On 02 December 2015, after nearly 3 years with 14 rounds of negotiations, the Minister of Industry and Trade of Vietnam, H.E. Vu Huy Hoang and the European Commissioner for Trade, H.E. Cecilia Malmström have signed the Vietnam-EU Free Trade Agreement (FTA). Both parties will finalize the ratification process as soon as possible for the FTA to take effect from the beginning of 2018.

The FTA is considered one of the most comprehensive and ambitious trade and investment agreements. It is the second agreement in the ASEAN region after Singapore and it will intensify the bilateral relations between Vietnam and the EU.

The agreement has separate chapters on Trade of Goods, Rules of Origin, Customs and Trade Facilitation, Sanitary and Phytosanitary measures and Technical Barriers to Trade, Trade in Services, Investment, Trade Remedies, competition, State-Owned Enterprises, Government Procurement, Intellectual Property, sustainable Development, Cooperation and Capacity Building, Legal and Institutional Issues.

Nearly all customs duties – over 99% of the tariffs will be eliminated. The small remaining number is mainly due to the transition period. Vietnam will liberalize 65% of import duties on EU exports to Vietnam at entry into force and the remaining duties will be eliminated due to the next ten years; EU duties will be eliminated over a seven year period. The market will be opened for most of EU food products, i.e. wine, spirits and frozen pork meat will be liberalized after seven years and dairy products after a maximum of five years. The EU will eliminate duties for some sensitive products in the textile and footwear sector. The EU has offered access to Vietnamese exports via tariff rate quotas (TRQs), because some sensitive agricultural products will not be fully liberalized. Furthermore, the agreement will contain an annex with provisions to address non-tariff barriers in the automotive sector. Vietnamese exports of textile, clothing and footwear to the EU are expected to more than double in 2020 as a result of the FTA.

The FTA will help to increase quality of investment flows from EU, accelerate the process of sharing expertise and transfer of green technology and the creation of more employment activities.

The real wages of skilled laborers may increase by up to 12% while real salary of common workers may rise by 13%. The macro economy will be stable and inflation rate is controlled. Vietnam’s business activities will be booming in the next few years once the EU- Vietnam FTA officially comes into force and Government’s policies as well as institutional reforms start showing their positive effects.

Vietnam’s GDP is expected to increase by 0.5% annually, increase in exports is 4-6% per year. If this trend continues until 2020, Vietnam’s exports to EU will increase by USD 16 billion. Until 2025, the FTA is estimated to generate an additional 7-8% of GDP above the trend growth rate.

***

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Lawyer in Vietnam Oliver Massmann New Decree guiding the Law on Investment What you must know:

On 12 November 2015, after months of delay, the Government has finally issued Decree No. 118/2015/ND-CP (“New Decree”) on detailing and guiding the implementation of certain provisions of the Law on Investment.

Set out below are major worth-noting points in this New Decree:

Investment conditions for foreign investors

Investment conditions for foreign investors are defined as conditions that foreign investors must satisfy when investing in conditional business sectors applicable for foreign investors pursuant to Vietnam’s laws, ordinances, decrees and international treaties on investment.

These conditions include:

– Conditions on foreign ownership of charter capital in an economic organization;

– Conditions on investment form;

– Conditions on scope of investment activities;

– Conditions on a Vietnamese partner participating in investment activities; and

– Other conditions pursuant to laws, ordinances, decrees and international treaties on investment.

The above conditions must be satisfied when foreign investors:

– Making investment to establish an economic organization;

– Contributing capital, purchasing shares, capital contribution portion in an economic organization;

– Investing in the form of business cooperation contract;

– Receiving investment projects transferred from another investor or other cases of receiving transferred investment projects; or

– Amending or supplementing investment business lines or sectors of foreign invested economic organizations.

Conditional business sectors applicable for foreign investors as well as the corresponding conditions are not included in the New Decree but will be published on the National information gate on foreign investment. For business sectors whose conditions are not specified anywhere in Vietnam’s WTO Commitments and other international treaties on investment or not yet committed (“Uncommitted Sectors”), the investment registration authority must seek approval of the Ministry of Planning and Investment and other specialized ministries on the foreign investment.

It is worth noting that the New Decree recognizes ‘licensing precedent’, meaning where foreign investment in Uncommitted Sectors has been approved and such Uncommitted Sectors have been published on the National information gate on foreign investment, any later foreign investors making investment in the same Uncommitted Sectors will no longer need the approval of the specialized managing ministry.

Licensing procedures on investment registration and enterprise registration by foreign investors

Instead of go through 2 different steps, namely (1) applying for issuance of an Investment Registration Certificate; and (2) applying for issuance of an Enterprise Registration Certificate when establishing an enterprise in Vietnam, foreign investors now can apply for these two certificates at the same time. Specifically:

– Foreign investors submit the applications for issuance of an Investment Registration Certificate and an Enterprise Registration Certificate to the investment registration authority;

– Within 01 working day from the receipt of the applications, the investment registration authority sends the application for enterprise establishment registration to the Business Registration authority for review and notifying the investment registration authority of its decision;

– If there is any request for amendments or supplements to either the application for investment registration or enterprise establishment, the investment registration authority will provide the investors a single response within 5 working days from the receipt of the applications.

The coordination regime between the investment registration authority and the business registration authority will be detailed by the Ministry of Planning and Investment later.

Securing the implementation of an investment project

Investors that are granted, or leased land by the Government, or allowed by the Government to change the land use purpose, with certain exceptions, must make a deposit from 1-3% of the total investment capital recorded in a document approving the investment plan or in the Investment Registration Certificate based on a progressive basis, in particular:

– For capital part of up to VND300 billion, the deposit rate is 3%;

– For capital part from VND300 billion to VND1,000 billion, the deposit rate is 2%;

– For capital part from VND1,000 billion, the deposit rate is 1%.

M&A procedures

There is explicitly no requirement of application for Investment Registration Certificate in acquisitions of target companies by foreign investors.

However, foreign investors must register its acquisition of the target company if:

– They contribute capital to, purchase shares or capital contribution portion of an economic organization doing business in conditional sectors which are applicable for foreign investors;

– The capital contribution, shares and capital contribution portion result in F1, F2 and F2’ mentioned in the graph above holding 51% or more of the target company:

o Increasing foreign ownership rate from below 51% to more than 51%; and

o Increasing the existing foreign ownership rate of 51% to a higher ownership rate.

After completion of the acquisition, the target company must carry out procedures to change its members or shareholders at the business registration authority.

For investment of foreign investors other than F1, F2 and F2’, the target company only needs to carry out procedures to change its members or shareholders at the business registration authority without the foreign investors having to register the acquisition transaction with the investment authority.

