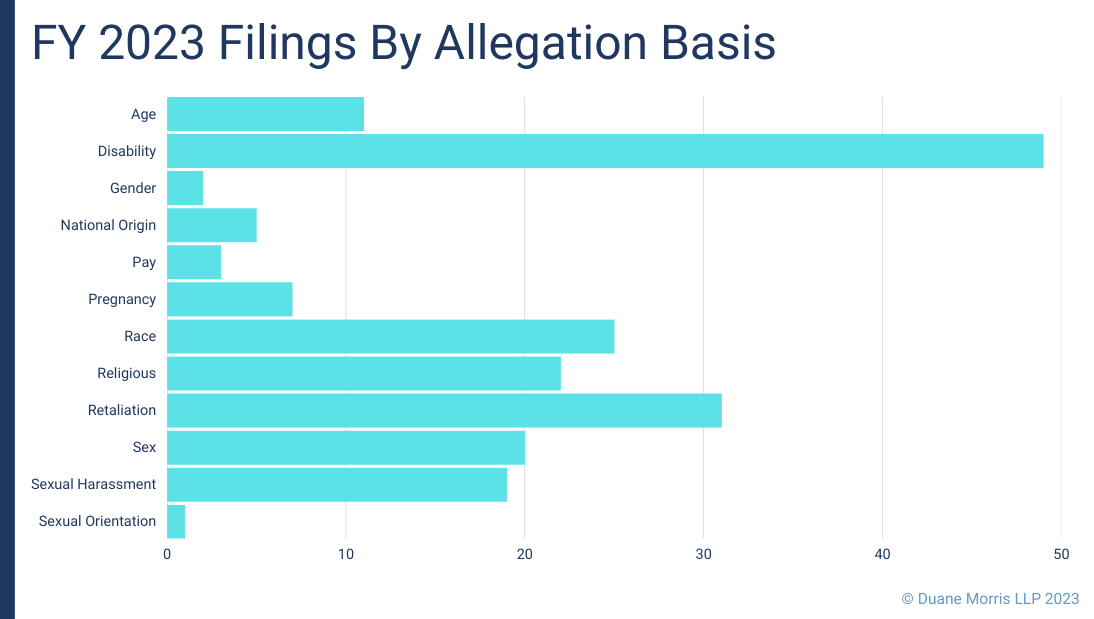

Lawsuit Filings Based On Type Of Discrimination

We also analyzed the types of lawsuits the EEOC filed, in terms of the statutes and theories of discrimination alleged, in order to determine how the EEOC is shifting its strategic priorities.

When considered on a percentage basis, the distribution of cases filed by statute remained roughly consistent compared to FY 2023 and FY 2022. Title VII cases once again made up the majority of cases filed, making up 68% of all filings (down from the 69% filings in FY 2022, and significantly above 61% in FY 2021). ADA cases also made up a significant percentage of the EEOC’s September filings, totaling 34%, in line with 29.7% in FY 2022, although down from the 37% in FY 2021. There were also 12 ADEA cases filed in FY 2023, after 7 age discrimination cases filed in FY 2022.

The graphs below show the number of lawsuits filed according to the statute under which they were filed (Title VII, Americans With Disabilities Act, Pregnancy Discrimination Act, Equal Pay Act, and Age Discrimination in Employment Act) and, for Title VII cases, the theory of discrimination alleged.

