Duane Morris Takeaway: This week’s episode of the Class Action Weekly Wire features Duane Morris partners Jerry Maatman and Katelynn Gray and associate Ryan Garippo with their discussion of the key trends analyzed in the 2025 edition of the TCPA Class Action Review, including notable rulings in the Eleventh and Second Circuits shaping related litigation in 2025.

Bookmark or download the TCPA Class Action Review – 2025, which is fully searchable and viewable from any device.

Check out today’s episode and subscribe to our show from your preferred podcast platform: Spotify, Amazon Music, Apple Podcasts, Samsung Podcasts, Podcast Index, Tune In, Listen Notes, iHeartRadio, Deezer, and YouTube.

Episode Transcript

Jerry Maatman: Welcome to our listeners. Thank you for being here for our weekly podcast series, the Class Action Weekly Wire. I’m Jerry Maatman, a partner at Duane Morris, and joining me today are Katelynn Gray and Ryan Garippo. Welcome to the podcast.

Katelynn Gray: Thanks, Jerry, happy to be a part of the podcast.

Ryan Garippo: Thanks for having me, Jerry

Jerry: Today on the podcast we’re discussing the desk reference and publication of the Duane Morris Class Action Defense Group that was launched on the Telephone Consumer Protection Act, known as the TCPA. It’s a guide for corporate counsel on the ins and outs of the statute and what’s happened over the past year, and what we see coming in the future. Katelynn, can you tell our listeners about this publication?

Katelynn: Absolutely, Jerry. So, the TCPA has been a long focus of litigation, particularly for class actions. The class action team of Duane Morris released the second edition of the TCPA Class Action Review earlier this week. This publication analyzes the key TCPA-related rulings and developments in 2024, and the significant legal decisions and trends impacting this type of class actions for 2025. We hope that companies will benefit from this resource in their compliance with these ever-evolving laws and standards. As someone that’s worked on this chapter for the last couple of years, I can tell you there’s been a lot of updates.