***

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Lawyer in Vietnam Oliver Massmann PUBLIC MERGERS AND ACQUISITIONS IN VIETNAM: MARKET ANALYSIS OVERVIEW

Largest / most noteworthy public M&A transactions in the past 12 months

IT and electronic equipment

In June 2014, Vietnam’s leading IT corporation, FPT Software, acquired RWE IT Slovakia, a subsidiary of the RWE Group (one of Europe’s leading utility companies). Therefore, RWE IT Slovakia will be 100% owned by FPT Software and be renamed FPT Slovakia. This deal is also the first M&A transaction of FPT and first M&A deal by a Vietnam ICT company outside Vietnam. However, the deal value has not been disclosed.

Oil gas and chemicals

In November 2014, SapuraKencana Petroleum Berhad (Malaysia) acquired the entire interest of Malaysia’s national oil company Petroliam Nasional Berhad (Petronas) in three blocks offshore from southern Vietnam for US$400 million after an international bidding process.

Financial

Noteworthy public M&A transactions include the following:

• In December 2014, Vietnam National Financial Switching JSC (Banknetvn) merged with Smartlink Card JSC (Smartlink). Banknetvn then became the only card switching company on the market in which the central bank holds 25% of the total shares.

• In May 2015, Sai Gon Thuong Tin Commercial Joint Stock Bank (more commonly known as Sacombank) merged with Southern Commercial Joint Stock Bank. Following the merger, Southern Bank shareholders obtained a 0.75 Sacombank share for each share they held. The merged entity, to be called Sacombank, will have a charter capital of more than VND18.85 trillion (US$856 million) and total assets of over VND290.86 trillion (US$13.2 billion). Sacombank’s shareholders agreed to the merger by a 93.7% vote.

• In May 2015, the merger between the Mekong Housing Bank and the Bank for Investment and Development of Vietnam was completed.

• In April 2015, Credit Saison spent about JPY5 billion to take a 49% stake in HDFinance, Vietnam’s third largest consumer finance business.

• In August 2015, the Mekong Development Bank (MDB) was set to merge with the Vietnam Maritime Commercial Bank (Maritime Bank) to form an institution that would be among the country’s five largest banks in terms of charter capital. Currently, Maritime Bank’s charter capital is US$373.8 million and MDB’s is US$175.23 million, meaning that the new banking institution would have a charter capital of US$549 million and total assets of US$5.28 billion.

• The Vietnam Bank for Industry and Trade (Vietinbank) will merge with Petrolimex Group Commercial Joint Stock Bank (PG Bank). The change rate for PG Bank shares to Vietinbank shares is 1:0.9, which means Vietinbank will exchange 270 million of its shares for 300 million of PG Bank shares. The merger will increase Vietinbank’s total assets by VND25 trillion (US$1.19 billion) to VND685 trillion (US$31.7 billion), and its chartered capital by VND3 trillion (US$142.86 million) to more than VND40 trillion (US$1.85 billion).

Mining, metals and engineering

In 2014, Vietnam Coal and Minerals Group (Vinacomin) sold 100% of its charter capital in Vietnam Coal – Mineral Single Member Financial Limited Company to Vietnam Prosperity Bank (VP Bank). The deal value has not been disclosed.

Pharmaceuticals, biotechnology and healthcare

In September 2014, Standard Chartered Private Equity successfully acquired a significant minority stake in An Giang Plant Protection JSC, a market leader in the Vietnam agricultural sector for US$90 million.

Other

Retail. Noteworthy public M&A deals include the following:

• In August 2014, Thailand’s Berli Jucker Public Company Limited (BJC) bought Metro Cash & Carry Vietnam in a deal valued at EUR655 million.

• Thailand’s Central Group completed the acquisition of 49% of the total shares in NKT New Technology and Solution Investment and Development Corporation, the owner of Nguyen Kim Trading Company. The deal value has not been disclosed.

• Vingroup bought 70% of the total shares in Ocean Retail Company, a member of Ocean Group that owns the OceanMart retail system in northern Vietnam, and renamed it VinMart Retail Group. The deal value is US$26 million.

Food. Noteworthy deals include the following:

• In April 2015, Masan Group announced the acquisition of stakes in two companies. It acquired 52% of the total shares in Vietnam French Cattle Feed JSC (Proconco) and 70% of the total shares in Agro Nutrition Company JSC (Anco). The acquisition occurred when the group bought 99.99% of the total shares in Sam Kim Limited Liability Company and renamed it Masan Nutri-Science Company.

• In May 2015, Filipino firm Pilmico Foods Corporation acquired some feed companies in Vietnam in an expansion bid. Pilmico, a subsidiary of the Aboitiz Group, had bought 70% of the total shares in Vinh Hoan 1 Feed JSC (VHF) at US$28 million in 2014.

• F&N Dairy Investments Pte Ltd holds 110.4 million shares of Vietnam Dairy Products Joint Stock Company (Vinamilk), equivalent to 11.04% of its charter capital. It is now the second largest shareholder of Vinamilk after the State Capital Investment Corporation (SCIC).

• Mondelēz International completed the acquisition of 80% of the total shares in Kinh Do Corporation, a popular snack business in Vietnam, for about US$370 million

Real estate. Noteworthy deals include the following:

• In January 2014, the Hong Kong-based Tung Shing Group acquired 53% of the total shares in Mövenpick Saigon Hotel in Phu Nhuan District, for approximately US$16 million.

• In March 2015, Lotte Group acquired 70% of the Diamond Plaza project. The building had benefited from an initial investment of about US$60 million. However, Lotte Group did not reveal the amount of money spent on the deal.

• In November 2014, Ho Chi Minh City-based property company, Novaland Joint Stock Company, bought some stalled projects, including Icon 56 and Galaxy 9 in District 4 and Lexington Residence in District 2, which had benefited from investments of about VND3 trillion (US$142.5 million).

• In June 2015, Gaw Capital Partners (GCP), the Hong Kong-based private equity firm, acquired an existing portfolio of real estate projects in Vietnam. The portfolio was purchased for US$106 million and is comprised of four of the remaining projects originally held under Indochina Land Holdings 2 Ltd.

• In early July 2015, Gamuda Land Vietnam, a division of Malaysian property developer Gamuda Berhad acquired Celadon City from the Saigon Thuong Tin Real Estate JSC (Sacomreal) and the Thanh Thanh Cong JSC (TTC) for an estimated VND1.4 trillion (US$64.1 million). The estimated original investment is VND24.8 trillion (US$1.1 billion).

