Limited partnerships (LPs) are commonly used globally as fund vehicles for both private equity (PE) and venture capital (VC) funds. In Singapore, LPs were created as a business vehicle by the Limited Partnerships Act in 2008 (the Act), which came into effect on 4 May 2009 as part of Singapore’s efforts to become a fund management hub.

Those efforts have been supplemented by a myriad of other measures including (a) the creation of variable capital companies (VCCs) by the Variable Companies Act 2018, which came into force only on 14 January 2020; (b) the establishment of several classes of fund management licences including the venture capital fund management licence; and (c) a favourable tax environment that includes a one-tier system of taxation of income, no capital gain taxes and an extensive network of double taxation treaties, as well as several incentive schemes and grants. We will discuss these measures in more detail in other articles.

Shift Towards “Onshoring” of PE and VC Funds to Singapore

For now, we would like to highlight that Singapore’s measures appear to be working to an extent. In the past, given the familiarity of industry participants with established tax-neutral offshore jurisdictions and their laws governing private funds, fund managers in Asia traditionally opted to incorporate their fund vehicles in offshore jurisdictions, in particular the Cayman Islands. As a result, there was a disjoint between the place of incorporation of a fund and the jurisdiction in which the fund’s activities were managed. However, in recent years we have observed a growing trend by fund managers towards “onshoring” PE and VC funds to jurisdictions in the Asia Pacific region, particularly in Singapore.

This trend may also be driven by the evolving worldwide legal and regulatory environment for private investment funds and their managers. Global efforts to counter base erosion and profit shifting, money-laundering and terrorist financing have brought about increased regulation and regulatory oversight of private investment funds in various jurisdictions. For example, where closed-ended private funds established in the Cayman Islands were previously left largely unregulated, the introduction of the Private Funds Law 2020 now requires such funds to be registered with the Cayman Islands Monetary Authority. There are also ongoing compliance requirements, including in relation to valuation procedures and frequency, safekeeping and custody standards and annual audit requirements.

Finally, Singapore has benefited from being fast and nimble, as it was one of the first movers in the region to build up a conducive legal framework for the establishment of funds for the PE and VC industry. In Hong Kong, the financial hub that Singapore regularly finds itself compared to, the LP concept tailored towards PE funds was only recently introduced in the form of the Limited Partnership Fund Ordinance (Cap 637) in 2020. As we mentioned above, Singapore had created the Singapore LP over a decade ago and is now in the process of further modernising the regime: the Accounting and Corporate Regulatory Authority (ACRA) in Singapore issued a consultation paper seeking feedback on proposed amendments to the Act in October 2021, clearly displaying how Singapore remains committed to making the Singapore LP an attractive vehicle for funds.

Singapore LPs in Numbers

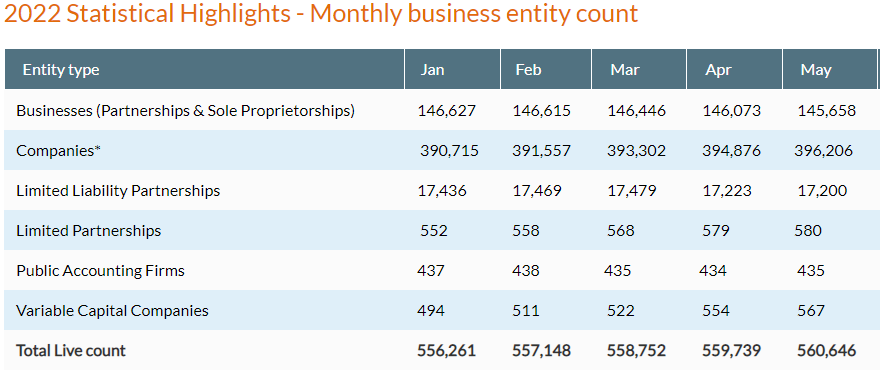

Even though Singapore LPs were created in 2009 and VCCs in 2020, it is noteworthy that as of May 2022, there are 580 LPs registered in Singapore while there are 567 registered VCCs.

See the following snapshot from the website of Singapore’s ACRA:

There could be a few reasons for this:

- Natural death: Some of the LPs created earlier may have already been dissolved. Funds’ lives tend to be limited in time, usually around up to a decade. On the other hand, all VCCs are still newly incorporated.

- Money: The Monetary Authority of Singapore (MAS) currently administers a scheme that covers qualifying expenses incurred for incorporating or redomiciling VCCs in Singapore. The scheme works roughly as follows: If you are a qualifying fund manager, the MAS will co-fund 70 percent of qualifying expenses (legal, tax and administration or regulatory compliance services), up to a maximum of $150,000 for each VCC you incorporate or redomicile in Singapore and a cap of not more than three VCCs per qualifying fund manager. Parties interested in taking advantage of this scheme should be prompt, as it expires on 15 January 2023.

- Hype: VCCs are new and many fund managers wish to be early adopters.

- Usefulness: VCCs are indeed very useful corporate vehicles, particularly in the context of umbrella funds. We will elaborate on the benefits of VCCs in our next article.

Time will tell whether this trend will become entrenched. However, Singapore LPs remain a leading vehicle for the creation of PE and VC funds. We briefly discuss their key features below.