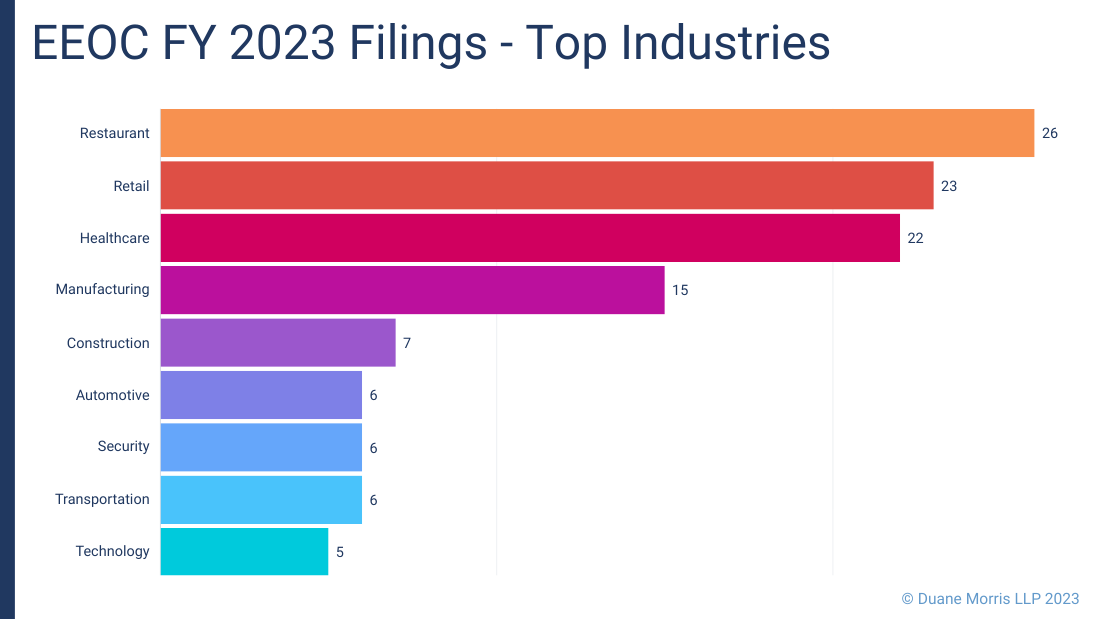

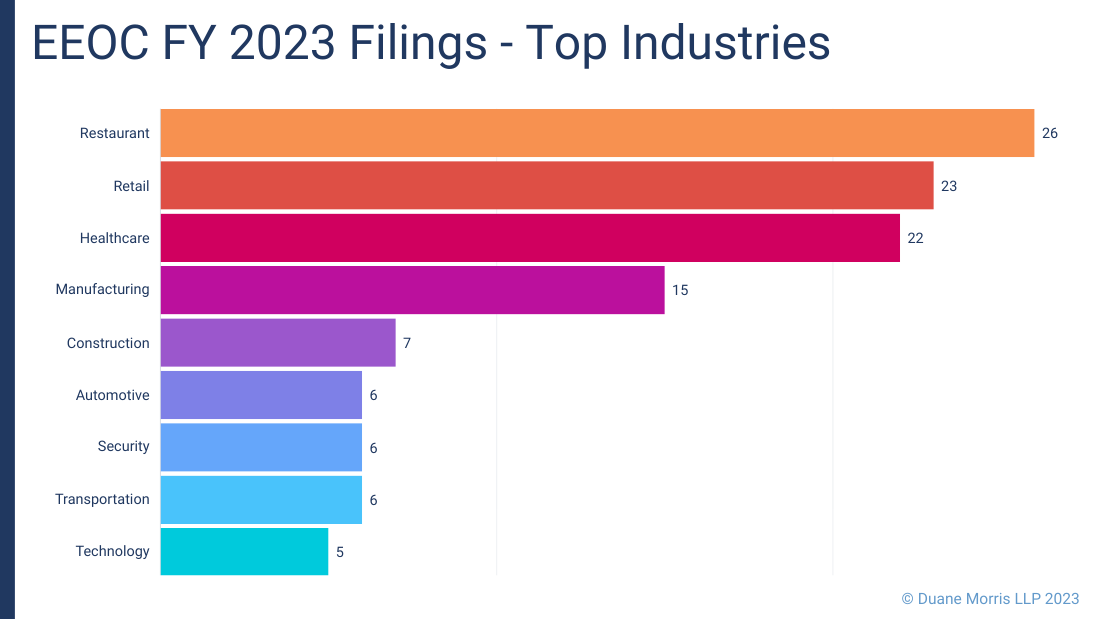

Lawsuits Filings Based On Industry

The graphs below show the number of lawsuits filed by industry. Three industries were the primary targets of lawsuit filings in FY 2023: Restaurants with 28 filings, Retail with 24 filings, and Healthcare with 24 filings. Not far off those industries are Manufacturing with 15 filings; Construction with 7 filings; Automotive, Security, and Transportation with 6 filings each; and Technology with 5 filings.

Hospitality and Healthcare employers should be keenly aware of the EEOC’s enforcement of alleged discriminatory practices in these sectors. But in reality, employers in nearly any industry are vulnerable to EEOC-initiated litigation., as detailed by the below graph.

Looking Ahead To Fiscal Year 2024

Moving into FY 2024, the EEOC’s budget includes a $26.069 million increase from 2023, and focuses on six key areas including advancing racial justice and combatting systemic discrimination on all protected bases; protecting pay equity; supporting diversity, equity, inclusion, and accessibility (DEIA); addressing the use of artificial intelligence in employment decisions and preventing unlawful retaliation.

The EEOC also announced goals for its own Diversity, Equity, Inclusion, and Accesibility (DEIA) program where it seeks to achieve four goals, including workplace diversity, employee equity, inclusive practices, and accessibility. Additionally, the EEOC continues to polish its FY 2021 software initiatives addressing artificial intelligence, machine learning, and other emerging technologies in continued efforts to provide guidance. Finally, the joint anti-retaliation initiative among the EEOC, the U.S. Department of Labor, and the National Labor Relations Board will continue to address retaliation in American workplaces.

Key Employer Takeaways

In sum, FY 2023 was a year of new leadership and structural changes at the EEOC. With a significantly increased proposed budget, it is more crucial than ever for employers pay close attentions in regards to the EEOC’s strategic priorities and enforcement agendas. We anticipate these figures will grow by next year’s report, so it is more crucial than ever for employers to comply with discrimination laws.