• In 2015, Vingroup has become a dominant local M&A acquirer with a long list of transactions in the real estate, retail and logistics sectors. Its most notable additions include:

o Masteri Thao Dien for US$75 million;

o 30% stake ownership in Vinatex for US$26 million;

o 90% stake ownership in Giang Vo Trade Show Center for US$69 million; and

o 30% stake ownership in Hop Nhat Express for US$52 million.

• In November 2014, the US-based Global Emerging Markets Fund (GEM) agreed to acquire 10% of Hoang Anh Gia Lai, a Vietnamese plantation and real estate company, for US$80 million. GEM will obtain a board seat and will support the company potential listing on the international markets in the future.

Insurance. In April 2015, Canada-headquartered Fairfax Financial Holdings, through its subsidiary Fairfax Asia Limited, acquired about 35% of the total shares of the Bank for Investment and Development of Vietnam Insurance Joint Stock Corporation for US$50 million, therefore becoming a strategic investor in the firm.

The major trends in the structuring of public M&A transactions

In Vietnam, M&A transactions usually take the form of either share or asset acquisitions, with share acquisition transactions outnumbering asset acquisition transactions.

Share acquisitions by foreign purchasers are commonly structured as offshore direct investments. The new investor can:

• Acquire shares or capital contributions from an existing shareholder in the target (for example, a joint stock company, limited liability company, and so on).

• Subscribe for newly issued shares of the target (for a joint stock company).

• Make further capital contributions to the target (for a limited liability company).

In the case of an asset deal, a foreign purchaser must generally establish a new subsidiary in Vietnam.

In addition, M&A transactions can also take the form of a merger. One or more companies of the same type can be merged into another company by transferring all assets, rights, obligations and interests to the merged company, terminating the existence of the merging company.

The 2014 Enterprise Law sets out the types of business structuring that can be used by investors as a result of M&A transactions. In addition, the 2014 Investment Law is the first law that regulates M&A transactions and clearly provides that such transactions do not require an investment certificate. This change will hopefully end years of uncertainty and frustration faced by foreign investors seeking entry into the Vietnam market or expansion through M&A transactions. However, it is still early to assess the effectiveness of these laws, as they have only been implemented since July 2015, and their guiding documents have not been issued yet. This has left enterprise registration and licence amendments in limbo, particularly for enterprises that have obtained licences under the former Enterprise Law and Investment Law. This situation has a direct impact on M&A transactions.

The level/extent of private equity-backed bids in the past 12 months

Investment in the form of M&A transactions is still the most popular form compared with private equity investment. In recent months, private equity funds have been following the securities market in Vietnam, especially companies carrying out value chain operations. Consumer goods and infrastructure are the sectors that attract the most attention. However, due to limited publicly available information, it is not possible to fully assess the level of private equity-backed bids.

The approach of the competition regulator(s) in the past 12 months

The Vietnam Competition Authority under the Ministry of Industry and Trade (VCA) must be notified of the transaction if participating companies have a combined market share in the relevant market of 30% up to 50%. The VCA will then examine whether the calculation of the combined market share is correct and whether the transaction is prohibited (that is, whether the combined market share exceeds 50%, except in certain cases). The transaction can be conducted when the VCA issues a written confirmation that the transaction is not prohibited under competition law.

For more information on the VCA, see www.vca.gov.vn/Default.aspx?lg=2.

Main factors affecting the public M&A market over the next 12 months

The country’s deeper and wider integration into the world’s economy is offering new opportunities for M&A activities.

Another factor is the government’s target to equitise state-owned enterprises (SoEs). The Prime Minister approved the plan to turn 432 SoEs into joint stock companies in the 2014-2015 period. To date, 176 of such companies have been equitised. Initial public offerings by major SoEs have been creating new, attractive supplies to the M&A market. The restructuring of commercial banks and divestments from non-core business by SoEs have made the M&A market more attractive.

Encouraging signs for foreign investment include:

• Economic recovery.

• Reformed policies to allow wider access to foreign investors.

• The conclusion of free trade agreements (FTAs) and the Trans-Pacific Partnership (TPP).

• The bouncing back of the stock market.

• New regulations that increase the authorised levels of foreign investment in public listed companies.

The introduction of the new Investment Law, Enterprise Law and other laws and policies are creating an improved legal environment for investment and trade in general, and the M&A market in particular. However, the following factors also affect M&A transactions:

• Divergent interpretations and implementations by local licensing authorities of international treaties such as Vietnam’s WTO Commitments.

• Different licensing procedures applied to different types of transactions (for example, for foreign invested companies and domestic companies, public companies and private companies, and for buying state-owned shares or private shares).

Although legal and governance barriers, along with macro instability and the lack of market transparency are still the greatest concerns for investors, M&A deals in Vietnam are still expected to be one of the key, effective channels for market entry.

The major expected trends in the Vietnam M&A market include:

• Bank restructurings.

• Acquisitions and anti-acquisitions.

• Growing Japanese investment in Vietnam through M&A transactions.

• Reform of SoEs.

The derivatives market is expected to open in 2016, which will help in preventing risks, boosting the growth of the stock market and in promoting M&A deals.

***

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Lawyer in Vietnam Oliver Massmann Public Merger and Acquisitions in Vietnam

There has been a steady growth in M&A activities in Vietnam since Vietnam officially became a member of the World Trade Organization (WTO) in 2007. The first M&A wave in Vietnam occurred during the period between 2008 and 2013, with a reported total value of US$15 billion. Japanese investors made about US$1.2 billion worth of deals in 2012. Japan is the leading country for M&A deals in Vietnam in terms of both quantity and value. This helped the M&A market in Vietnam to reach a peak of US$5.1 billion in 2012. Fast-moving consumer goods are considered to be the most attractive sector, with a total value of M&A transactions up to US$1 billion, accounting for 25% of the total M&A value in Vietnam. The retail and real property sectors are also very active, with high value M&A deals. Vietnam’s M&A market experienced a strong recovery in 2014, with six deals being reportedly made every week. There were a total of 313 M&A deals in 2014, with a value of US$2.5 billion, a 15% increase compared with the previous year.

How to obtain control of a public company

The most common means of obtaining control over a public company are as follows:

The acquisition of shares/charter capital through:

buying shares/charter capital from the existing shareholders of the company;

buying shares/charter capital of a listed company on the stock exchange; and

public share purchase offer.

Through a merger. The 2014 Law on Enterprises sets out the procedures for company mergers by way of a transfer of all lawful assets, rights, obligations and interests to the merged company, and for the simultaneous termination of the merging companies.

Through the acquisition of assets.

There are restrictions on the purchase of shares/charter capital of local companies by foreign investors. In addition, the law does not yet allow merger or assets acquisition transactions where a foreign investor is a party.

