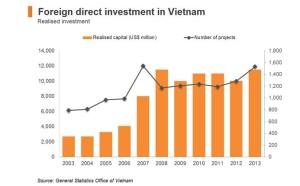

According to the Ministry of Planning and Investment (MPI), in the first 5 months of 2019, foreign direct investment (FDI) projects were US $7.3 billion, up 7.8% as compared to the same period in 2018. In addition, FDI contribution to the state budget rose from US $1.8 billion during 1994-2000 to US $14.2 billion during 2001-10, and to US $23.7 billion during 2011-15. In 2017 alone, FDI contributed US $8 billion to the state budget, accounting for 17% of the total state budget.[1] Phan Huu Thang, Vice Chairman of Vietnam’s Association of Foreign-Invested Enterprises, told Vietnam Investment Review that hi-tech processing and manufacturing, smart agriculture, healthcare, education and training, and renewable energy will be the hottest sectors for FDI in the coming months and years.[2] All these numbers and projections sound fantastic, but there are always impediments to a flourishing FDI program, as well as untapped (or under-utilized) opportunities. More importantly, how can the Comprehensive and Progressive Trans Pacific Partnership (CPTPP) and European Union—Vietnam Free Trade (EVFTA) agreements foster and support FDI?

Two important draft laws affecting FDI originally slated for passage in July 2019 have, unfortunately, been postponed for passage until May 2020 per Resolution 78 (78/2019/QH14) in the Vietnam National Assembly: the Law on Investment in the Public Private Partnership Form [Law on PPP] and the Law Amending the Law on Investment and the Law on Enterprises.[3] There will be more to come on the effect of those laws after passage.

Unintended Effects of CPTPP and EVFTA on FDI

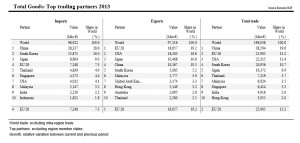

In the first five months of 2019, Vietnam’s FDI attraction reached a total value of US $16.7 billion, up 69 percent over the same period last year.[4] Currently, there are 131 countries and territories with valid investment projects in Vietnam, of which the Republic of Korea (RoK), Japan and Singapore claim the top three places (Japan and Singapore are CPTPP countries).[5] Since the beginning of 2019, however, a new top contender is emerging—China. In the past, China has been the seventh largest investor in Vietnam (with US $15 billion total); however, in the first half of 2019, their FDI alone was US $2 billion.[6] This is not a great surprise as the US—China “trade war” continues, but it does highlight that China is intending to exploit Vietnam’s entrance into the CPTPP and EVFTA (Agreements that China does not currently benefit from). This year, the Vietnamese government licensed the US $280 million ACTR tire-manufacturing project in the southern province of Tay Ninh, and a US $214.4 million project by the Advance Vietnam Tire Co., Ltd in the Mekong Delta province of Tien Giang.

ACTR manufactures steel-radial tires for trucks and busses, and is a joint venture between China’s Sailun Vietnam Co., Ltd, (with 65% equity) and the US’s Cooper Tire and Rubber Co. (35% equity). Because of the more stringent Certificate of Origin (COO) requirements under the CPTPP, China could no longer import tire components from CPTPP countries and process them domestically to obtain CPTPP member-country benefits (or vice versa—export components for assembly). They would need to have a physical processing plant located in Vietnam to claim “Made in Vietnam” COO. With that member-country COO, China now enjoys zero-tariffs on those products exported to member nations. That is a significant counter to the US—China trade tariffs, and a direct result of CPTPP. Advance Vietnam Tire Co. (owned by Guizhou Advance Type Investment co., Ltd, of China) is an almost identical example to ACTR; other than Advance is not a joint venture. China could have invested in other CPTPP countries, but Vietnam is the most attractive and cost-effective venue for FDI compared to others.

The EVFTA contains similar provisions as the CPTPP regarding tariffs and duties. With the EVFTA now in force, China has poised itself to take advantage of this new regulatory environment for the European markets. Using the examples from above, China will now be able to compete (in effect with domestic-preference) directly with Europe’s largest physically domestic producer of tires, Michelin.

Before CPTPP, EVFTA, and the US—China trade tensions, Chinese investors were mainly small businesses with out-dated technology, but now many large corporations are funding large-scale projects. Five of the seven biggest foreign-invested projects in the last five months came from Chinese backers, including not only the ones already discussed, but also a US $260 million electronic equipment and multimedia audio products manufacturing project invested by Hong Kong-based Goertek Co., Ltd.[7] Chinese investors are also increasing merger and acquisition (M&A) activities. Hong Kong topped foreign investors in Vietnam with the US $3.8 billion purchase of Vietnam Beverage Co. Ltd, in Saigon Beer-Alcohol-Beverage Corp (SABECO).

