Context

The UK withdrawal from the European Union (EU), often known as Brexit, has become one of the most remarkable events in the history of not only the UK, but also the world. Brexit refers to a political movement which would result in the expiration of the British membership in the EU after a referendum held on June 23, 2016. This event will not simply affect the economy of the UK as well as other nations in the EU but will also have influential impact on the global market in general; and Vietnam is not an exception.

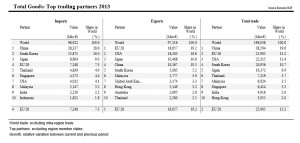

Being one of the most active trade partners with the EU, Vietnam accounted for nearly 20% of the total trade between EU and members of the Association of Southeast Asian Nations (ASEAN) in 2015. More importantly, the United Kingdom (UK) has become Vietnam’s largest trading partner in the EU, with a bilateral trade reaching US$5.4 billion last year. In addition, although not currently ratified, a Free Trade Agreement (FTA) between Vietnam and the EU, also known as the EU – Vietnam Free Trade Agreement (EVFTA), has been concluded and is expected to be in force in 2018.

Immediate Impact

Several experts and policymakers have predicted the impact that Brexit would have on Vietnam as well as some solutions to this situation. According to Trinh D. Nguyen, an economic expert on Asian emerging markets, Vietnam could be the most heavily affected economy among Asian emerging markets as a result of the predicted EU economic downturn after Brexit.

Regarding the immediate or short-term impact, despite the fact that the UK is the largest trading partner of Vietnam in the EU, the UK only accounts for 10% – 12% of the total export volume of Vietnam to the EU. Although trading activities between Vietnam and the UK are likely to be affected as the EVFTA will not be applicable between the two countries, this will not have an immediate or sufficient impact on Vietnam’s economy due to minimal trade volume.

Another aspect that attracts substantial attention after Brexit is market volatility. After the result of the vote was announced, the British Pound fell dramatically, hitting a 31-year low against the US dollar, with a decrease of more than 10%. When this currency is compared to the Vietnamese Dong, its value has dropped a massive 12.55%.

In addition, other sectors of the market including gold and stocks in Vietnam also experienced some fluctuations. Particularly, gold price in Vietnam rocketed to $1,601 per tael, the highest in the past 10 months. Meanwhile, in an opposite direction, the stock market in the country dropped 11.5 points or 1.85 percent to 620.77 immediately after Brexit. The same trend was also experienced in the global stock market. However, many experts believe that this was a result of investors’ panic instead of direct negative influence of Brexit on Vietnam.

Long-term Impact

As mentioned, the British Pound reacted shortly after this nation voted to leave the EU. Although this was an immediate reaction, its consequences, according to several experts, could lead to a number of long-term effects. Since the Pound devaluated, it is expected that imported goods’ price would increase. As a result, the EU demand for these products, including those imported from Vietnam, would decline. Therefore, the devaluation of the Pound is likely to affect the Vietnamese economy to some extent despite Vietnam’s low export volume to the EU.

However, the Pound is not the only currency that decreased in value after Brexit. In fact, the Euro also experienced a similar trend. After Brexit, the Euro itself lost 4% in value. Again, this would limit the EU demand for imported products, affecting the Vietnamese economy where the EU has become one of the most important trading partners. On another hand, value of the US Dollar has increased significantly compared with other currencies, resulting in potential more investment from US investors in the country.

Nevertheless, it is argued that as the Pound itself lost value, imported products from almost anywhere in the world would increase in prices. Moreover, the demand is always present although it could decrease by a few percent. Therefore, Brexit should not have an enormous impact on imported products in Vietnam. However, this claim has not considered all aspects of the matter. Although it is undeniable that prices of the majority of imported products in the UK would increase, products from Vietnam are likely to increase more in prices when being compared to those of others as the value of the Vietnamese Dong accelerated excessively after Brexit. Particularly, in ASEAN, the Vietnamese Dong is the currency that increased the most in value when compared to both the British Pound and the Euro after the event. Therefore, Vietnamese exported products might suffer the most in the area.

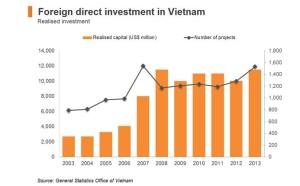

Brexit will divert British investment and British business strategy in Vietnam will be affected. Although direct investment from the UK is not significant, capital influx via the UK is. Therefore, in the long term, there could be certain difficulties in attracting these capital flows.

Vietnam is the only Southeast Asian nation that has finalized its FTA with the EU. Although the EVFTA has not yet been ratified, it is an advantage to Vietnam when competing with other ASEAN nations in the EU market, especially when after Brexit, these nations could face several obstacles before reaching a final agreement. Despite this, as the UK has ended their membership in the EU, the EVFTA is no longer applicable between Vietnam and the UK. Brexit has temporarily been disrupting the process of reducing trade barriers between Vietnam and the EU. As a result, a new FTA must be negotiated between the two countries or the UK must build a similar regime as the GSP in the EU to reduce impact of Brexit on bilateral trade with Vietnam.

In order to maintain the trading partnership between Vietnam and the UK, the solutions must come from the Governments.

Solutions for Vietnam

Appreciations in other currencies as a result of Brexit would help improve Vietnam’s competitiveness over other countries, for example, Japan and China. If Vietnam’s Government takes timely action to make its economy more stable and improve business environment, Vietnam would be an attracting destination for capital inflows.

In order to achieve such objective, macro policies must be more flexible. The Government should also pay special attention to coordinating monetary and fiscal policies to ensure harmonization between policy flexibility and economic stability. The appreciation of the US Dollar as a global safe haven currency has introduced further opportunities for US investors in Vietnam, especially when many trade restrictions will soon be lifted following the ratification of the – already signed – Trans-Pacific Partnership Agreement.

Institutional Reform – A MUST

Comprehensive institutional reform of the state-owned enterprise (SOE) sector is of highest importance. It could be done by real privatization with majority options for investors. Investors must be granted with real performance control and business management control for SOE management every year. These reforms should be fully implemented until end of 2017 or it will be too late to grasp the benefits of the upcoming EVFTA and the TPP.

Leader in ASEAN – Learn from Germany in the EU

Last but not least, Brexit has handed Germany the leading role in Europe. Vietnam should forge even stronger ties with Germany and make use of Germany’s recipe for its economic strength.

—o0o—

Please do not hesitate to contact Mr. Oliver Massmann under omassmann@duanemorris.com if you have any questions on the above or should you request our assistance. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

THANK YOU !