Securities of public companies must be registered and deposited at the Vietnam Securities Depository Centre before being traded.

Depending on the numbers of shares purchased, an investor can become a controlling shareholder. Under the Vietnam Law on Securities, a shareholder that directly or indirectly owns 5% or more of the voting shares of an issuing organisation is a major shareholder. Any transactions that result in more than 10% ownership of the paid-up charter capital of the securities company must seek approval of the State Securities Commission (SSC).

What a bidder generally questions before making a bid

Before officially contacting the potential target, the bidder conducts a preliminary assessment based on publicly available information. The bidder then contacts the target, expresses its intention of buying shares/subscribing for its shares and the parties sign a confidentiality agreement before the due diligence process. The confidentiality agreement basically includes confidentiality obligations in performing the transaction. The enforcement of confidentiality agreements by courts in Vietnam remains untested.

A bidder’s legal due diligence usually covers the following matters:

Corporate details of the target and its subsidiaries, affiliates and other companies that form part of the target.

Contingent liabilities (from past or pending litigation).

Employment matters.

Contractual agreements of the target.

Statutory approvals and permits regarding the business activities of the target.

Insurance, tax, intellectual property, debts, and land-related issues.

Anti-trust, corruption and other regulatory issues.

Restrictions on shares transfer of key shareholders

Founding shareholders can only transfer their shares to other founding shareholders of the company within three years from the issuance of the Enterprise Registration Certificate. After then, the shares can be transferred freely. An internal approval of the general meeting of shareholders is always required if:

The company increases its capital by issuing new shares.

There is any share transfer of the founding shareholders within the above three-year period.

If the sale and purchase is a direct agreement between the company and the seller in relation to an issuance of shares, the selling price must be lower than the market price at the time of selling, or in the absence of a market price, the book value of the shares at the time of the approval plan to sell the shares. In addition, the selling price to foreign and domestic buyers must be the same.

When a tender offer is required

A tender offer is required in the following cases:

Purchase of a company’s circulating shares that results in a purchaser, with no shareholding or less than a 25% shareholding, acquiring a 25% shareholding or more.

Purchase of a company’s circulating shares that results in a purchaser (and affiliated persons of the purchaser), with a 25% or more shareholding, acquiring a further 10% or more of circulating shares of the company.

Purchase of a company’s circulating shares that results in a purchaser (and affiliated persons of the purchaser), with a 25% shareholding or more, acquiring a further 5% up to 10% of currently circulating shares of the company within less than one year from the date of completion of a previous offer.

There is no guidance on building a stake by using derivatives. In addition, the bidder cannot purchase shares or share purchase rights outside the offer process during the tender offer period.

The bidder must publicly announce the tender offer in three consecutive editions of one electronic newspaper or one written newspaper and (for a listed company only) on the relevant stock exchange within seven days from the receipt of the State Securities Commission’s (SSC’s) opinion regarding the registration of the tender offer. The tender offer can only be implemented after the SSC has provided its opinion, and following the public announcement by the bidder.

Making the bid public

The offer timetable is as follows:

The bidder prepares registration documents for its public bid to purchase shares.

The bidder sends the bid registration documents to the SSC for approval and, at the same time, sends the registration documents to the target.

The SSC reviews the tender documents within seven days.

The board of the target must send its opinions regarding the offer to the SSC and the shareholders of the target within 14 days from receipt of the tender documents.

The bid is announced in the mass media (although this is not a legal requirement).

The length of the offer period is between 30 and 60 days.

The bidder reports the results of the tender to the SSC within 10 days of completion.

Companies operating in specific sectors (such as banking, insurance, and so on) can be subject to a different timetable.

Form of consideration and minimum level of consideration

Under Vietnamese law, shares can be purchased by offering cash, gold, land use rights, intellectual property rights, technology, technical know-how or other assets. In practice, acquisitions are most commonly made for cash consideration.

In cases of full acquisition of state-owned enterprises, the first payment for the share purchase must not be less than 70% of the value of such shares, with the remaining amount being paid within 12 months.

In transactions involving auctions of shares by state-owned enterprises, the purchaser must make a deposit of 10% of the value of the shares registered for subscription based on the reserve price at least five working days before the auction date included in the target company’s rule. Additionally, the purchaser must transfer the entire consideration for the shares into the bank account of the body conducting the auction within ten working days of the announcement of the auction results.

In the case of a public tender offer, the payment and transfer of shares via a securities agent company appointed to act as an agent for the public tender offer must comply with Decree 58/2012/ND-CP.

Delisting a company

If a company seeks voluntarily de-listing, it must submit an application for de-listing that includes the following documents:

A request for de-listing.

For a joint stock company:

the shareholders’ general meeting approval of de-listing of the stock;

the board of directors’ approval of de-listing of bonds; and

the shareholders’ general meeting approval of de-listing of convertible bonds.

The members’ council (for a multi-member limited liability company) or the company’s owner (for a single member limited liability company) approval of de-listing of bonds.

For a securities investment fund, the investors’ congress approval of de-listing of the fund’s certificate.

For a public securities investment company, the shareholders’ general meeting approval of stock de-listing.

A listed company can only de-list its securities if de-listing is approved by a decision of the general meeting of shareholders passed by more than 50% of the voting shareholders who are not major shareholders.

If a company voluntarily de-lists from the Hanoi Stock Exchange or Ho Chi Minh Stock Exchange, the application for de-listing must also include a plan to deal with the interests of shareholders and investors. The Hanoi Stock Exchange or Ho Chi Minh Stock Exchange must consider the request for de-listing within ten and 15 days from the receipt of a valid application, respectively.

Transfer duties payable on the sale of shares in a company

Depending on whether the seller is an individual or a corporate entity, the following taxes will apply:

Capital gains tax. Capital gains tax is a form of income tax that is payable on any premium on the original investor’s actual contribution to capital or its costs to purchase such capital. Foreign companies and local corporate entities are subject to a corporate income tax of 22% (20% from 1 January 2016). However, if the assets transferred are securities, a foreign corporate seller is subject to corporate income tax of 0.1% on the gross transfer price.

Personal income tax. If the seller is an individual resident, personal income tax will be imposed at the rate of 20% of the gains made, and 0.1% on the sales price if the transferred assets are securities. An individual tax resident is defined as a person who:

stays in Vietnam for 183 days or longer within a calendar year;

stays in Vietnam for a period of 12 consecutive months from his arrival in Vietnam;

has a registered permanent residence in Vietnam; or

rents a house in Vietnam under a lease contract of a term of at least 90 days in a tax year.

If the seller is an individual non-resident, he is subject to personal income tax at 0.1% on the gross transfer price, regardless of whether there is any capital gain.

