Vietnam is the most investment worthy place in ASEAN – this is a common response of many foreign investors when being asked about their investment plan in the upcoming years. This is not an exaggeration about Vietnam’s current investment environment as well as its potentiality but is in fact based on valid and practical grounds, where improved economic diversification, international integration, reformed investment legislation and good economic policy must be counted.

Economic recovery and stable development

According to a recent statistics by the General Statistics Office, GDP growth of Vietnam over the first six months is quite high, at 6.28%. This is the highest growth for the past five years and could be far over the targeted growth for 2015. Not only the Vietnamese Government is optimistic about the economic development of the country this year, other international organizations also provide positive forecast about Vietnam’s GDP growth in 2015. For example, ANZ maintains its forecast about Vietnam’s GDP growth to be at 6.5% in 2015 and 2016 based on positive signals such as increased domestic demand, increasing attraction of foreign direct investment of the manufacturing industry and consumer confidence index reaching a new peak in June. Vietnam is also the only country among the nine East Asian countries that World Bank raises its GDP forecast in 2015 compared with its previous forecast at the end of 2014. “The world in 2050”, a study made by PwC, concludes that Vietnam will have the second highest annual GDP-growth rate worldwide. There will be an average growth by 5.3% each year, from 2014 till 2050. That means Vietnam will have the fastest growing economy within Asia till 2050. In addition, the inflation rate is controlled by the Government with Consumption Price Index to be in the range of 3-5% for the whole year, which is far below the maximum allowed inflation rate of 5% in 2015. These two important macroeconomic indices have proved the Government’s success to a certain extent in recovering and maintaining stable development of the economy.

Government’s sound economic policy and positive results

Together with macroeconomic stability and controlled inflation, the Government of Vietnam is fiercely improving the business and investment environment and making great attempts to achieve key economic indicators of top regional countries until 2016. Resolution No. 19/NQ-CP/2015 of the Government dated 12 March 2015 has set out the Government’s strong commitments and positive changes to improve the business environment and strengthen the economy’s ability to compete in 2015 and 2016 by pushing for reforms to reduce time-consuming and burdensome administrative procedures; enhancing governmental offices’ transparency and accountability; and adopting international standards. Up to 01 January 2015, the total time for tax compliance is reduced to 370 hours per year, which is an impressive decrease compared with 872 hours annually according to the 2013 statistics. Time for tax declaration and payment is also reduced to 121.5 hours per year, with possibility of online tax declaration and payment. In 2014, 95% of the enterprises have conducted online tax payment compared with 65% of previous years.

With the implementation of single window regime at international sea ports, it is expected that goods clearance time would be reduced from 21 days to 14 days for exports and 13 days for imports. Enterprises would benefit from the reduction of 10-20% in costs and 30% in customs clearance time if the national customs single window regime is fully implemented.

Not only in the tax and customs sectors, the Government also managed to reform administrative procedures in insurance sector. The total time for insurance payment is decreased by 100 hours, from 335 hours to 235 hours per year.

Vietnam’s regional and international integration

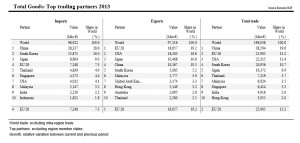

Investors consider that Vietnam’s current efforts to integrate into the world economy by negotiating many Free Trade Agreements (FTAs) also brings them better investment opportunities. In particular, Vietnam, together with other 12 countries, including its major trading partners like Japan and the United States is negotiating the Trans-Pacific Partnership (TPP) with market size of 800 million people (accounting for 38% of global GDP). Vietnam would be the largest beneficiary of this trade pact as a result of its strong trade ties with the United States, and its highly competitive positions in industries such as manufacturing where China is gradually losing its competitive advantage. Statistics shows that by participating in the TPP, Vietnam’s GDP would add an additional increase of 13.6% to the baseline scenario.

Beside the TPP, the EU- Vietnam FTA will also unlock huge opportunities to Vietnam such as tariff reductions, trade facilitation, investment attraction, expansion of markets to 27 EU countries, sustainable development and economic restructuring. 99% of Vietnam’s exports to the EU will be entitled with 0% import duty, leading to an increase of 30-40% in exports and 20%-25% in imports.

Vietnam and nine ASEAN countries will establish an ASEAN Economic Community (AEC) by end of this year. This is a potential and dynamic market with over 620 million consumers, 60% of which is under the age of 35. This community, once established, would be the 7th largest economy in the world – 4th largest by 2050 if growth trends continue. AEC will be an attractive single production hub and facilitate international trade. The aim is to remove barriers to investment and enhance free movement of skilled labours. Investors can have a production base in one country and sell their products across the rest. Many foreign investors have started the trend and relocated their production base from other countries, especially from China, to Vietnam as shown in examples below.