It appears clear from the investment activity in Vietnam since the onset of CPTPP that it has had a substantial positive impact on FDI. With the advent of EVFTA coming in force (and providing similar—if not more—beneficial trade platforms), Vietnam will have a multitude of investors rushing to reap the benefits of those trade agreements. For Vietnam be able to absorb this inevitable expansion of its FDI landscape the government needs to adapt holistically (and quickly) to the new global trade environment they have embarked on to realize its full potential.

EVFTA and CPTPP Vocational Training Market Opportunity

As Phan Huu Thang mentioned, education and training and renewable energy will be some of the hottest sectors in the coming months and years for FDI. An often-overlooked aspect of FDI is Vocational Training Schools. Vocational training will be critical to the long-term success of Vietnam’s infrastructure platforms, especially when operating and maintaining an enhanced energy and power sector. With highly advanced and technologically complex energy platforms (especially renewables) comes a requirement for competently trained personnel to sustain them. Vietnam has a large workforce pool; however, technical training for these opportunities is currently limited.

The EVFTA and CPTPP both have provisions easing the access of engineering and technology support to assist in achieving the required knowledge and training skillsets.[8] Vietnam recognized this also and updated their regulatory requirements regarding vocational schools through Decree 15 (15/2019/ND-CP), which specifies the order and procedures for opening foreign-invested vocational training schools.[9] The FDI project would need to be in line with the national planning of vocational training in Vietnam, but the threshold capital requirements have been lowered to VND 5 billion (US $216,000) to open a vocational training centre, VND 50 billion (US $2.2 million) for a vocational secondary school, and VND 100 billion (US $4.4 million) for a vocational college.[10] In addition, if a project is aligned with an industry of national priority or significance (enter renewable-energy), the Ministry of Labour will be the sole authority on issuing licenses[11]—a departure from the traditional methodology in an effort to streamline the process. This is good news for many renewable energy projects. Not only will a foreign business have more opportunities for development under CPTPP and EVFTA, but they can also add a minimal supplement to that investment and create the necessary workforce to support it.

An example from USA clearly demonstrates the opportunity in vocational training schools. In 2011, Boeing, Inc. opened a final assembly facility for the 787 Dreamliner in Charleston, South Carolina. Along with that came a demand for technically trained personnel to operate the complex facility and to have personnel trained in the intricate technology involved in assembling the aircrafts. Boeing invested US $80 million to have an aeronautical vocational training facility built near Boeing’s assembly plant (completed June 2019).[12] This is a win-win for Boeing. They provided the initial funding to build the vocational facility; in return, they have professionally trained personnel, and the government takes over costs of maintaining the training facility. Boeing also gets guarantees from the government to repay Boeing’s initial investment through tax incentives and bond issuance. This is a textbook case of vocational FDI supplementing an already significant investment.

As many foreign investors establish their presence even more in Vietnam’s infrastructure landscape, this is another opportunity for FDI to affect Vietnam’s (and the investor’s) bottom-line. The EVFTA and CPTPP are enablers as they both allow services to flow less restrictively between the parties. Phan Huu Thang noted that for Vietnam to realize its fourth-industrial-revolution plan (4IR), local enterprises [must] be encouraged to cooperate with foreign-invested enterprises to learn experience, transfer technology, and receive support in training.[13] Vocational training centers will help fill that need.

Summary

Vietnam’s FDI has been steadily increasing for decades. FDI has helped transform Vietnam from a poor nation to the verge of a massive middle-class population. CPTPP and EVFTA are two vehicles that will propel Vietnam across that line and perhaps even further. The tangible benefits of CPTPP are already proving themselves as evidenced by the hard-data collected. The unintended effects on FDI from non-member countries, however, have a distinct possibility of compounding those benefits exponentially as others see the potential of CPTPP and EVFTA. Traditionally under-utilized sectors for FDI in education and training are also poised to take advantage of these trade agreements. While not the most high profile, E&T are necessary support vehicles to sustain the larger sectors. Vietnam has been slow, thus far, in aggressively changing their regulatory environment to adapt; however, they need to act expeditiously to fully reform their regulatory environment in order to meet this inevitable influx of FDI.

***

If you have any question on the above, please do not hesitate to contact Dr. Oliver Massmann under omassmann@duanemorris.com or any other lawyers in our office listing. Dr. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Thank you very much!