Payment of the above transfer taxes is mandatory in Vietnam.

Restrictions on repatriation of profits and/ or foreign exchange rules for foreign companies

If the target company in Vietnam already has an investment certificate, it must open a direct investment capital account at a licensed bank in Vietnam. Payment for a share purchase by a foreign investor must be conducted through this account. The account can be denominated in Vietnamese dong or a foreign currency. In addition, if the foreign investor is an offshore investor, it will also need to open a capital account at a commercial bank operating in Vietnam to carry out the payment on the seller’s account and receive profits.

If the target company in Vietnam does not have an investment certificate, the foreign investor will need to open an indirect investment capital account for payment to the seller and remittance of profits.

***

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Lawyer in Vietnam Oliver Massmann BREAKING NEWS The Trans Pacific Partnership Agreement VIETNAM WILL REAP HUGE BENEFITS

Trade ministers reached an agreement on the TPP on Monday (05 October 2015) after five days of intensive talks, following their failure to reach consensus in Hawaii in late July.

The TPP is one of the largest trade agreements ever to be negotiated, involving some of the largest nations in the world with an annual gross domestic product of nearly $28 trillion that represents roughly 40 percent of global GDP and one-third of world trade. Countries participating in the negotiations include those throughout the Asia- Pacific region, namely Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States and Vietnam. The TPP is touted to be the 21st century trade agreement, set a template for regional and global trade and investment and incorporate next-generation issues.

The TPP addresses a number of rising trade issues which have been stumbling blocks to global trade recently, such as e-commerce, financial services and cross-border electronic communications. Other cross-cutting issues are also covered, such as role of state-owned enterprises in the economy, government procurement, and other topics.

Vietnam would be the largest beneficiary of this trade pact as a result of its strong trade ties with the United States, and its highly competitive positions in industries such as manufacturing where China is gradually losing its competitive advantage. Vietnam is also considered as one of the countries among Japan, Malaysia, Brunei, New Zealand that the United States would like to establish formal trade agreements. Statistics shows that by participating in the TPP, Vietnam’s GDP would add an additional increase of 13.6% to the baseline scenario.

Some major points in the TPP are as follows:

Free trade zone: tariff and quotas have been long used as trade measures to protect domestic industries from cheap overseas goods and efficient sources of collecting revenue for the states, especially for developing ones. However, tariff and quotas have been used less compared with other non-tariff measures in the past years. With the TPP, tariff and non-tariff barriers are even reduced and removed more substantially across all trade in services and goods. TPP Parties, especially Vietnam, would gain many benefits from the upcoming business opportunities and open market access resulting from the trade pact.

Trade in goods

With tariff and non-tariff reduction and elimination on industrial goods, high quality- jobs will be supported and trade in a 800-million people market will increase. Most tariff elimination will be implemented immediately, with tariff on some other products will be reduced over a committed period of time. For elimination and reduction of restrictive policies on agricultural goods, food security will be enhanced. Vietnam’s agricultural products will have more opportunities to be exported to other TPP members and gain their competitive advantage due to cheap labors and natural endowments.

Trade in services

Trade in services is of utmost importance to all TPP Parties. Thus, all 12 countries give consent to a liberalized trade in this area. Besides incorporating basic WTO principles (national treatment, most-favored nation treatment, market access, and local presence), the TPP takes a negative approach, meaning that their markets are fully opened to service suppliers from other TPP Parties, except otherwise indicated in their commitments.

Comprehensive trade: The TPP includes commitments that seek to encourage participation and development of businesses of all levels and sizes. Small-and medium-sized businesses, which are quite popular in Vietnam, will receive assistance from other countries to understand the agreement, take advantage of their opportunities, build their own trade capacity to grow fast in the future.

Government procurement: All TPP parties commit to ensure transparent, predictable and non-discriminatory government procurement markets. National treatment and non-discrimination are core principles. Governments undertake to timely publish information on tender, allow sufficient time for bidders to prepare for and submit bids, maintain confidentiality of tenders. The TPP also requires its Parties assess bids based on fair and objective principles, evaluate and award bids only based on criteria set out in notices and tender documentation, create an effective regime for complaints and settling disputes, etc. These rules require all Parties, especially Vietnam, in the context of China’s bidders predominantly win the bids with cheap offer price but low-quality services, to reform their bidding procedures and protect their own interests by disqualifying tenders with poor performance and low capacity.

State-owned enterprises: Vietnam and Malaysia have many state-owned enterprises. The United States and others have some as well which are involved in public services and other activities. TPP negotiators have place emphasis on how to regulate operation of such enterprises, preferential treatment granted to these enterprises, non-discrimination of the state-owned enterprises against other countries’ goods and services. Participating in the TPP would then be a driving force for Vietnam in its privatization process of 432 state-owned enterprises in the 2014-2015 period. The remaining Vietnamese state-owned enterprise will also need to undergo strict reform procedures to meet standard requirements in the TPP.

Transparency and anti-corruption: The TPP includes rules on goods governance, bribery and corrosive anti-corruption, which have long been considered as one of the factors that discourage investors when deciding their business expansion, especially in countries like Vietnam with corruption index ranking Number 119 out of 175 countries globally according to Transparency International. The TPP Parties have agreed on adopting or maintaining laws criminalizing corruption behaviors by a public official affecting international trade or investment. Parties also commit to effectively enforce their anticorruption laws and regulations. As part of the TPP, Vietnam’s business environment in terms of transparency and “cleanliness” would be much improved, paving the way for more foreign investment in the upcoming time.

Other important trade and trade-related issues are covered in 30 chapters of the TPP, ranging from customs and trade facilitation; sanitary and phytosanitary measures; technical barriers to trade; trade remedies; investment; intellectual property; labor; environment; dispute settlement; etc. All TPP parties are conducting procedures to release the text of the agreement, which would then have to be approved domestically in each country member.

***

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Lawyer in Vietnam Oliver Massmann Solar Power Vietnam Breaking News: First Ever Regulations GOVERNMENT’S INCENTIVES TO DEVELOP SOLAR POWER PROJECTS IN VIETNAM

Vietnam is among the countries with the world’s highest annual sunshine allocation on the world’s solar radiation map. This is an advantage for Vietnam in its efforts to develop a solar power industry, in the context of increasing demand for electricity and the potential risks of traditional electricity production sources.

To encourage investment in renewable energy projects, the Vietnam Ministry of Industry and Trade (MOIT) has proposed the first Draft Decision of the Prime Minister on incentives for solar power projects, especially in terms of investment capital, tax and land use rights. These incentives would apply to power generation projects using the photovoltaic method. The following analysis is based on the latest Draft Decision, which will be subject to further changes when the official decision is adopted.