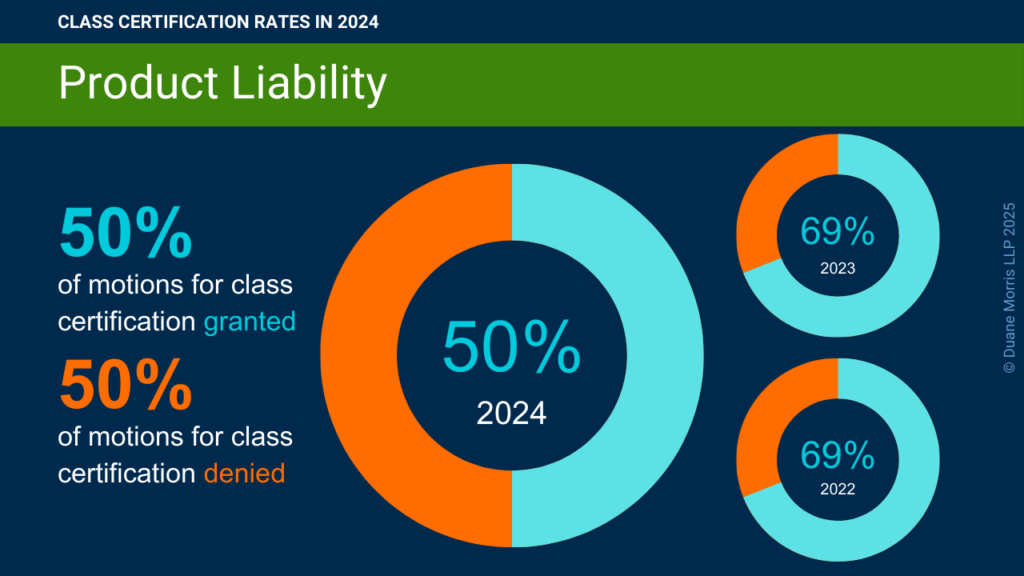

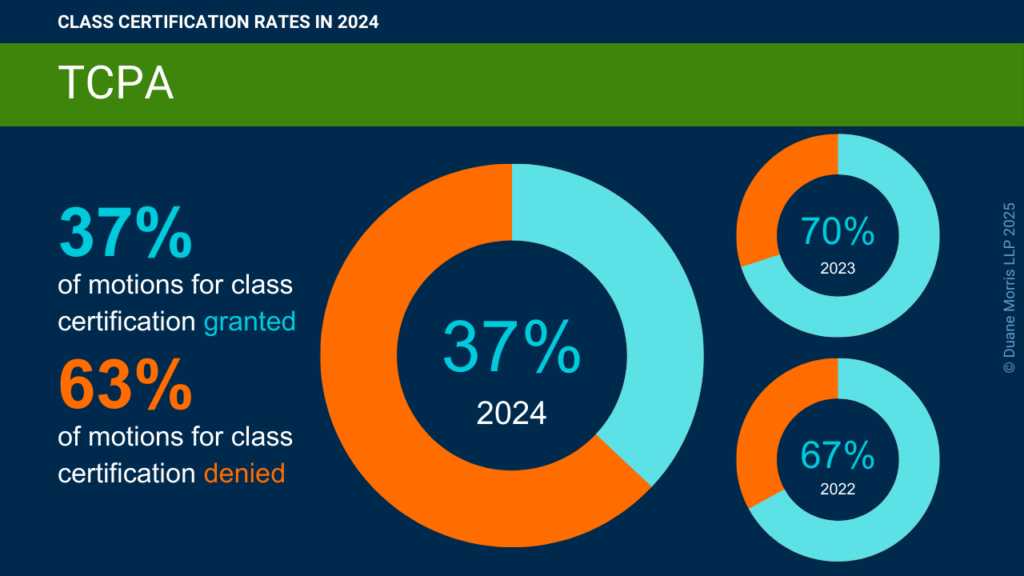

Jerry: Interestingly, in 2024 I would characterize what occurred as a mixed bag – victories for plaintiffs, victories for defendants. Ryan, how are the classes treated by federal courts in terms of certification rulings over the past year?

Ryan: There are wins on both sides, Jerry, but defendants came out way ahead in terms of getting classes certified – courts granted motions for class certification only 37% of the time, they denied class certification motions 63% of the time. So that’s way lower that last year when plaintiffs’ bar was much more successful in obtaining class certification, with courts granting 70% of certifications, so we saw a big swing from last year to this.

Jerry: That’s quite an interesting turn of events from 2023 to 2024. Katelynn, were there any notable appellate court rulings that deciphered the contours of TCPA claims?

Katelynn: There was, actually. So, the Eleventh Circuit issued 123-page opinion that offered a treasure trove of insights regarding the need for constant vigilance when it comes to TCPA compliance – particularly for employers involved in these types of class actions. This was in a case that had been ongoing and that we discussed last year within the framework of Article III standing in the TCPA class actions. The case was called Drazen, et al. v. Pinto. In the most recent ruling, the Eleventh Circuit vacated the district court’s final approval of a settlement of a class action alleging GoDaddy.com, Inc. violated the TCPA by sending unwanted marketing texts and phone calls through a prohibited automatic telephone dialing system. The Eleventh Circuit held the district court abused its discretion by approving the class-wide settlement, which would have provided up to $35 million to pay in class members’ claims and up to $10.5 million to class counsel and attorneys’ fees. The Eleventh Circuit concluded that the district court inappropriately certified the class and shouldn’t have approved the proposed settlement agreement and granted class counsel’s motion for attorneys’ fees. The Eleventh Circuit held that the district court overlooked evidence of collusion between class counsel and GoDaddy’s attorneys, treated the settlement as a common fund instead of a claims-made resolution, and improperly calculated attorneys’ fees after erroneously concluding it was not a coupon settlement. In this instance, the Eleventh Circuit remanded the case back to the district court for further proceedings.

Jerry: Gosh, at 123 pages that’s a virtual war and peace novel for a federal appellate court, and certainly a key takeaway for corporate counsel to realize that even multimillion-dollar TCPA class action settlements can be vaporized on appeal if the i’s are not dotted and the t’s are not crossed in the appropriate way as required by Rule 23. Ryan, I know there was another significant ruling by the Second Circuit in this space last year in the Soliman case. Can you tell our listeners about that decision?

Ryan: Yeah, the ruling was a win for companies that have pre-existing lists of numbers that they use to make calls. In Soliman, the plaintiff filed a class action alleging that the defendant violated the TCPA by sending unsolicited text messages, using an ATDS and an artificial or pre-recorded voice. The plaintiff asserted the defendant had sent several automated marketing text messages to her cell phone using a system that employed a pre-existing list of telephone numbers. Although the plaintiff had previously consented to receive such messages from the defendant, she opted out by texting “STOP.” The plaintiff then contended that she subsequently received another automated message. So, the district court ruled that the defendant’s system did not violate the TCPA because it used a pre-existing list of numbers rather than generating the numbers randomly or sequentially, as the Supreme Court found in Duguid. So, the district court also found that the TCPA’s prohibition against artificial or pre-recorded voice messages does not apply to text messages. The Second Circuit agreed with the District Court. It held that the defendant’s text messaging system did not violate the TCPA and explained that the TCPA prohibits systems that generate random numbers, not those that use pre-existing lists, and that these text messages are not covered by the prohibition on artificial or pre-reported voices. The Second Circuit therefore affirmed the dismissal of the claims.