Key Features of Singapore LPs

Most key features of Singapore LPs would be well-known to anybody familiar with this type of vehicle in other jurisdictions. They include the following: Unlimited Liability for General Partner (GP) and Limited Liability for Limited Partners.

Two points to note here:

- GPs may be corporations. Corporations do have limited liability, which is rarely disregarded or “pierced”. Further, GPs are often simple special purpose vehicles without any substance. Therefore, the unlimited liability of the GP gives no assurance to creditors. However, we have seen instances where licensed fund managers are in fact the GP. This could be attractive to creditors and potential creditors of the LP (including limited partners), but naturally it is a much riskier option for the GP fund manager.

- Limited partners’ limited liability will be respected for as long as they do not take part in the management of the LP and do not have the power to bind the LP. In connection with this, the Act sets out a (long) list of matters that will not result in limited partners being regarded as taking part in the management of the LP. Those matters include (i) voting rights that are customarily agreed upon in side letters with large limited partners and (ii) even advising the LP on the business, affairs or transactions of the LP. A consultation paper issued by ACRA in October 2021 has proposed to further clarify and expand the scope of these matters.

Contractual Flexibility

The establishment of Singapore LPs is regulated under the Act. However, the Act hardly regulates the contents of the LP agreement between the GP and the limited partners, allowing for greater contractual flexibility compared to other vehicles. In particular, the Act allows for the LP agreement to stipulate any increase or reduction of a limited partner’s agreed contribution and there are no restrictions on capital reduction or distribution of profits during the continuance of the partnership [1].

The parties also have flexibility to agree on various matters in the LP agreement, such as:

- Capital commitments of the limited partners (including situations where the fund has multiple closings);

- Distribution policy of the LP;

- Rights and obligations of the GP (including the circumstances in which the GP may be removed);

- Transfer restrictions and the procedures for transfers of partnership interests; and

- Requirements and conditions if the parties wish to dissolve the fund.

Tax Transparency

Singapore LPs are treated as tax-transparent vehicles where tax is not levied at the LP level. Instead, limited partners may be taxed on their respective share of income from the LP, depending on the relevant income tax rules applicable to each limited partner.

An income tax return is required to be filed by the LP annually with the Inland Revenue Authority of Singapore (IRAS) and includes a report on the capital contribution of the partners. The duty to file the income tax return is generally assumed by the GP. Distributions of profits by the LP to the partners are not subject to withholding tax, regardless of whether the partner is a local or foreign partner.

Privacy Considerations

Singapore LPs are not subject to prescribed audit requirements and are not required to file accounts with ACRA. Every GP must however ensure that all accounting records, which document the transactions and financial position of the LP are kept and retained for a period of at least five years following the completion of the transactions or operations to which they relate.

In addition, in the case of an investment fund structured as a LP that is managed by a licensed fund manager under the Securities and Futures Act 2001, the particulars of the limited partners are not required to be made publicly available. These features are aligned with and recognize the nature of private funds, where confidentiality and privacy are often a key concern.

Amendments Proposed in the ACRA Consultation Paper

Some of the other amendments to the Act proposed in the ACRA consultation paper include the following:

- Introduction of a redomiciliation regime for LPs, which is currently provided for companies and VCCs. If introduced, this would benefit existing offshore LPs that are looking to tap into the numerous benefits of being a Singapore-based LP; and

- Introduction of additional forms that a GP or limited partner can take on, besides an individual or corporation as is presently the case. These would include a LP registered under the Act and a non-Singapore LP with or without a legal personality.

Conclusion

Singapore has established itself as an attractive location for fund management and ranks high in terms of political stability, business-friendly policies and tax certainty. Coupled with a well-established and a “light-touch” LP legal framework, these factors provide a viable alternative to fund managers considering Singapore as a base to domicile their funds and tap into the investment opportunities that are found across the Asia Pacific region and beyond.

Next article on the Singapore Private Equity and Venture Capital Landscape Series – The Variable Capital Company

For More Information

If you have any questions about this Alert, please contact Ramiro Rodriguez, Suilyn Yip, Jacob Low, any of the attorneys in our Singapore office or the attorney in the firm with whom you regularly in contact.

About Duane Morris & Selvam LLP

Duane Morris & Selvam LLP (DMS) is a joint law venture between international firm Duane Morris LLP (DM) and Singapore-based firm Selvam LLC. DMS runs a unique Latin American-Asian practice out of Singapore, with a team of international lawyers qualified in multiple jurisdictions including Singapore, the US, the UK, Canada, Mexico and Colombia, with substantial experience in international transactions and disputes. DMS also has a wide cooperation network with some of the best Latin American and Asian law firms.

Disclaimer: This Alert has been prepared and published for informational purposes only and is not offered, nor should be construed, as legal advice. For more information, please see the firm’s full disclaimer.

[1] Do note that a limited partner is liable to refund to the LP as partnership property any distribution of capital or profits of the LP made to the limited partner if (a) every GP at the time of the distribution was insolvent at the time of the distribution or became insolvent as a result of the distribution; (b) the limited partner knew or ought to have known at the time of the distribution that every GP was insolvent or would become insolvent as a result of the distribution; and (c) every GP is adjudicated bankrupt or is ordered to be wound up within one year after the date of the distribution.