Investment incentives

Investment capital: Investors may mobilize capital from domestic or overseas organizations and individuals to invest in solar power projects. Such projects are entitled to investment credit and export credit incentives. In particular, investors could apply for a loan of up to 70 percent of the total investment capital of their project with a maximum term of 12 years. Moreover, investors could also enjoy export credit incentives in a loan of up to 85 percent of the export/import contract value, also with a maximum term of 12 years.

Import duty: Solar power projects are exempted from an import duty on those goods imported to create fixed assets of the projects; these include components, materials and semi-finished products that are not available in Vietnam and that are needed for the project’s operation.

Corporate income tax: According to current taxation regulations, solar power projects will also enjoy the same corporate income tax exemption and reduction as projects in sectors that are receiving investment incentives. For example, a corporate income tax rate of 10 percent will be applied for 15 years, tax exemptions will occur within four years and taxes will be reduced by 50 percent in the next nine years.

Land: Solar power projects, lines and transformer stations connected to the national grid enjoy the same exemptions and reductions in land use and land rental as projects entitled to special investment treatment. Such incentives, among other things, include exemption of land rental within three years from the operation date of the project.

Who will be the off-taker?

According to the Draft Decision, the Electricity of Vietnam (EVN) or its authorized member units will be the power purchaser. The power sale and purchase will be conducted by negotiating and signing the power sale and purchase agreement according to the template agreement stipulated by the MOIT. Terms of the agreement extend 20 years from the commercial operation date of the project. Duane Morris will continue to monitor the issuance of the template agreement by the MOIT.

Feed-in-tariff (FIT) rate

EVN is responsible for buying the whole electric output from solar power projects, with the electric buying price at the point of electricity receipt to be 1,800 Vietnamese dong/kwh and 3,500 Vietnamese dong/kWh (equivalent to 12 U.S. cents/kWh and 16.7 U.S. cents/kWh).

For solar power projects installed on the roof of a house connected to the grid, if the electricty generated is more than that consumed, the difference to be bought at the point of electricity receipt is 3,150 Vietnamese dong/kWh (not including VAT, equivalent to 15 U.S. cents/kWh). This price will be adjusted based on the fluctuation rate between the Vietnamese dong and U.S. dollar. If the electricity generated is less than that consumed, the electricity received from the grid must be paid at the normal commercial price charged by the electricity purchaser.

The above FIT rate is still low compared to other neighboring Asian countries. In Thailand, the new FIT is THB 5.66/KWh (about 15.7 U.S. cents/kWh) for a solar farm of less than 90MW. For a solar rooftop, the FIT rate varies depending on the capacity of the project. With a solar rooftop of 250–1,000 KW, the FIT would be THB 6.01/kWh (about 17 U.S. cents/kWh). The FIT for solar rooftops of 10–250 KW and less than 10KW are THB 6.40/kWh (about 18 U.S. cents/kWh) and THB 6.96/kWh (about 19 U.S. cents/kWh), respectively. In the current Draft Decision, Vietnam does not draw any difference between the capacity of the solar rooftop projects but sets the FIT rate based on the difference between electricity consumed and generated. Meanwhile, the FIT in the Philippines for solar power projects is also higher than that of Vietnam, i.e., P 9.68/kWh (equivalent to 21 U.S. cents/kWh). As Vietnam’s FIT is still in the drafting process and not yet final, the anticipation is high for this to be amended in the next draft to reach regional levels. This is of vital importance to attract investment.

Conclusion

If the Draft Decision is adopted, it would be the first-ever legal document regulating solar energy in Vietnam. The Government of Vietnam strives to attract foreign investment in the sector and to take full advantage of the plentiful solar energy—an average solar radiation of 5kWh/m2 per day—across Vietnam. Foreign investors, especially those in the U.S, have been eyeing Vietnam for their investment in clean energy. The Government of Vietnam is aware of the need to garner support for these projects and is offering incentives. While these projects may not meet investors’ expectations in the immediate future, the movement appears positive. The developing agreement on the Trans-Pacific Partnership (TPP), affecting Vietnam, the United States and 10 other countries, points the way toward a developing energy sector in general—and clean energy in particular. Therefore, these factors suggest a growing market and plenty of investment incentives for U.S investors, as well as other members of the TPP.

Oliver Massmann is the General Director of Duane Morris Vietnam LLC. Mr. Massmann practices in the area of corporate international taxation and on power/water projects, matters related to oil and gas companies and telecoms, privatization and equitization, mergers and acquisitions, and general commercial matters for multinational clients in relation to investment and doing business in Vietnam. He can be reached at omassmann@duanemorris.com.

Disclaimer: This article is prepared and published for informational purposes only and should not be construed as legal advice. The views expressed in this article are those of the author and do not necessarily reflect the views of the author’s law firm or its individual partners.

Vietnam Foreign Direct Investment

By Oliver Massmann and Manfred Otto – Duane Morris Vietnam LLC

Foreign Direct Investment

A Brief Overview

Vietnam is undergoing fundamental changes to form the basis for its attractiveness and competitiveness in preparation for the ASEAN Economic Community (AEC), the upcoming trade agreements including the EU-Vietnam FTA and the Transpacific Partnership Agreement (TPP).

Since July 2015, a number of new laws and regulations governing foreign investment, enterprises, real estate and foreign ownership limits have come into effect. For example, the new Law on Investment and the new Law on Enterprises:

(i) clarify definitions of foreign-invested enterprises;

(ii) facilitate M&A activities;

(iii) reduce the number of prohibited and conditional business sectors;

(iv) reduce statutory business licensing times;

(v) provide more flexibility with regard to corporate governance (such as multiple legal representatives and lower voting thresholds); and

(vi) create more favourable conditions for shareholder lawsuits.

In addition, new laws and regulations affecting foreign ownership of real estate have come into effect. Foreigners can now own apartments and for the first time buy houses. They are now also permitted to sublease and inherit real estate.

With the coming into effect of several international trade agreements and more particularly, the EVFTA, EuroCham members are looking forward to the positive changes that will be implemented and that will further business incentives as well as contribute to Vietnam’s growth.

Vietnam as an attractive FDI destination

In addition to the numerous legal changes, Vietnam has fundamental elements that participate to its continued growth. For instance, Vietnam is in a demographic golden age, with 25% of its 90 million people population between 10 and 24 years old. GDP per capital is increasing drastically as Vietnam has the fastest-growing middle class in South East Asia – (12.9% per annum over the period 2012-2020). Along with a high literacy rate and education levels, comparatively low wages, connectivity and central location within ASEAN, more and more foreign investors choose Vietnam as their hub to service the Mekong region and beyond.

