By Oliver Massmann and Manfred Otto – Duane Morris Vietnam LLC

Foreign Direct Investment

A Brief Overview

Vietnam is undergoing fundamental changes to form the basis for its attractiveness and competitiveness in preparation for the ASEAN Economic Community (AEC), the upcoming trade agreements including the EU-Vietnam FTA and the Transpacific Partnership Agreement (TPP).

Since July 2015, a number of new laws and regulations governing foreign investment, enterprises, real estate and foreign ownership limits have come into effect. For example, the new Law on Investment and the new Law on Enterprises:

(i) clarify definitions of foreign-invested enterprises;

(ii) facilitate M&A activities;

(iii) reduce the number of prohibited and conditional business sectors;

(iv) reduce statutory business licensing times;

(v) provide more flexibility with regard to corporate governance (such as multiple legal representatives and lower voting thresholds); and

(vi) create more favourable conditions for shareholder lawsuits.

In addition, new laws and regulations affecting foreign ownership of real estate have come into effect. Foreigners can now own apartments and for the first time buy houses. They are now also permitted to sublease and inherit real estate.

With the coming into effect of several international trade agreements and more particularly, the EVFTA, EuroCham members are looking forward to the positive changes that will be implemented and that will further business incentives as well as contribute to Vietnam’s growth.

Vietnam as an attractive FDI destination

In addition to the numerous legal changes, Vietnam has fundamental elements that participate to its continued growth. For instance, Vietnam is in a demographic golden age, with 25% of its 90 million people population between 10 and 24 years old. GDP per capital is increasing drastically as Vietnam has the fastest-growing middle class in South East Asia – (12.9% per annum over the period 2012-2020). Along with a high literacy rate and education levels, comparatively low wages, connectivity and central location within ASEAN, more and more foreign investors choose Vietnam as their hub to service the Mekong region and beyond.

Vietnam’s attractive profile is reflected in its generally welcoming of foreign direct investment (FDI) in manufacturing activities. The gradual opening of most service sectors under Vietnam’s WTO commitments schedule that began in 2007 has been completed in 2015. Domestic law has expanded market access in some sectors beyond those of Vietnam’s WTO commitments. For example, foreign shareholding in public companies that was previously capped at 49% is now generally open for to up 100% foreign ownership. Vietnam also grants investment incentives including tax breaks in areas, such as high-tech, environmental technology, and agriculture, where European businesses are global leaders.

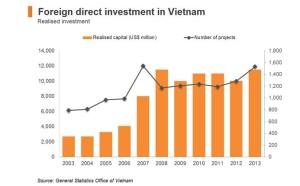

Furthermore, in 2014, Vietnam recorded $21.92 billion in FDI with a total of 1843 investment licenses for foreign invested projects with a registered capital of $16.5 billion, representing a 14% increase from the previous year. Among the foreign investors, the EU is an increasingly important source of FDI for Vietnam as ‘according to the Foreign Investment Agency of the Vietnamese Ministry of Planning and investment, investors from 23 out of 28 Member States of the EU injected a total committed FDI worth US$19.1 billion into 1566 projects over the course of the past 25 years (by 15 December 2014)’. With this strong activity, in 2014, the EU positioned itself as fifth in the top FDI partners of Vietnam with a combined committed FDI of US$587.1 million.

Source: ‘Vietnam’s logistics market: Exploring the opportunities, Hong Kong Trade Development Council (HKTDC)

In addition to FDI, the EU-Vietnam’s strong trade relationship can be seen through programmes like the Multilateral Trade Assistance Project (MUTRAP) which accounts for over €35.12 billion. MUTRAP has been instrumental in supporting Vietnam’s negotiating efforts during the WTO accession process and now continues to assist Vietnam in the implementation of trade commitments. In terms of trade, both the EU and Vietnamese businesses are expected to benefit under the EVFTA. The FTA will gradually eliminate tariffs for over 99% of goods and services besides other mechanisms to support bilateral trade. On 4 August 2015, the EU and Vietnam reached an agreement in principle for the free trade deal, an agreement that will also attract further FDI into the country.

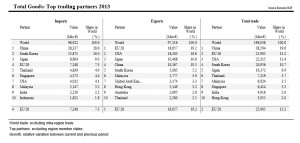

Vietnam’s top trading partners 2013

Finally, the EU’s strong commitment to support Vietnam in its modernisation and integration in the world economy is mirrored by the aid programmes. In line with Vietnam’s 2020 socio-economic plan, the EU has increased its aid by 30 % reaching 400 million euros via its multi-annual indicative programme for the period of 2014-2020 focusing on the development of clean energy in Vietnam.

Further improvements necessary

It is clear that Vietnam’s development and its attractiveness to foreign investors are undeniable as Vietnam is constantly improving its business environment.

However, as of this writing, guiding regulations for many new laws have still not been published, and investors are experiencing delays in the processing of applications. We expect processing times to improve once the new implementing regulations come into effect and officials get accustomed to the changes.

Another issue that has been highlighted by our members is that many foreign investors still face significant challenges when dealing with Vietnam’s bureaucracy. Tax filing, customs clearance, business registration and licensing, and other administrative procedures are often delayed, outcomes can be unpredictable, and businesses find themselves spending resources on administration that they would prefer to invest in expanding their core activities.

Despite remaining hurdles, the national government of Vietnam has expressed an understanding of the issues surrounding foreign investment. Providing foreign investors increased access to its market, the stream of FDI is expected to continue. For many foreign investors the positive economic development of the country and its fundamentals substantially outweigh potential risks.

In this light, EuroCham wishes to present the key issues that our members face in their activity in Vietnam along with some key recommendations. EuroCham hopes to engage in a constructive dialogue and increasing cooperation with the relevant authorities on all the issues presented in this edition in order to improve the business environment for all enterprises in Vietnam and contribute to the country’s fast modernisation.

***

1‘Vietnam; from golden age to golden oldies’, UK FOC, 07/01/15. Available at

2‘Report revises 2014 FDI figures’ Viet Nam News, 18/03/15. Available at

3‘Investment -EU-Vietnam economic and trade relations’, Delegation to the European Union to Vietnam, 2015. Available at

4‘Vietnam’s logistics market: Exploring the opportunities, Hong Kong Trade Development Council (HKTDC), 20/01/15. Available at

5‘Trade – EU-Vietnam economic and trade relations’, Delegation to the European Union to Vietnam, 2015. Available at

6‘European Union, Trade in goods with Vietnam’, European Commission DG Trade, 10/04/15, p.9. Available at

7‘Development Cooperation’, Delegation to the European Union to Vietnam, 2015. Available at