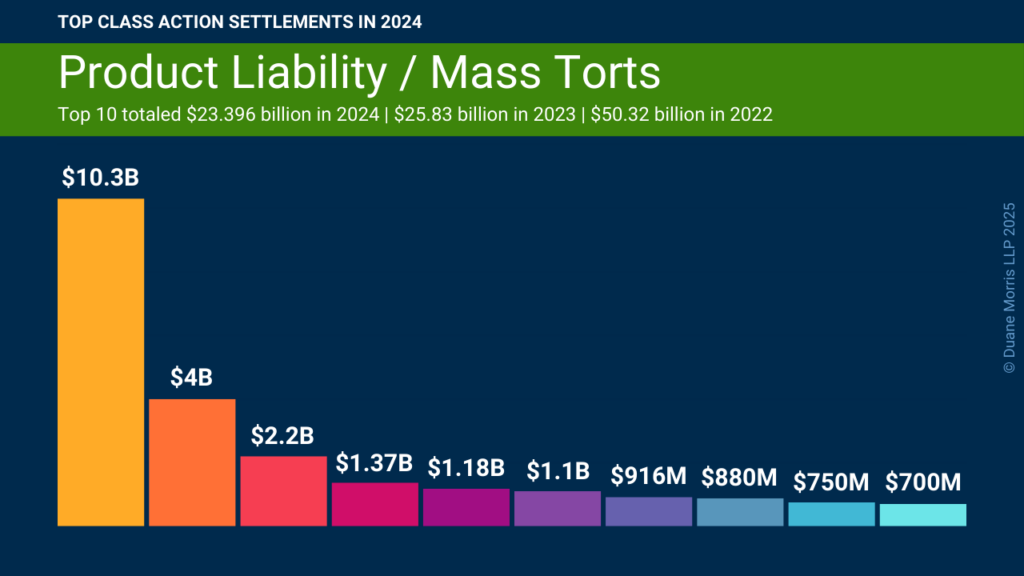

Jerry: I know this is a hotly contested issue in the circuit, so I would predict in 2025 we’re going to see more rulings on this issue from the other circuits. Maybe even a circuit split that finds its way to the U.S. Supreme Court. I’ve always thought the mantra of the plaintiffs’ bar is file the case, certify the case, monetize the case, and to knock down significant settlements. How did the plaintiffs’ bar do in 2024 when it came to this space in terms of monetizing their cases and pulling down class action settlements?

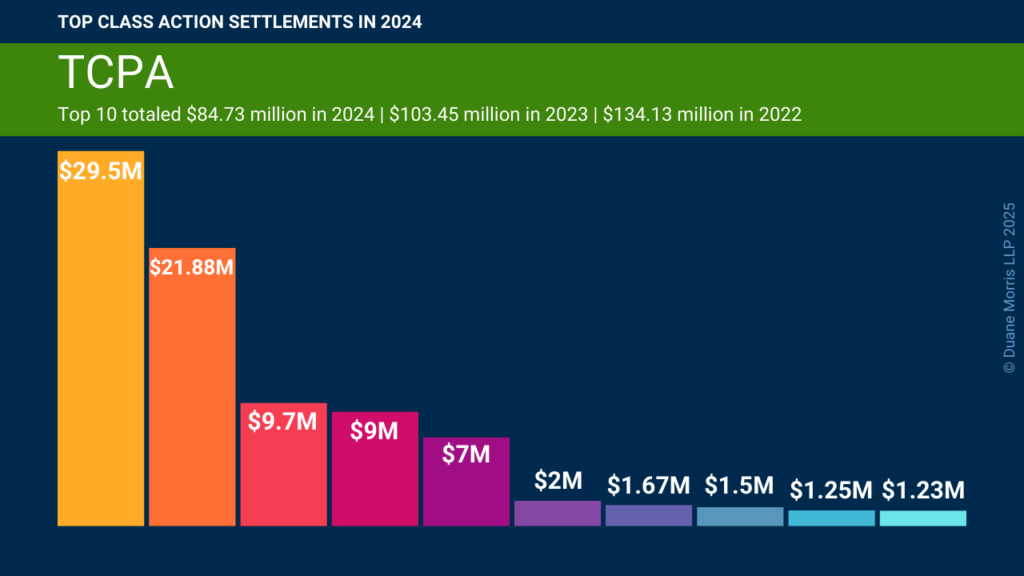

Katelynn: They did very well in securing high-dollar settlements. In 2024, the top 10 TCPA class actions totaled $84.73 million, which was actually down from the 2023 total of $103 million.

Jerry: That’s a lot of money for a few errant phone calls, and certainly we’ll be tracking these settlements in the coming year in our Duane Morris Class Action Review. Well, thank you both for joining us today and lending your expertise and describing our new desk reference, the TCPA Class Action Review. Thanks so much for being here.

Ryan: Thanks so much for the opportunity, Jerry. Appreciate it.

Katelynn: Thanks for having us, Jerry. Thank you to all the listeners, we appreciate your time.