Vietnam’s attractive profile is reflected in its generally welcoming of foreign direct investment (FDI) in manufacturing activities. The gradual opening of most service sectors under Vietnam’s WTO commitments schedule that began in 2007 has been completed in 2015. Domestic law has expanded market access in some sectors beyond those of Vietnam’s WTO commitments. For example, foreign shareholding in public companies that was previously capped at 49% is now generally open for to up 100% foreign ownership. Vietnam also grants investment incentives including tax breaks in areas, such as high-tech, environmental technology, and agriculture, where European businesses are global leaders.

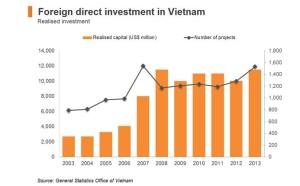

Furthermore, in 2014, Vietnam recorded $21.92 billion in FDI with a total of 1843 investment licenses for foreign invested projects with a registered capital of $16.5 billion, representing a 14% increase from the previous year. Among the foreign investors, the EU is an increasingly important source of FDI for Vietnam as ‘according to the Foreign Investment Agency of the Vietnamese Ministry of Planning and investment, investors from 23 out of 28 Member States of the EU injected a total committed FDI worth US$19.1 billion into 1566 projects over the course of the past 25 years (by 15 December 2014)’. With this strong activity, in 2014, the EU positioned itself as fifth in the top FDI partners of Vietnam with a combined committed FDI of US$587.1 million.

Source: ‘Vietnam’s logistics market: Exploring the opportunities, Hong Kong Trade Development Council (HKTDC)

In addition to FDI, the EU-Vietnam’s strong trade relationship can be seen through programmes like the Multilateral Trade Assistance Project (MUTRAP) which accounts for over €35.12 billion. MUTRAP has been instrumental in supporting Vietnam’s negotiating efforts during the WTO accession process and now continues to assist Vietnam in the implementation of trade commitments. In terms of trade, both the EU and Vietnamese businesses are expected to benefit under the EVFTA. The FTA will gradually eliminate tariffs for over 99% of goods and services besides other mechanisms to support bilateral trade. On 4 August 2015, the EU and Vietnam reached an agreement in principle for the free trade deal, an agreement that will also attract further FDI into the country.

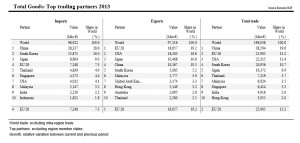

Vietnam’s top trading partners 2013

Finally, the EU’s strong commitment to support Vietnam in its modernisation and integration in the world economy is mirrored by the aid programmes. In line with Vietnam’s 2020 socio-economic plan, the EU has increased its aid by 30 % reaching 400 million euros via its multi-annual indicative programme for the period of 2014-2020 focusing on the development of clean energy in Vietnam.

Further improvements necessary

It is clear that Vietnam’s development and its attractiveness to foreign investors are undeniable as Vietnam is constantly improving its business environment.

However, as of this writing, guiding regulations for many new laws have still not been published, and investors are experiencing delays in the processing of applications. We expect processing times to improve once the new implementing regulations come into effect and officials get accustomed to the changes.

Another issue that has been highlighted by our members is that many foreign investors still face significant challenges when dealing with Vietnam’s bureaucracy. Tax filing, customs clearance, business registration and licensing, and other administrative procedures are often delayed, outcomes can be unpredictable, and businesses find themselves spending resources on administration that they would prefer to invest in expanding their core activities.

Despite remaining hurdles, the national government of Vietnam has expressed an understanding of the issues surrounding foreign investment. Providing foreign investors increased access to its market, the stream of FDI is expected to continue. For many foreign investors the positive economic development of the country and its fundamentals substantially outweigh potential risks.

In this light, EuroCham wishes to present the key issues that our members face in their activity in Vietnam along with some key recommendations. EuroCham hopes to engage in a constructive dialogue and increasing cooperation with the relevant authorities on all the issues presented in this edition in order to improve the business environment for all enterprises in Vietnam and contribute to the country’s fast modernisation.

***

1‘Vietnam; from golden age to golden oldies’, UK FOC, 07/01/15. Available at

2‘Report revises 2014 FDI figures’ Viet Nam News, 18/03/15. Available at

3‘Investment -EU-Vietnam economic and trade relations’, Delegation to the European Union to Vietnam, 2015. Available at

4‘Vietnam’s logistics market: Exploring the opportunities, Hong Kong Trade Development Council (HKTDC), 20/01/15. Available at

5‘Trade – EU-Vietnam economic and trade relations’, Delegation to the European Union to Vietnam, 2015. Available at

6‘European Union, Trade in goods with Vietnam’, European Commission DG Trade, 10/04/15, p.9. Available at

7‘Development Cooperation’, Delegation to the European Union to Vietnam, 2015. Available at

Lawyer in Vietnam Oliver Massmann New Decree Guiding Enterprise Law on Enterprise Registration – Quicker Timeline and Simplified Procedure

On 14 September 2015, the Government issued Decree No. 78/2015/ND-CP on enterprise registration (“Decree 78”). This is a long-awaited decree guiding the 2014 Enterprise Law, replacing Decree No. 43/2010/ND-CP on enterprise registration and Decree No. 05/2013/ND-CP amending Decree No. 43/2010/ND-CP on administrative procedures. Decree 78 will take effect on 01 November 2015. Some positive changes of this new decree are discussed below:

Enterprises are now able to register their operation online

Online enterprise registration is a procedure carried out by the owner of the enterprise or the enterprise itself via the National information gate on enterprise registration.

Online enterprise registration dossier includes the same documents as required by the paper dossier and are converted into electronic form. Online enterprise registration dossier has the same validity as the usual paper one.

Who can execute the enterprise registration documents

The 2014 Enterprise Law allows enterprises to have more than one legal representatives. Signature of each legal representative in enterprise registration documents has the same legal validity. In addition, not only the owner of the enterprise but also the enterprise itself (through its legal representative(s)) could execute the enterprise registration documents and holds responsible for the lawfulness, accuracy and truthfulness of the declared information in the dossier.

Decree 78 no longer requires enterprises:

– Register changes in enterprise registration content within 10 working days from the date the enterprise decides on the changes, except as otherwise required by law;

– Submit their financial statements to the business registration authority in accordance with the law.

Role of the Request for enterprise registration and the Enterprise Registration Certificate (ERC)

The ERC concurrently serves as the Tax Registration of the enterprise and the ERC is not a business license. In case there is any inconsistency between the electronic ERC, Branch Registration Certificate, Representative Office Registration Certificate, Certificate on business location and the paper ones, the one which records information in the enterprise registration dossier has legal validity.

