Vietnam’s Ministry of Science and Technology recently published and invited comments on an outline version of a new science and technology law (the “Draft Amended Law”) to replace the 2013 Law on Science and Technology (the “2013 Law”). The 2013 Law lacks specific regulations on innovation and has unclear guidelines for the form and classification of science and technology organizations. Overall, it has not fostered the development of high-quality human resources in science, technology and innovation (“ST&I”) or created conditions conducive to investment and financing in ST&I.[1] Furthermore, and of particular interest to proponents of the Europe – Vietnam Free Trade Agreement (“EVFTA”), the domestic legal framework codified by the 2013 Law requires alignment with Vietnam’s commitments in the EVFTA. To overcome these challenges and ensure the effective economic integration of advances in ST&I, the Government has recognized the need to update the 2013 Law. Overall, this proposed legislation is an improvement. If effectively implemented, it will stimulate and advance science, technology, and innovation projects in Vietnam, especially in light of the EVFTA, while also enhancing the practical implementation of science and technology in agricultural practices in particular. We at Duane Morris Vietnam LLC have the following comments on the Draft Amended Law.

First, although the Draft Amended Law broadens the scope of the 2013 Law by adding the word “innovation” to the name, the terms used to expand the regulatory boundaries such as “innovation system,” “national innovation system,” and “innovation activities” are not defined or clearly explained. Although the document is labeled as an outline, unless and until these terms are clarified the Government will need to publish post-promulgation guidelines to clarify what is meant and to harmonize the law with existing guidelines from the 2013 Law.

Second, Chapter II regulates the form and classification of science and technology organizations, clearly delineating between public and non-public entities and distinguishing between “universities with research functions” and “science and technology organizations.” However, such provisions are not comprehensive and are not consistent with regulations promulgated under the 2019 Higher Education Law. The provisions in this chapter also do not address the ongoing privatization of state-owned enterprises or the trend for universities to become financially independent.

Third, the Draft Amended Law introduces provisions exempting science and technology organizations and scientists from civil liability for damage or risks incurred during the execution of tasks due to “objective reasons.” This provision will on the one hand incentivize science and technology organizations to conduct scientific research but on the other hand it may also open the door for abuse. The Government will therefore need to issue specific guidelines to clarify what activities qualify for this exemption.

Fourth, the Draft Amended Law omits the granting of interest-free or low-interest loans within the framework of national funds for science and technology. This change will remove one source of funding for young scientists and certain science and technology organizations, particularly those conducting ST&I projects in the agricultural sector.

On the plus side, the Draft Amended Law enhances intellectual property rights protection as required by Chapter 12 of the EVFTA. The changes strengthen enforcement mechanisms for patents, copyrights, trademarks, and trade secrets and will bring the law into alignment with the 2022 amended intellectual property law that was revised to reflect Vietnam’s commitments under the EVFTA.[2] The Draft Amended Law also addresses the commitment made in Chapter 16 of the EVFTA to enhance the capacity of small and medium-sized enterprises (“SME“). The draft law provides specific definitions, a legal framework and funding mechanisms for ST&I activities conducted by SME. This change both aligns the law with the EVFTA and remedies a significant shortcoming in the 2013 Law.

In conclusion, the Draft Amended Law marks notable advancements in rectifying current deficiencies, particularly in aligning with international standards and Vietnam’s obligations under various bilateral and multilateral agreements.

The author acknowledges the contributions of Duane Morris Vietnam LLC colleagues Oliver Massmann and Nguyen Thu Quynh.

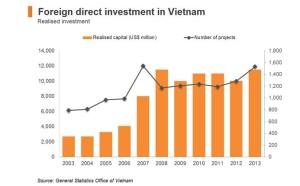

[1] Although Vietnam’s national budgets have prioritized investment in scientific and technological activities, the percentage of investment remains relatively low compared to the rest of the world. Additionally, there are disparities in the allocation of financial resources for scientific and technological activities.

[2] For example, Article 41 of the Draft Amended Law strengthens the ownership and use of scientific research and technological development results in line with the 2022 amended IP Law.