Other FTAs that Vietnam has just concluded are Vietnam – Korea FTA and Vietnam – Eurasian Economic Union. These FTAs open the doors for Vietnam to export its textiles, leather, wood furniture, and agricultural products, etc. These FTAs are driving foreign investors to increase the investment capital and expand their businesses in Vietnam. The FTAs are expected to create a second investment wave in Vietnam after the first wave when Vietnam acceded to the WTO in 2007.

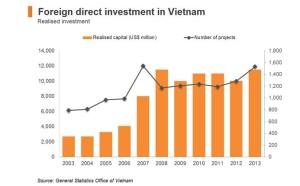

Second investment wave in Vietnam

It is no longer in theory. Vietnam is actually benefitting the most from growing wages in China, with more and more manufacturers shifting their production to Vietnam. foreign investors of a number of high-tech investment projects in Vietnam have decided to increase the investment capital and expand their production activities to timely grab the opportunities that FTAs create when they come into effect.

Recently, Bel Vietnam, a famous producer of French cheese in Vietnam has started constructing a 17,000 m2 new factory in Binh Duong with the total investment capital of US$17 million. The factory is expected to come into operation by June 2016 and full operation will be in 2020 with its capacity to be 9 times as much as the old factory. According to the General Director of Bel Vietnam, the new factory will be used as a regional supply centre, focusing on South East Asian market to take advantage of the AEC. The new factory will also serve as an R&D centre for products of the group.

LG Group is another case. Its initial investment capital was US$ 300 million to build a factory in Hai Phong. However, it then decided to increase the capital to US$ 1.5 billion. The factory is the largest complex in the region in an area of 800,000 m2, which will manufacture and assemble high tech products such as TVs, mobile phones, vacuum cleaners, etc. for export and domestic consumption.

Samsung in its export-oriented investment strategy announced its increase in investment capital by US$ 3 billion on 10 November 2014. Samsung is currently operating US$ 1 billion, US$ 2 billion and US$ 2.5 billion plants in Thai Nguyen and Bac Ninh Province. The additional US$ 3 billion is used to expand the US$ 2 billion plant to produce handsets. This is another example of production shifting away from China as a result of South Korea’s low exports to this country.

Other investors in textile sector are also preparing their entry into Vietnam’s market to grasp the advantages of the upcoming TPP. Since members of the TPP do not include China, India and Thailand, who are the direct competitors of Vietnam in the textile industry, Vietnam will have price related competitive advantage over these countries due to tax preferential treatment that TPP countries grant to Vietnam. This is critical considering the fact that China and the EU are still studying about the possibility to negotiate an FTA with each other. Up to now, Itochu Group from Japan has purchased 3% of Vinatex’s shares at US$ 9.25 million and invested in certain textile projects in Vietnam. A Taiwanese textile group has also increased its capital investment by US$ 320 million to conduct a complete production process in Vietnam. It is expected that with the TPP, Vietnam’s textile export turnover will reach US$ 30 billion in 2020 and US$ 55 billion in 2030. Not only in the textile industry, there has recently been a range of relocation of production facilities for low value goods such as footwear from China to Vietnam as investors search for lower production costs. According to 2014 statistics, more than 70% of foreign direct investment projects in Vietnam was in the manufacturing and assembly processing sectors. This number has already included low value-added textile and material manufacturing from China.

New investment legislation

At the same time, the Government is really aware of the importance of institutional reforms in improving the business climate. It is becoming more important when the new trade pacts are coming into effect very soon and institutional reforms are among conditions of these agreements. New laws considered the most liberal and investor-friendly in the region, such as the new Enterprise Law, Investment Law and a decree on Public Private Partnership, have been adopted. Barriers to business and investment are removed to pave the way for an open, transparent and full-of-opportunity environment for foreign investors. The 2014 Investment Law makes a great attempt to reduce the number of prohibited business activities and conditional business activities. More importantly, the 2014 Investment Law for the first time includes provisions regulating M&A activities. Accordingly, starting from 01 July 2015, foreign investors will not need to undergo lengthy investment certificate procedures when buying stakes in Vietnamese target companies. The change will hopefully end years of uncertainty and frustration faced by foreign investors eyeing Vietnam market entry or expansion via M&A. The second wave of M&A seems to already start in 2014 when six deals are reportedly made every week. The total M&A deals in 2014 was 313 with value of US$2.5 billion, a 15% increase compared with the previous year. Notable deals in 2014 include the acquisition of 19 Cash & Carry and their related real property of Metro by Berli Jucker with deal value of US$ 879 million; Vingroup bought 70% of Ocean Retail Company’s capital; Mondelez International bought 80% of Kinh Do JSC’s capital in sweets manufacturing section at US$370 million; and Standard Chartered Private Equity acquired a significant minority stake in An Giang Plant Protection JSC at US$90 million. The business community highly hopes that total value of M&A deals could reach US$20 billion in the second wave (2014-2018).