Each enterprise is issued with an enterprise code indicated in the ERC. This code is no longer the business registration code but tax code of the enterprise.

Simplified enterprise registration procedure

In an attempt to reforming administrative procedures and fighting against corruption, Decree 78 clearly states that the enterprise registration authority is not allowed to request for additional documents or other documents not required in the enterprise registration dossier by the law. In this regards, the number of required documents in the application dossier is also reduced significantly.

Time to get an ERC after submission of a valid dossier is shortened to three working days instead of five working days as previously. However, it needs to be seen in practice whether the authority sticks to this timeline.

In case there is any change to the business lines of the enterprise, it does no longer have to register the new business lines but only needs to notify the authority on the same. The notification dossier removes documents confirming the legal capital by the authority in case the new business line requires legal capital; or a valid copy of the certificate of practising for individual according to the specialized areas.

Notably, in a joint stock company, if a founding shareholder has not fully paid for the registered shares, it will automatically no longer be company’s shareholder and its name will be removed from the list of founding shareholders of the company.

***

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

Lawyer in Vietnam Oliver Massmann Core Features of new Investment Law for Investors

1) In your opinion, what are the most important features of the new investment law from an investor’s perspective?

It is considered as the most-investor friendly investment law ever in Vietnam. It provides clearer investment procedure timeline, consolidated conditional business sectors, defined capital ratio to be qualified as foreign investors which determines which licensing procedure applies. Notably, it explicitly states that there would be no investment registration certificate required for M&A transaction.

2) What impact do you expect these to have? How effective do you think this law will be?

The investment environment will become more attractive. Investors would face less burdens and unexpected statutory requirements. A new wave of M&A is expected to come. However, the real effectiveness of this law would need to be assessed at a later stage when the implementing decrees are issued. As long as these documents have not been adopted, positive changes that the new investment law is said to bring are just theoretical.

3) How does this law fit in with the current investment climate of Vietnam, and the growth and development path the country is taking?

Vietnam is making great efforts to integrate into the world’s economy. The EU-Vietnam FTA is at the final stage whereas the TPP is also expected to be concluded soon. The Government of Vietnam is fiercely improving the business and investment environment and making great attempts to achieve key economic indicators of top regional countries until 2016. Resolution No. 19/NQ-CP/2015 of the Government dated 12 March 2015 has set out the Government’s strong commitments and positive changes to improve the business environment and strengthen the economy’s ability to compete in 2015 and 2016 by pushing for reforms to reduce time-consuming and burdensome administrative procedures; enhancing governmental offices’ transparency and accountability; and adopting international standards. These positive changes could be seen clearly in the tax, insurance and customs related sectors.

Please do not hesitate to contact Oliver Massmann under omassmann@duanemorris.com if you have any questions or want to know more details on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

INTERESTED IN DOING BUSINESS IN VIETNAM? VISIT: www.vietnamlaws.xyz

THANK YOU VERY MUCH!

Lawyer in Vietnam Oliver Massmann New Vietnam investment law won’t help public sector

“As only a minority of the shares is offered for sale, the investors are not quite interested.” Oliver Massmann, General Director, Duane Morris Vietnam LLC

A new investment law that took effect in July is likely to keep investment flowing to Vietnam’s private sector but won’t help Prime Minister Nguyen Tan Dung achieve this year’s target for selling minority stakes in several hundred public-sector firms.

Prime Minister Nguyen Tan Dung’s push to sell minority stakes and reduce bloat in nearly 300 Vietnamese state-owned firms by the end of the year is unlikely to be successful despite recent reforms in business laws implemented in July that make it easier for foreign investors to acquire companies.

“This seems to be an ambitious target as the number of privatized enterprises is only 61 in the first six months of 2015,” Oliver Massmann, general director at the Hanoi office of corporate law firm Duane Morris LLP, tells MGO via email. “Moreover, as only a minority of the shares is offered for sale, the investors are not quite interested in the transaction, especially when they would not have any decision-making power or their involvement in the management of the enterprise is very limited.”

Public sector firms account for 30 percent of Vietnam’s GDP, and the country has been seeking to privatize and restructure them in order to reduce their debt, confine spending to core business activities, and help them acquire strategic foreign partnerships. According to a piece Mr. Massmann wrote for industry magazine The Asia Miner last year, state enterprises own 70 percent of property in Vietnam and account for 60 percent of commercial bank credit.

But despite initiating the process of restructuring and reforming public firms several years ago, Vietnam has been unable so far to address a number of factors that are hampering the divestment process.

Vietnam law continues to cap foreign ownership at 49 percent in listed firms, which many public sector enterprises are. And in most cases Vietnam is not selling stakes anywhere near the 49 percent limit — or even large enough to give investors decision-blocking powers.

In addition, it remains difficult for investors to value the shares that are being offered, given the lack of adequate audit reports. As a result, the Vietnamese Ministry of Finance is carrying out valuations of each firm. As recently as last month, Asian Development Bank’s chief economist Aaron Batten noted that only 8 percent of state firms publish financial reports on their websites, according to a report in the English-language daily Viet Nam News.

Due to these unresolved factors, Vietnam also fell short of its disinvestment target in 2014. Now, with stock markets in the region wobbly, public sector firms are likely to have an even harder time than they did last year, when as many as 143 firms were able to privatize some shares, according to Vietnamese media reports.

Mr. Massmann clarified, however, that the lack of investor interest in public enterprises comes against the backdrop of an improved overall investment and business climate in the country.

The 2014 Investment Law, which went into effect July 1, does away with something called an investment certificate, a business registration for foreign investors that was supposed to be approved in 45 days but in practice took four to six months to process, according to Mr. Massmann’s firm.

The law has also reduced the number of “conditional” business activities, areas of the economy in which investors have to seek approval with provincial planning departments. Construction, urban planning and education continue to remain conditional activities, but even in these sectors, acquisitions should become much easier, business analysts say.

Meanwhile, earlier tax law changes have also drastically cut the hours businesses spend on tax preparation and filing,

Vietnam has made “positive changes to improve the business environment and strengthen the economy’s ability to compete in 2015 and 2016,” Mr. Massmann tells MGO.

The apparel and textile manufacturing sector has drawn a large share of investment this year and is likely to continue to do so. Seafood processing, electronics manufacturing and retail and banking are also likely to attract investment into next year.

Mr. Massmann also foresees that the government will try to make investing in state firms more attractive by increasing the share of equity for sale, something that has so far been resisted by the management of many state firms, who perhaps fear that equity shares that allow for closer scrutiny of corporate governance could expose poor management or even corruption.

***

Please do not hesitate to contact Mr. Oliver Massmann under omassmann@duanemorris.com if you have any questions on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.