The Parliamentary website has today published a letter from Minister Anne Marie Trevelyan MP to the Chair of the Foreign Relations Committee which includes a section on the current state of UK sanctions enforcement. The letter is part of a report by the Committee.

In relation to sanctions enforcement the letter indicates that the first fines for breaches of sanctions imposed since 2022 are expected this year.

The section of the letter can be quoted in full below:

“Fines for non-compliance

Secondly, regarding the number of fines that have been issued for non-compliance with our Russia sanctions regime, I can confirm that there have been 10 Monetary Penalties imposed by OFSI since it received the power to impose these in 2017, totalling £22m.

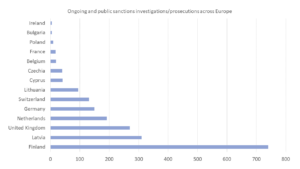

OFSI cannot pre-determine case outcomes but does expect to see the first Monetary Penalties resulting from 2022 Russia designations come to fruition in 2024. This is in line with other jurisdictions, including the US, given the time it takes to properly investigate cases.

Financial sanctions breaches are often complex and investigations proportionately long. OFSI is responsible for both investigating breaches and deciding on the appropriate outcome, including initial penalty amounts. There are several important statutory periods to allow for representations and appeals that OFSI must comply with that also impact the time between investigations commencing and penalties being made public.

Some breaches are found to be relatively minor in nature. In these cases, OFSI will not necessarily impose a penalty, as it may be more appropriate to deal with the case in a different way such as a warning letter or referring the matter to a regulator. In 2022-2023, OFSI recorded 473 suspected breaches of financial sanctions (excluding oil price cap and counter-terrorism breaches). This is a significant increase on the 147 cases recorded in 2021-2022. This increase was expected given the scale of increased Russia sanctions, and OFSI has increased its enforcement capacity in response.”