Meanwhile, the 2014 Enterprise Law grants certain flexibilities for investors to manage their entities in Vietnam by allowing multiple legal representatives and carry out all types of business activities provided that they are not prohibited by law.

Potential privatization market

In addition, the Government aims at privatizing 289 state-owned enterprises in 2015 and highly emphasized on substantive and efficient privatization. The number of commercial banks is forced to be reduced to 13-15 in 2017 and smaller banks under the pressure of competition and capital requirements will look for new foreign investors to achieve expansion. The Government is also aware that privatization process must increase the number of shares sold and ensure a win-win solution for both investors and the government. During the 2000- 2013 period, the number of state-owned enterprises fell by almost 50% from 5,800 to 3,135. Privatization was reported to be successful with over 80% growths in earnings, while 40% had growth of over 10% following privatization. These successes drive foreign investors in their investment in these very potential areas.

Relaxed foreign ownership in public listed companies

In an attempt to ease burdens on investors, on 26 June 2015, the Government issued Decree No. 60/2015/ND-CP to provide more flexibilities in foreign ownership ratio in public listed companies, up to 100% in certain cases. Decree 60 also allows foreign investors to make unlimited investment in Government bonds, bonds guaranteed by the Government, bonds of the provincial authority or enterprises. Foreign investors may also invest in securities investment fund certificates, shares of securities investment companies, non-voting shares of public listed companies, derivative securities, and depository receipts without any limit.

Government’s reduced monopoly over distribution and production of power, petrol and coal

In Vietnam’s energy market, EVN has long been known as the state monopoly in transmission and distribution of electricity. Vietnam still features the Single Buyer Model with EVN’s purchase of all electricity generated from on-grid independent power projects. Investors find it extremely hard to negotiate the Power Purchase Agreement with EVN. Meanwhile, EVN keeps operating at loss with huge debts to PetroVietnam and Vinacomin.

Although the decree is still in draft, the proposed adoption of the list of goods and services subject to state monopoly will then limit the power of EVN. The State only maintains its monopoly over the operation of multi-purposes hydropower and nuclear power plants, transmission, moderation as well as operation of the national electricity system of big power plants and those having special importance in terms of socio-economic and national defense and security. Trading in petroleum and oil is also no longer subject to state monopoly.

With an open and competitive market, foreign investors will find it more attractive to invest in this sector. They are now no longer required to sell the electricity they generate to EVN but can sell it to other distribution companies or even transmit/ distribute through their own system.

Foreign investors will also no longer face obstacles in negotiating the power price with the EVN. According to a recent report by Ban Viet Securities Joint Stock Company, although power retail price in Vietnam has doubled during the past ten years, from VND 781/kWh (3.5 US cents/ kWh) in 2005 to VND1,622/ kWh (7.3 US cents/ kWh) in 2015, this is still low compared with other countries like Cambodia, Thailand, and Singapore in the APEC. This is among major reasons that discourage investors from pooling their capital into the sector.

However, power price is planned to increase from 2016 according to power increase schedule, which aims to ensure capital recovery and reasonable profits for investors. Accordingly, power retail price may increase at 8-9 US cents/ kWh in 2020, equivalent to an increase by 18.4% within the next five years. Power price should also reflect the demand and supply in the market. Foreign investors then find more incentives when making their investment decision.

Conclusion

Country Limitation of market access* Country Limitation of market access*

Malaysia medium Myanmar high

Indonesia medium Cambodia medium

Philippines medium Laos medium

Singapore low India high

Thailand medium China medium

Brunei high Vietnam low

Vietnam ties in first place with Singapore, thus it provides highest possible protection for investment

Vietnam is a country of changes and currently offering increasing opportunities for foreign businesses. The underlying strength of the economy is reflected in, among others, controlled macroeconomic indicators, strong productivity gains and extensive integration into regional and global economy. It is now exactly time for foreign investors to start their business plans and grasp the upcoming clear opportunities.

***

Please do not hesitate to contact Mr. Oliver Massmann under omassmann@duanemorris.com if you have any questions on the above. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.

INTERESTED IN DOING BUSINESS IN VIETNAM? VISIT: www.vietnamlaws.xyz;

THANK YOU VERY MUCH!